亚欧车市 | 俄罗斯汽车市场 10 月销量:中国品牌接近一半!

芝能科技出品

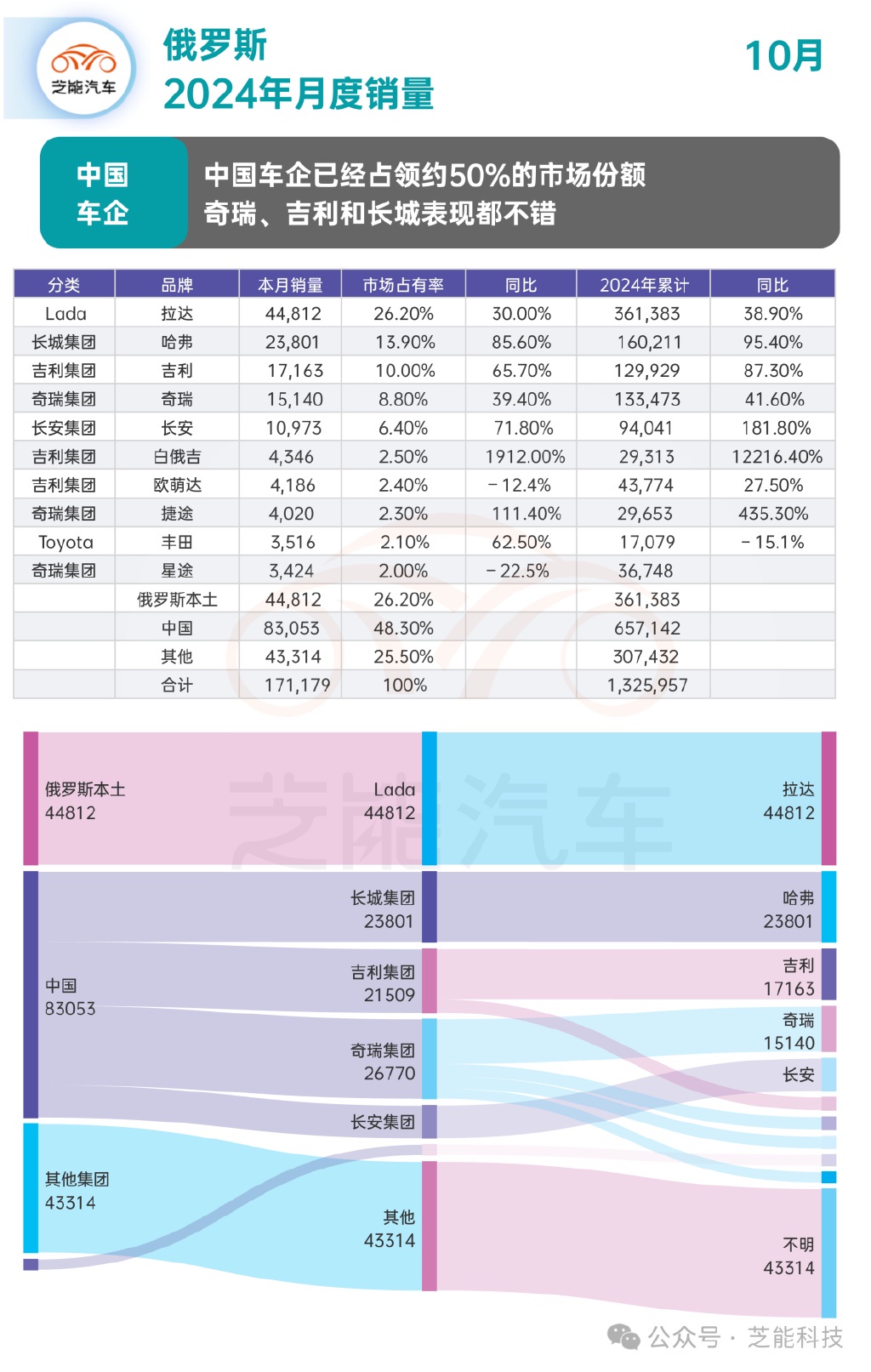

10 月份俄罗斯乘用车市场共售出 171,179 辆新车,中国车企的总销量达到 83,053 辆,市场占有率为 48.30%,接近一半,凸显了中国车企在俄罗斯市场的重要地位,各品牌销量可观且增长强劲。

