Congratulations to my former employer. Since its establishment in 2016, Pony.ai has been in the spotlight and has officially submitted its prospectus to the U.S. Securities and Exchange Commission, aiming for a Nasdaq IPO. As the highest-valued and most-funded autonomous driving company in China, its financial and operational details have also been revealed.

Financial Status: Lost 2.3 billion yuan in the past 2.5 years. From early 2022 to June 30, 2024, Pony.ai accumulated revenue of $165 million, but its net loss during the same period reached $324 million. Over its eight years of operation, the company has raised $1.3 billion, with a post-money valuation exceeding $8.5 billion in its last funding round. However, its current cash and cash equivalents amount to approximately 2.38 billion yuan, indicating significant financial pressure in the long run.

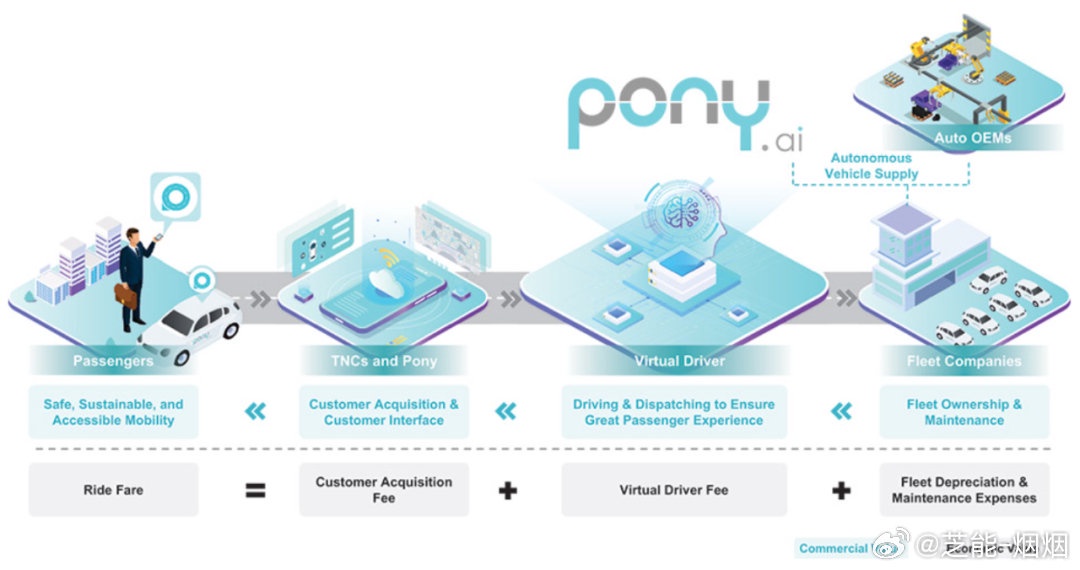

Robotaxi Business: Operates a fleet of over 250 vehicles, deployed in multiple cities with full commercial unmanned operation licenses. It has over 220,000 registered users, with a repeat service usage rate of about 70%, averaging more than 15 daily orders per vehicle. Revenue comes from providing solutions to OEMs or operating its own platform. It has close collaborations with Toyota and GAC.

Robotruck Business: Manages a fleet of 190 autonomous trucks, with a cumulative operational mileage of 767 million ton-kilometers. It builds an ecosystem with OEMs and logistics platforms, offering technology upstream and deploying vehicles downstream, partnering with Sany Heavy Industry and Sinotrans, among others.

Licensing and Application Division: Provides full-stack technology solutions to passenger vehicle OEMs, with clients like IM Motors. It also operates V2X business, backed by an autonomous driving AV software stack.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.