Posts

Posts Likes Received

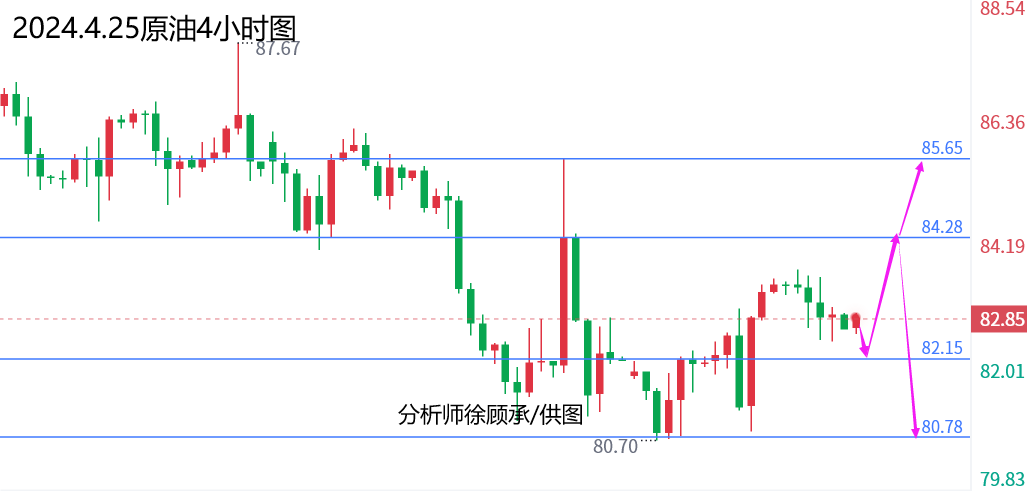

Likes ReceivedCrude oil: At the beginning of the week, we suggested going long at 81.1 with a stop loss at 80.5. Yesterday during the Asian session, the price continued to rise, testing a high of 83.7 before pulling back to 82.7 after the European session opened. After the US session opened, the price saw a slight rally. Despite negative data, it surged to 83.6 but failed to hold. The 15-minute K-line formed a doji, and the late session tested a low of 82.4 before closing at 82.8. This morning, the price remains bullish, currently trading around 82.9 at the time of writing.

From a technical perspective, Monday saw the price stabilize at the bottom of 80.7, while Tuesday saw a rally followed by a pullback to test support. Wednesday's price action was weak and corrective. For Thursday, we expect a pullback to around 82.1 during the Asian and European sessions as a defensive level. As long as this level holds, the price is expected to trade within the 80.7-85.65 range, buying low and selling high. Therefore, today's strategy suggested by Xu Gucheng is to go long at 82.1, targeting 83.5-83.7, with a stop loss at 81.45. If 83.7 is broken, expect a rise to 84.3 and above 85.65 this week. If the US session rallies to around 84, consider going short targeting 82.5-82.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.