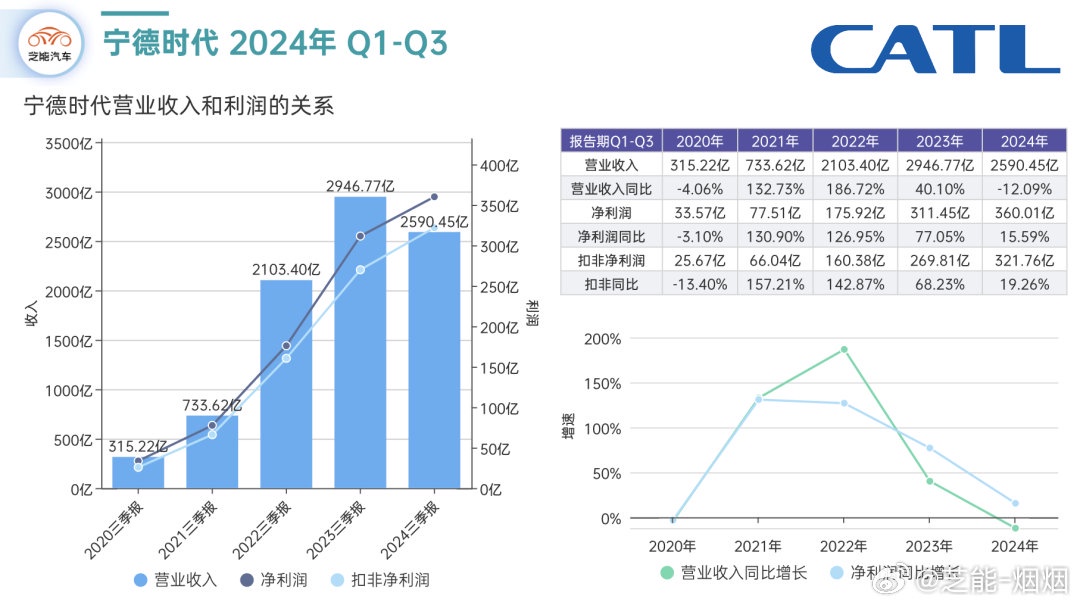

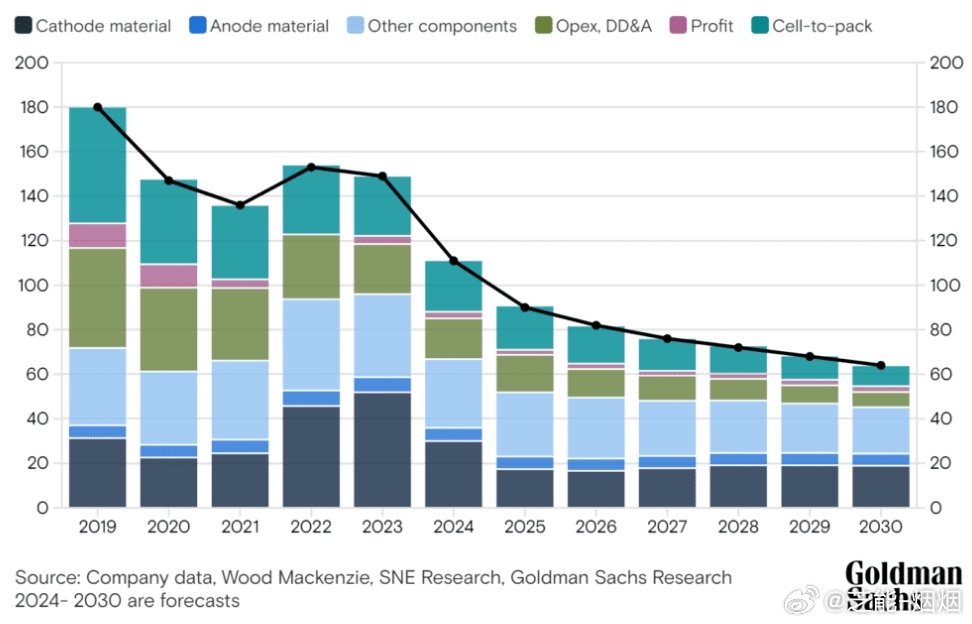

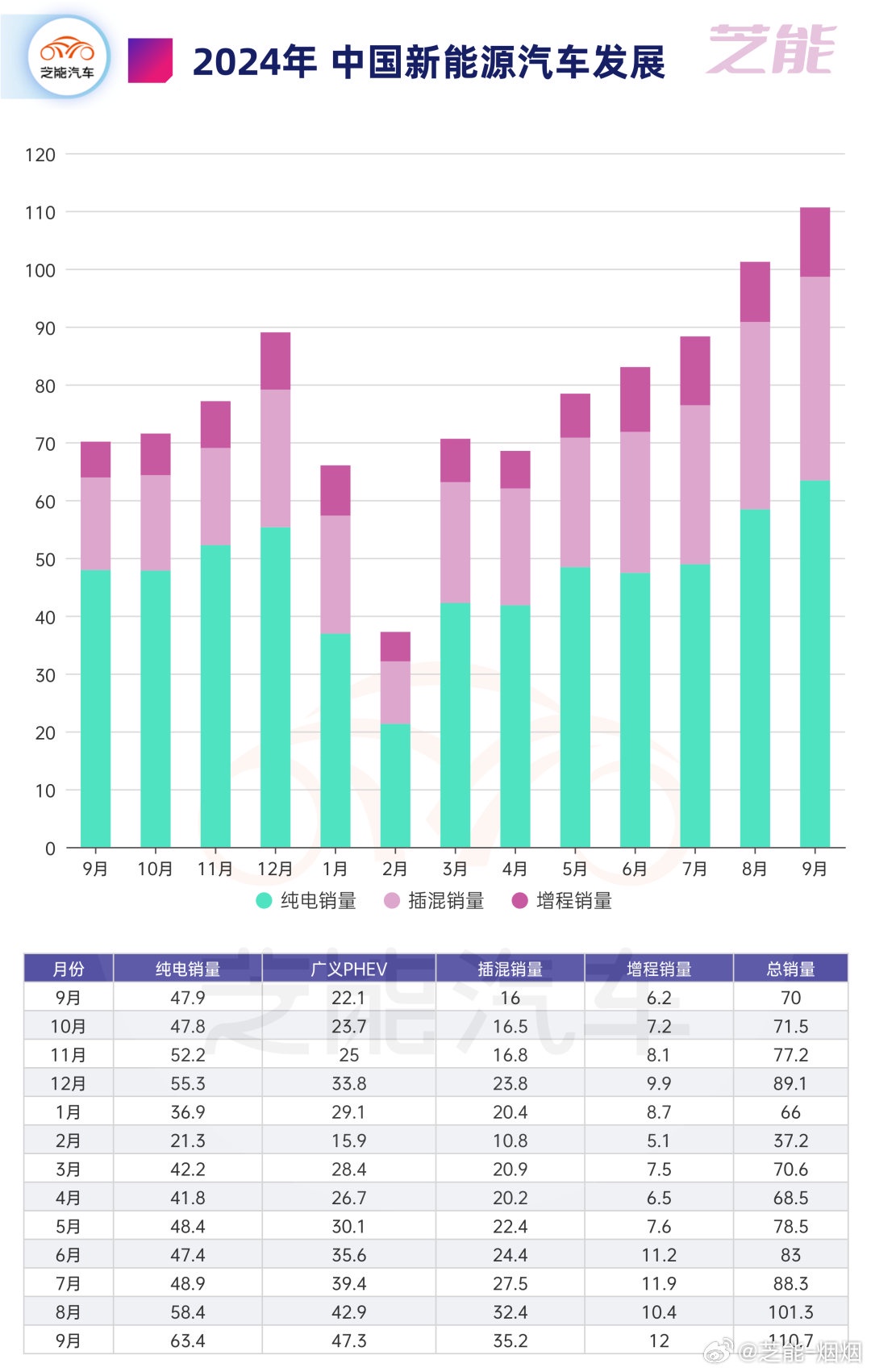

Revenue in the third quarter decreased by 12.48% year-on-year to 92.278 billion yuan, while net profit increased by 25.97% year-on-year to 13.136 billion yuan. The divergence between revenue and profit was mainly due to changes in the shipment structure and price declines of power batteries and energy storage batteries.

