BlackRock Just Waived Millions in Management Fees to Keep One of Its CLOs From Blowing Up . When the world's largest asset manager has to eat fees just to patch over a struggling portfolio, something's seriously wrong.

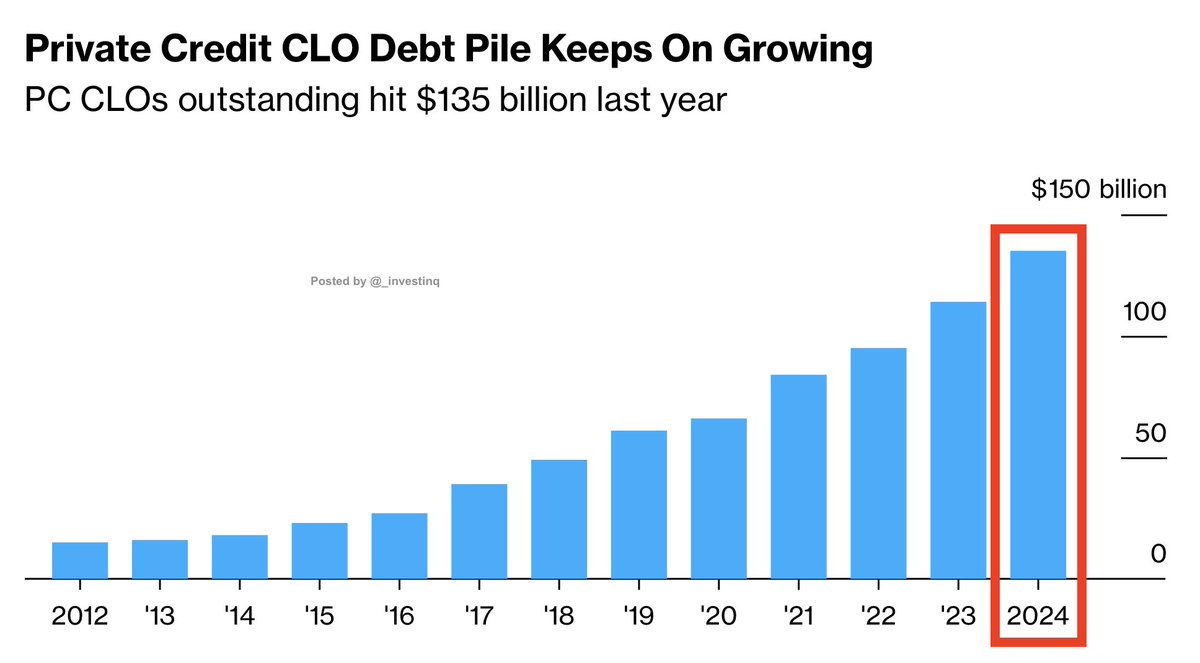

Here's what happened, blackRock manages a CLO, think of it as a pool of loans from private companies that get bundled together and sold as bonds to investors. Different investors buy different tiers based on risk, some buy the safe tier (senior), others buy the riskier tier (junior) for higher returns. The whole structure only works if the loans stay healthy.But the loans in BlackRock's CLO started failing. Companies like Renovo Home Partners went bankrupt. Pluralsight is struggling. Several portfolio companies collapsed or got hit with fraud investigations. The portfolio got so bad that in October it failed something called an over-collateralization test basically a health check that ensures there are enough good loans to cover the bonds investors own.When you fail that test, the structure is supposed to automatically protect senior investors by cutting off cash flow to junior investors first. Junior investors would take the losses. Instead of letting thathappen and looking terrible, BlackRock waived its own management fees and used that money to artificially boost the collateral numbers so the portfolio would pass the test. It's essentially buying time but it doesn't fix the underlying problem.The private credit market has grown massively to $1.7 trillion because investors want higher returns. Private credit CLOs alone hit $135 billion outstanding last year, a massive jump from practically nothing a decade ago. But in the rush for returns and growth, managers got sloppy about checking whether borrowers could actually repay the loans. Now we're seeing defaults pile up. BlackRock's move shows even the smartest managers can't contain the damage. If they can't fix it, imagine what happens when smaller fund managers start facing the same pressure. That's when things could get really messy.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.