Hong Kong stocks surged and then fell back, with the Hang Seng Index closing up 0.1%. New energy vehicles were active, but China Evergrande fell 11%.

I'm PortAI, I can summarize articles.

小鵬汽車漲約 4.8%,盤中漲超 6%,蔚來漲超 2%,理想汽車、京東漲超 1%,網易、微博漲超 0.9%,騰訊、百度小幅上漲,嗶哩嗶哩、小米跌超 1%。

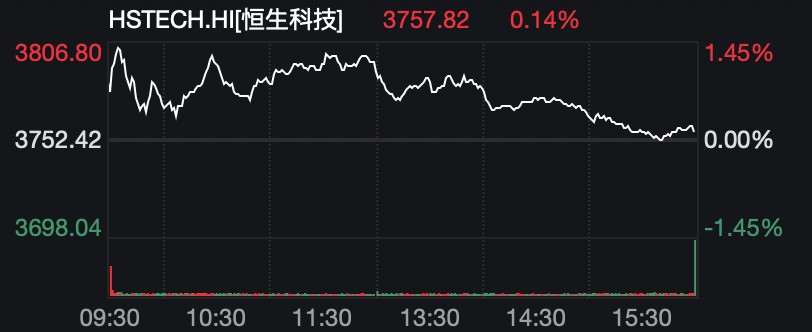

10 月 5 日,港股高開,午前高位寬幅震盪,午後逐漸走低,恒指收漲 0.1%,恒生科技指數漲 0.14%,盤中一度漲超 1%,國企指數漲 0.09%。

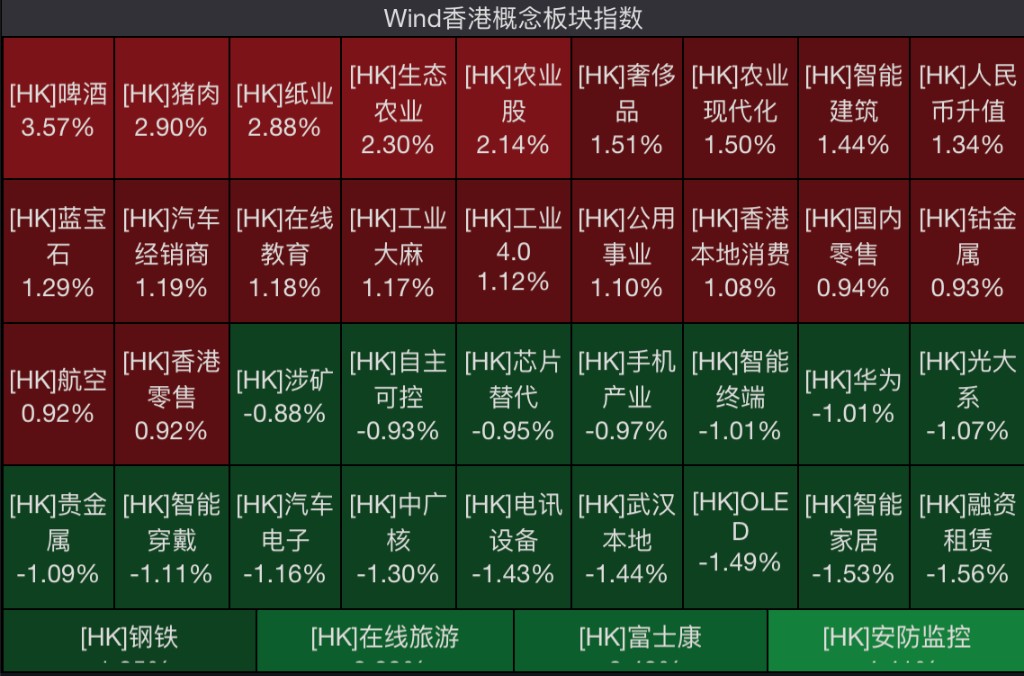

盤面上,零售、啤酒、新能源汽車等漲幅居前,安防、鋼鐵、貴金屬有色等跌幅居前。

小鵬汽車漲約 4.8%,盤中漲超 6%,蔚來漲超 2%,理想汽車、京東漲超 1%,網易、微博漲超 0.9%,騰訊、百度小幅上漲,嗶哩嗶哩、小米跌超 1%。

啤酒豬肉領漲

百威亞太漲逾 5.4%,華潤啤酒漲 2.4%。萬洲國際漲逾 3.2%,雨潤食品漲逾 2%

新能源汽車活躍

零跑汽車漲逾 8%,長城、比亞迪、北汽、廣汽等跟漲。

地產走勢分化

融創中國漲逾 6%,龍光集團漲逾 5%,美的置業、富力地產、合景泰富漲逾 3%,

中國恒大開盤震盪上行,盤中一度漲超 7%,尾盤砸盤轉跌,收跌 11.11%。連續兩日跌超 10%。

生物製藥早盤跳水 尾盤收窄跌幅

煤炭、石油石化收跌

貴金屬有色低迷