Trump wins the election, is ESG in for a change? WuXi AppTec submits its answer.

Introduction: While policies waver, WuXi AppTec, a leading CXO player in the pharmaceutical industry, is steadily climbing in the ESG arena.

Recently, the victory of Republican candidate Trump in the U.S. election has drawn global attention, particularly from those in the ESG (Environmental, Social, and Governance) community.

After four years, this marks Trump's second impending entry into the "White House," but many still vividly remember his actions during his first term—prioritizing local economic development while denying climate change: withdrawing from the Paris Agreement, supporting anti-ESG movements, scrapping hundreds of environmental protection policies, and loosening regulations on fossil fuels...

During this campaign, Trump remained steadfast in his support for traditional energy, with some even predicting that his return could push the U.S. to withdraw further from the United Nations Framework Convention on Climate Change (UNFCCC), the parent treaty of the Paris Agreement, potentially upending the multilateral climate framework.

Major media outlets have used headlines like "Will Trump Kill ESG?" to express pessimism about his impact on ESG, particularly environmental (E) issues, upon his return to the White House. However, beneath the macro-level concerns, some institutions and companies remain unwavering in advancing their ESG commitments, contributing to a more sustainable society and world.

Recently, WuXi AppTec, a renowned CXO service provider in the pharmaceutical industry, released two updates on its ESG progress and achievements: it scored the highest in its industry in the 2024 S&P Global Corporate Sustainability Assessment (CSA), ranking first globally in the "Life Science Tools & Services" sector, and earned a gold rating in the 2024 EcoVadis Corporate Social Responsibility assessment, placing it in the top 2% of all participating companies.

Both S&P and EcoVadis are highly influential and authoritative institutions in the ESG field. Today, we’ll use WuXi AppTec as a case study to explore what these institutions and companies stand for—perhaps the future isn’t as bleak as it seems.

01 Trump Can't "Kill" ESG

ESG stands for Environmental, Social, and Governance. The term originated from the concept of "sustainable development" but wasn’t formally introduced until 2004 by the United Nations Global Compact.

Unlike the traditionally vague notion of "sustainable development," ESG offers clear evaluation pillars and rich dimensions. It’s not solely about environmentalism (E) or simple philanthropy (S). As Wu Yanyang, a senior ESG researcher at Industrial Research, pointed out, ESG truly emphasizes governance (G)—embedding E and S into G.

This means ESG performance reflects a company’s ability to identify and mitigate risks. When facing external risks, companies with stronger ESG performance are better equipped to withstand challenges and drive long-term sustainable growth.

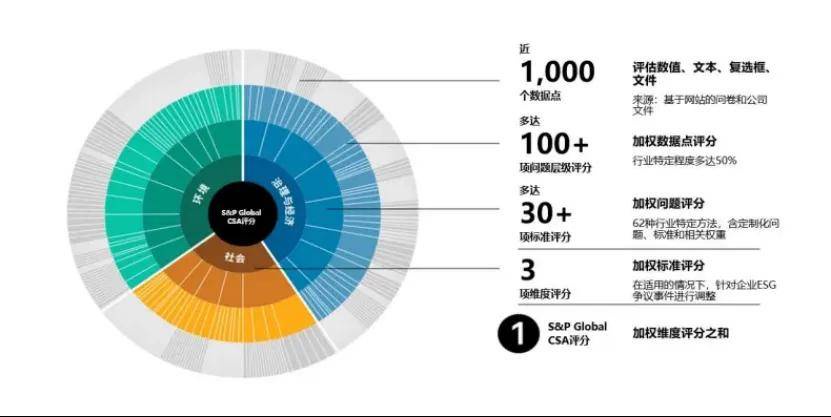

Take the S&P CSA methodology as an example—one of the oldest and largest global corporate sustainability assessments, launched in 1999. It provides a comprehensive quantitative score for companies’ disclosure and performance across economic, environmental, and social standards.

The S&P CSA currently covers sustainability assessment criteria for 62 industries, with over 30 key evaluation topics—detailed and extensive. As an independent, credible third-party benchmark, CSA links a company’s sustainability performance to its business strategy, offering a holistic view of its sustainability management.

Image source: S&P Global

This multi-dimensional approach makes ESG far more resilient than many realize.

Even a vocal ESG critic like Trump only opposes climate-related topics under the E pillar. On social (S) issues like human rights, community, and labor, his "America First" rhetoric is more emphatic than anyone’s. And for governance (G), the U.S., with its ever-evolving regulatory landscape, can hardly afford to ignore it.

ESG and sustainable development have become global consensus across industries—they won’t be easily "killed" by a change in the U.S. presidency.

02 The Pharmaceutical Industry, Unfazed by Political "Hurricanes"

That said, Trump’s return undeniably brings uncertainty to certain industries and companies.

In the U.S., the two parties are deeply divided on ESG, leading to policy swings. For instance, the Biden-Harris administration’s Inflation Reduction Act (IRA) is hailed as the largest climate investment legislation in U.S. history, while Trump has repeatedly opposed it during his campaign, vowing to repeal or roll back parts or all of it if re-elected.

This ideological clash and policy volatility could spill over into real-world industries. Bill Ford, Executive Chairman of Ford Motor Company, once publicly stated that political "hurricanes" undermine the company’s ability to plan and compete.

