There is only one way to save the economy,

Economically: Flooding the market with liquidity + extremely proactive fiscal policies, using new debt to eliminate old debt...

Politically: ...

The policy signal of not cutting LPR

The unchanged LPR in September does not mean the policy will continue to stay firm. With the Fed cutting rates by 50bp in September, today's unchanged domestic LPR is indeed somewhat surprising. Minmetals Securities tends to believe that the intensity of current policies may be more critical. Especially considering that the economy in September may slow further compared to August, to "strive to complete" the annual targets, introducing policies at the end of Q3 or the beginning of Q4 is undoubtedly necessary. More importantly, a systematic and coordinated "combo of measures" may be the key reason why the LPR was "temporarily" not cut today.

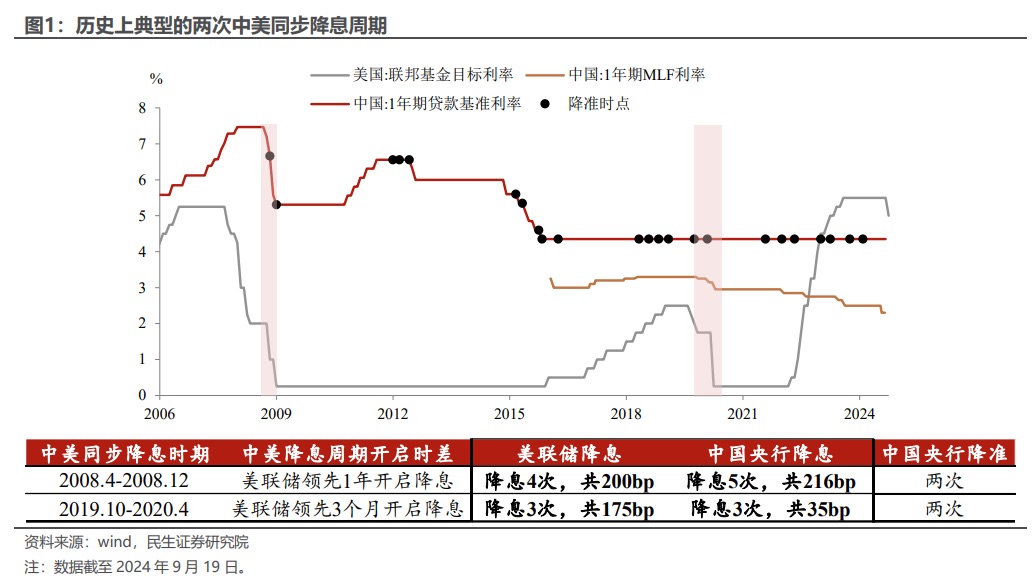

Historical experience: When overseas rate cuts materialize, domestic monetary policy also eases, though the timing is not entirely synchronized. In the two typical overseas rate-cutting cycles (2008, 2019-2020), domestic monetary policy also turned accommodative, but in both cases, the timing of domestic easing was slightly later than overseas.

To balance reducing social financing costs and stabilizing bank interest margins, China's economy may first cut existing mortgage rates and then the 1-year LPR, which could be the optimal choice at present.

$SSE Index(000001.SH)$Hang Seng Index(00HSI.HK)$Hang Seng TECH Index(STECH.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.