"Higher and Longer" Panic Continues: US Stocks and Bonds Plunge, Marking the Worst Month of the Year

標普 500 指數 9 月以來累跌超 5%,拖累該指數一年來首次出現季度下跌。10 年期美債收益率或遭遇一年來最大月度漲幅。

市場繼續消化美聯儲 “更長期更高” 利率的預期,美國股債將迎來今年最糟糕的一個月。

標準普爾 500 指數 9 月以來累計下跌超過 5%,拖累該指數 12 個月來首次出現季度下跌。

10 年期美債收益率一路走高,週三上行 7 個基點,觸及 2007 年以來的最高水平,本月以來累計上行 50 個基點,或遭遇一年來最大月度漲幅。

加拿大皇家銀行 BlueBay 固定收益公司首席投資官 Mark Dowding 表示:

人們開始意識到,實際上,更長期更高意味着(利率)長期走高。這種認識一直傷害着人們的情緒。

本月初,期貨市場交易員押注到 2024 年底利率將達到 4.2% 左右,而現在,他們押注利率將達到 4.8%。上週,美聯儲暫停加息,將基準利率穩定在 5.25%-5.5% 的範圍內,但點陣圖顯示今年將再次加息。

嘉信理財高級投資策略師 Kevin Gordon 表示:

市場今年對美聯儲政策的判斷一直是錯誤的。今年大部分時間裏,市場預期今年將大幅降息......現在人們普遍認為 “也許(美聯儲)確實是這麼想的(繼續加息)”。

美債收益率飆升降低了股票相對於債券的吸引力,同時增加了企業借貸成本,“更長期更高” 利率的預期對股市造成了打擊。

今年迄今為止,標普指數仍累計大漲了 11%,但這主要是受到科技 “七巨頭” 的支撐。人工智能投資浪潮下,“七巨頭” 股價一飛沖天,總市值一度達到 11.5 萬億美元,相當於德國經濟規模的三倍。

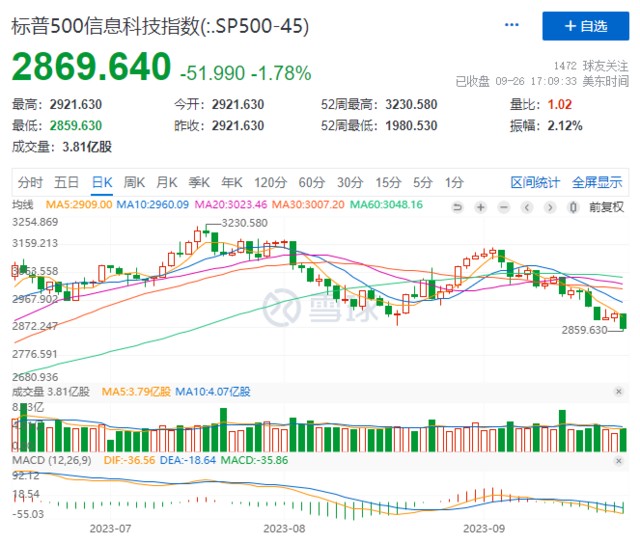

但在利率高壓下,AI 引擎熄火,更集中於大型科技股的標普 500 信息科技指數,已從 7 月份的高點下跌了超 10%。

企業債市場也受到影響,本月美國垃圾債的平均利率已從 8.5% 升至近 9%,漲幅超過了國債收益率的漲幅。

富蘭克林鄧普頓固定收益公司首席投資官 Sonal Desai 表示:

市場似乎終於同意我們並未處於衰退邊緣的觀點。

一系列強於預期的經濟數據,令美聯儲上週下調了失業率預測,並上調了增長預測,油價飆升給通脹帶來上行壓力,均意味着美聯儲可能不得不繼續加息。