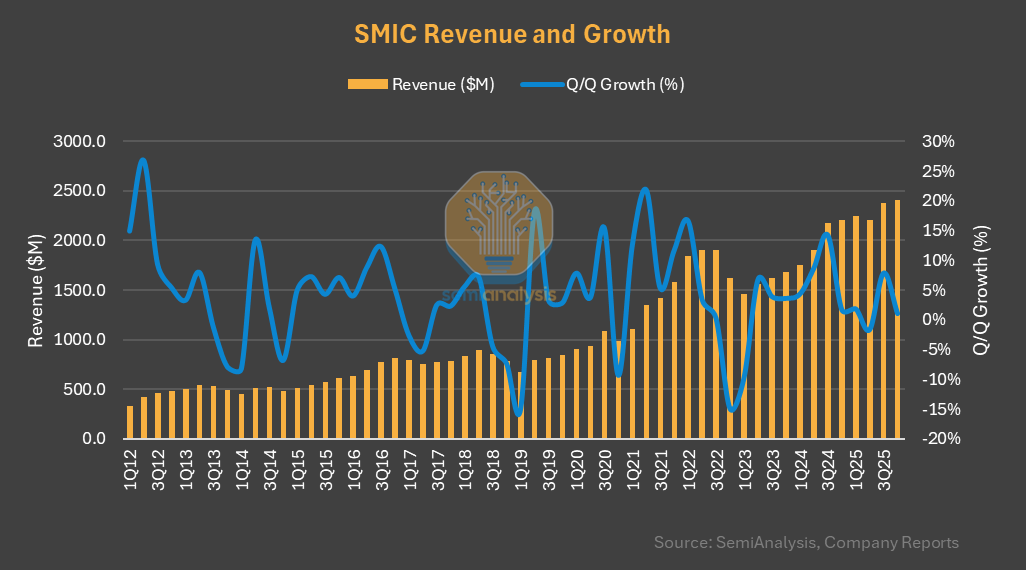

中芯國際 2025 年第三季度

- 收入環比增長 8%,同比增長 10%,達到 24 億美元(高於高端指引)- 晶圓出貨量(300 毫米當量):110 萬片(環比增長 5%)- 晶圓平均售價:2041 美元(環比增長 4%)- 產能利用率:95.8%(對比 2025 年第二季度的 92.5%)- 2025 年資本支出預計超過 75 億美元- 12 月季度收入將增長 0-2%;高折舊成本影響毛利率來源:Sravan Kundojjala

本文版權歸屬原作者/機構所有。

當前內容僅代表作者觀點,與本平台立場無關。內容僅供投資者參考,亦不構成任何投資建議。如對本平台提供的內容服務有任何疑問或建議,請聯絡我們。