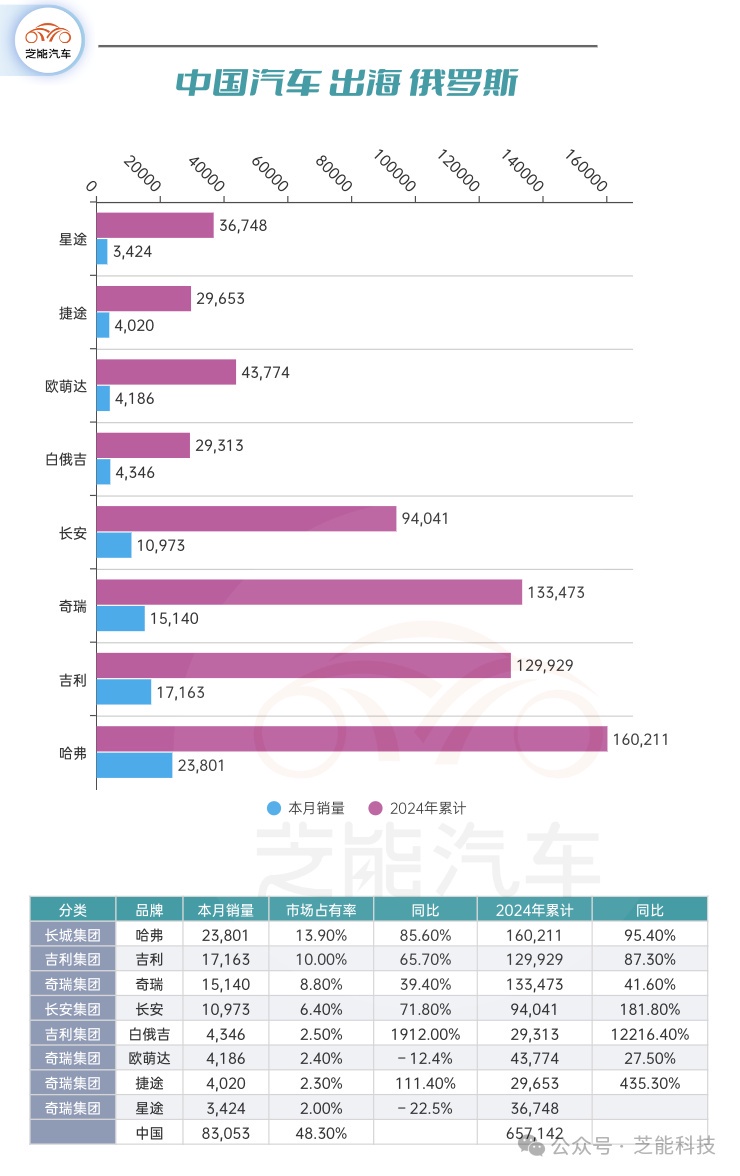

● 哈弗:10 月销量为 23,801 辆,市场占有率达 13.90%,同比增长 85.60%。

● 吉利:吉利集团的吉利品牌 10 月销量为 17,163 辆,市场占有率 10.00%,同比增长 65.70%。

● 奇瑞:奇瑞集团的奇瑞品牌 10 月销量为 15,140 辆,市场占有率 8.80%,同比增长 39.40%。

● 长安:长安集团的长安品牌 10 月销量为 10,973 辆,市场占有率 6.40%,同比增长 71.80%。

● 吉利集团与白俄罗斯合资的白俄吉(Belgee)品牌 10 月销量为 4,346 辆,市场占有率 2.50%,同比增长率更是高达 1912.00%,

属于奇瑞集团的欧萌达、捷途、星途等品牌也均进入销量榜单前十。其中:

◎ 欧萌达 10 月销量 4,186 辆,市场占有率 2.40%;

◎ 捷途销量 4,020 辆,市场占有率 2.30%,同比增长 111.40%;

◎ 星途销量 3,424 辆,市场占有率 2.00%

01

品牌的月度销量

2024 年 10 月:

● 哈弗以 85.6% 的增长率打破月度销量记录,市场份额达到 13.9%,创历史新高。其 SUV 车型受到俄罗斯消费者的高度认可,尤其是哈弗 Jolion 和 M6,为销量增长提供了核心支撑。

● 吉利 (+65.7%) 紧随其后,升至第三位,也创下了品牌历史最佳月销量,中国自主品牌通过本地化生产、市场适配与 SUV 车型策略,在俄罗斯市场取得了显著成功。

● 奇瑞 (+39.4%) 和长安 (+71.8%)分列第四和第五位,持续扩大市场影响力,Omoda 和 Jetour 虽然处境各异,但 Jetour 以 111.4% 的增幅刷新月度记录,进一步巩固了中国品牌的整体表现。

● 作为俄罗斯本土品牌,拉达依然保持市场领导地位,10 月销量增长 30%,市场份额为 26.2%。然而,这一增速低于整体市场的 52.4%,导致其市场份额同比下降。

这一趋势显示出本土品牌在面对海外品牌,尤其是中国品牌的竞争时,正逐步失去部分市场份额。拉达需加速产品迭代和营销创新,以应对市场格局的变化。

● 丰田自 2022 年因地缘政治影响退出俄罗斯市场以来,本月以 62.5% 的同比增幅首次跻身前十。其 2.1% 的市场份额超越了年初至今的 1.3%,俄罗斯消费者对丰田品牌依旧具有高度认可,外资品牌在当前市场环境下仍然具备复苏潜力。

