AMD 1Q25

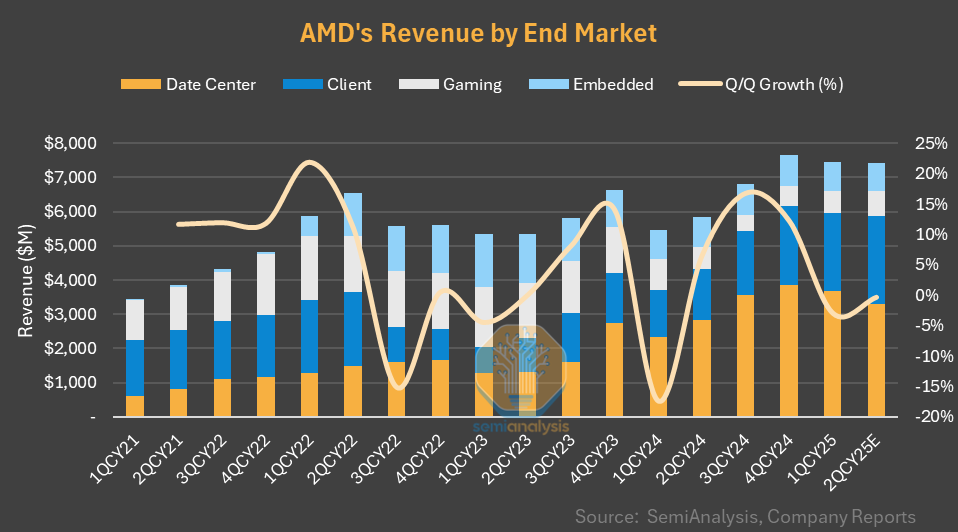

- Revenue down -3% q/q and up +36% y/y to $7.4B, driven by client mix and DC CPU/GPU- China MI308 impact: $1.5B in CY25; $700M in 2Q & the majority of the rest in 3Q; No change in $500B TAM despite China impact- DC GPU down q/q but up y/y in 1Q25; will be down q/q & y/y in 2Q; will be up y/y in 3Q and 4Q-MI350 sampling in 1Q25; accelerated production by mid-year; 2H25 deployment; Oracle multi-billion dollarMI355x partnership- MI400 on track to launch next year; Customer enthusiasm for rack-scale MI400Source: Sravan Kundojjala

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.