The "Technology+" alliance opens up the photovoltaic "Beyond Moore's Law" curve

Introduction: The methodology to traverse cycles and remain unshaken by volatility fundamentally lies in "ascending dimensions"—only by standing at the highest level can one see clearly.

01 Rising Thresholds: BC Enters the 2.0 Era

In the "post-Moore era," surpassing Moore's Law by introducing new materials, device structures, and system architectures has provided new development pathways for integrated circuits.

Similarly, in the photovoltaic (PV) field, BC technology has broken through the physical limitations of traditional cells by optimizing cell structures and high compatibility, demonstrating performance growth potential beyond conventional PV technologies.

Of course, this also raises the bar.

The high threshold lies in two aspects: first, the growth potential of conversion efficiency.

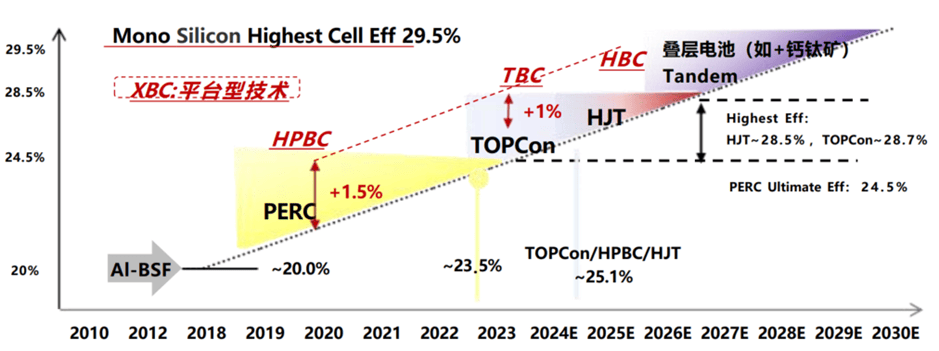

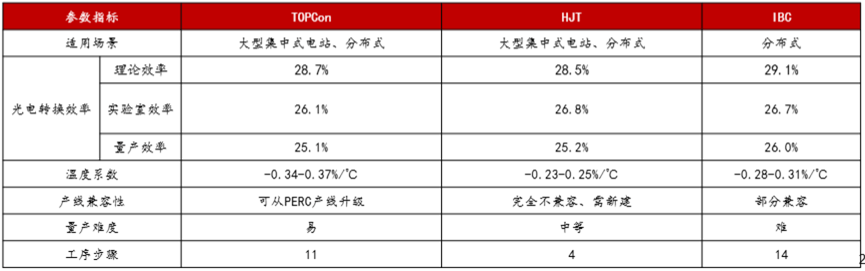

Currently, the industry-recognized theoretical efficiency limit for monocrystalline silicon cells is 29.4%. BC cells, with a theoretical conversion efficiency limit of 29.1%, are considered the closest to the ultimate efficiency of monocrystalline silicon cells.

Especially this year, BC cell technology has repeatedly broken records in key metrics such as conversion efficiency and mass production, propelling BC into the "2.0 era."

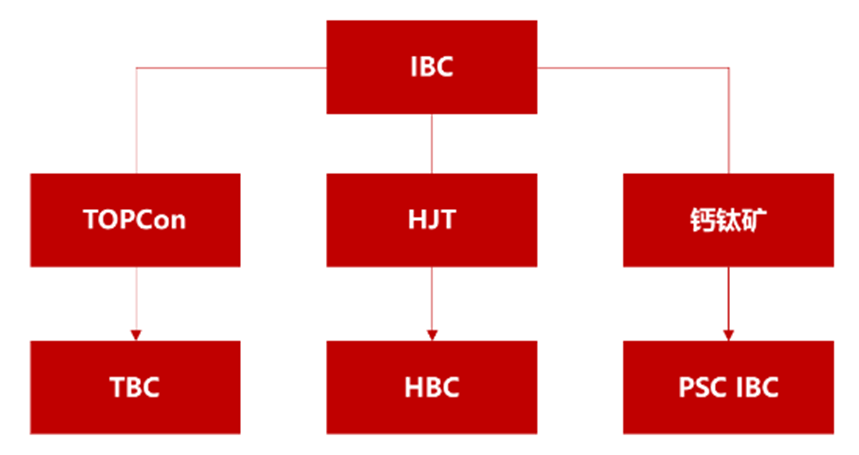

Second, as other technological approaches gradually approach efficiency bottlenecks, xBC technology, as a highly inclusive platform technology, increasingly highlights its inherent advantages in compatibility and adaptability.

