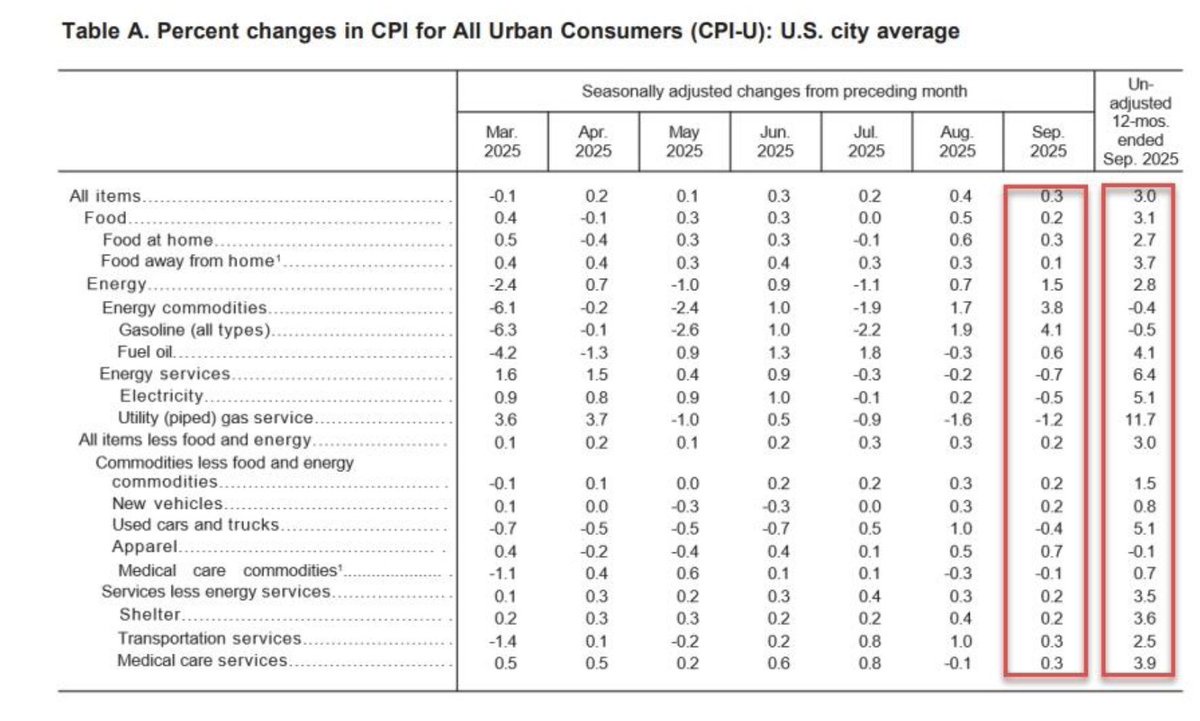

今早的 CPI 数据低于预期,环比上涨 0.3%,预期为 0.4%,年通胀率为 3.0%。这仍是自 1 月以来的最高同比涨幅,但总体确认通胀再次缓解。

汽油是上涨的主要推手,涨幅达 4.1%,而电力和天然气价格下降。食品价格仅微涨 0.2%,其中烘焙食品和饮料成本小幅上升。

住房成本继续降温。租金通胀同比降至 3.4%,为 2021 年以来最低水平,月租金涨幅为两年多来最小。

住房整体环比仅上涨 0.28%,表明作为顽固通胀最大推手之一的住房成本终于开始松动。

核心 CPI 环比仅上涨 0.2%,年率降至 3.0%,为 6 月以来最低。机票和服装价格上涨,但二手车、保险和通信成本均下降。

剔除住房的核心服务通胀降至 3.3%,为 5 月以来最低,显示旅游、保险和娱乐等服务密集型领域的通胀压力全面缓解。

现在,更大的故事可能是货币供应量,因为虽然通胀在纸面上看似受控,但新一轮通胀的基础可能已在暗中形成。过去几个月,美国货币供应量(M2)在近两年收缩后再次开始扩张。

这一转变很重要:当美联储收紧政策时,货币供应量收缩,支出和信贷放缓;但一旦货币供应量再次上升,就表明流动性正重新流入系统。

货币供应量增加意味着通过政府支出、信贷增长或美联储资产负债表操作,经济中将有更多现金,这些流动性最终会推高资产价格,随后引发需求驱动的通胀。它不会立即反映在 CPI 中,而是会滞后几个月。

这就是为什么市场现在为通胀降温而欢呼,但长期投资者将流动性重新加速视为一个警告信号,表明今天的反通胀可能成为明天的再通胀。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。