JPMorgan: High oil prices have already begun to "disrupt demand"

“第三季度油價的飆升,反過來抑制了需求。”

“人為” 造成的油價飆升,或已經開始令需求遭到破壞。

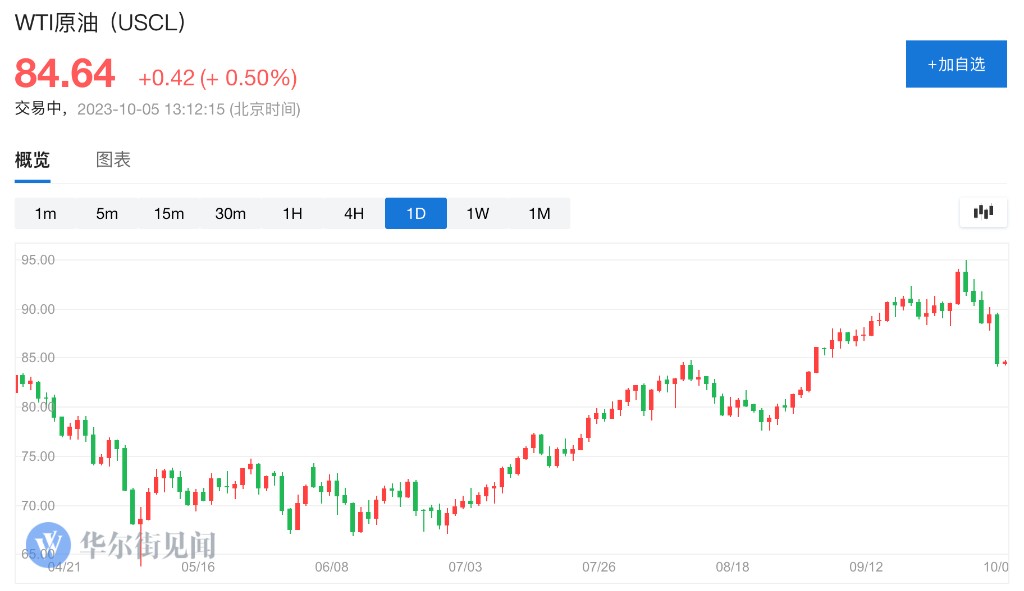

隔夜,油價突降。WTI 原油收於 84.43,當日跌去近 6%,創去年 9 月以來最大單日跌幅;布倫特原油跌 5.48%,兩種油價均跌破 50 日均線關鍵技術位,展現看跌信號。

與此同時,美國能源信息署(EIA)週三發佈的庫存週報顯示,美國上週 EIA 原油庫存降幅超預期,庫存創下 2022 年 12 月以來新低,汽油需求四周均值也創 1998 年以來季節性新低。

儘管原油庫存降幅超預期,但汽油需求不振,令油價承壓。

摩根大通在最近的一份客户報告中表示,原油的需求破壞已經開始,預計本季度原油需求將在近期反彈後下降。

摩根大通全球大宗商品策略團隊主管 Natasha Kaneva 寫道:

在 9 月份達到每桶 90 美元的目標後,我們的年底目標仍是 (每桶) 86 美元。

夏季庫存減少將在今年最後幾個月轉為小幅增加。此外,在美國、歐洲和一些新興市場國家,油價上漲對需求的抑制再次顯現出來。

當油價不斷上升,石油及石油製品的成本也會上升,這些價格上漲最終可能傳遞給消費者,導致商品和服務變得更昂貴。這可能會減少人們的購買力,降低他們對各種商品和服務的需求,尤其是對油耗較高的產品和服務,如汽車燃料和遠途旅行。

自沙特在今年 6 月減產以來,全球石油供應緊張,汽油價格在 9 月份創下了 2023 年的新高。

摩根大通認為,消費者對油價的忍耐力可能已經到達了一個界限:

已經有跡象表明,消費者已經通過減少燃料消耗做出了反應。2023 年第三季度汽油價格的飆升反過來抑制了汽油需求。

至於柴油,該報告強調,最近柴油價格上漲了 30%,主要影響到建築公司、運輸企業和農民,增加了貨運和食品生產的成本。

航空燃油價格在第三季度也有所上漲,美國聯合航空 (United Airlines)、達美航空 (Delta)、美國航空 (American) 和其他受成本上升影響的航空公司紛紛發出警告。