Posts

Posts Likes Received

Likes ReceivedNine Maos Nine: Walk Through the Darkest Moment, Only Full Recovery?

On August 23, 2022, 9.9 Group (9922.HK) released its mid-term report. The financial highlights are as follows:

-

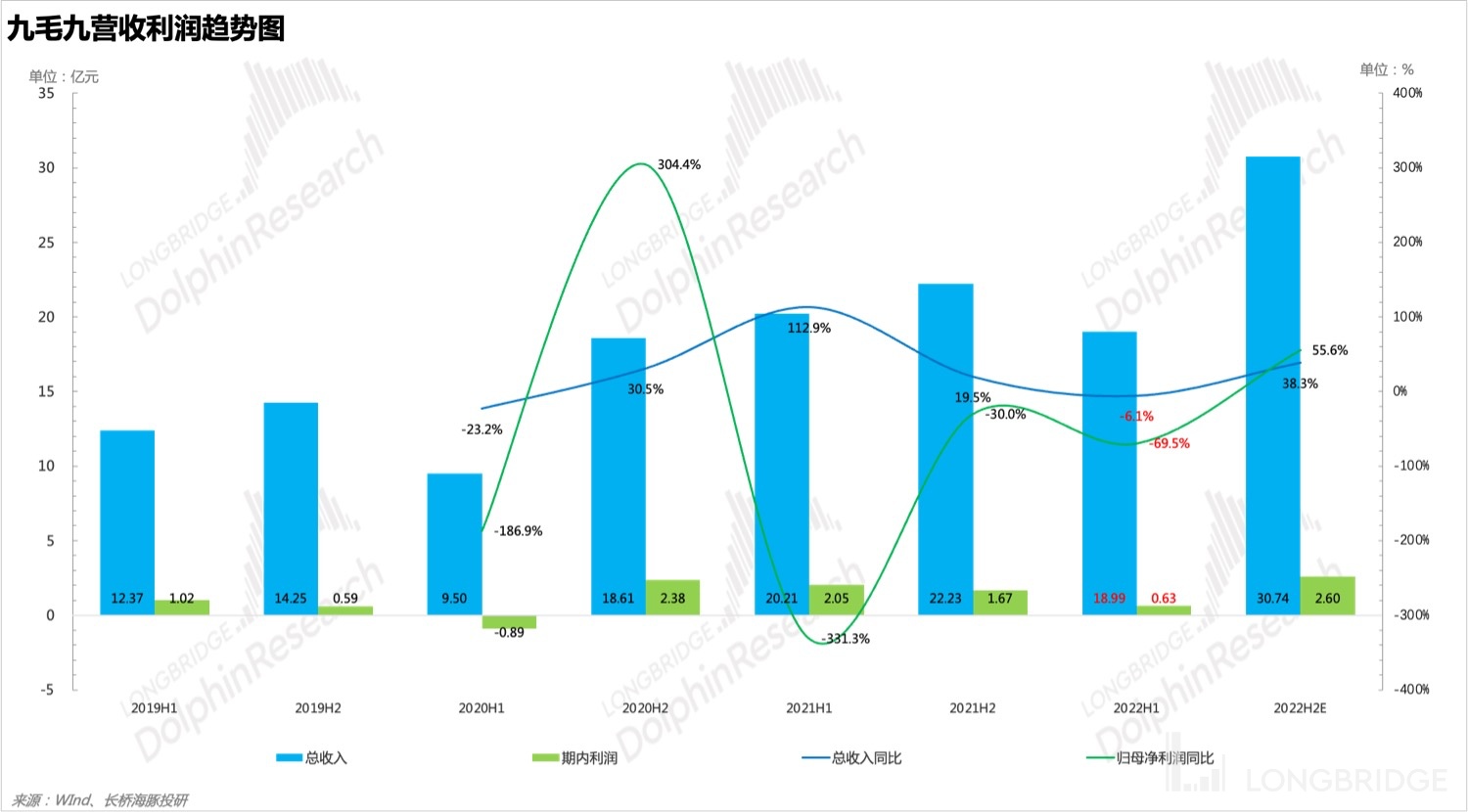

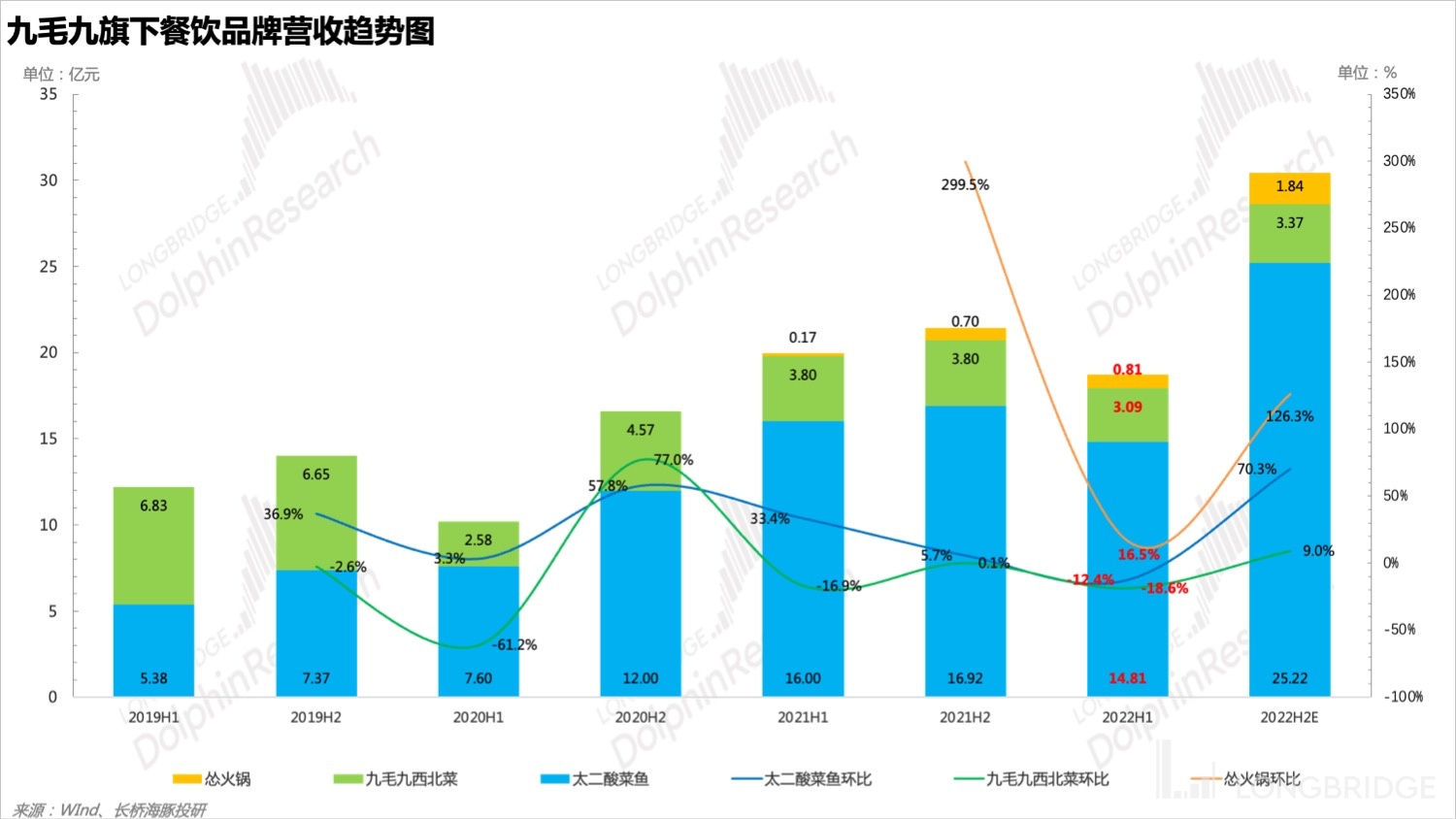

Revenue is not as pessimistic, but profit decline on a year-on-year basis is indeed severe: In the first half of 2022, 9.9 Group's revenue was RMB 1.9 billion, a year-on-year decrease of 6%. Overall performance is not too pessimistic, but the profit in the period was RMB 63 million, a year-on-year decrease of 69.5%. The strong leverage business led to a profit decline far greater than the revenue decline. In addition, the impact of the epidemic is mostly on the stores in first- and second-tier cities. Despite the epidemic, 9.9 Group maintained its plan to expand its stores in the first half of the year. Therefore, the pre-expansion cost of store expansion further eroded profits, such as store rent and decoration, personnel reserve and training, and business travel expenses. Meanwhile, in the first half of the year, due to the depreciation of the RMB against the HKD, 9.9 Group suffered a foreign exchange loss of about RMB 20 million.

