Total Assets

Total Assets Rate Of Return

Rate Of ReturnThe hidden AI "water seller"? Argan (AGX) Q3 earnings quick read: Not just construction, but also a winner in energy transition

AI data centers not only require chips but also massive amounts of electricity. While everyone is focused on Nvidia, power plant builder Argan (AGX) just delivered a very interesting report card. 📊

Here are the key highlights for Q3 FY26:

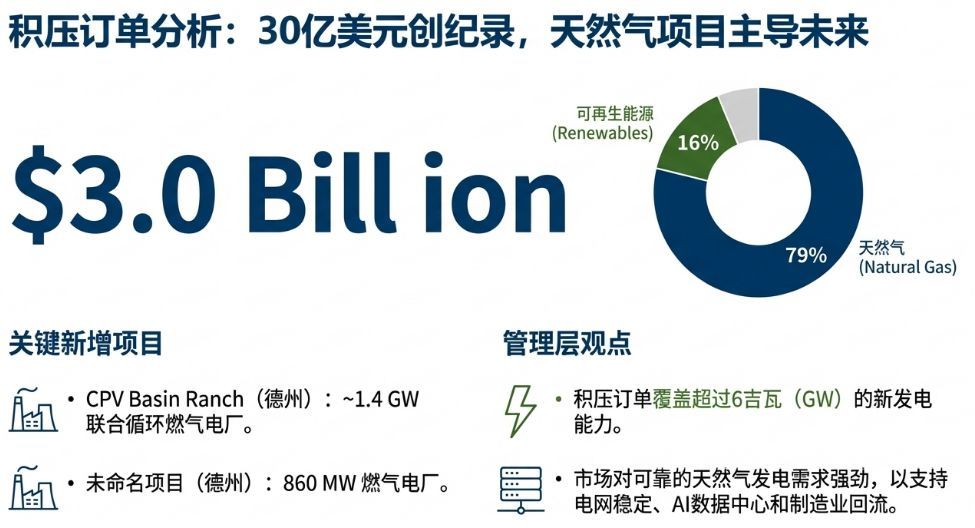

1. Backlog Hits Record High (Backlog is King) 📜

The most eye-catching data isn't revenue but the staggering $3 billion backlog.

- This means extremely high revenue visibility in the future.

- Main drivers: Natural gas projects (79%) and renewables (16%).

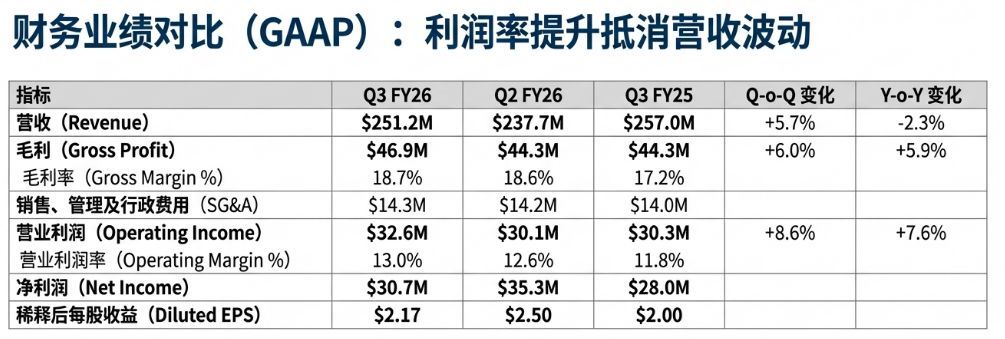

2. Profitability Significantly Improved 💰

Although revenue dipped slightly by 2.3% YoY to $251 million due to project transitions, profitability strengthened:

- Gross Margin: Rose to 18.7% (vs. 17.2% last year).

- EPS: $2.17 (vs. $2.00 last year).

- Reasons: Better project mix, strong pricing power, and fewer competitors.

3. Why Is It a Key Player in AI Infrastructure? 🏭

Management made it clear in the call: AI data centers and reshoring manufacturing require 24/7 uninterrupted power supply.

- Wind/solar are intermittent and must rely on natural gas power to stabilize the grid.

- Argan is one of the few EPC firms capable of handling such complex combined-cycle gas plants, with deeper moat than expected.

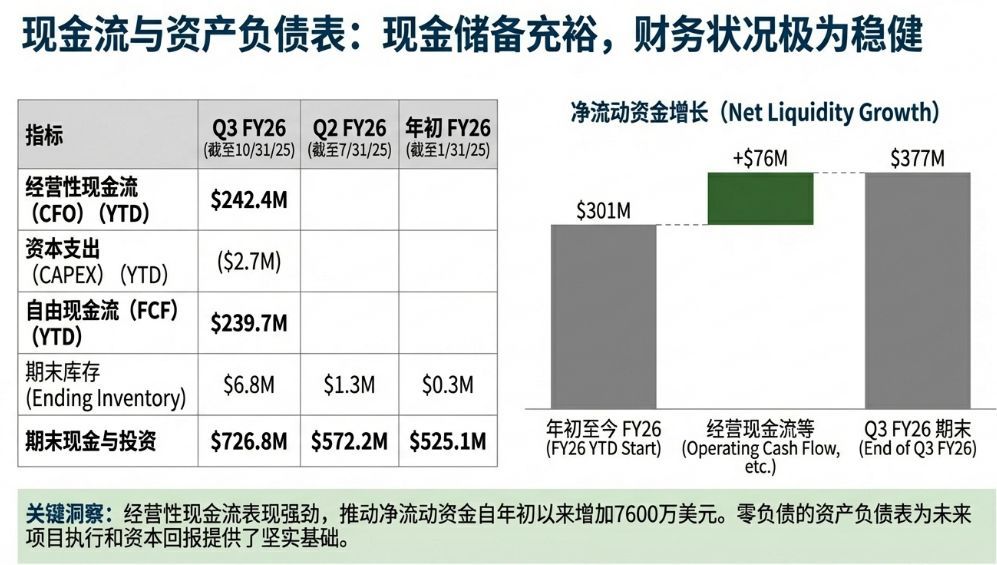

4. Rock-Solid Balance Sheet 🛡️

- Zero debt.

- Cash and investments total $726 million.

- Dividend raised 33%, with ongoing share buybacks.

💡 Bottom Line:

Argan is riding the "supercycle" of energy infrastructure. If you're bullish on AI-driven long-term power demand, this $3B-backlog, zero-debt company belongs on your watchlist.

$Argan(AGX.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.