Beta US stock pre-market 0506 | The three major stock indices continue to decline; China-US negotiations to make progress in the coming weeks; WeRide surges

Market Update

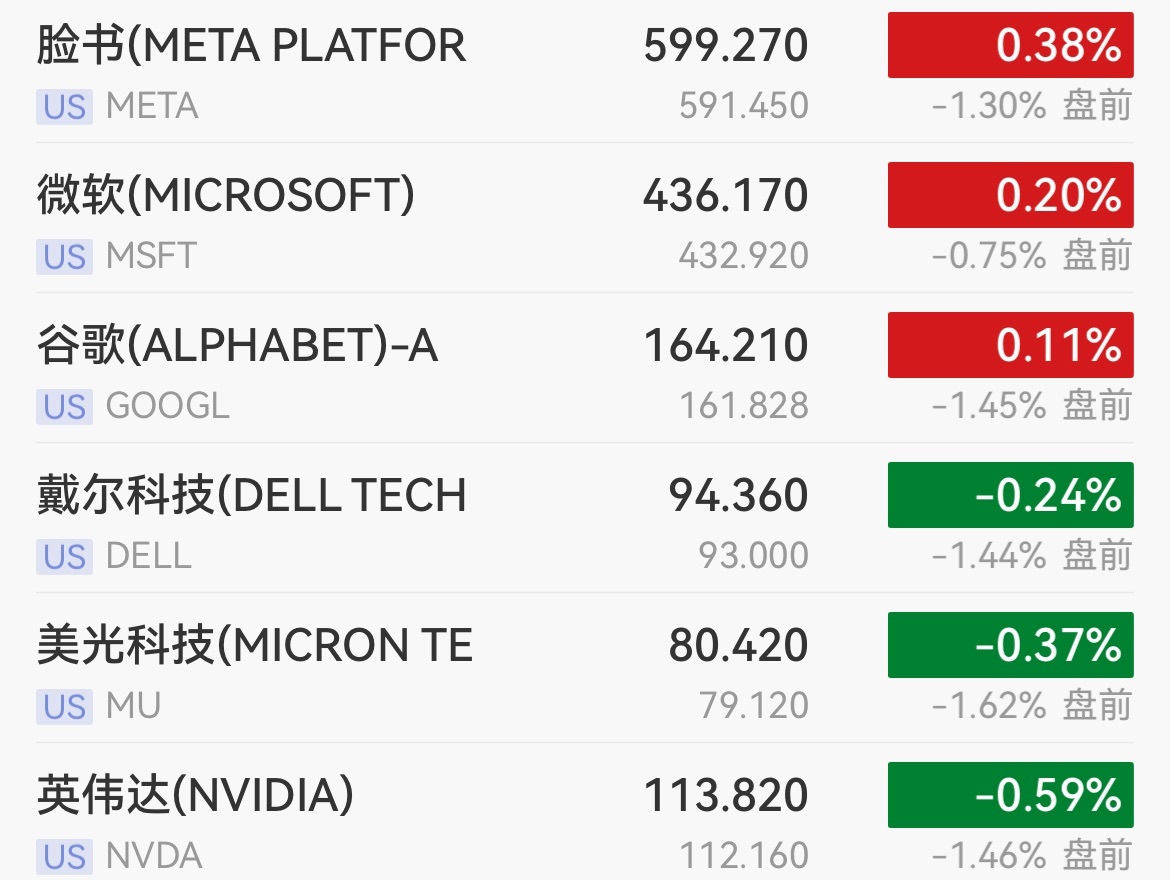

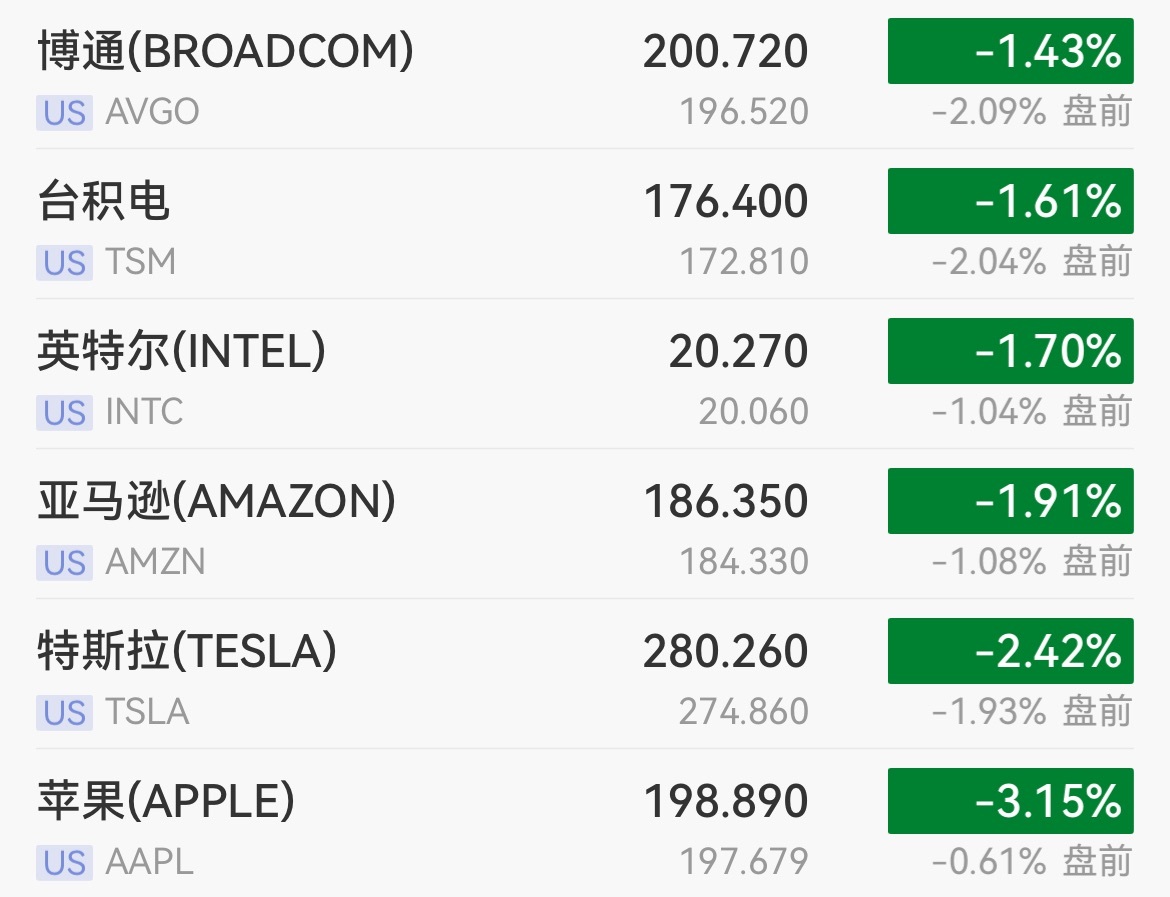

1. Major index futures continue to decline, Nasdaq 100 futures down 1.23%, Dow futures down 0.75%, S&P 500 futures down 0.92%.

2. Most large-cap tech stocks fell in pre-market trading, Meta, Google, Micron, and Nvidia all down over 1%, Broadcom and TSMC down over 2%.

3. Most popular Chinese stocks fell in pre-market trading, GDS down over 3%, Nio down nearly 2%, WeRide up nearly 15%.

Macro and Industry Events

1. U.S. March trade balance -$140.5 billion, estimated -$137.2 billion, previous -$122.7 billion.

2. U.S. Treasury Secretary Besant said progress in U.S.-China trade talks is expected in the coming weeks, Trump's 145% tariffs on China cannot be sustained long-term. The governor of California explicitly stated that the Trump administration's tariff policies have caused significant harm to California, and California will continue to "keep its trade doors open" to China. Additionally, governors from six states including Massachusetts and New York have invited premiers from six Canadian provinces to a meeting in Boston in the coming weeks.

3. If negotiations fail, the EU will impose tariffs on $100 billion worth of U.S. goods

According to insiders, if ongoing trade talks fail to produce results satisfactory to the EU, the EU plans to impose additional tariffs on approximately €100 billion ($113 billion) worth of U.S. goods. The proposed retaliatory measures will be shared with member states as early as Wednesday, with consultations lasting a month before finalizing the list.

4. Australian Foreign Minister Penny Wong urged the U.S. government to reconsider plans to impose 100% tariffs on non-U.S. made films. Since 2019, the Australian government has committed A$540 million in tax incentives to attract international film productions, most of which went to Hollywood films.

