Top 10 Influencers in 2025

Top 10 Influencers in 2025 Likes Received

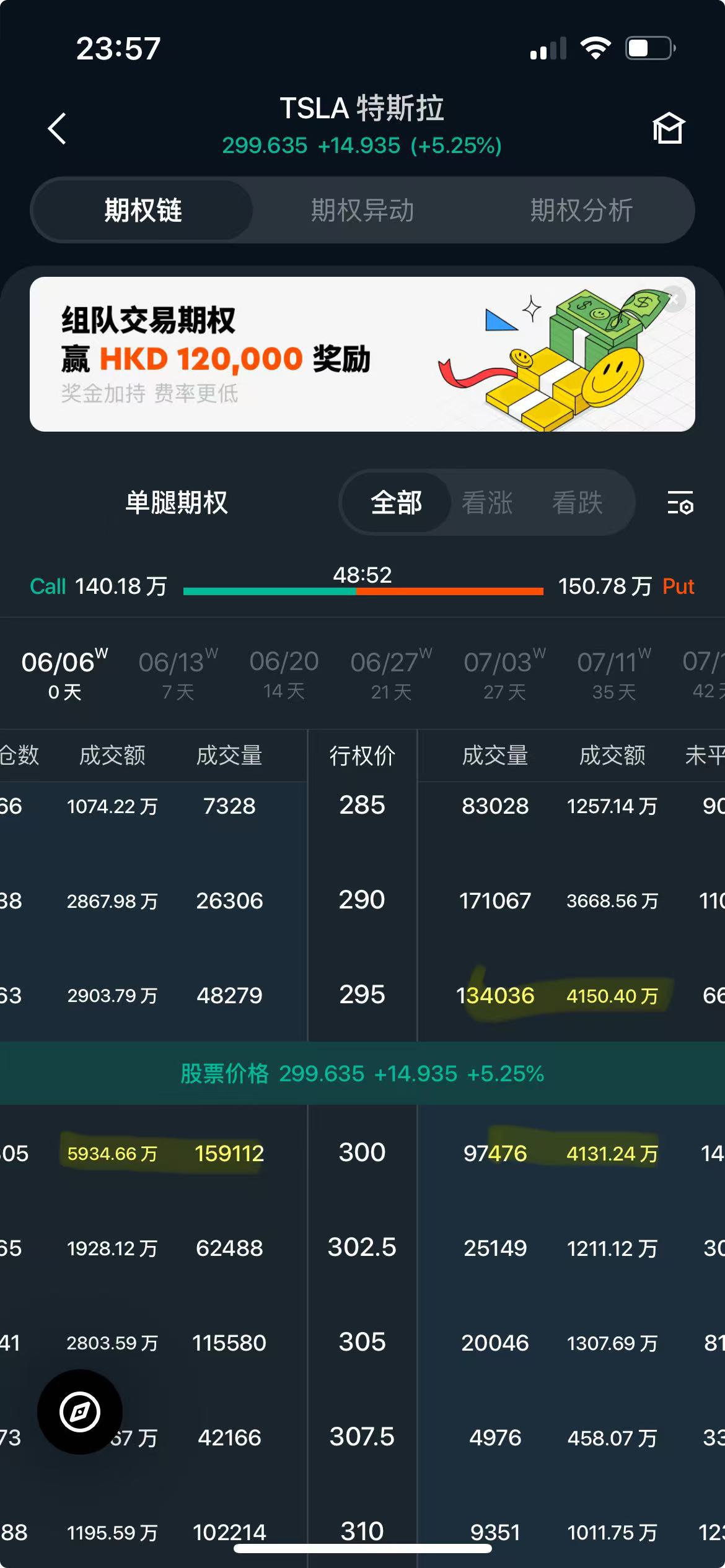

Likes ReceivedEchoing the retired brother, apart from indicators like large block trades, the near-expiration options chain can also provide a lot of information, especially for stocks with active options trading (like TSLA/PLTR). Taking TSLA on 6.6 as an example, here’s my intraday screenshot when the price was fluctuating around 299. You could see unusually high volume and open interest for the 300 call and 295 put in the near-expiration options, which essentially framed the price range. Eventually, the price first surged to 300 and then fell back to 295, trapping both bulls and bears.

Also, during rapid rallies, observe the calls at nearby strike prices. If the volume is consistently high across consecutive strikes, it might indicate a squeeze. In such cases, never go against the trend. Refer to PLTR on 0530, which I analyzed before.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.