芝能车市周报 | 日系在华第 46 周:丰田、本田、日产和马自达

芝能科技出品

日系汽车市场在 46 周周呈现出两极分化的特点。丰田以稳健的销量和较高的同比增长率持续领跑,而本田与日产则在销量同比下滑中面临挑战。

主力车型如丰田的轩逸、荣放表现稳定,但本田的 CR-V 和雅阁显现疲态,部分品牌在新能源车型上发力,市场反应尚未形成显著优势。

我们通过核心品牌数据与车型点评,深入探讨日系车的市场现状及未来发展方向。

01

核心品牌数据:

丰田独占鳌头,

本田与日产面临压力

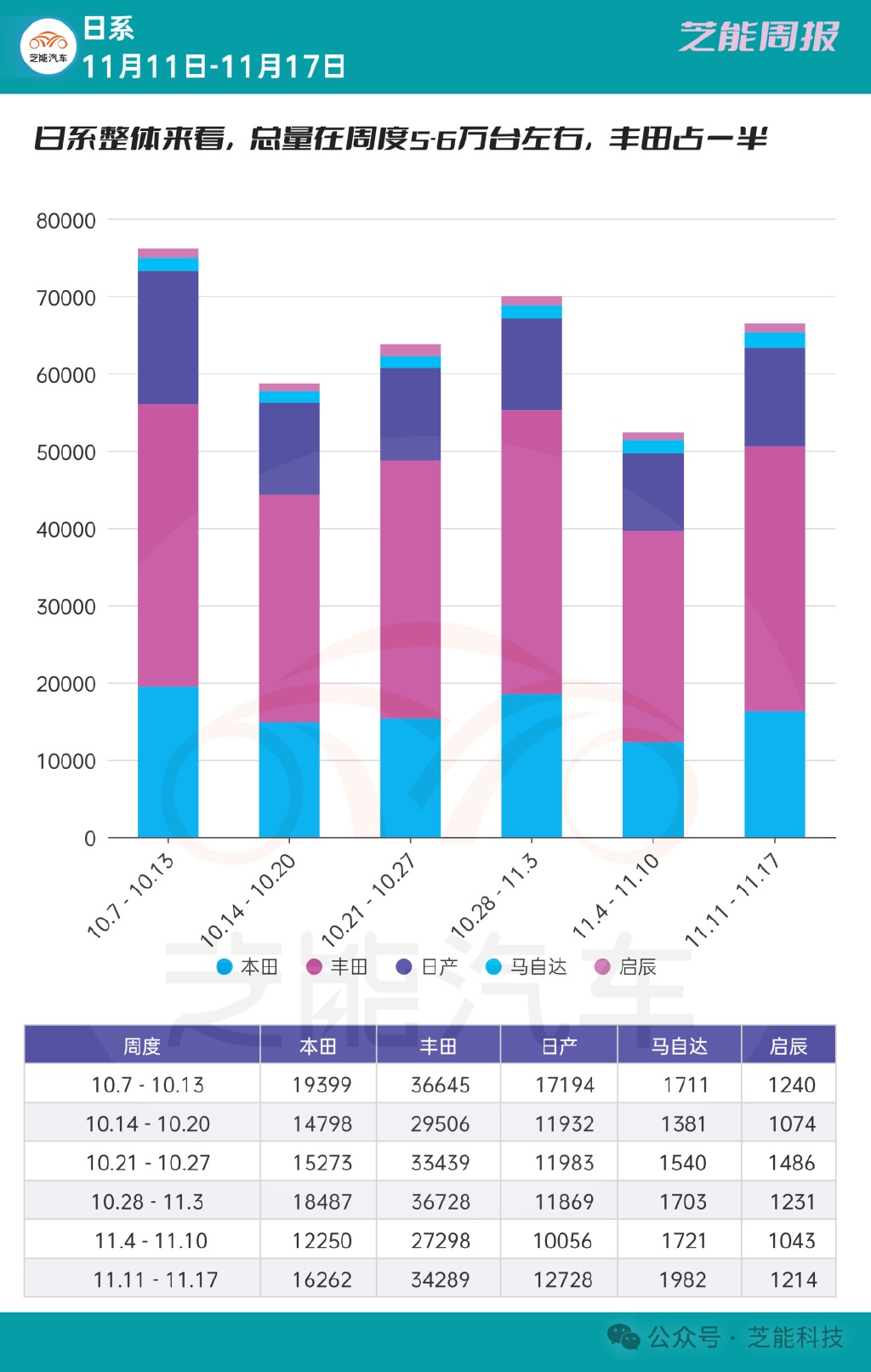

根据本周销量数据,日系品牌在中国市场展现出鲜明的差异化表现。

● 丰田以 34289 辆的周销量,同比增长 11.79%,具有极强的市场韧性。作为日系品牌的领导者,丰田的双擎系列还是受到了转向混动化的优势,特别是将来会有购置税的恢复征收。

● 本田周销量为 16262 辆,同比下滑 34.51%,成为表现最疲软的日系品牌。核心车型如 CR-V 和雅阁的销量虽仍有一定支撑,但没有好的表现。

