EQT IX Biopharma (42C) – Bullish Investment Case

Current Price : $0.22

Portfolio Context: 5.5% allocation (controlled risk)

Time Horizon: 6–12 months

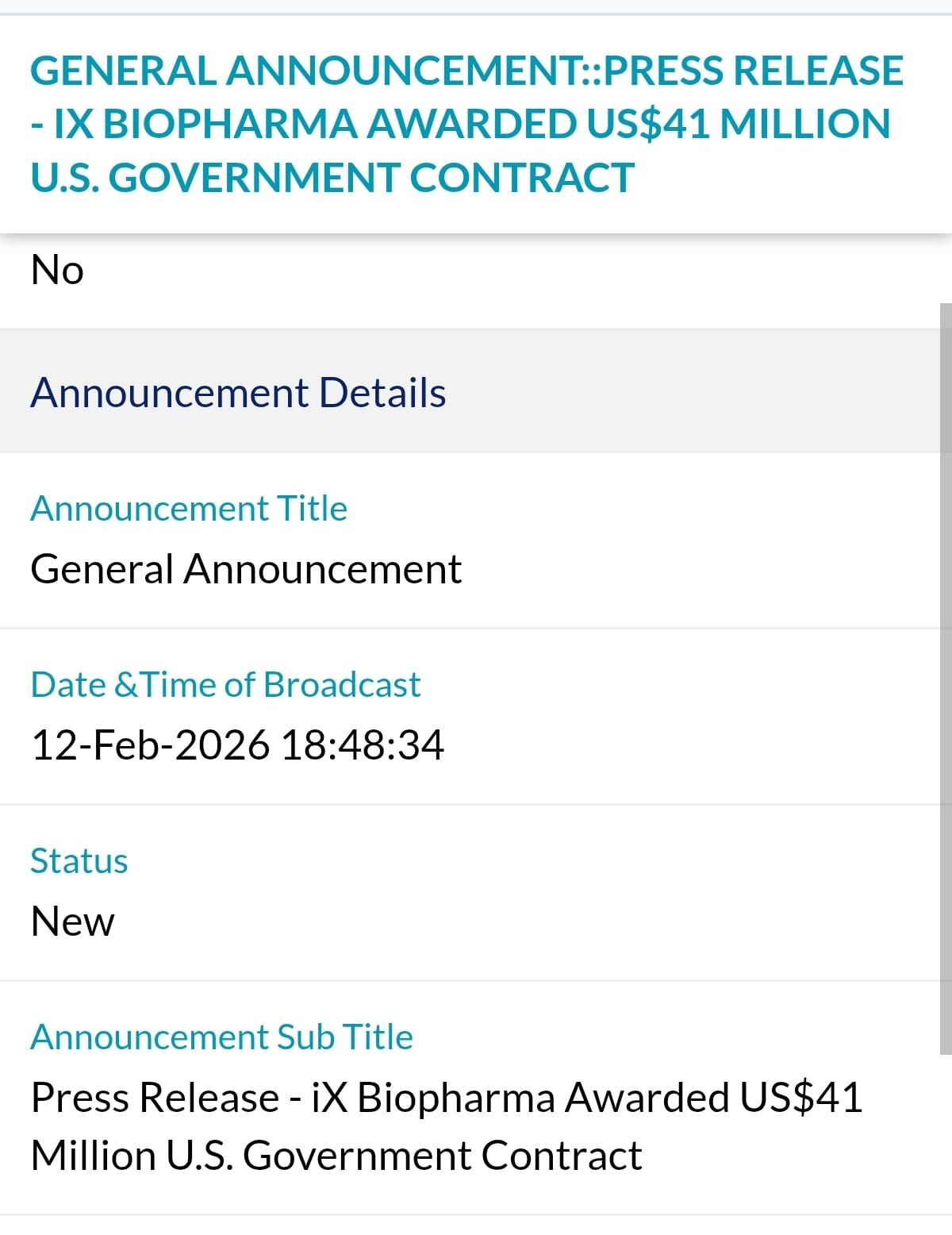

🔥 1️⃣ Transformational US$41M DoD Contract

Major catalyst secured.

✔ US$41M non-dilutive funding

✔ Funds Phase 3 development of Wafermine®

✔ Supports potential FDA Emergency Use Authorization (EUA)

✔ Sole-source U.S. government award

This significantly reduces:

Dilution risk

Funding uncertainty

Cash runway concerns

This is not speculative hype — it’s government-backed validation.

💊 2️⃣ Positioned in Non-Opioid Pain Market

Global shift away from opioids is structural.

Wafermine®:

Sublingual ketamine wafer

Rapid pain relief

Designed for battlefield & emergency settings

Potential hospital & civilian expansion later

Non-opioid pain management is a high-demand segment with strong policy support.

🏛 3️⃣ Government Endorsement = Credibility Boost

U.S. DoD involvement signals:

✔ Clinical confidence

✔ Strategic importance

✔ Potential early military adoption

This moves 42C from speculative biotech → government-backed clinical asset.

Few SGX small caps get this level of validation.

💰 4️⃣ Improved Financial Position

With US$41M spread over ~36 months:

Stronger balance sheet

Lower near-term need for placements

Greater negotiating power in partnerships

Cash runway likely extended into 2027+.

This is critical for Phase 3 biotech companies.

📊 5️⃣ 12-Month Valuation Outlook

Realistic valuation scenarios:

🧱 Base Case:

$0.30 – $0.35

🚀 Bull Case:

$0.40 – $0.60

These reflect:

Continued Phase 3 progress

Positive interim updates

Possible EUA momentum

Additional contracts

At $0.22, risk/reward is asymmetrically attractive.

📈 6️⃣ Technical Setup

Key Levels:

• $0.24 – Breakout trigger

• $0.27 – First supply zone

• $0.30 – Major resistance

• $0.35+ – Momentum zone

Holding above $0.20 keeps bullish structure intact.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.