By integrating technologies like TOPCon, PERC, HJT, and perovskite, BC can further enhance efficiency, approaching the theoretical limits of conversion efficiency.

Additionally, BC cells boast unique performance advantages such as 100% front-side light absorption, bipolar passivated contact structures, and silver-free metallization coatings. Their modules also offer competitive edges like ultra-high welding stability, anti-microcracking, high-temperature suppression, and shadow power generation optimization.

Compared to TOPCon, BC technology holds unparalleled advantages.

For instance, its efficiency ceiling is higher. TOPCon's theoretical conversion efficiency limit is 28.7%, while BC's reaches 29.1%, and even 43% when combined with perovskite.

Another example is BC cells' ability to eliminate front-side grid lines, making them aesthetically pleasing for distributed applications.

TOPCon holds advantages in production line compatibility and mass production feasibility. This is why BC technology has long been niche—primarily due to its high technical and investment thresholds.

Thus, only leading manufacturers with robust technical reserves, financial strength, and outstanding R&D capabilities can pursue BC—precisely the advantage that allows BC advocates to adopt a "differentiated" strategy and avoid cutthroat competition.

The "IC-like trend" further elevates this threshold.

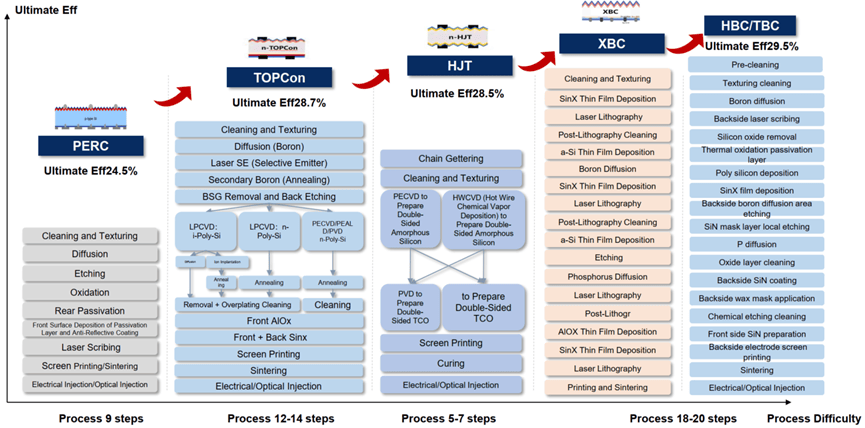

With rapid iterations in PV cell technology and significantly increased process steps, quality control has shifted from single-point checks in the P-type era to comprehensive process control in the N-type era.

PV cell technology is entering a new phase—evolving toward IC-like manufacturing, aligning with integrated circuit production standards. Manufacturers must possess holistic manufacturing capabilities and finer process control to achieve higher product efficiency and performance.

Moreover, industry competition will transition from low-level price wars to mid-level battles over technology and processes, ultimately ascending to high-level competition in standardized and refined manufacturing.

Competition in the BC field exemplifies this high-level dynamic.

As BC cell processes become more complex, with higher difficulty in each step and increased control points, product reliability improves significantly, accompanied by innovations like scaled production to reduce costs.

The BC ecosystem is burgeoning, and its potential cannot be underestimated, given its rarity in integrating and synergizing multiple technologies.

Coupled with high barriers and few capable competitors, the BC sector remains in a blue-ocean phase of growth and opportunity.

02 The "Technology+" Alliance: At the Core of the Ecosystem

Maxeon (SunPower) is the pioneer of IBC cells and the inventor and industrializer of BC technology based on tunnel oxide passivated contact (TOPCon) principles.

In 1975, Schwartz and Lammert proposed the concept of back-contact PV cells. In 1984, Stanford professor Swanson developed a point-contact solar cell resembling IBC and founded SunPower in 1985, further advancing IBC technology.

SunPower mass-produced its first-generation large-area IBC cell, the A-300, in 2004, achieving 21.5% efficiency and 400MW capacity. In 2007, it launched the second-generation IBC cell with 22.4% average efficiency and 600MW capacity, initiating GW-scale industrialization.

In 2020, TCL Zhonghuan (002129.SZ) partnered with TotalEnergies (TTE.N), spinning off Maxeon as an independent company inheriting SunPower's brand, R&D, and global operations (excluding the U.S. and Canada), along with its IBC and shingled patent portfolio.

Over nearly 40 years, Maxeon has mass-produced IBC cells and modules in multiple countries for over two decades, breaking world records 11 times. It holds over 1,900 patents across 30+ countries, covering IBC cell structures, unique materials, and proprietary processes.

