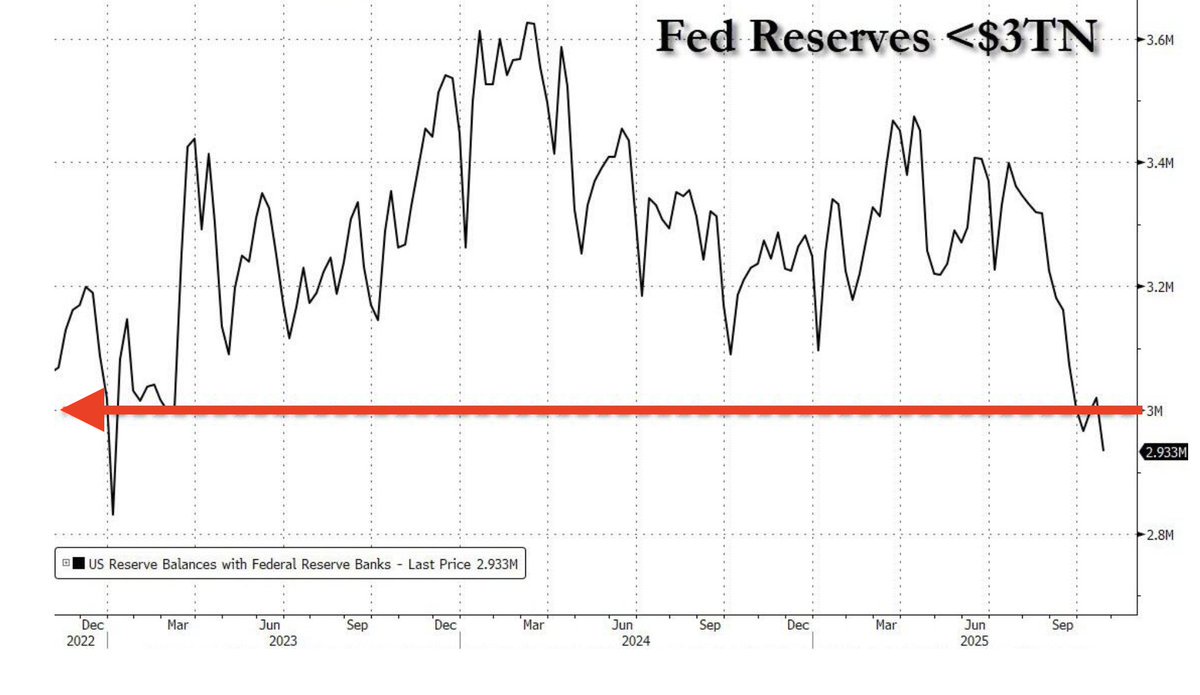

美联储储备金再次跌破 3 万亿美元,截至 10 月 22 日当周降至 2.933 万亿美元,又减少了 590 亿美元。

这是连续第二周低于 3 万亿美元大关,且下降速度正在加快。本月早些时候,我们经历了连续八周的储备金流失,之后短暂暂停,但现在下滑速度再次加快,最新降幅超过了之前常见的 200 亿至 450 亿美元波动。这是怎么回事?自 7 月债务上限提高以来,美国财政部一直在重建其现金储备,使其超过 8000 亿美元。为此,他们向市场大量发行短期国库券。但每次财政部发行新票据并筹集资金时,这些现金就会从私人银行存款转移到财政部在美联储的账户。当这些结算发生时,银行和交易商必须交付现金,这直接消耗了储备金。现在情况变得复杂:曾经作为 2.5 万亿美元流动性缓冲的隔夜逆回购工具(RRP)现在基本空了,只剩下几十亿美元。在量化紧缩和财政部发债消耗现金时,RRP 吸收了冲击。现在这个缓冲消失了,每一美元的流失都直接冲击银行。这种紧张局势已经蔓延到货币市场。10 月 15 日,回购利率飙升至 4.36%,这在平常日子里异常高。银行已开始动用美联储的常备回购工具(SRF),这是自新冠疫情流动性危机以来我们未见过的紧急支持手段。SOFR 利差正在扩大,有效联邦基金利率逐步上升,融资成本全面收紧。这就是为什么所有人都在关注下周的联邦公开市场委员会会议(10 月 28-29 日)。摩根大通和美国银行都预计美联储将很快结束量化紧缩。鲍威尔在 10 月 14 日的讲话中暗示了这一点,称我们"接近充足储备",并承认回购利率正在走强。美联储的策略很明确:在另一场融资危机爆发前停止量化紧缩,就像 2019 年 9 月回购利率飙升至 10% 时那样。如果美联储确实宣布结束量化紧缩,流动性应该会迅速放松。国债收益率可能会下降,风险资产将反弹,货币市场压力将缓解。但在此之前,我们处于一个危险时期。更多财政部结算即将到来,月末压力临近,储备金正危险地接近低点。来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。