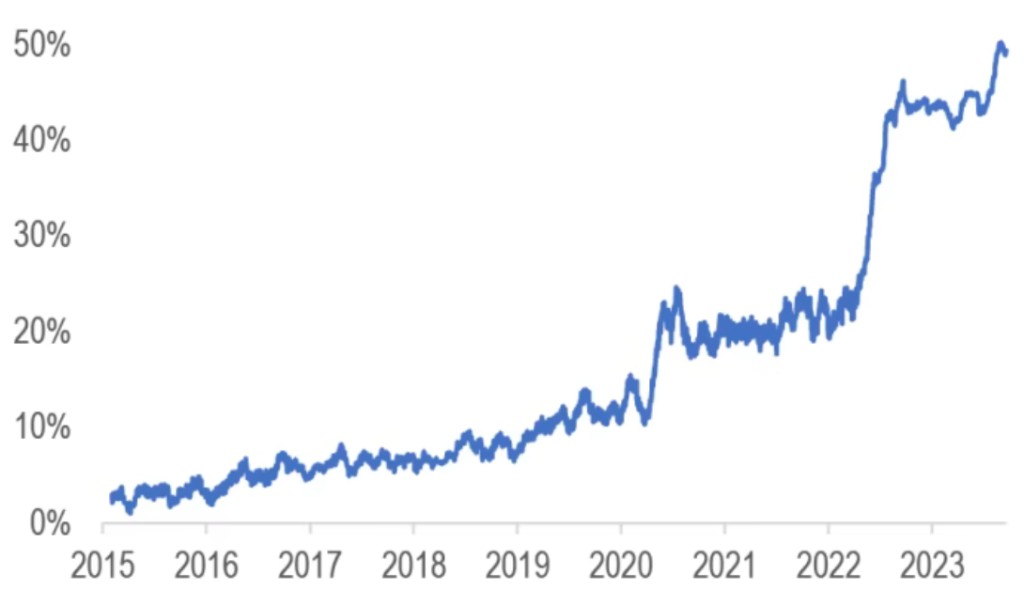

Share ratio of 50%! "Zero-day options" make a comeback

2018 年的市場災難即將重現?

被稱為 “末日期權” 的零日期權(0DTEs)勢頭再起,或使本就不平靜的股市加劇波動,五年前的市場崩盤或將重現。

據摩根大通稱,零日期權交易量不斷創下歷史新高,並且最近已佔所有標普 500 指數期權交易量的一半。

摩根大通週一公佈的報告指出,零日期權的 “繁榮” 似乎是它自己的事情,其特殊的用户羣主要是高頻交易者和散户投資者。 因此,它並沒有真正影響其他期權領域的交易量(SPDR 標普 500 ETF 的短期期權除外)。

末日期權是在交易當天到期並失效的期權合約,這意味着期權的到期時間只剩下最多 24 個小時,投資者對這類期權進行快速的買入、賣出操作。由於到期時間極其有限,這類期權的價格比到期日更長的期權更便宜,槓桿也更高,大約每 1 美元,就可以撬動起 1000 美元的市值。

巨大的槓桿帶來巨大的利潤,引誘散户投資者蜂擁而至投機,使 “末日期權” 去年在華爾街大行其道;然而,巨大的槓桿也意味着巨大的風險,很快市場上出現了劇烈的討論聲。

據華爾街見聞稍早前文章,摩根大通首席市場策略師兼全球研究聯席主管 Marko Kolanovic 曾警告稱,零日期權交易正在呈爆炸式增長,並可能造成與 2018 年初同一級別的市場災難。這個相對不透明的金融角落是一顆潛伏在市場中的定時炸彈,可能引發 “Volmageddon 2.0” 式的市場崩盤。

2018 年 2 月,一個追蹤波動率的基金因為市場下跌至接近贖回線而遭到拋售。這場危機導致道瓊斯工業指數和標普 500 指數大跌,被市場稱為 “波動性末日”(Volmageddon)。

相較於摩根大通,美國銀行的態度更加樂觀。美銀股票衍生品策略師 Nitin Saksena 和 Benjamin Bowler 站出來反駁稱,零日期權不會導致所謂的 “Volmageddon 2.0”,該期權背後的現實情況遠比 “Volmageddon 2.0” 微妙得多。

8 月上旬美股大跌期間,高盛和瑞銀髮現,零日期權看跌期權交易激增,導致投資者大舉拋售,加劇了美股的跌勢。此外,野村和花旗均表示出對零日期權看跌期權驟增的擔憂。

根據摩根大通最新的報告,最近推出的首批基於零日期權的 ETF 可能會進一步加劇市場崩盤的風險。

近日,基金公司 Defiance 推出了兩隻積極管理的基金,這兩隻基金通過賣出每日標普 500 和納斯達克 100 指數期權的看跌期權,以實現收益。

這種策略借鑑了近期非常流行的基於期權收益的 ETF 策略,其中最典型的代表就是推出約 3 年的 JPMorgan Equity Premium Income ETF(JEPI),它已募集了近 300 億美元的資產。

值得一提的是,Defiance 為其 S&P 500 0DTE 基金選擇的交易代碼為 JEPY,試圖碰瓷 JEPI。這些新 ETF 的資產目前只有約 1500 萬美元,其影響微不足道,但如果募集了大量的資產,可能會加劇 0DTE 期權帶來的尾部風險。