● 日产周销量 12728 辆,同比减少 21.23%,轩逸系列继续保持高销量,但其余车型竞争力明显弱化。

● 马自达小幅增长,周销量 1982 辆,同比提升 12.49%,在小众市场中维持一定份额。

● 启辰表现出亮点,周销量 1214 辆,同比激增 43.50%,但整体市场规模仍较小。

从数据可以看出,丰田显然是本周最大赢家,密密麻麻的车型布局和双擎技术优势为其提供了市场支持。

● 日系品牌在中国市场的表现呈现分化:

◎ 丰田凭借稳健的燃油车和混动车型布局,保持了市场主导地位;

◎ 而本田与日产则面临产品力不足、新能源转型滞后的双重挑战。

在新能源快速崛起的当下,自主品牌和新势力的竞争使得日系车亟需更具竞争力的电动化产品。

● 未来,日系品牌若想继续保持市场地位,应从以下几个方面着手:

◎ 加速新能源车型的本地化布局:结合中国消费者需求,推出价格适中、性能突出的纯电车型。

◎ 强化高端车型的竞争力:在中大型车和豪华 MPV 领域进一步深耕。

◎ 通过中国本土供应链来提升技术与品牌形象:通过中国本土的供应链来升级智能化(座舱 + 智能驾驶)与科技化升级,重塑品牌吸引力。

02

车型点评:

