Gu Chaoming: Soaring interest rates are approaching a critical point.

小心 1987“黑色星期一” 重演!

美聯儲下一步怎麼走?野村警告利率水平已至臨界點,美聯儲應 “三思而行”。法興高呼,若繼續加息,1987“黑色星期一” 將重演。

1987 年 10 月 19 日,道瓊斯工業平均指數暴跌 22.6%,這一天後來被稱為 “黑色星期一”。那年 10 月,全球股市損失達 1.7 萬億美元,23 個主要市場中有 19 個市場的跌幅超過 20%。

近日,辜朝明指出,飆升的利率正逼近風險資產價格大幅波動的關鍵點,房地產和其他對利率敏感的行業已經對利率飆升做出了反應,但股市等風險資產未對美聯儲激進加息完全定價,如果利率達到這一臨界水平,美國經濟軟着陸的設想將不復存在,市場可能會崩潰,甚至可能再次出現資產負債表衰退。

“大空頭” 法國興業銀行策略師 Albert Edwards 則指出,美聯儲繼續加息或使隨着美國國債收益率的攀升,債券市場將吸引更多投資者,股市將受到毀滅性的打擊,當前股市的韌性令人想起 1987 年"黑色星期一" 。

利率正在逼近關鍵點

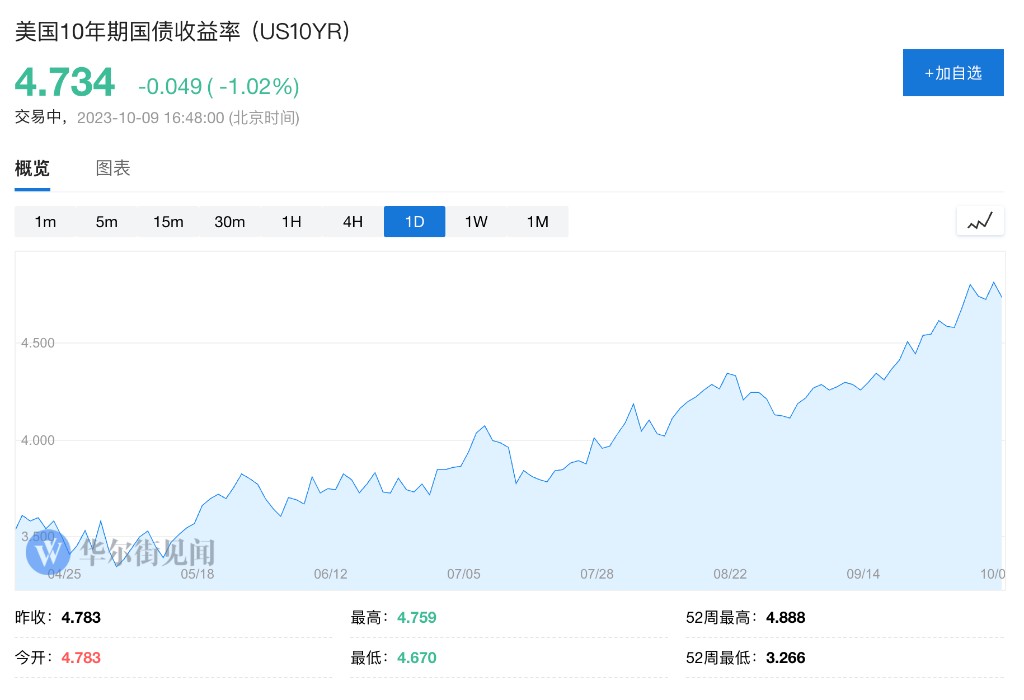

辜朝明指出,儘管美聯儲激此前進加息,迅速提高利率,且美聯儲主席鮑威爾多次發出警告,但美國 10 年期國債收益率前一段時間一直在 3.5% 至 4.5% 之間的小幅波動,沒有出現大幅上漲或下跌。

辜朝明認為,這一情況的出現是因為市場認為通脹將在短期內得到控制,短期利率將走低。但是,如果市場參與者意識到實際情況並非如此,那麼基於這種預期的資產價格可能會突然發生糾正。

