BABA Diamond Holder

BABA Diamond Holder BABA Return Rate

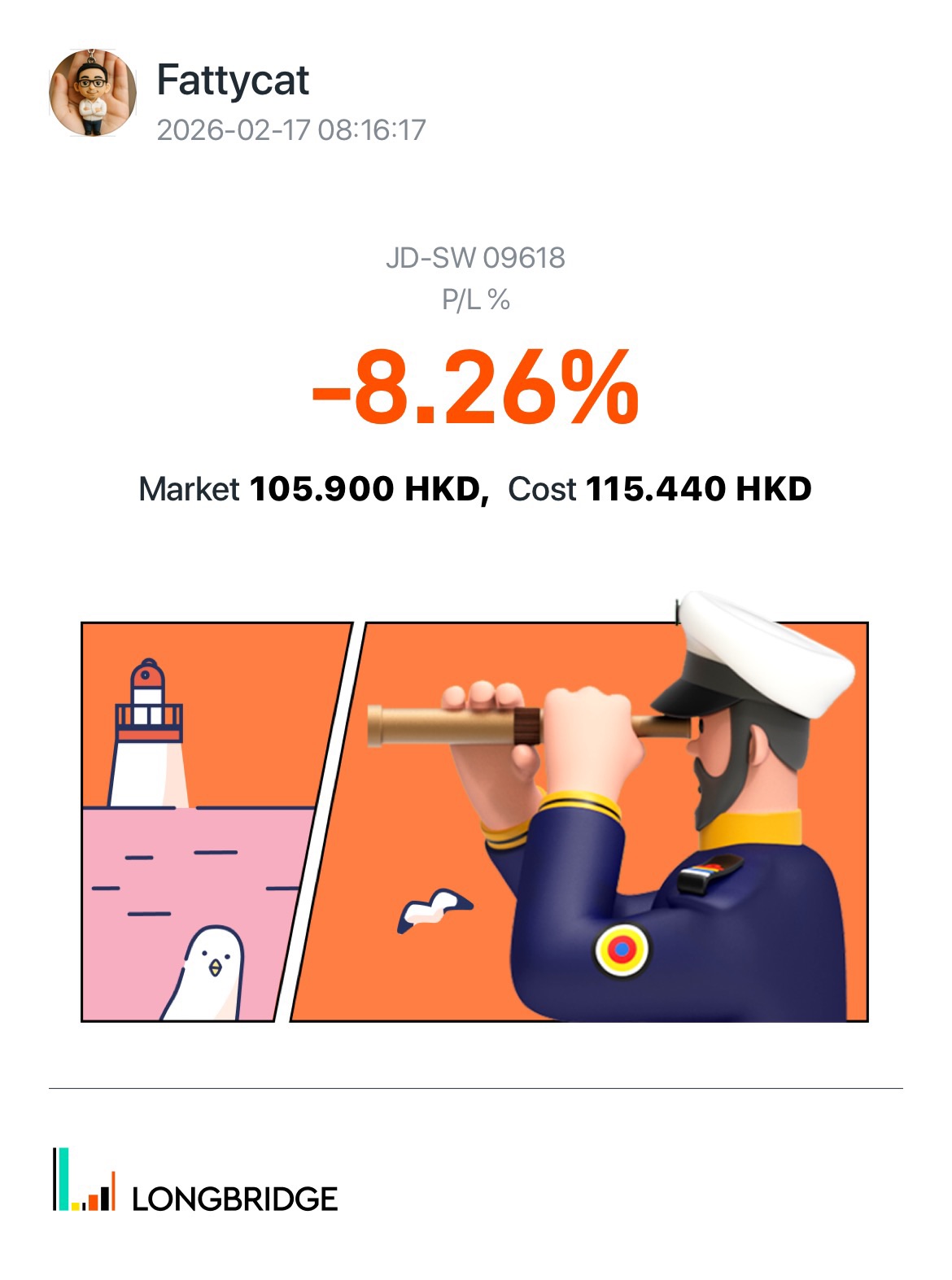

BABA Return Rate$JD-SW(09618.HK)JD.com is trading close to historic lows and below many estimates of its intrinsic value. As of February 2026, the stock has a trailing P/E of about 7. For long-term value investors, it provides a dividend yield exceeding 3.75% and benefits from a best-in-class logistics network in China that supports a strong, defensible moat.

At current prices, the market seems to be assuming no future growth. An outlook that may be overly pessimistic given the company’s continued revenue expansion. I am holding with strong conviction. Are you?

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.