02

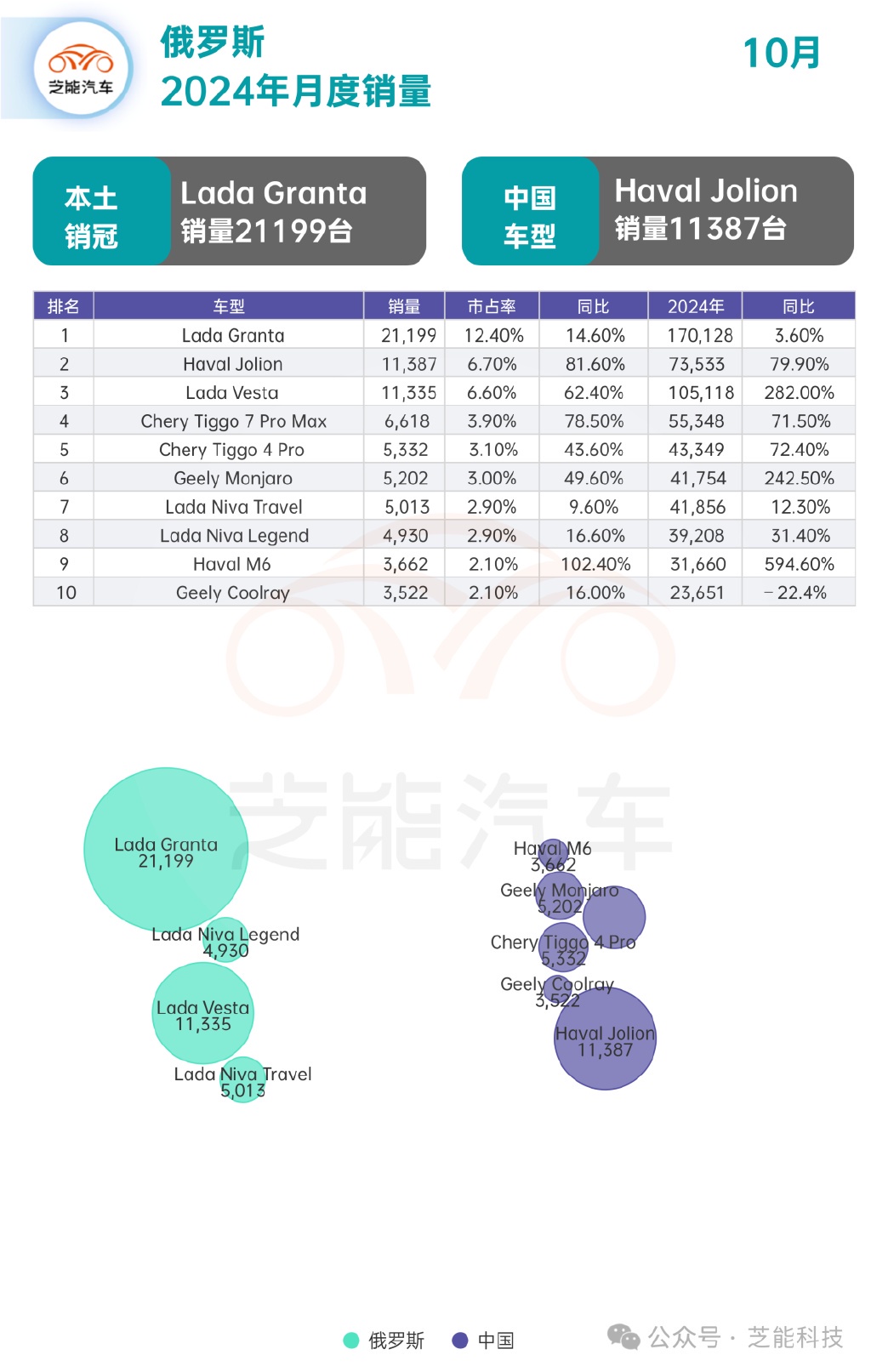

车型的月度销量

● 拉达 Granta 依然是俄罗斯市场销量最高的车型,10 月同比增长 14.6%,但市场份额从 16.5% 下降至 12.4%,拉达的市场统治力正在被中国品牌逐渐侵蚀。

● 哈弗 Jolion (+81.6%) 本月升至销量第二,创下品牌历史最佳排名,月销量首次突破 10,000 辆。这款 SUV 凭借高性价比、优质配置和可靠性,在俄罗斯市场赢得了广泛消费者青睐。

Jolion 的成功不仅是哈弗整体销量增长的核心驱动力,也标志着中国品牌在 SUV 市场的全面崛起。

除了哈弗 Jolion,奇瑞瑞虎系列也表现抢眼。

● 瑞虎 7 Pro Mx (+78.5%) 和瑞虎 4 Pro (+43.6%)继续跻身畅销车型排行榜,证明奇瑞的产品布局契合了俄罗斯市场对紧凑型 SUV 的需求。

● 此外,吉利 Monjaro (+49.6%)凭借高端定位与强劲性能,进一步提升了品牌在俄罗斯市场的竞争力。

● 哈弗 M6 (+102.4%) 本月销量增幅最高,成为畅销车型榜单的一大亮点,这款 SUV 以实用性和价格优势,在俄罗斯市场深受欢迎,连续三个月进入前十。

小结

中国品牌在俄罗斯市场的增长潜力仍然巨大,但也需注意如何保持产品竞争力,持续优化本地化策略。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。