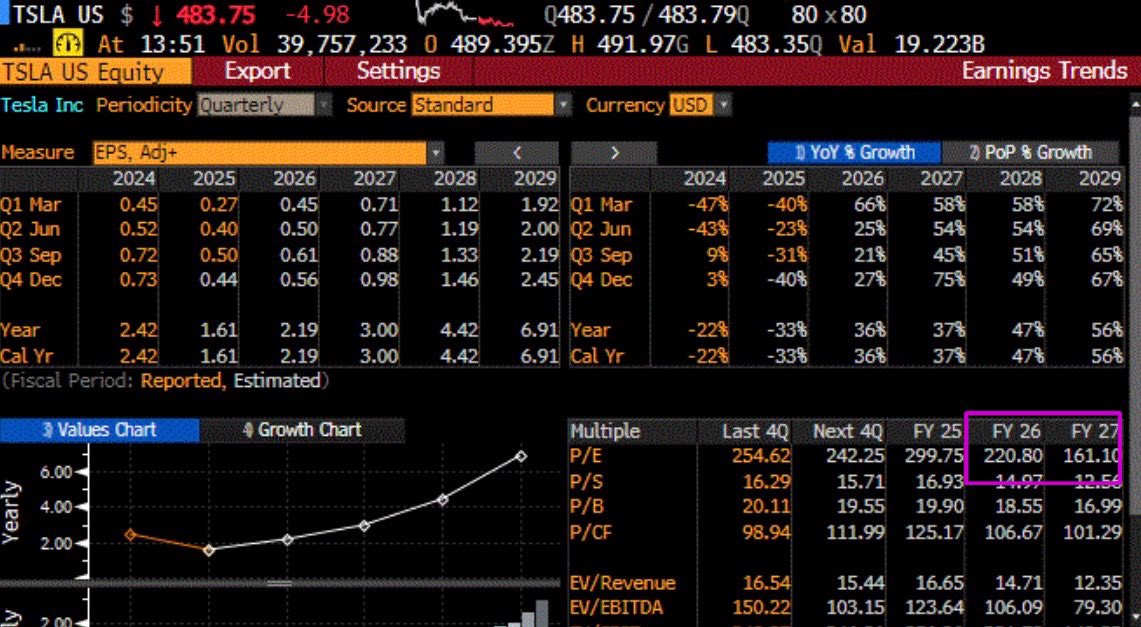

我喜歡$特斯拉 (TSLA.US) 的故事:全球最賺錢的電動汽車商業模式,即將規模化推廣的通用無監督自動駕駛技術,2026 年開始量產的 Optimus 機器人,以及全力以赴的 @埃隆·馬斯克。 但我不喜歡它的估值:2026 年市盈率高達 220 倍,而長期預期每股收益增長率僅為 +35%(PEG 比率 6 倍),且盈利預期持續下調(過去 3 個月下調 11%,過去一年下調 47%)。 批評者讓我忽略財務數據只關注技術,但這種思維每次都會讓你陷入麻煩。

下一個重要催化劑是$特斯拉 (TSLA.US) 宣佈將在部分或全部奧斯汀工廠生產的車輛中移除安全監控裝置,這標誌着技術已準備就緒,此後$特斯拉 (TSLA.US) 的無人駕駛出租車將實現完全無人監督的自動駕駛。 @埃隆·馬斯克承諾今年年底前實現這一目標,這可能是特斯拉股價持續走高的原因。本文版權歸屬原作者/機構所有。

當前內容僅代表作者觀點,與本平台立場無關。內容僅供投資者參考,亦不構成任何投資建議。如對本平台提供的內容服務有任何疑問或建議,請聯絡我們。