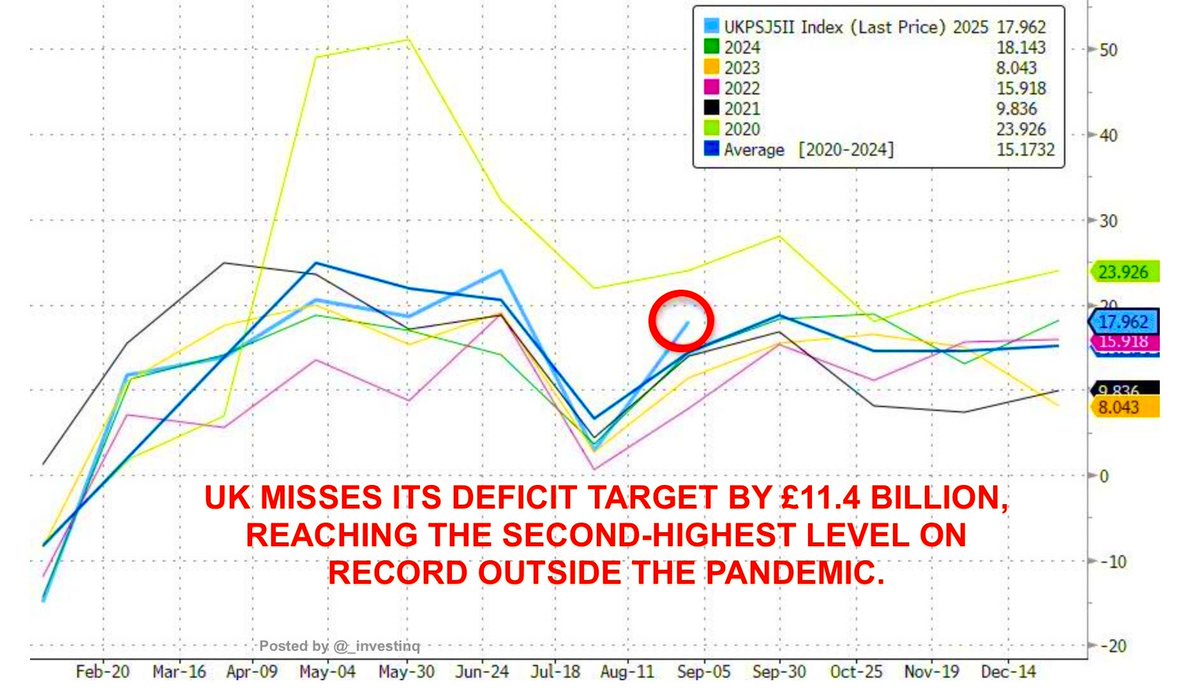

The UK’s borrowing picture is getting worse. In August, the government took on £18 billion in new debt, the highest August total in five years and far above the OBR’s £12.5 billion forecast. That was also £3.5 billion more than the same month last year. Over the first five months of the fiscal year borrowing has climbed to £83.8 billion, the second-highest on record for this period since 1993, behind only the pandemic year.

Revenues have not collapsed. Taxes and National Insurance receipts are rising, but spending has been growing even faster. Welfare programs, public services, and swelling debt interest costs are driving the gap. Interest payments alone reached £8.4 billion in August, nearly £2 billion higher than last year. The budget deficit after five months stands at £62 billion, well above last years figure, while public sector net debt has pushed up to 96.4% of GDP, a level not seen since the early 1960s. Chancellor Rachel Reeves enters her November budget under heavy pressure. A £35 billion shortfall has opened up, leaving few options other than tax increases and tighter spending. Markets didn’t take the news lightly British pound slipped to about $1.3483 and gilt yields moved higherGovernment officials insist borrowing will be brought down and spending targeted toward priorities rather than debt service. Opponents argue that fiscal discipline has already slipped away. Inflation, higher interest costs, and overshot forecasts have left the UK’s finances in a fragile state. The US is facing a parallel challenge. Government debt now exceeds 123% of GDP, well above the UK’s 96%. Both economies are under strain from the same forces, inflation driven costs, heavy social commitments, and expensive debt servicing in a high-rate environment.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.