中国 2024 上半年汽车出海盘点:美洲篇

芝能科技出品

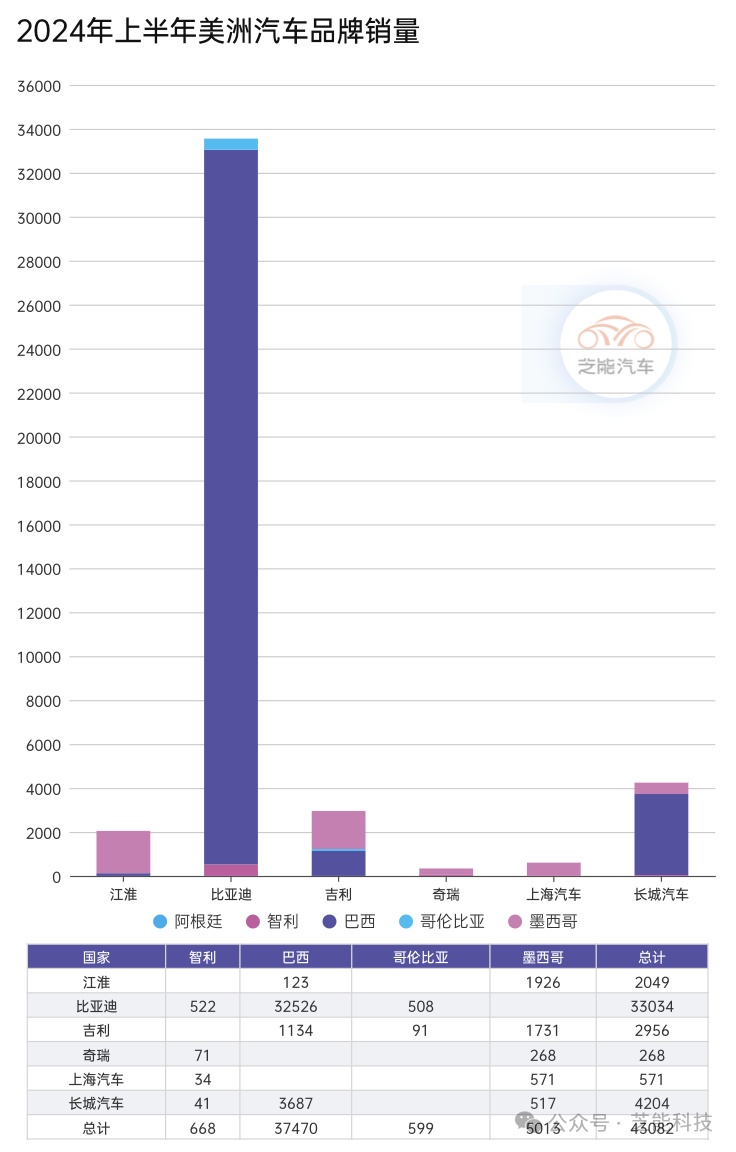

中国的油车和电车去美洲的胜算如何?美洲市场整体来看,中国车企正在努力探索出路;从数量来看,中国品牌在巴西和墨西哥的汽车市场上的表现十分引人注目。

01

总体销量情况

● 比亚迪在巴西以 32,562 辆的销量遥遥领先,

● 奇瑞紧随其后,在巴西售出 27,969 辆,在墨西哥售出 10,936 辆。

● 长城汽车在巴西的销量为 12,731 辆,在墨西哥为 1,301 辆。

● 上汽和江淮也在墨西哥市场有所斩获,分别售出 4,106 辆和 2,103 辆。

仅看电车的话,在南美和墨西哥的汽车市场上,中国电车品牌的销量数据:

● 江淮:在巴西售出 123 辆,在墨西哥售出 1,926 辆,总计 2,049 辆。

● 比亚迪:在智利售出 522 辆,在巴西售出 32,526 辆,在哥伦比亚售出 508 辆,总计 33,034 辆。

● 吉利:在智利售出 71 辆,在巴西售出 1,134 辆,在哥伦比亚售出 91 辆,在墨西哥售出 1,731 辆,总计 2,956 辆。

● 奇瑞:在墨西哥售出 268 辆。

● 上海汽车:在墨西哥售出 571 辆。

● 长城汽车:在智利售出 41 辆,在巴西售出 3,687 辆,在墨西哥售出 517 辆,总计 4,204 辆。

从数据来看,比亚迪在巴西市场表现最为强劲,而长城汽车在巴西和墨西哥市场也有显著销量。其他品牌在各个市场的表现虽然较为分散,但也展示了中国汽车品牌在南美市场的整体增长。

02

美洲的政策

巴西自今年 1 月起,对于从海外购买电动汽车、混合动力汽车和插电式混合动力汽车的活动将逐步恢复进口税。

● 对于混合动力汽车,2024 年 1 月起进口税的税率为 15%,7 月起增至 25%。2025 年 7 月起该项税费的税率变更为 30%,一年之后(2026 年 7 月)再次增加至 35%。

● 对于插电式混合动力汽车,这四个时间节点的进口税税率分别为 12%、20%、28%、35%。

● 对于电动汽车,该项税率的变更顺序为 10%、18%、25%、35%。当然整体巴西对电动汽车的购买力也不算强。

在墨西哥由于受到很大的压力,也很难有破局的机会。整个中国电动汽车在美洲并没有特别大的机会,特别是在美国和加拿大都进不去的情况。

小结

在美洲,国产汽车的销售战略围绕油车和混动是更合理的,毕竟电力系统和充电桩的建设还需要一段时间。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。