东南亚车市 | 新加坡和马来西亚 10 月:比亚迪新兴崛起, 小鹏汽车扩展

芝能科技出品

10 月份,我们来盘点下马来西亚和新加坡汽车市场:

● 在马来西亚,Perodua 继续巩固其市场地位,而 Proton 和 Toyota 表现有所下滑,新兴品牌如 Jaecoo 和比亚迪则持续发力。

● 在新加坡,市场整体增长迅速,比亚迪的份额大幅上升,甚至成为年度销量第二品牌,这些市场的品牌份额、车型表现和新势力的深入分析,可以看出区域市场正迎来新一轮格局变化。

01

马来西亚与新加坡的品牌表现:

市场格局与动态

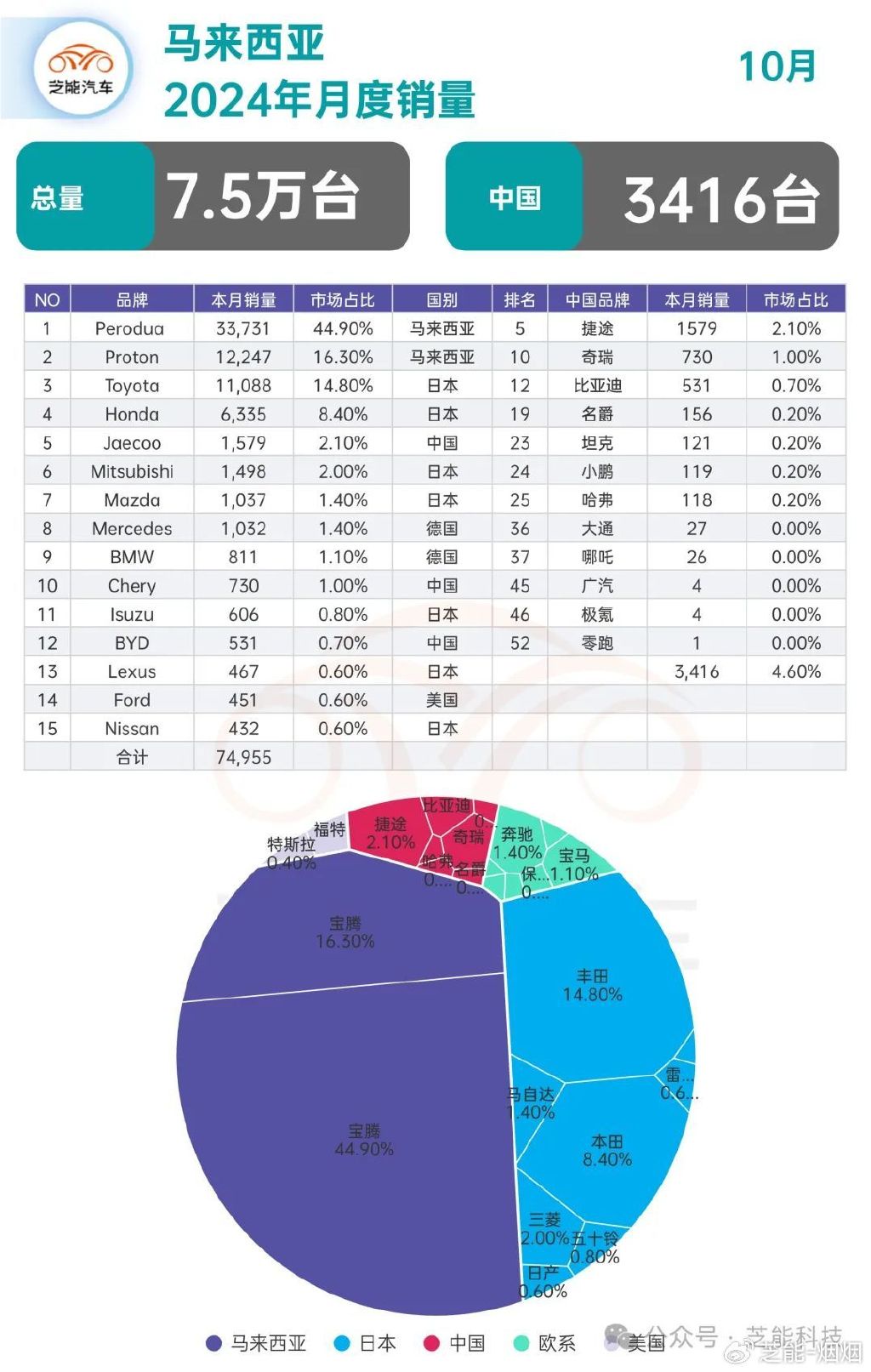

● 马来西亚市场数据:Perodua 主导市场,新势力崭露头角

10 月份,马来西亚注册新轻型车总数为 75,044 辆,环比回暖明显 。

◎ Perodua:市场份额从 9 月的 38.8% 回升至 44.9%,尽管较 8 月略有下降,但仍是市场主导者 ;

◎ Proton:下降至 16.3%,显示出较大的压力,排名第二 ;

◎ Toyota:份额为 14.8%,继续位列第三,但与竞争对手的差距进一步扩大 ;

◎ Honda:跌至 8.4%,呈现出下滑趋势 。

新兴品牌中 :

◎ 捷途以 2.1% 的份额稳定排名第 5,表现突出 ;

◎ 奇瑞跌至第 10 ;

◎ 比亚迪跃升两位至第 12 ;

◎ 而 MG 和小鹏分别飙升至第 19 和第 24 位 ;

