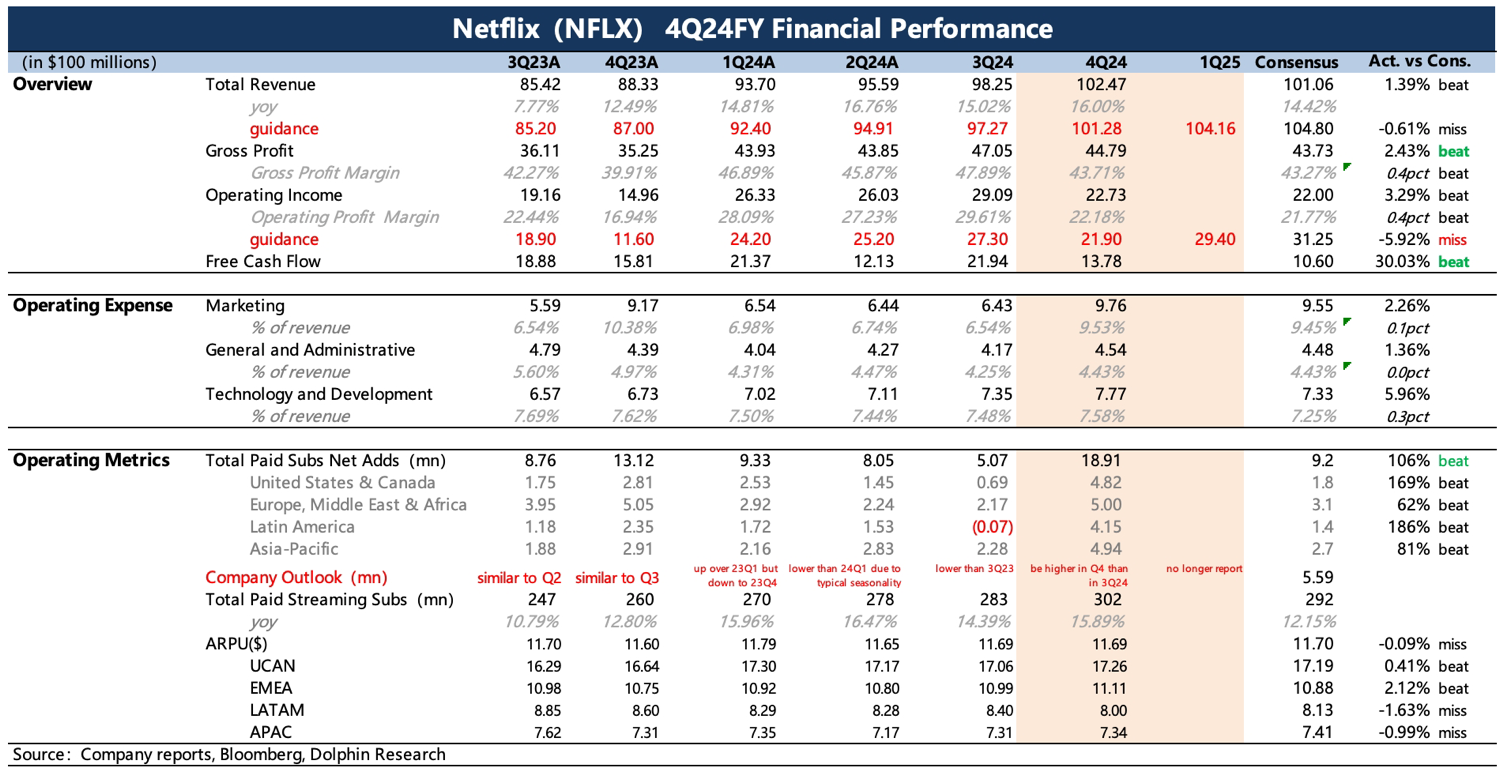

$Netflix(NFLX.US) Quick Read: Q4 performance overall exceeded expectations, but more importantly, the management's thinking is quite clear regarding both the description of future prospects and the emphasis on shareholder returns. This will undoubtedly alleviate some concerns about the slowing impact of account sharing, advertising effectiveness, and exchange rate effects, further boosting market investment confidence.

(1) Three major positives from the Q4 financial report: subscription numbers exceeded expectations, 2025 guidance raised, and repurchase budget increased by 15 billion.

(2) Q4 new subscriber additions were astonishing again, with market expectations of over 10 million, but actual additions were nearly 19 million, with all four regions performing well.

(3) The average revenue per member (ARM) has not changed much, mainly because the Ad-support users have not yet achieved high enough ad fill rates and conversion rates, resulting in a lower average monetization value (subscription fee + advertising revenue) compared to Premium users. In Q4 and throughout 2024, Netflix only raised prices in a small number of countries (mainly in Europe). In core countries like the US, Canada, the UK, and France, the last price adjustment was at the end of 2023, maintaining a rhythm of adjustments every 1-2 years, with a new round of price increases expected in core regions in 2025.

(4) Q4 operating profit exceeded guidance and was basically in line with the latest market expectations (slightly higher than BBG). With the improvement in advertising efficiency this year, there is still room for profit margin enhancement.

(5) Given the continued popularity of blockbuster shows in Q4 and confidence in the rich reserves for 2025 (new seasons of several historically popular shows), management has raised the performance guidance—revenue (+1%) and profit margin (+100bps). However, starting from Q1 2025, the financial report will no longer routinely disclose quarterly subscriber numbers and average revenue per member.

(6) Cash flow usage: Management has added a 15 billion repurchase budget to continue maintaining the repurchase momentum (62 billion repurchased throughout last year), with an expected free cash flow of 8 billion in 2025, and the content investment budget scale increased from 17 billion this year to 18 billion.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.