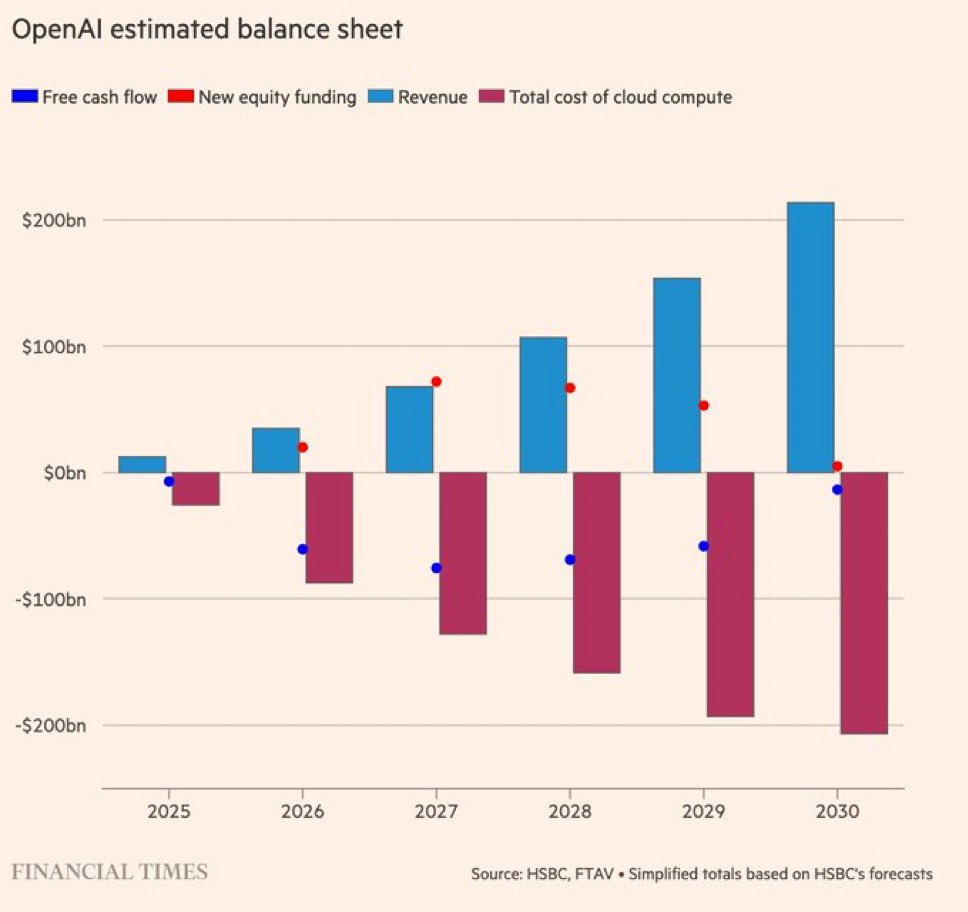

OpenAI 有望在本十年实现巨额收入,但云计算账单更大,因此业务实际上从未实现正向现金流,需要数千亿美元的外部资金来维持增长。汇丰银行预测,随着 ChatGPT 和 AI 工具覆盖数十亿用户,到 2030 年 OpenAI 的销售额将攀升至 2000 亿美元以上,但在同一时期,他们认为 OpenAI 将在计算上花费约 8000 亿美元,主要是从微软、甲骨文和亚马逊租用 GPU 和数据中心容量。

这种不匹配意味着 OpenAI 在整个十年内都将保持负现金流,并存在约 2070 亿美元的资金缺口,需要通过股权、债务或合作伙伴的战略资金来填补。

对行业而言,这意味着 OpenAI 看起来不像一家传统的软件公司,而更像一家资本密集型的公用事业公司,每个新用户都会带来一笔巨大的计算账单,抵消订阅或广告收入。如果这一计算正确,那么 AI 领域的短期赢家将是基础设施层的云服务提供商、芯片制造商和数据中心运营商,而 OpenAI 及其类似公司则处于中间位置,开发出色的产品,但将大部分资金直接注入他人的 GPU 农场。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。