In contrast, the pharmaceutical industry has been more consistent in its proactive ESG practices. Even before ESG became a concept, benevolence was part of the industry’s DNA—it has always been driven by the mission to benefit patients and advance sustainable development for itself and society, making it less susceptible to political "hurricanes."

Take the fight against infectious diseases as an example. The global pharmaceutical industry has demonstrated a strong sense of social responsibility and collaboration. When COVID-19 erupted in early 2020, it coincided with the U.S. presidential transition. Regardless of which party was in power, the industry remained committed to corporate social responsibility, with innovation and cooperation never slowing down—breakthrough vaccines were developed at unprecedented speed during Trump’s final year in office and quickly distributed worldwide, making a monumental impact.

03 Responsible Operations: Solid Actions, Reassured Clients

In this "all-hands-on-deck" industry, how did WuXi AppTec achieve the top global ranking in S&P CSA’s "Life Science Tools & Services" sector?

The company has been publishing detailed ESG reports annually since 2021, offering insights into its strategic planning, implementation, and tangible outcomes.

First, at the strategic level, as early as 2020, WuXi AppTec (603259.SH,$WUXI APPTEC(2359.HK)) integrated sustainability into its corporate strategy. Aligning with the United Nations Sustainable Development Goals (SDGs), the company formulated a comprehensive ESG strategy: "Through our integrated enabling platform, we empower global partners to develop more new and better medicines to benefit patients worldwide; through responsible operations, we collaborate with stakeholders to advance social and environmental sustainability."

As a service provider to pharmaceutical companies, WuXi AppTec offers end-to-end support for drug discovery, development, and commercialization—a rare capability in the industry. If trust is the foundation of collaboration, then compliance and responsible operations are the bedrock of trust. These "basics" are key to governance (G) in ESG. While they may not make for flashy PR stories, they genuinely reassure clients.

For example, when partnering with a CXO, pharmaceutical clients care about two things: whether the CXO can deliver stable services meeting global regulatory standards to accelerate R&D and production, and whether their core asset—intellectual property (IP)—is secure and protected.

WuXi AppTec’s disclosed data shows that by adhering to high-quality standards, the company has repeatedly passed audits and inspections by global regulatory bodies like the U.S. FDA, European EMA, China’s NMPA, and Japan’s PMDA, enabling clients to pursue global drug approvals.

Its chemical business platform has even been exempted from over 20 pre-approval inspections by the FDA and EMA—a testament to the trust these authorities place in the company.

In 2023 alone, the company underwent 748 quality audits from global clients, regulators, and independent third parties, along with 83 information security audits from clients. This translates to an average of 2 quality audits daily and 7 information security audits monthly—all 100% compliant with no major findings, and no significant cybersecurity or trade secret breaches. These efforts have become routine for WuXi AppTec.

To better manage supply chain risks, WuXi AppTec has incorporated ESG factors into its risk identification process, conducting targeted periodic ESG risk assessments to enhance supply chain stability.

The company reports that in the CSA’s 102 assessment questions, it scored full marks in 43 categories, including risk governance, code of conduct, and supplier evaluation—a authoritative validation of its governance performance.

04 Tackling Climate Change, Inside and Out

On climate change, WuXi AppTec is no less impressive, achieving perfect scores in CSA’s climate risk management and climate-related financial disclosure categories.

As a tech-driven company, WuXi AppTec tackles climate change holistically. It has set ambitious environmental targets: by 2030, energy and carbon intensity will each drop 25% from 2020 levels, while water intensity will decrease by 30%. In 2023, it went further by committing to the Science Based Targets initiative (SBTi), with plans to set science-based carbon targets within two years.

Operationally, its global sites employ diverse measures. For instance, its Swiss Kuweit facility, recently awarded EcoVadis silver, features double-glazed facades and automated blinds to regulate temperature naturally, alongside solar panels, high-efficiency transformers, and heat recovery systems—reducing emissions by 70% compared to conventional setups.

WuXi AppTec’s Swiss Kuweit Facility

On clean energy, the Swiss site alone generated ~198,000 kWh from solar and sourced ~3,530,000 kWh of hydropower in 2023—showcasing its active energy transition efforts.

Beyond facilities, scientists are honing "technical prowess": WuXi AppTec pioneered continuous manufacturing a decade ago, refining it yearly. In 2023, it supported over 100 global clients across 300+ projects using this tech, cutting waste by 1,000+ tons.

Its integrated enzyme catalysis platform has served 40+ clients in 70+ projects, reducing solvent use by ~1,700 tons, shortening reaction steps, and boosting yields—making R&D greener while optimizing supply chains.

05 ESG: A Long-Term "Win-Win"

ESG is a long game—early investments may not yield immediate returns, but persistence pays off.

Companies are both drivers and beneficiaries of ESG. For instance, WuXi AppTec’s steadfast sustainability focus, coupled with operational excellence, now empowers 6,000+ global pharma clients annually, accelerating life-saving drugs—a true "win-win" for business and society.

Thus, regardless of U.S. political shifts, the global march toward sustainability won’t reverse. Countless forward-thinking firms will keep joining the ESG movement, collectively forging a brighter future.$WuXi AppTec(603259.SH) $WUXI APPTEC(02359.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.