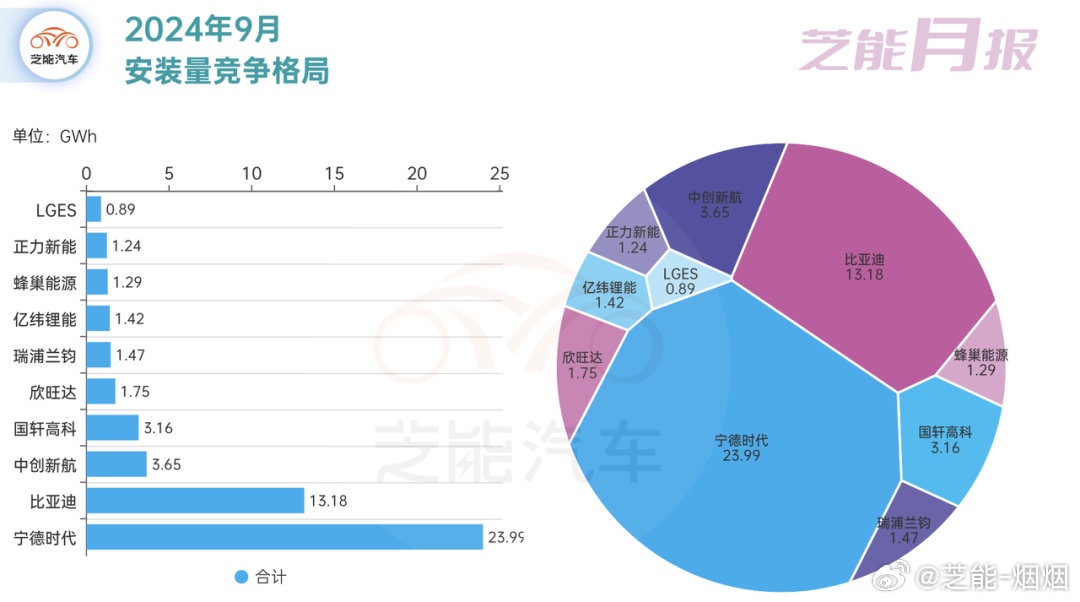

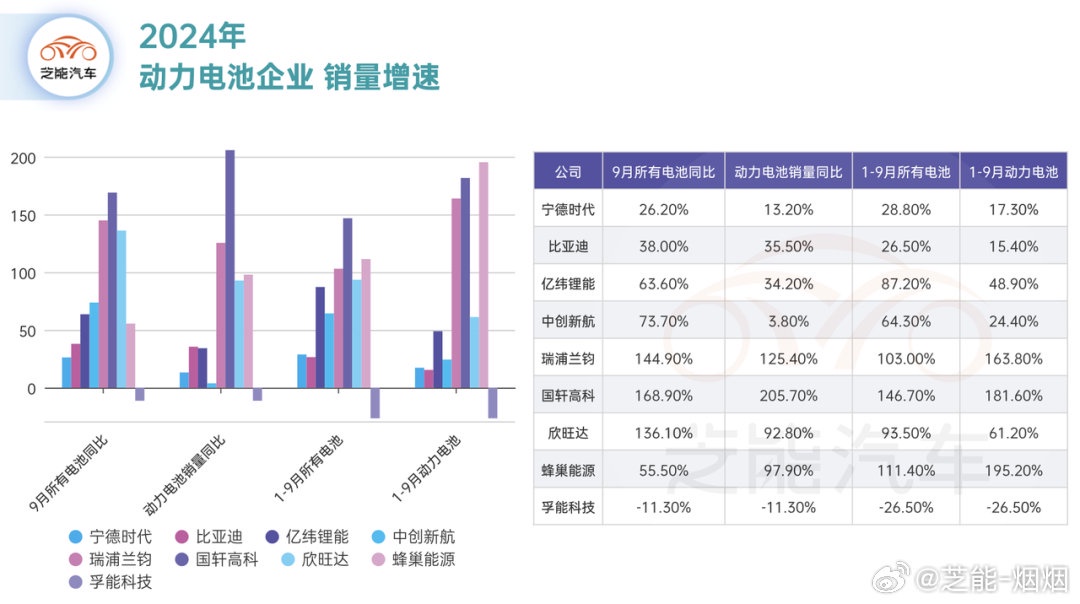

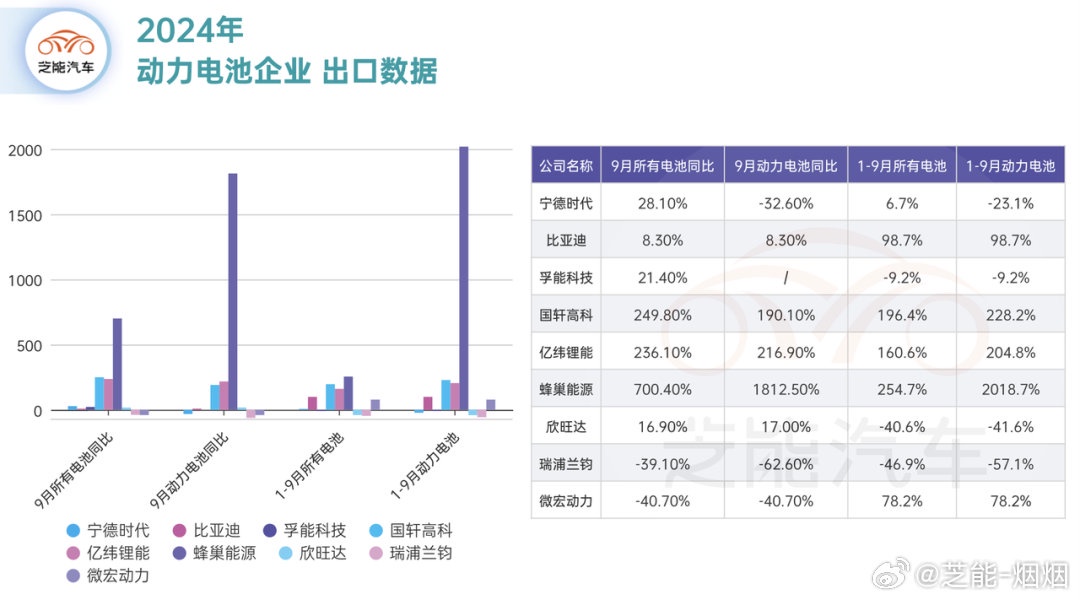

CATL expanded its market share in the domestic power battery market, but its global market share declined due to obstacles in the penetration of overseas electric vehicles and policy impacts.

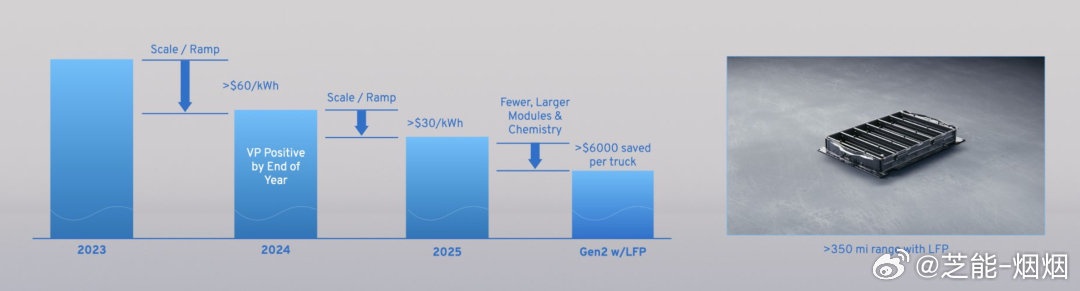

The company faces challenges such as slowing growth in the global electric vehicle market, fluctuations in raw material prices, and supply chain tensions.

Despite this, CATL maintained high gross and net profit margins through cost control and internal efficiency improvements.

In the future, CATL needs to continue enhancing its competitiveness while reducing reliance on subsidies, particularly in expanding its energy storage battery business and international markets.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.