Posts

Posts Likes Received

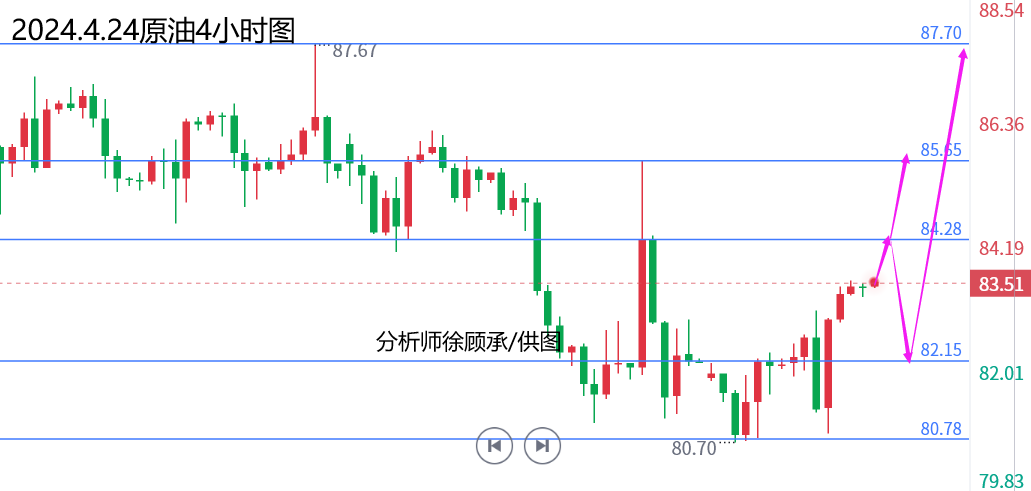

Likes ReceivedCrude oil: At the beginning of the week, Xu Gucheng also mentioned trying a long position at 81.1 with a stop loss at 80.5. The market hit a low of 80.7, and during Monday, it tested 80.7 three times without breaking below, which was in line with expectations. On Tuesday during the U.S. session, it tested the low again at 80.8. The previous API data was 408.9, with an expectation of 180, and the actual release was -323, which was significantly bullish. During the Asian session, crude oil maintained its upward trend and closed at 83.5. Today's focus is on the EIA data to be released at 22:30. The Asian and European sessions are expected to continue rising. Those holding long positions from 81.1 can partially take profits at 83.5 and observe whether 84.3-84.5 holds firmly. If it does, the market may further test 85.6-86.4 and 87.7 this week.

Therefore, with the EIA data today, we won’t speculate on whether the data will be bullish or bearish. Instead, we’ll focus on whether 84.3-84.5 breaks above. Below, we’ll continue to monitor Monday’s opening levels at 82.2-82. As long as 82 holds, we’ll maintain a range-trading strategy between 80.5 and 87.7. The overall trend remains bullish. If the data tonight is significantly bearish and the price fails to hold above 84.5, consider shorting around 84-84.5, targeting 82. Operationally, Xu Gucheng suggests shorting on a rebound to 84.3-84.5 with a stop loss above 84.8, targeting 83-82. If the price falls but holds above 82, consider going long with a stop loss at 81.5, targeting a breakout at 84.5, and further targets at 85.7 and 87.7 if broken.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.