经典燃油车与新能源车型的对决

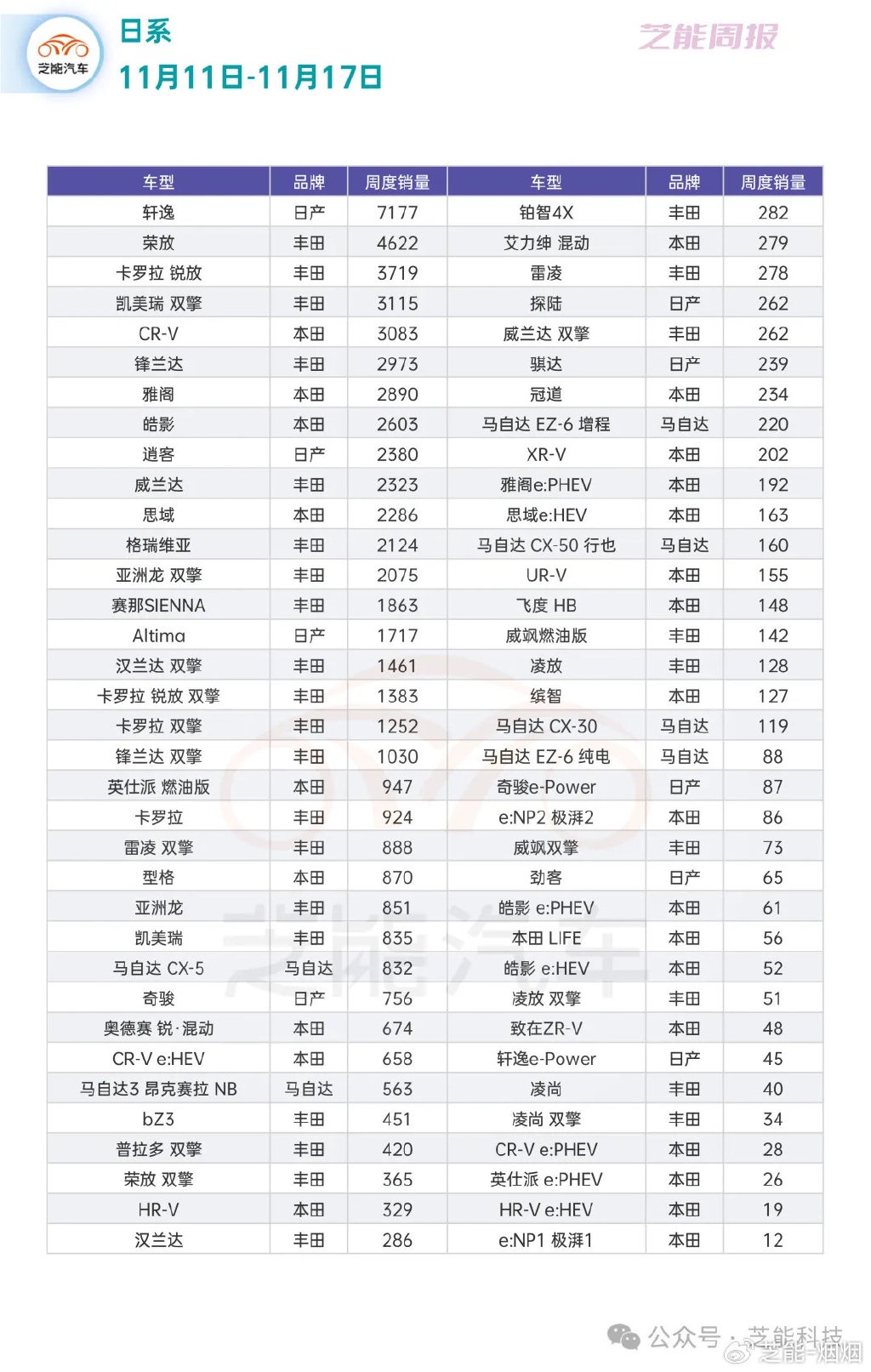

细分到具体车型,可以更清晰地看出不同品牌的市场表现与产品策略。

● 燃油车:稳定的基石

◎ 轩逸(7177 辆)仍是日产的销量中坚,凭借性价比和品牌认可度继续占领 A 级车市场的主流地位。

◎ 荣放(4622 辆)与卡罗拉 锐放(3719 辆):为丰田贡献了大部分销量,丰田在 SUV 和家轿市场的均衡布局。

◎ 雅阁(2890 辆)作为本田的主力中型车,依然保持了一定的市场影响力,但面临 BBA 等豪华品牌的下压以及自主品牌高端化的竞争。

● 混动产品

◎ 丰田在新能源领域布局的多款双擎车型表现平稳。凯美瑞 双擎(3115 辆)和亚洲龙 双擎(2075 辆)等车型体现了消费者对混动车型的认可。但纯电车型如 bZ3(451 辆),市场表现仍不及预期,需进一步加强竞争力。

◎ 本田的混动好像很一般,CR-V e:HEV(658 辆)和雅阁 e:PHEV(192 辆)销量疲软,无法改变其整体销量下滑的态势。

◎ 日产的混动效果也不好,轩逸 e-Power(45 辆)表现平平,难以与自主品牌的新能源爆款车型抗衡。

● 小众与高端车型:有限亮点

◎ 丰田的高端 MPV 车型赛那(1863 辆),延续了较好的市场口碑,但产能供给和价格定位仍是其进一步扩张的瓶颈。

◎ 马自达凭借其个性化设计和驾驶乐趣,CX-5(832 辆)保持了一定市场热度,但整体销量规模较小。

小结

当前日系车在中国市场遭遇挑战,但类似丰田和本田这样还是有利润基础,在国内削减规模徐徐图之,拿来做出口基地其实也还可以的。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。