Musk's Return - The Biggest Positive for Tesla

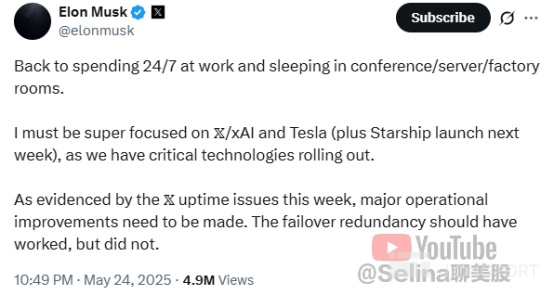

On May 24, Musk announced that he would refocus on $Tesla(TSLA.US) business and reduce his involvement in X platform and other non-core matters. Following this announcement, Tesla's stock price rose nearly 7%, reflecting the high market approval for the legendary CEO's "return to core business." Whether from a fundamental or technical perspective, Musk's return is undoubtedly the biggest positive for Tesla in the near term.

Before discussing this return, let's first share Musk's three previous "market-saving moments" of returning to Tesla.

By 2025, Musk has already had three representative cases of "returning" or refocusing on Tesla's business at critical moments, driving stock price increases. Each time, it served as a "stabilizer" when Tesla faced market skepticism or downward pressure on its stock price, becoming a key node in rebuilding confidence and driving valuation recovery.

First: The Strategic Shift After the 2018 "Privatization Storm"

In August 2018, Musk tweeted on X platform (then Twitter) that he was "considering taking Tesla private at $420 per share," triggering an SEC investigation and plunging the market into uncertainty. After settling with the SEC, Musk reduced his controversial social media activity and focused on solving the core issue—the Model 3 "production hell." Although the stock price fluctuated wildly in the short term, as Model 3 deliveries improved, Tesla entered a fundamental turning point in 2019, kicking off a two-year super bull market.

Second: The 2022 "Market Rescue Pledge" After Acquiring Twitter

In October 2022, after acquiring Twitter for $44 billion, Musk devoted significant time to the social platform's operations. Accused of "distracting from his main business," Tesla's market value evaporated over $700 billion in months. In early 2023, Musk announced his resignation as Twitter CEO and explicitly stated he would "refocus on Tesla, AI, and autonomous driving strategy." Tesla's stock price then bottomed at around $101 in January 2023 before rebounding sharply, nearly doubling to over $290 within the year, recovering some of the lost market value.

Third: The 2024 Focus on AI and Robotaxi's "Super Intelligence" Positioning

In the second half of 2023, Tesla faced multiple pressures: a global EV price war, slower FSD deliveries, declining gross margins, and a persistently weak stock price with low market sentiment. Starting in early 2024, Musk explicitly positioned Tesla as an "AI + robotics company" in earnings calls, social media, and interviews, heavily promoting FSD 12, Dojo supercomputer, Optimus humanoid robot, and Robotaxi progress. As expectations for the Robotaxi launch grew, Tesla's stock price rebounded over 50% from its April low, with technical indicators strengthening and investor confidence significantly.

Back to the topic, after discussing the previous three returns, let's analyze Musk's current return from both fundamental and technical perspectives.

Fundamental Analysis: Confidence Restoration and Strategic Refocus

1. Increased CEO Focus, Improved Management Expectations

Over the past year, Musk's frequent involvement in X platform, AI projects, and political affairs raised investor concerns about his divided attention. His statement of "returning to Tesla" has eased market worries about his distraction. Large institutional investors had previously called for Musk to focus more on Tesla's core business, and now confidence in the company's governance structure is gradually being restored.

2. Accelerated Development of Robotaxi and New Models

Musk explicitly stated he would advance the development and launch of Robotaxi (autonomous taxi) and low-cost new vehicle projects. Tesla plans to introduce its long-awaited driverless taxi service in Austin, Texas, on June 12. This will be a key milestone for Musk to reshape Tesla's business with autonomous driving and AI, effectively boosting the company's penetration in the mid-to-low-end market and reigniting sales growth.

3. Strengthened Synergy Between AI and Energy Business

Beyond its core EV business, Tesla's AI chip (Dojo) and energy storage system (Megapack) initiatives are also accelerating. Musk stated he would prioritize allocating AI resources to Tesla over X or xAI, helping to channel technological dividends back to the company's main business. This statement has strengthened market trust in Tesla's ability to deliver on its AI vision.

Technical Analysis: Robotaxi Concept Heats Up, Technical Indicators Recover

1. Resistance and Support Levels

Based on recent stock performance, Tesla's resistance level is expected in the $370–380 range. If Tesla can break through this resistance zone with positive fundamentals or favorable market conditions, it could open up new upside potential, paving the way for the stock to target $400.

The support level lies in the $330–340 range, which served as a key bottom during previous pullbacks and offers strong support. If the stock falls back to this range, it may attract bargain-hunting buyers, creating a floor to prevent further declines.

It's clear that Tesla is now in a strong uptrend, but how far this rally will go remains uncertain. The current resistance is near $380, and after-hours trading has already pushed the stock to $367, setting a new recent high. This indicates that the uptrend remains intact, and the short-term momentum is still strong. For investors holding Tesla, patience and holding for further gains are advisable.

2. Indicator Signals

- Bollinger Bands: The stock is trading between the middle and upper bands, close to the upper band, with the bands widening—a sign of a "bullish trend" and short-term strength.

- MACD: The DIF and DEA lines have crossed above the zero line, maintaining a golden cross, with the histogram expanding positively—indicating strong mid-term bullish momentum.

- KDJ: The K and D values are hovering in overbought territory without a clear death cross, suggesting continued strength amid high market enthusiasm.

- RSI: The RSI lines oscillate in the 60–70 range, not yet severely overbought. A break above 70 would signal a strong uptrend, implying further upside potential.

In summary, Tesla's technicals are in a typical "continuation of uptrend" phase, with Bollinger Band expansion, MACD golden cross, and KDJ hovering without a death cross—all clear bullish signals. As long as the stock holds above the $330–340 support zone, the uptrend remains intact. A breakout above $370–380 could target $400.

Strategy: Short-Term Trend Following, Steady Progress; Long-Term Logic, Patience for Gains

For short-term trading, the current bullish technical structure, with the stock reclaiming key moving averages and strong momentum indicators, favors trend-following strategies. Focus on "buying on pullbacks" or "breakout confirmations" rather than chasing highs. Monitor news (e.g., AI, Robotaxi updates), volume spikes, and fund inflows to confirm short-term strength.

For long-term investing, prioritize "left-side accumulation during undervaluation" and "right-side additions as fundamentals materialize." Market-wide corrections or stock-specific negatives may present buying opportunities. Track Tesla's AI and FSD commercialization progress, as well as Musk's focus. Unmet expectations or management volatility could lead to temporary valuation pressure.

Conclusion: Not a Sentiment Rally, but a Return to Core Themes

Each of Musk's "returns" marks a strategic re-anchoring.

In 2025, with Robotaxi nearing launch and FSD evolving, Tesla may regain its "tech growth" valuation logic, transcending traditional automaker metrics.

$NASDAQ Composite Index(.IXIC.US) $Dow Jones Industrial Average(.DJI.US) $SPDR S&P 500(SPY.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.