Middle Eastern capital continues to provide support. American electric vehicle company Lucid Group recently announced the completion of a public offering of 262,446,931 common shares, with Bank of America Securities as the sole underwriter. Lucid has reached an agreement with its major shareholder, Ayar Third Investment Company, an affiliate of Saudi Arabia's Public Investment Fund, under which Ayar agreed to purchase 374,717,927 common shares in a private placement at the same price as the public offering. The total proceeds from this financing are expected to be approximately $1.67 billion, which will be used for general corporate purposes, such as capital expenditures and working capital.

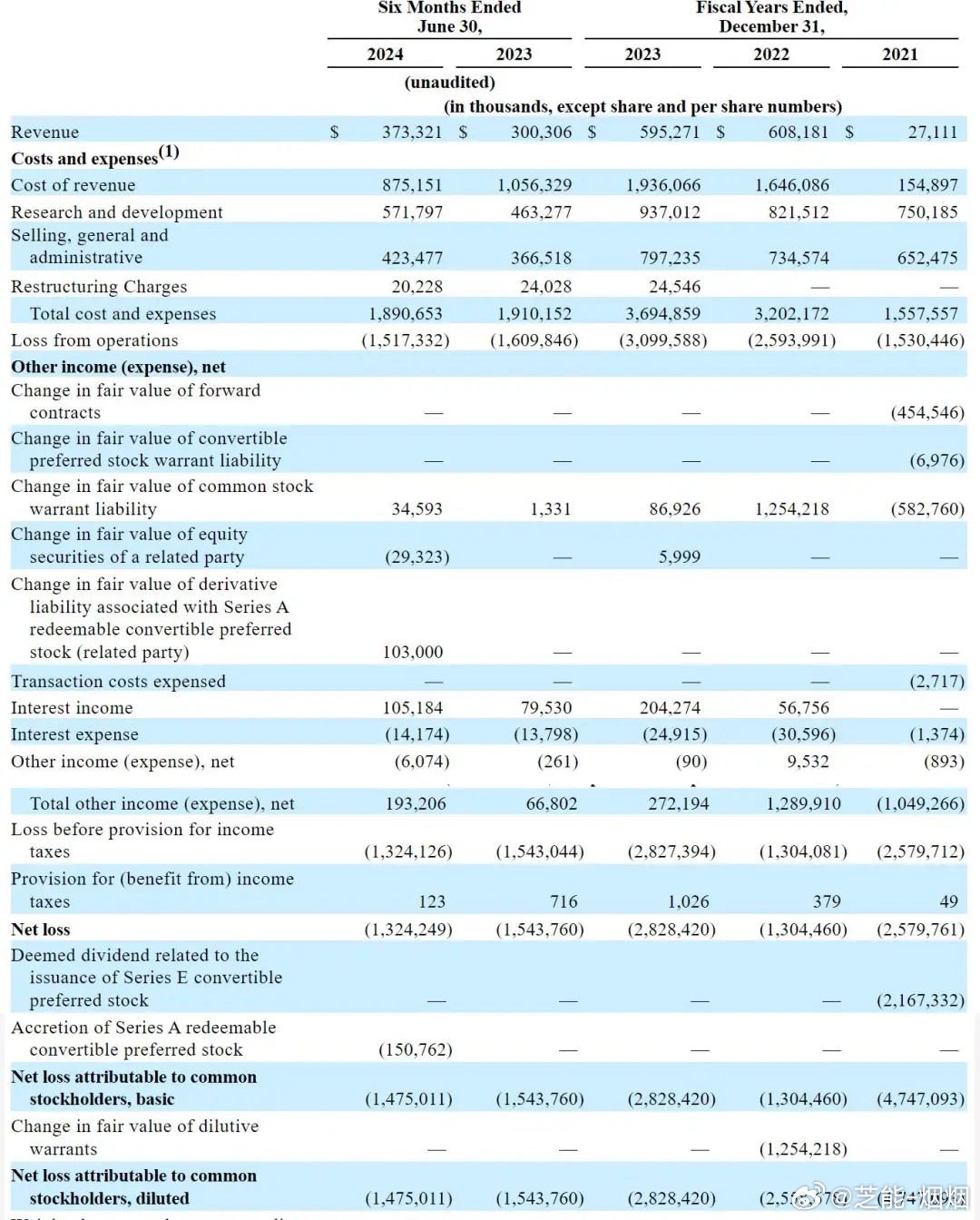

Lucid reported revenue of $373 million in the first half of 2024, a 24% year-over-year increase. Notably, revenue from the Middle East grew significantly to $95.23 million, compared to just $6.75 million in the same period last year. Despite remaining in a loss-making position in the first half of 2024, with a net loss of $1.324 billion, the company expects its operating loss in the third quarter to be lower than analysts' forecasts.

The renewed backing from Middle Eastern capital has injected strong momentum into Lucid's development.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.