I believe $Warner Bros. Discovery(WBD.US) deal uncertainty is a temporary overhang on $Netflix(NFLX.US) stock, presenting investors with a potential asymmetrical return opportunity.

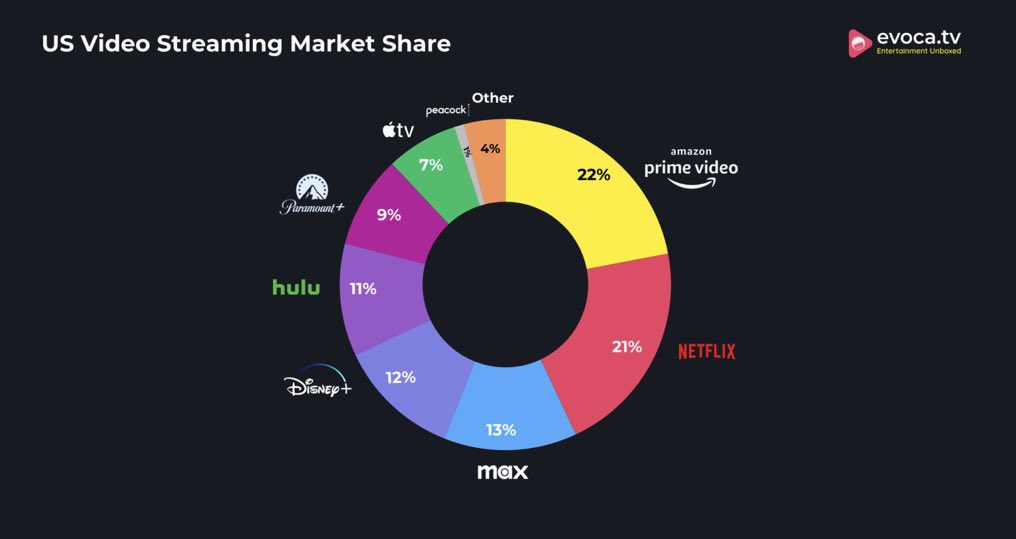

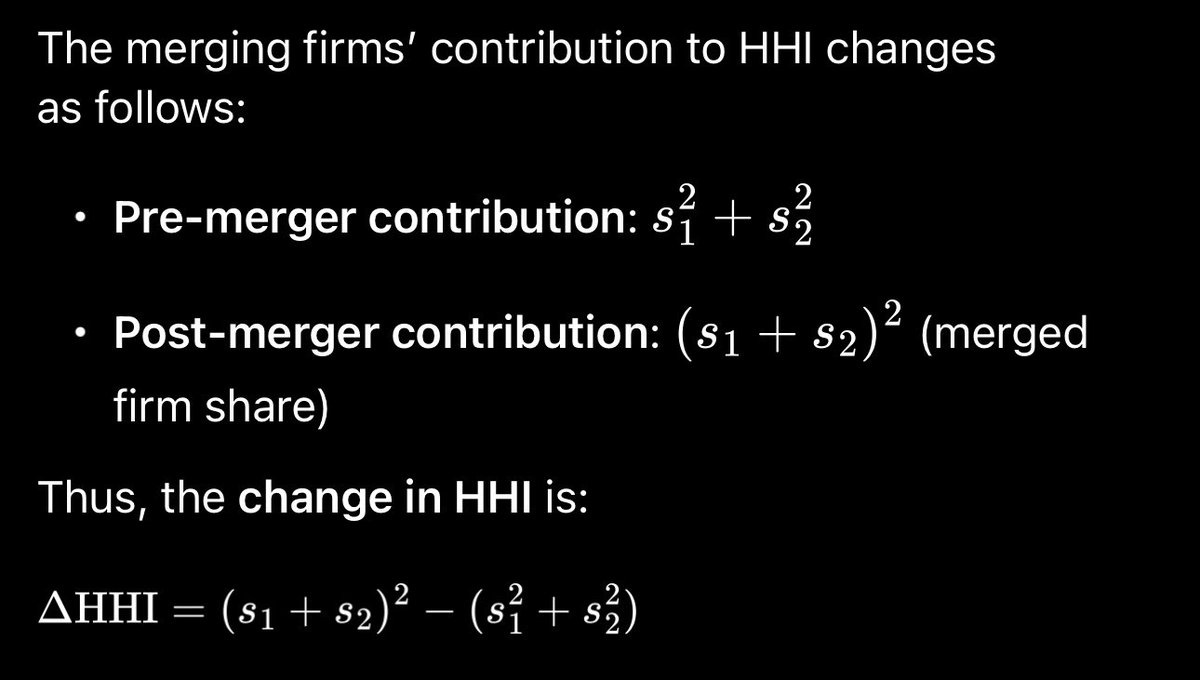

$Netflix(NFLX.US) ‘s $27.75/share all-cash offer for $Warner Bros. Discovery(WBD.US) is not dilutive from an accounting standpoint, and any deal overhang should potentially dissipate after the March 20 special meeting and regulators approve (or don’t approve) a deal. The Herfindahl-Hirschman Index (HHI) is the key tool the U.S. DOJ and FTC use to assess market concentration in potential mergers under the 2023 Merger Guidelines effective since Dec 2023. The HHI concentration ratios are problematic for both $Netflix(NFLX.US) and $PSY as acquirers of $Warner Bros. Discovery(WBD.US) but are more so for NFLX with a 21% US streaming share vs WBD at 13% and PSKY at 9%. With a 34% combined share in the NFLX-WBD scenario any change in HHI above 100 would likely be considered concentrated under the FTC’s 2023 Merger Guidelines. We estimate the change in HHI is +546 for a NFLX-WBD deal vs +234 for a PSKY-WBD deal. Regulators use a change in HHI threshold of 200 as the threshold for concentration change if the combined share is less than 30%, as it is in the case of a PSKY-WBD combination. This assumes regulators land in the camp that this deal is viewed narrowly as streaming, vs overall TV viewing, the latter which would include YouTube as a competitor, which would result in much lower NFLX-WBD HHI concentration ratios.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.