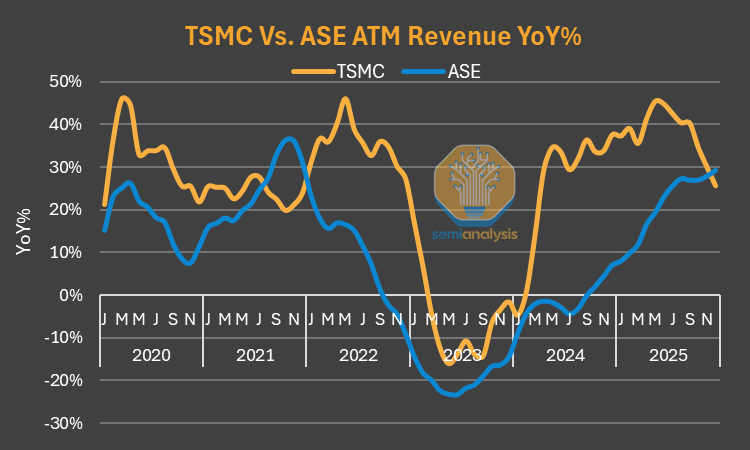

Historically, $Taiwan Semiconductor(TSM.US) and ASE revenues tracked each other directionally. That relationship breaks down in early 2024 as 2 things happened:

1) TSMC ramped CoWoS and absorbed packaging revenue that previously flowed to the OSATs.2) While TSMC enjoyed AI-driven revenue, mainstream demand remained muted. While TSMC continues to grow, tight CoWoS capacity and rapid growth in accelerator SKU counts are pushing incremental packaging and test work towards the OSATs, providing a source of upside they previously lacked.(Chart is 3mma, YoY growth is USD-denominated)Source: Chips & Wafers

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.