◎ 哈弗也跻身第 25 位 。

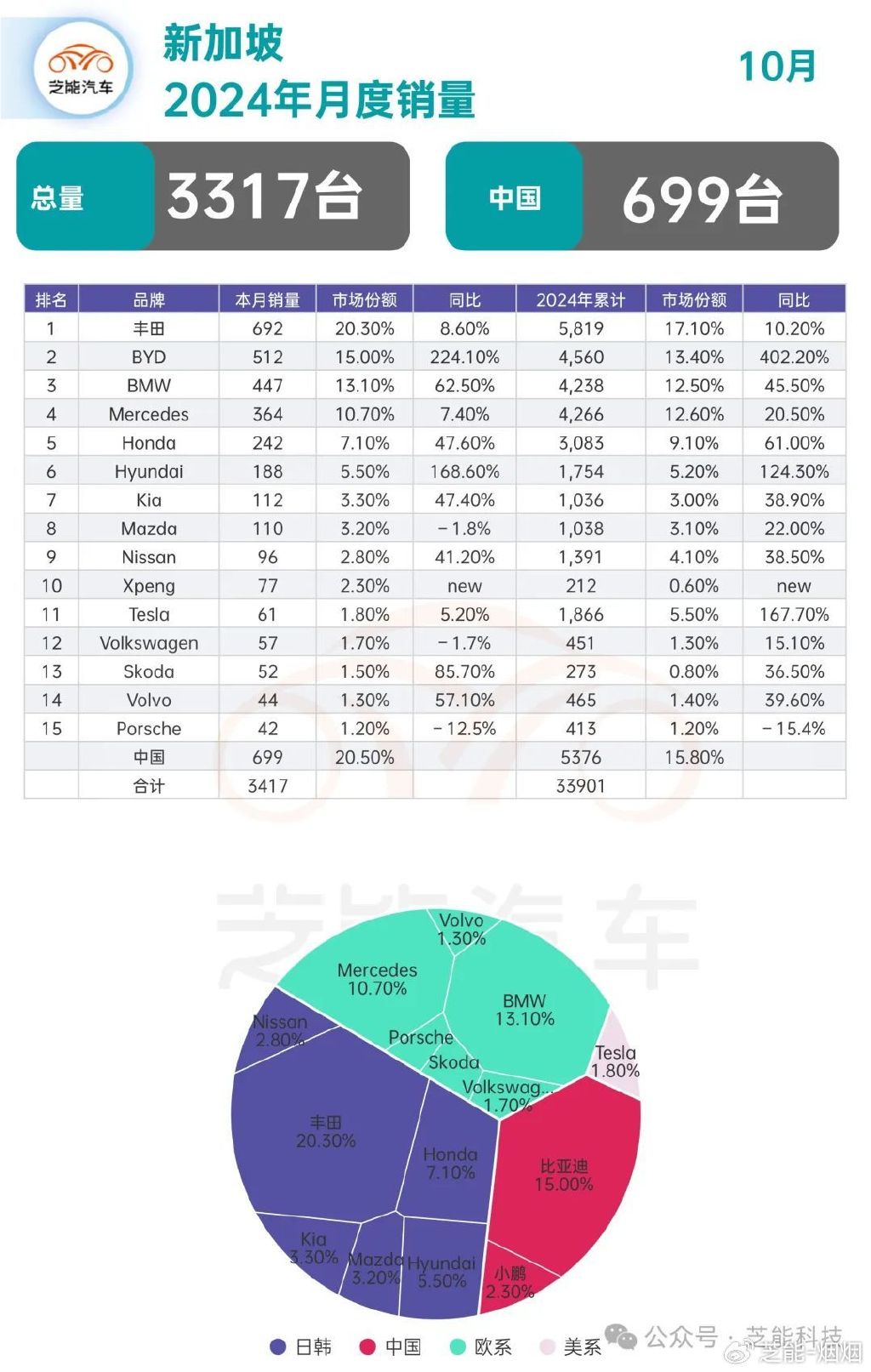

● 新加坡市场数据:销量猛增,比亚迪表现抢眼

新加坡市场以较小基数实现显著增长,10 月份新车销量 3,407 辆,同比增长 44.9%,累计销量达 33,974 辆,同比增长 48.3%。

◎ 丰田:虽然同比增长仅为 8.6%,但凭借 20.3% 的市场份额继续领跑。

◎ 比亚迪:表现尤为亮眼,同比增长 224.1%,以 15% 的份额稳居第二。

◎ 宝马:同比增长 62.5%,上升至第五,超越了表现疲软的梅赛德斯(+7.4%)。

◎ 现代:同比激增 168.6%,排名第六。

◎ 小鹏汽车:仅三个月进入市场,10 月份以 2.3% 的份额首次跻身前十。

02

核心车型分析:

传统畅销与新势力并存

● 马来西亚车型排行榜:Perodua 一家独大,在马来西亚市场,Perodua 的产品线表现无疑是最大亮点。

◎ Perodua Bezza:延续冠军地位,成为市场首选。

◎ Perodua Axia、Myvi、Alza、Ativa:品牌前五中占据四席,显示出 Perodua 对市场需求的深刻洞察力。

◎ Proton Saga:跌至第四位,但依然是 Proton 品牌的核心支柱。