5. Wells Fargo Securities: S&P 500 will close above 7000 this year

Christopher Harvey, head of equity strategy at Wells Fargo Securities, expects the S&P 500 to rise to 7007 by year-end, unchanged from his early 2025 forecast. The index is currently at 5672, having risen over 10% in the past nine trading days, marking its longest winning streak in over 20 years. Harvey predicts the U.S. benchmark index will gain another 24% in the next eight months.

6. Citi CEO: Companies cannot bear tariffs above 10%

Citi CEO Jane Fraser said Monday that most of the bank's commercial clients can absorb the 10% tariffs the U.S. has imposed on its trade partners, but 25% would be unbearable. She warned that companies are holding off on investment and hiring until the economic outlook becomes clearer.

7. Apollo CEO: Trade uncertainty puts U.S. at risk of recession

Apollo Global Management CEO Marc Rowan said the U.S. risks an economic slowdown if trade uncertainties are not resolved.

Individual Stock Events

1. WeRide surges nearly 15% pre-market as it expands strategic partnership with Uber

As of press time, $WeRide(WRD.US) is up nearly 15% pre-market. The company and Uber announced Monday an expansion of their strategic partnership, planning to deploy autonomous Robotaxi services in 15 cities across Europe and the Middle East over the next five years.

2. Tesla's April sales in Germany nearly halve, UK new car sales hit lowest level in over two years

Germany's KBA said Tuesday that Tesla's April sales in Germany nearly halved despite an overall increase in pure EV sales. Tesla sold 885 cars in Germany in April, down 45.9% YoY. From January to April 2025, Tesla's sales fell 60.4% YoY to 5,820 units. In contrast, total new EV registrations in April rose 53.5% YoY.

3. BofA raises $Amazon(AMZN.US) price target to $230

BofA noted that Amazon's Q1 revenue and profit were $155.7 billion and $18.4 billion, above consensus estimates of $155.1 billion and $17.5 billion. The company's Q2 outlook also beat expectations. BofA maintains its "Buy" rating, raising the price target from $225 to $230.

4. UBS: Berkshire Hathaway retains advantages even as Buffett prepares to step down

UBS said Berkshire Hathaway's "permanent capital" and its structural advantage of using vast business operations to inform investment decisions remain intact even as Warren Buffett prepares to step down. Analysts noted: "The company's reliance on Buffett's investment prowess has significantly diminished, as it now owns a portfolio of leading businesses with strong cash flows."

5. Apple's AI may debut in iOS 18.6 in China with support from Alibaba and Baidu, reports say. Apple's customer service said it has not received relevant notices, and official information will be posted on its website. Alibaba Cloud and Baidu declined to comment.

6. Sensor Tower data shows fast-fashion platforms Shein and Temu increased digital ad spending in Europe in April. Shein's ad spending in France and the UK rose 35% MoM, while Temu's spending increased 40% and 20%, respectively.

7. OpenAI agrees to acquire AI coding assistant startup Windsurf for $3 billion. Windsurf was founded in 2021.

8. IBM says its watsonx Orchestrate AI agent product will launch on Oracle Cloud Infrastructure in July.

9. Tesla posted on social media: Over 95% of parts in every Model 3 and refreshed Model Y are made in China. Its video revealed that the localization rate of Model 3 and refreshed Model Y produced at Tesla's Shanghai Gigafactory exceeds 95%.

10. Musk said in an interview that Tesla will roll out unsupervised FSD technology within months, starting in Austin, Texas, before expanding to other U.S. regions. He said manually driven cars will become as rare as horses in the future.

11. U.S. seeks forced sale of Google's ad tech products, including ADX and DFP.

12. Microsoft's Skype officially shuts down, with core features migrating to another Microsoft communication app. The once-dominant VoIP service ends its 20+ year run.

13. Pony.ai rises 7% pre-market on Uber partnership

$Pony AI(PONY.US) and $Uber Tech(UBER.US) announced a strategic partnership to integrate Pony.ai's Robotaxi service and fleet into Uber's platform in H2 2024. The collaboration will begin in Middle Eastern markets this year, with plans to expand globally.

Today's Focus

- 20:55, U.S. weekly Redbook retail sales (YoY)

- 22:00, U.S. April Global Supply Chain Pressure Index

- 23:45, U.S. President Trump meets Canadian PM Carney

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.