Market Shocks: AI, Cisco, Rates

Hey community 👋 — here’s today’s global market briefing tailored. This week feels like a “macro meets AI sentiment reset” moment, and price action is getting interesting.

🔥 US markets: Open strong → Close weak (AI disruption fears rising)

Last night’s session saw classic risk-off rotation:

👉 Major indexes opened higher but faded into the close.

👉 AI disruption fears are no longer just bullish hype — they’re starting to pressure sectors seen as vulnerable.

Key developments:

- New AI tools triggering worries about automation risks in finance, legal, and software sectors.

- Software and service stocks particularly sensitive as investors reassess earnings durability.

- Real estate service stocks recorded their worst one-day drop since the pandemic (reflecting macro + tech disruption fears).

💡 Market narrative shifting:

AI = long-term growth driver

BUT

AI = near-term earnings uncertainty & sector disruption

This dual narrative is causing volatility rather than a straight AI rally.

📊 US Jobs data: Strong headline… but hidden weakness?

January Non-Farm Payrolls:

✅ +130K jobs (beat expectations)

✅ Unemployment rate: 4.3% (slightly lower)

⚠️ Annual revision: -862K jobs (huge downward adjustment)

Translation:

- Labour market still resilient short-term.

- But revisions suggest hiring was weaker than previously believed.

Market reaction:

👉 Rate-cut expectations pushed later — many now see first Fed cut around July instead of early-year.

For investors:

- “Higher for longer” rate environment still base case.

- Growth stocks may face valuation pressure.

💰 US budget update: Deficit narrows — tariffs driving revenue

US FY2026 (first 4 months):

- Budget deficit shrank ~17%.

- Tariff revenues surged.

Why markets care:

- Fiscal tightening could impact liquidity.

- Trade policy still a macro wildcard (especially for semis + global exporters).

🍎 Apple Siri delay — AI competition heating up

Reports suggest:

- New Siri upgrade may be postponed again.

- Internal testing exposed issues.

- Some features possibly pushed to September launch window.

Takeaway:

👉 Apple’s AI strategy is moving slower vs competitors — could impact market expectations if narrative shifts toward “lagging AI race”.

🤖 AI wars escalate globally — Zhipu launches GLM-5

Highlights:

- Focus on coding and agent-based AI workflows.

- Competition intensifying among China models (Qwen, Doubao, Wenxin, etc.) and overseas players.

Investor angle:

👉 AI is no longer just Nvidia vs hyperscalers — ecosystem competition expanding across regions.

📡 Cisco earnings: Beat expectations… stock drops anyway

Cisco reported:

- Revenue +10% YoY (record level)

- Strong AI infrastructure demand

- Raised outlook

BUT:

❌ After-hours stock fell >7%.

Why?

- Margin outlook weaker.

- AI expectations already very high — “good isn’t enough”.

Classic AI-era phenomenon:

👉 Market pricing future perfection.

🎯 Today’s watchlist

📌 US Initial Jobless Claims (macro direction clue)

📌 Earnings: Coinbase, Airbnb, NEBIUS, Huahong Semiconductor

📌 HK grey market: Haizhi Tech, Wall Nuclear (IPO sentiment gauge)

🎁 Comment & Earn!

1️⃣ Are we entering an “AI volatility phase” instead of AI straight bull run?

2️⃣ Cisco beating but dropping — is this peak expectations or buying opportunity?

3️⃣ With rate cuts potentially delayed to July, which sectors survive best?

💬 Drop your thoughts, predictions, or trades below and earn 188 Task Coins!

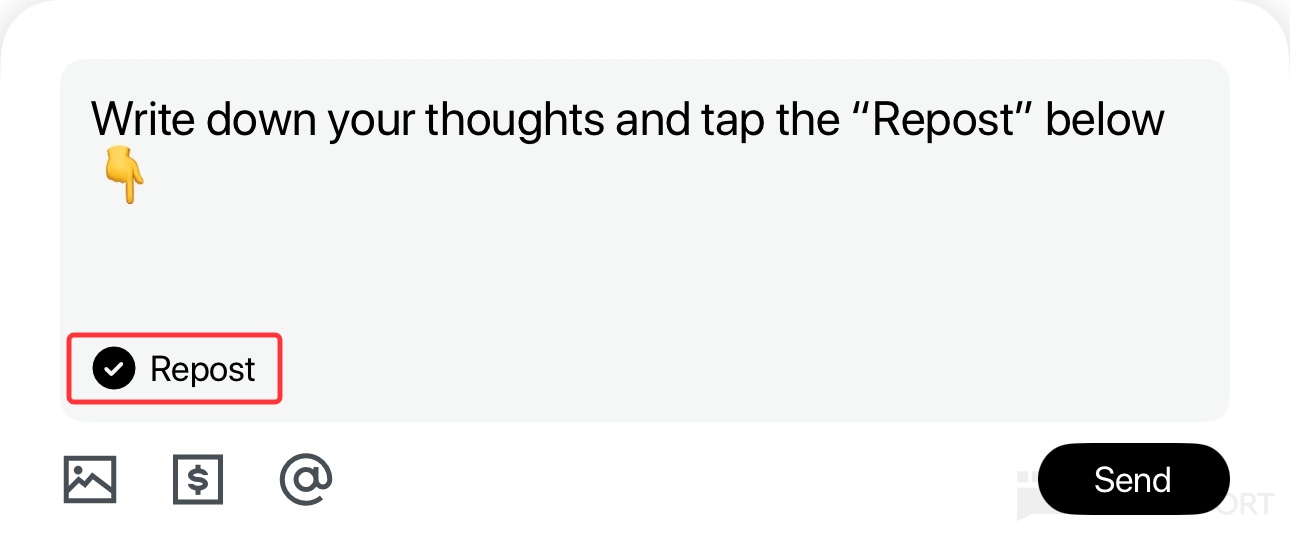

🤫 Ps: You’ll get an extra 100 Task Coins if you comment and repost (as shown below).

‼️ Important ‼️

- No reward will be given for duplicate or similar content.

- Rewards will be issued within 1-2 working days.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.