Traded Value

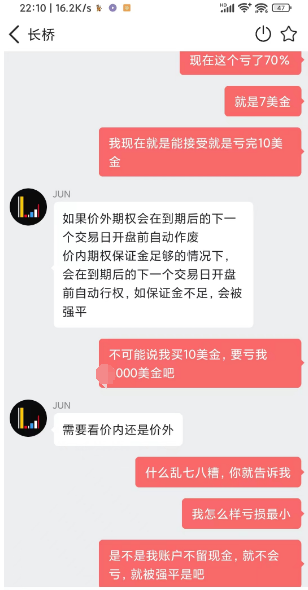

Traded ValueIf out-of-the-money options will automatically expire before the opening of the next trading day after expiration

In-the-money options with sufficient margin will be automatically exercised before the opening of the next trading day after expiration. If the margin is insufficient, they will be liquidated.

After all this, the customer scared me for nothing, talking about a margin call, which made me buy blindly last night.

I'm still learning online.

1. In-the-money options:

When there is a relationship between the strike price of an option and the current price of the underlying asset such that exercising the option immediately would generate a profit, the option is called an in-the-money option.

For call options, if the strike price is lower than the current price of the underlying asset, the call option is in-the-money.

For put options, if the strike price is higher than the current price of the underlying asset, the put option is in-the-money.

The characteristic of in-the-money options is that the strike price already provides some protection against the current price of the underlying asset, so the value of the option is favored by the market, and the price is relatively high.

2. Out-of-the-money options:

When there is a relationship between the strike price of an option and the current price of the underlying asset such that exercising the option immediately would not generate a profit or might even result in a loss, the option is called an out-of-the-money option.

For call options, if the strike price is higher than the current price of the underlying asset, the call option is out-of-the-money.

For put options, if the strike price is lower than the current price of the underlying asset, the put option is out-of-the-money.

The characteristic of out-of-the-money options is that the strike price is relatively far from the current price of the underlying asset, so the value of the option mainly depends on future price fluctuations of the underlying asset.

In summary, in-the-money options are those where the strike price and the current price of the underlying asset create a profit margin, while out-of-the-money options are those where the strike price and the current price of the underlying asset do not create a profit margin.

So, in the long run, is it in-the-money or out-of-the-money? I don’t want the stock.

US stock market quadruple witching day, expiration date options

On the US stock market's quadruple witching day, a beginner's analysis and reflection on yesterday's option positions. On quadruple witching days, it's wise to observe more and act less! I'm a complete newbie, so please correct me if I'm wrong or made any mistakes. I've only had my account for a month, and this is my first real encounter with quadruple witching day. Just like with zero-day options, theories learned from books are shallow; true understanding comes from practice. The story goes that after learning some theories and discussing with others a few days ago, I tried buying 1 option contract (equivalent to 100 shares). However, due to unfamiliarity with the trading interface and operational mistakes...

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.