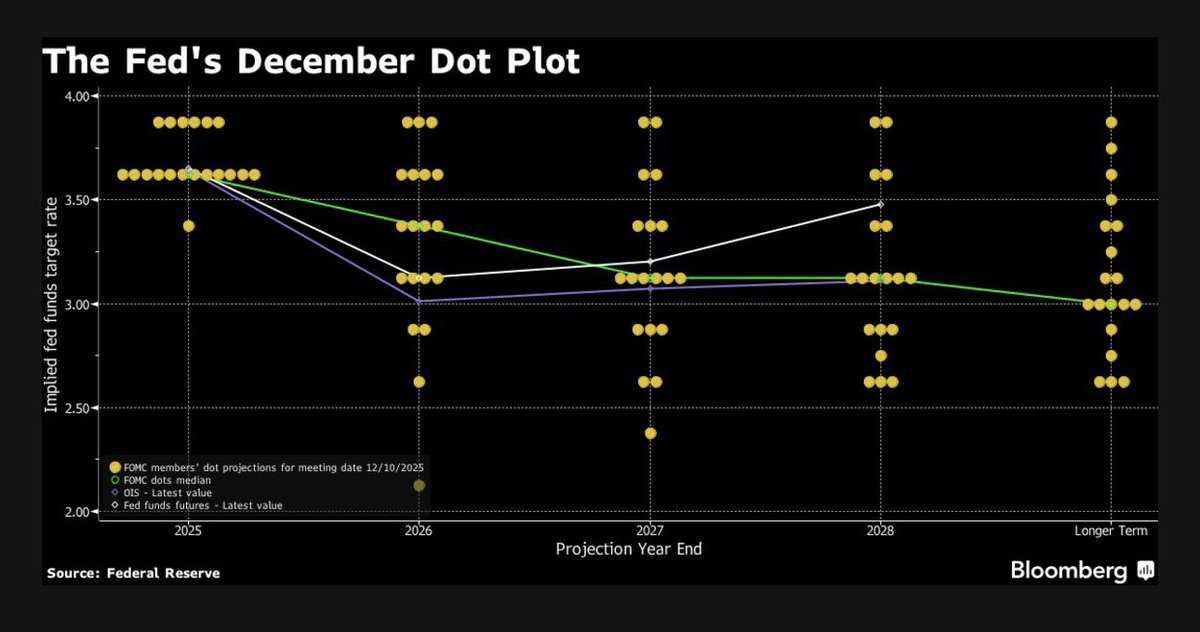

The Fed cut short term rates by 25bp to a range of 3.5-3.75%, its third consecutive interest rate reduction, and projected just one cut in 2026. The 9-3 vote was the most dissents since 2019. The Fed also subtly altered the wording of its statement suggesting greater uncertainty about when it might cut rates again.

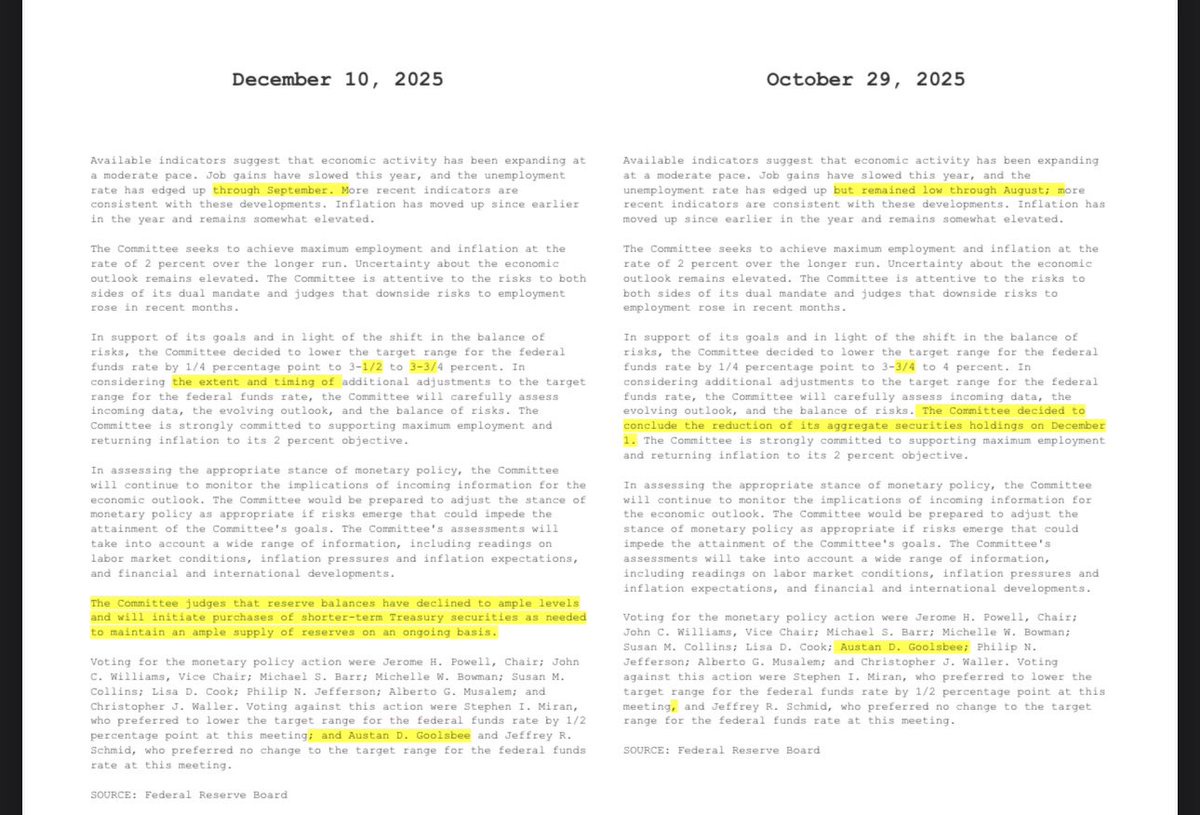

Today’s three dissents and the rate projections highlight divisions among the Fed that have emerged over whether weakness in the labor market or stubborn inflation represent the larger danger to the US economy.In their October statement, the FOMC described what it would take into account “in considering additional adjustments” to their benchmark. In Wednesday’s statement the committee reverted to language used last December — just before a pause in rate cuts — to say “in considering the extent and timing of additional adjustments.”Fed officials also authorized fresh purchases of short-term Treasury securities (QE light) to maintain an “ample” supply of bank reserves.Two regional Fed presidents — Austan Goolsbee from Chicago and Jeff Schmid from Kansas City — voted against the decision, preferring to keep rates unchanged. Governor Stephen Miran, whom Trump appointed to the central bank in September, dissented again in favor of a larger, half-point reduction.We do not view today’s actions as a “hawkish cut” as had been billed, given QE light (Fed buying short term treasuries) starting next week.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.