军工股、石油股、美债,谁才是 “巴以冲突” 的最佳对冲?

美股週一下午上演 “反攻” 行情,油價和美債期貨持續上漲。分析認為,對投資者而言,要想對沖巴以衝突帶來的風險,石油股、國防股和美債可能是不錯的選擇。

隨着投資者消化巴以衝突帶來的壓力,美聯儲官員釋放鴿派信號,美股週一下午上演 “反攻” 行情,油價和美債期貨持續上漲。

隔夜三大美國股指集體低開。盤初納斯達克綜合指數曾跌超 1.1%,道瓊斯工業平均指數曾跌近 150 點、跌超 0.4%,標普 500 指數早盤刷新日低時跌近 0.6%,此後均收窄跌幅,午盤集體轉漲後保持漲勢,刷新日高時,標普漲近 0.8%,納指漲近 0.6%,標普道指漲超 220 點、漲近 0.7%。

最終,三大指數集體連續第二個交易日收漲。標普收漲 0.63%,報 4335.66 點,連續兩日刷新 9 月 25 日以來收盤高位。道指收漲 197.07 點,漲幅 0.59%,報 33604.65 點,刷新 9 月 28 日以來高位。納指收漲 0.39%,報 13484.24 點,刷新 9 月 19 日以來高位。

衝突造成的地緣政治緊張局勢加劇,對能源市場產生了影響,一些專家預測,原油價格將短暫飆升,但總體影響有限。日益加劇的緊張局勢使交易員對持續的通脹和更高的利率感到擔憂,市場可能加劇動盪。

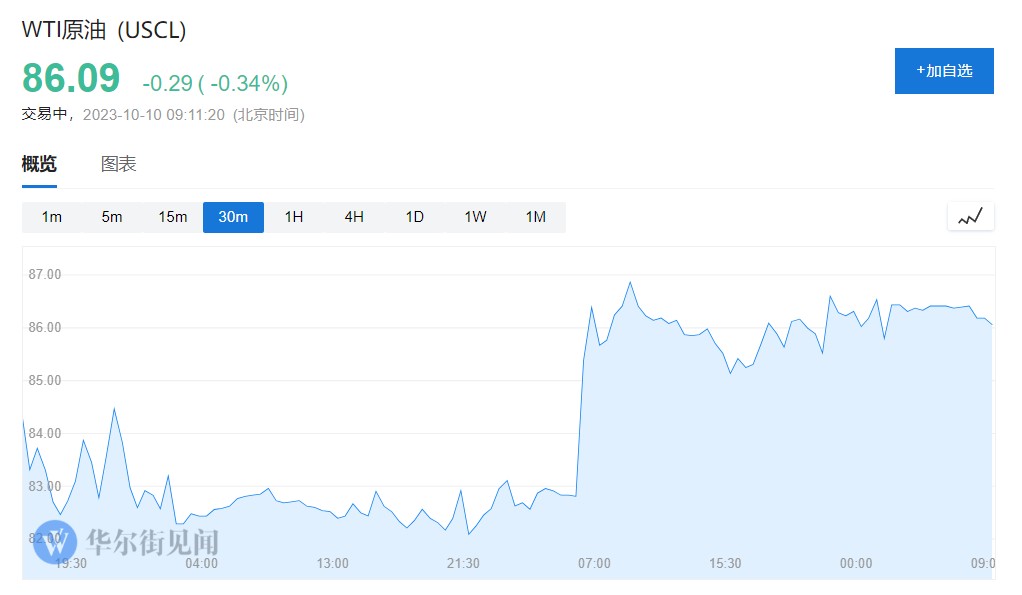

國際原油期貨跳空高開,全天保持漲勢。週一,WTI 原油期貨上漲 4.3%,收於 86.38 美元/桶。國際布倫特原油期貨價格上漲 4.2%,至 88.15 美元/桶。WTI 和布倫特原油均實現 4 月 3 日以來的最佳表現。

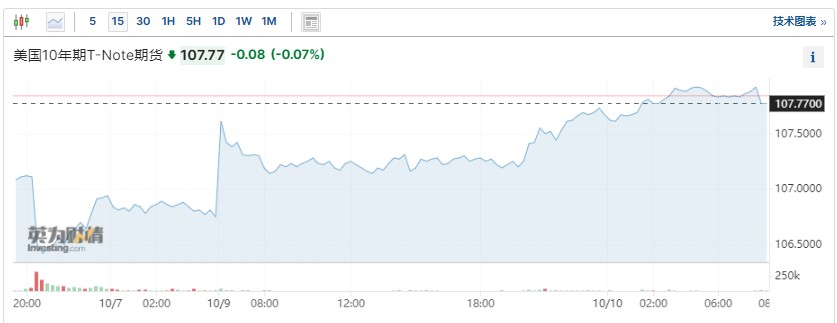

週一美債因哥倫比亞日假期休市一日,美債期貨全天維持漲勢。

《華爾街日報》資深投資專欄作家 James Mackintosh 在最新的報道中寫道,最重要的是戰爭升級的可能性。

最有可能的第一步是美國加碼對伊朗的制裁,伊朗幫助哈馬斯攻擊(以色列),這將扭轉原本已經緩和的美伊關係,這種關係曾幫助伊朗在過去一年中每天增加約 50 萬桶石油產量。

據高盛估計,如果伊朗明年減產 10 萬桶/日,油價就會上漲 1 美元。

如何對沖風險?

Mackintosh 認為,對投資者而言,要想對沖巴以衝突帶來的風險,石油股、國防股和美債可能是不錯的選擇。而且這三大類資產本身就相當有吸引力,緊張的石油市場帶來了高額利潤,而美債收益率已經升至 2007 年以來的最高水平。

美國石油公司的預期盈利遠高於往常,但遠低於去年秋季的峯值,即使回到 2005 年以來的平均水平,也只會將該行業市盈率推高至其長期平均值。

週一哈里伯頓收漲 6.8%,CF Industries 收漲 6.3%,Hess 收漲 5.3%,巴菲特到今年 6 月持股比升至 25% 的西方石油漲 4.5%,埃克森美孚漲 3.5%,道指唯一能源類成份股雪佛龍漲近 2.8%。

軍工股不僅受益於俄烏衝突帶來的短期提振,而且它們的價格遠低於今年早些時候。但它們也面臨國內政治反覆的不確定性,這在上個月美國國會通過暫行支出法案避免政府關閉時,對烏克蘭的支持被排除在外就再次證明了這一點。

週一軍工股大幅上漲,諾斯羅普·格魯曼公司領漲美股大盤,股價上漲超過 11%,有望創下 2020 年 3 月以來的最大漲幅紀錄;洛克希德·馬丁公司股價上漲超過 8%,RTX 漲超 4%。

歐股方面,軍工股是 Stoxx Europe 600 指數中表現最好的板塊之一。歐洲最大國防承包商 BAE 系統、意大利萊昂納多公司和法國達索航空公司的股價均上漲超過 4%,德國軍火製造商萊茵金屬公司股價上漲超過 7%。

Mackintosh 還表示,相對於石油股,他更喜歡美債,預計隨着利率上升對經濟造成衝擊,美國經濟將放緩。但那些既擔心衝突擴大、又看到經濟強勁增長潛力的投資者,如果衝突沒有升級,可能會更青睞石油股。

以往的中東衝突很少長期擾亂市場,除了 1973 年禁運和 1979 年兩伊戰爭對石油造成的巨大沖擊。

由於那個時代的幽靈以央行錯誤和通脹的形式困擾着市場,保護自己的投資組合不受最近戰爭升級的幽靈影響也許是明智之舉。