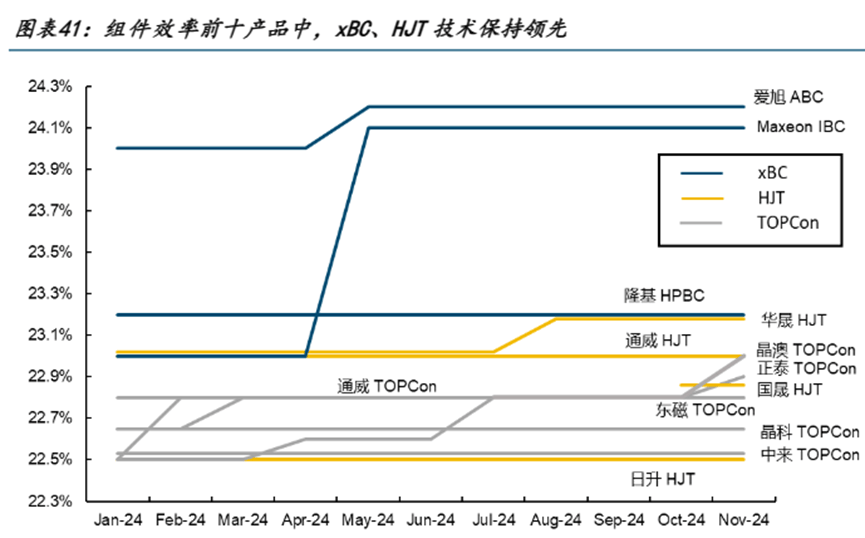

BC's structural features inherently enable high efficiency. Maxeon's IBC-based products consistently lead in commercially available PV conversion efficiency.

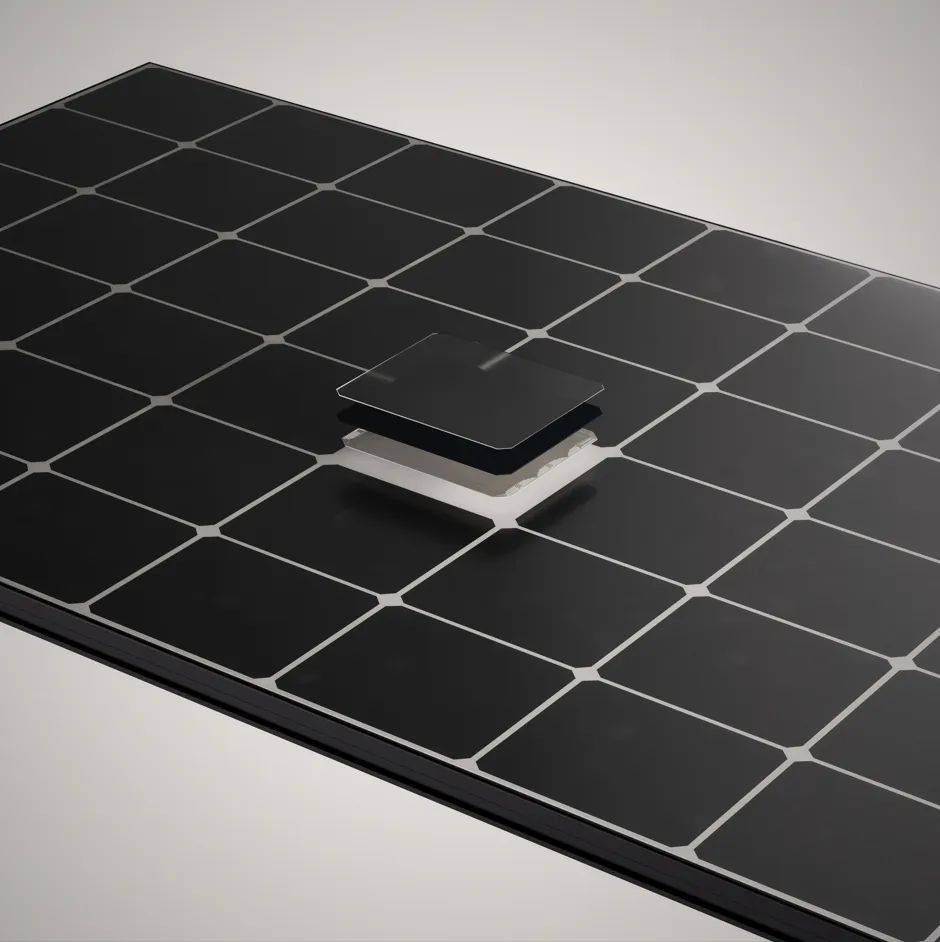

In March, Maxeon announced its seventh-generation modules, certified by NREL at 24.9% efficiency, with reliability and durability endorsements from other authorities, set for global Q3 sales.