◎ Toyota Vios 和 Hilux:作为国际品牌代表,继续稳居榜单。

◎ Jaecoo J7:以第 11 位的成绩表现不俗,作为新兴品牌进入市场的典范。

在新能源大势驱动下,新加坡市场的车型榜单更偏向电动车与豪华品牌。

◎ 比亚迪:凭借在新加坡的持续布局,成为新能源市场主力,稳居销量第二。

◎ 丰田:面临新能源压力,其经典车型仍保持强劲竞争力。

◎ 宝马和现代:新能源车型强势助推销量增长,其中现代的 IONIQ 系列备受青睐。

● 从 10 月数据来看 :

◎ 在马来西亚,Perodua 与 Proton 稳固了本地品牌优势,但国际品牌如 Toyota 与 Honda 逐渐失去市场份额。

◎ 在新加坡,丰田依旧强势,但新能源品牌的崛起对其形成了不小压力。比亚迪、小鹏、Zeekr 等品牌在新加坡市场的突破,标志着新能源时代的加速到来。

这一趋势可能在未来几年波及整个东南亚市场。捷途在马来西亚和小鹏在新加坡的成功突围,展示了新兴品牌只要切中用户需求,即使在传统品牌占主导的市场也能迅速站稳脚跟。

小结

东南亚汽车市场正进入快速转型期,如何应对新能源和新兴品牌的冲击将是未来发展的核心挑战;而对于新兴品牌,持续产品创新和市场推广将决定其能否长久立足。

——芝能汽车

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。