Posts

Posts Likes Received

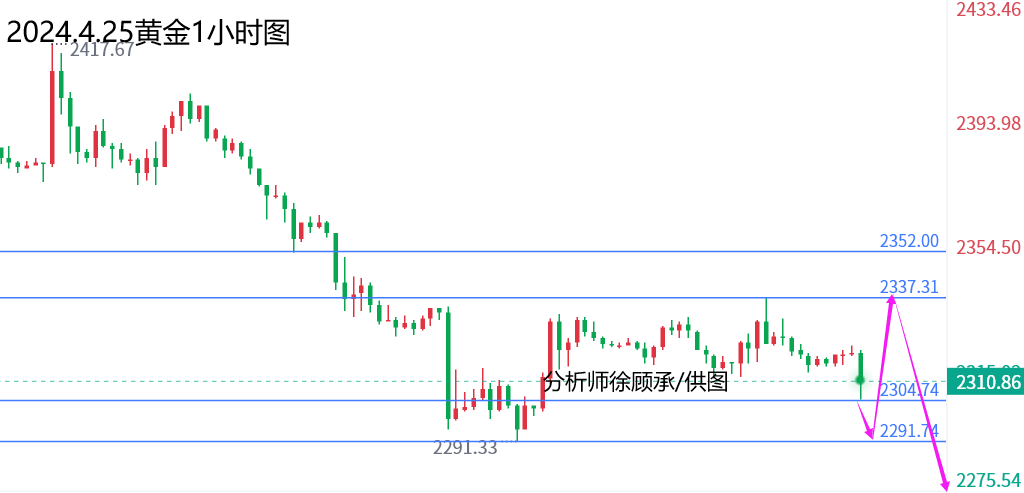

Likes ReceivedGold: Yesterday, the Asian session tested the high of 2330-2331 twice, and before the European session opened, it fell twice to test the low of 2311. The US session started to gain momentum, breaking through 2337, with a technical adjustment at the close, finally settling near 2313. In today's early session, the price first rose to below 2322 before the market sold off three times, and it has now fallen below the key support level of 2311, indicating weakness. As of writing, gold has hit a low near 2305.

Today's key economic data includes the US Initial Jobless Claims for the week ending April 20 and the US Q1 Real GDP Annualized QoQ Preliminary at 20:30, with expectations at 2.1%. Also, watch for the US Q1 Real Personal Consumption Expenditures QoQ Preliminary and the US Q1 Core PCE Price Index Annualized QoQ Preliminary. Later, at 22:00, the US Pending Home Sales MoM for March will be released.

From a technical perspective, the Asian session on Thursday appears weak, and the European session may continue the bearish trend. Key support below is at 2305-2300. If this level holds, the price may fluctuate between 2300-2337, buying low and selling high. However, the current trend is weak, with strong resistance above, making a short-term rebound unlikely. For now, it's safer to stay on the sidelines. Today's trading strategy suggested by Xu Gucheng is to try a long position at 2305-2300, with a stop-loss below 2393, targeting 2322. If it holds firmly, watch for a battle at 2337. Conservative traders can wait for 2390-2385 to attempt a long, with a stop-loss at 2382. If the Asian and European sessions continue to weaken without any rebound, look for short opportunities at 2320-2325-2330 before the US session, watching for a break below 2300.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.