Maxeon 6 and Maxeon 7 Modules

In late November, Maxeon's chief engineer Xu Guangqi stated at the 12th bifi PV Workshop 2024 Zhuhai that its next-gen IBC modules would surpass 25% efficiency, feature hotspot immunity, anti-cracking patented metal substrates, lead- and silver-free technology, and offer premium clients up to 40-year warranties with lower annual degradation.

Why a 40-year warranty?

For downstream clients, PV plants are 40-year fixed-asset investments, with modules accounting for nearly one-third of costs. Beyond efficiency, reliability is critical throughout a plant's lifecycle.

Reliability is the cornerstone of Maxeon's IBC products.

Maxeon panels degrade only 0.25% annually, retaining ~90% power after 40 years.

While xBC products like ABC and HPBC compete on efficiency, their long-term reliability and durability remain unproven.

Two decades of R&D give Maxeon clear advantages: robust metal bases withstand extreme weather; reverse bias ensures safe shading operation without hotspots; low operating temperatures boost output.

IBC cells also outperform in hotspot resistance under partial shading.

Maxeon's design limits hotspot temperatures to ≤85°C, whereas TOPCon and HJT half-cells exceed 150°C, risking backsheet burns or glass breakage if bypass diodes fail.

Continuous efficiency breakthroughs act as "running shoes" for leaders, while patent walls deter followers.

Balancing efficiency and reliability, Maxeon's IBC products thrive overseas, especially in Europe and the U.S.

In Europe, where distributed PV dominates and black roofs are preferred, BC's aesthetics enable seamless BIPV integration.

Moreover, overseas markets prioritize IP protection. Maxeon's vast patent portfolio allows it to erect "patent barriers" globally.

Patent barriers protect innovators by preventing unauthorized use, maintaining competitive edges.

A key tactic is "extraterritorial injunctions."

Infringing firms face overseas lawsuits, disrupting sales in specific regions, losing clients and market share.

For example, in 2020, Sharp sued OPPO Japan for patent infringement, seeking bans on five phone models. That same year, Maxeon sued a top PV firm's Japanese unit for shingled module patent violations, settling with a sales ban until June 2025.

In Europe or the U.S., patent disputes can trigger punitive damages, cross-border injunctions, and customs seizures, severely impacting shipments and brand reputation. Distributors and users of infringing products may also face liabilities.

With formidable patent defenses, Maxeon avoids China's cutthroat market, flourishing overseas.

Silicon wafer leader TCL Zhonghuan recognized BC's potential early, leveraging Maxeon's IP and channels.

In 2020, TCL Zhonghuan invested in Maxeon, eventually acquiring a 69.3% stake.

On November 26, TCL Zhonghuan and Maxeon signed a term sheet to consolidate overseas manufacturing and channel resources, enhancing synergy.

On December 2, TCL Zhonghuan announced CFIUS approval for the restructuring, confirming no unresolved U.S. national security concerns. The firms will advance strategic realignments in key markets.

Drawing on semiconductor expertise, TCL Zhonghuan combines wafer processes, flexible manufacturing, and industrial control to empower Maxeon in the BC market.

In the BC 2.0 era, TCL Zhonghuan+Maxeon's alliance—anchored by upstream IP, premium silicon supply, and Industry 4.0 smart factories—cements its ecosystem dominance.

As the BC ecosystem matures, giants like LONGi, Aiko, Tongwei (600438.SH), and Trina Solar (688599.SH) are entering with xBC technologies.

As Aiko's chairman Chen Gang stated, BC is the inevitable path to silicon cell efficiency limits.

Meanwhile, state-owned enterprises like China Huaneng and SPIC are ramping up BC procurement, accelerating adoption.

Will TCL Zhonghuan+Maxeon collaborate more with BC giants? The answer could reshape PV's future.

03 Spring Born in Winter

Amid overcapacity, China's MIIT tightened PV manufacturing standards on November 20, curbing expansion.

PV remains in crisis, but with growing demand and policy adjustments, recovery may come by next year.

The key to weathering cycles lies in "ascending dimensions"—only from the summit can one foresee the dawn.

When the industry rebounds, BC—nurtured in winter—could dominate within 3-5 years, blooming in the next spring.$TZE(002129.SZ)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.