兩週前結束的9 月美聯儲貨幣政策會議保持利率不變,但會後公佈的聯儲官員預測未來利率水平點陣圖釋放鷹派信號,顯示六成以上官員預計今年內還會再加息一次,以應對美國意外強勁的經濟。

同時,美聯儲官員對明後兩年的利率預期中位值較前次上調了 50 個基點。這意味着,聯儲預計明年的降息次數可能減半至兩次。

辜朝明稱,雖然很難預測利率的關鍵點在哪裏,但令人感到擔憂的是,自美聯儲暗示利率將不得不在比預期更長的時間內保持較高水平以來,債券一直處於動盪之中,30 年期國債收益率一度升至 5.05%,10 年期國債收益率超過 4.88%,均為 2007 年以來的最高水平。

辜朝明認為,當市場利率不隨着美聯儲設定的政策利率的變化而相應變化,那麼美聯儲的貨幣政策將不再奏效。美聯儲停止加息但美國國債收益率卻仍在攀升這可能會影響鮑威爾的下一步行動:

鮑威爾 9 月決定暫停加息並謹慎推進下一步舉措的一個重要考量便是,他擔心利率可能正在接近關鍵點,逐步接近關鍵位可能迫使美聯儲暫停加息。

Edwards 在上週的一份報告中指出,在利率迅速上升地情況下,美國經濟未來的 “不確定性增加”,再加上 “財政痢疾”——創紀錄的預算赤字和債務僵局推動了 10 年期美債收益率超過 4.7%。

Edwards 認為,隨着美國國債收益率的攀升,股市所呈現的韌性讓他回想起了 1987 年,最終股市投資者的樂觀情緒還是被澆滅了:

美國國債收益率不斷上升,為投資者提供了更高安全回報的投資選擇,這或將引發越來越多投資者撤離風險較高的股市。你是否覺得自己就像坐在一輛汽車裏,你知道自己即將撞車,但卻無力停車?

就像 1987 年一樣,現在任何衰退跡象都肯定會對股市造成毀滅性打擊。

美聯儲或將停止加息

辜朝明指出,近年來,貨幣政策的影響減弱,迫使美聯儲不得不加大利率調控力度,這使得美國經濟越來越容易受到資產泡沫和資產負債表衰退週期的影響,對臨界點臨近的擔憂可能促使美聯儲停止加息步伐:

在美聯儲停止加息的情況下,債券市場卻發生了變化,這有其積極一面的影響,消除了美聯儲採取行動的必要性,但我懷疑美聯儲也在擔心會失去控制的風險。 從這個意義上説,我預計美聯儲不僅會密切關注通脹趨勢,還會密切關注債券市場利率的走勢。

美聯儲當然不希望市場利率的變動超過政策利率的變動,而引發大問題。

“新美聯儲通訊社” Nick Timiraos 近日警告稱,美國長債收益率飆升正在摧毀經濟軟着陸的希望,借貸成本猛增可能大幅放緩經濟增長,並增加金融市場崩潰的風險,進而可能削弱美聯儲今年再度加息的理由。

至於臨界點到底在何處,此前,野村證券分析師 Matsuzawa 指出,3 個月-10 年期美債收益率曲線的倒掛,可能是觸發美國經濟和信貸進入技術性收縮的臨界點之一,並認為這將迫使美聯儲暫停加息。Matsuzawa 在報告中寫道:

在政策利率和市場利率尚未達到某個臨界點時,許多情況下,經濟和信貸會持續擴張,但一旦超過這個臨界點,即使政策利率沒有改變,經濟和信貸狀況也會進入技術性收縮。

3 個月-10 年期美債收益率曲線的倒掛是一個重要的轉折點,另一個指標是基於通脹預測的美債實際收益率。

上週二,10 年期美債實際收益率短暫突破 1%,與上一個經濟週期中經濟活動達到技術性收縮(2018 年底)時達到的水平持平。

圖片來源:野村證券 我們認為,一直到 11 月,美國經濟和信貸環境將繼續惡化,這將迫使美聯儲暫停加息。