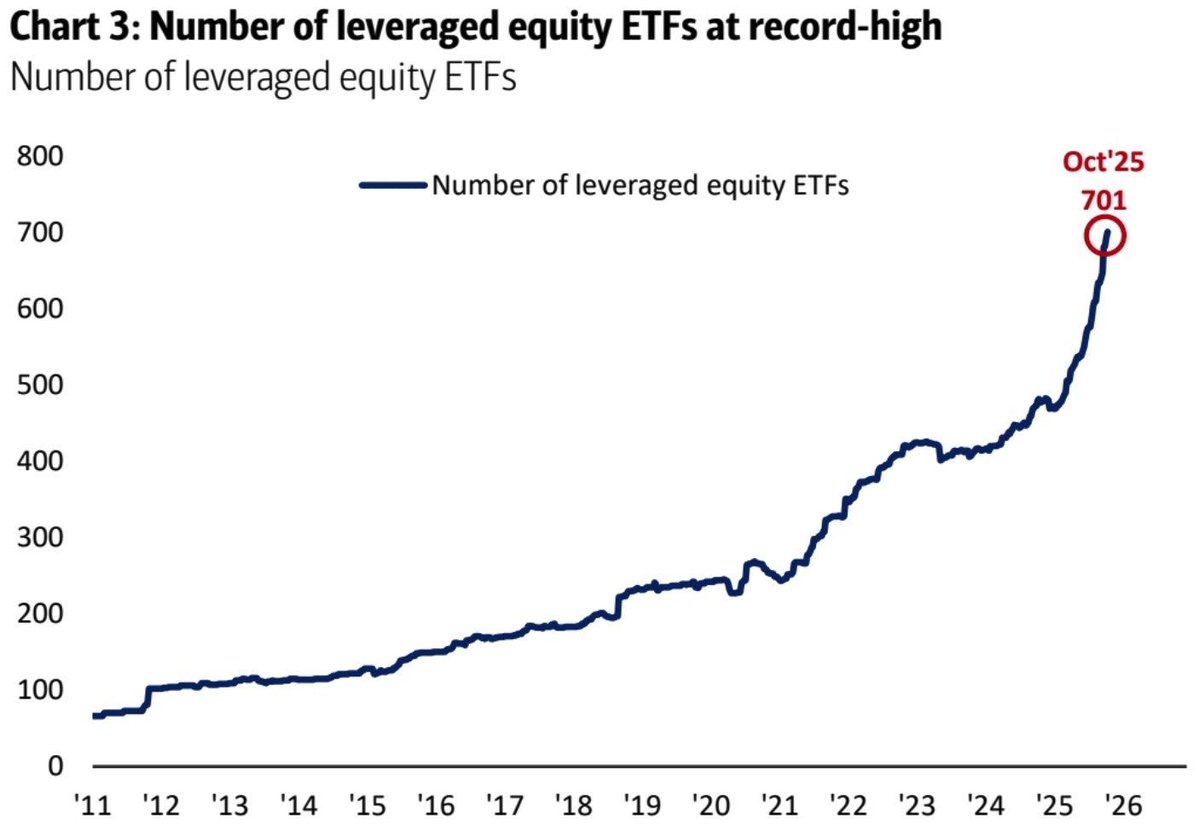

The number of leveraged ETFs has exploded. There are now more than 700 of them up from just around 70 back in 2011. That’s a massive jump, and it’s not because investors suddenly became smarter. It’s because leverage has turned into something that’s being sold to everyone. When leverage stops being a tool and starts being a product, it’s a sign that markets are starting to get overheated.

These ETFs promise to give you double or triple the returns of whatever index they track. If the S&P 500 goes up 1%, a 3x ETF aims to go up 3% but if the market drops 1%, that ETF falls 3%. They reset daily, which means over time they don’t move perfectly with the index. Volatility eats into returns. And every day, these funds have to buy or sell large chunks of stock to stay balanced. That buying and selling adds even more swings to the market.Earlier this month, JPMorgan said about $26 billion worth of leveraged ETF trades helped make a bad selloff worse. That’s how dangerous this can get. These funds are small in size compared to the whole ETF market but their impact is much bigger because they move faster and force bigger trades.This kind of thing has happened before. Before the dot-com crash, people rushed into IPOs that doubled on day one. Before the 2008 crisis, Wall Street created fancy products that made it easy to borrow more and hide risk. Every time, new products made it easier for regular people to take on too much risk. And every time, it ended the same way with big losses.Right now, margin debt is at record highs over $1.1 trillion. If you include leveraged ETFs, the real leverage is closer to $2 trillion. That’s a huge amount of borrowed money sitting in a market that’s already expensive. All it takes is a small drop to start a chain reaction. When prices fall, leveraged ETFs sell to rebalance. That selling pushes prices down more. Then margin calls hit and people are forced to sell againFor traders, this kind of market can be profitable, but it’s also dangerous. Volatility creates opportunities, but also bigger risks. Keeping positions small and protecting your capital matters more now than ever. Late-cycle markets always feel unstoppable until they’re not and when they turn, leverage is what makes the fall so much worse.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.