-

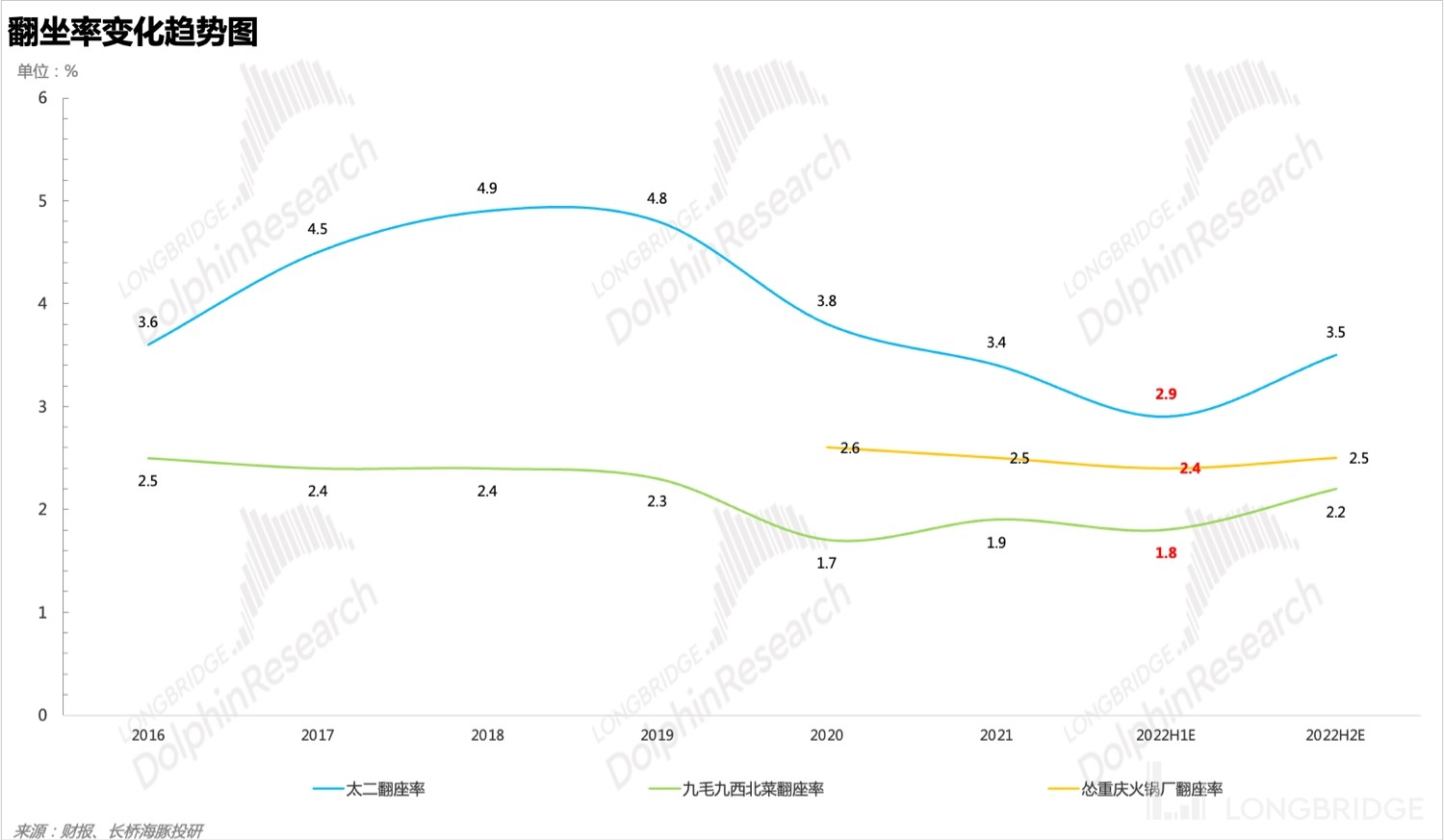

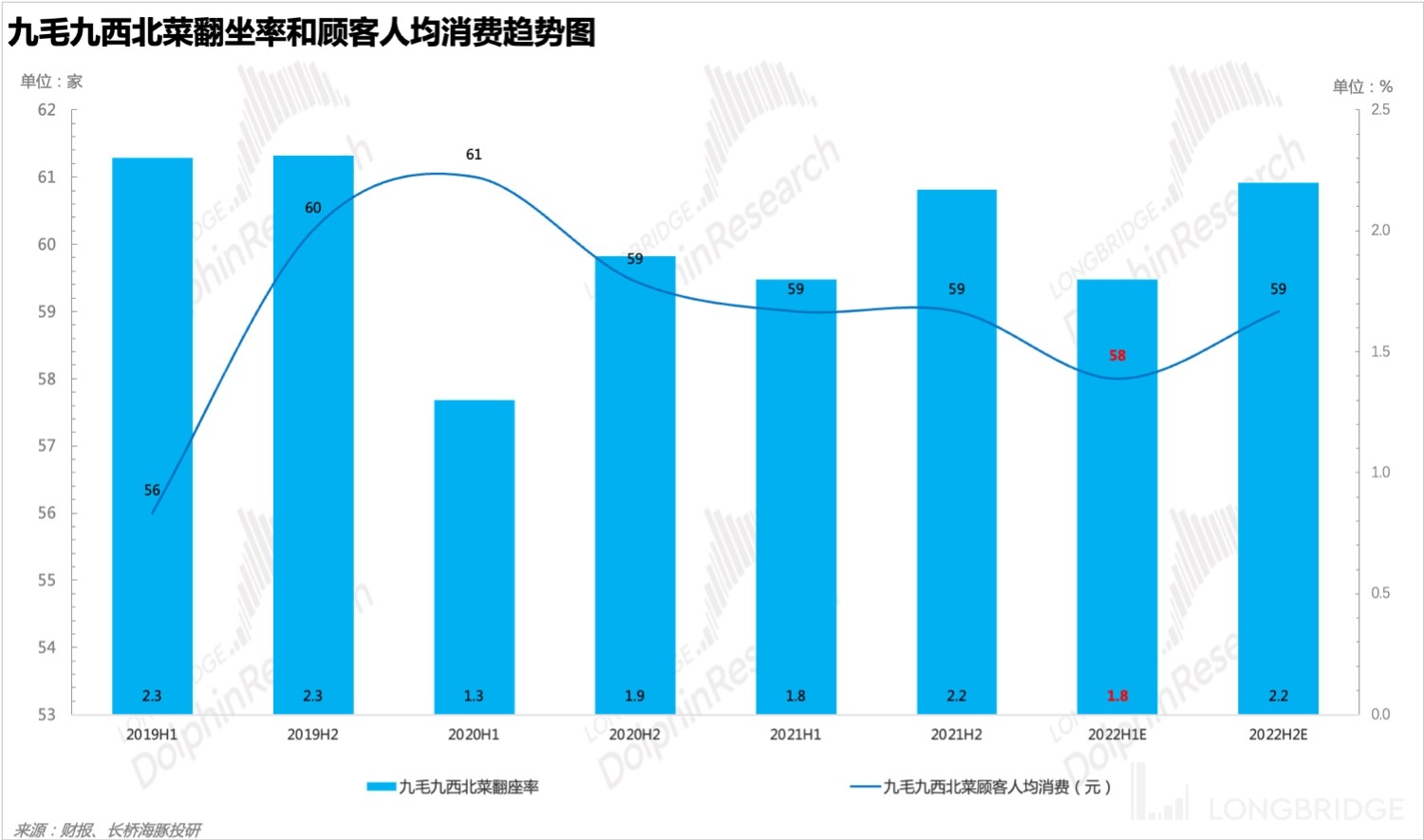

The epidemic led to a lack of dine-in customers and a decline in turnover rate: First, the epidemic appeared in Shenzhen, Guangdong, followed by Beijing and Shanghai, and then some new first-tier cities were intermittently affected by the epidemic. In addition, more than 50% of 9.9 Group's restaurant brands in first- and new first-tier cities were affected. The dine-in business was severely affected, and the turnover rate decreased significantly. Among them, the turnover rate of the Tai'er store dropped to 2.9, which is below the breakeven point calculated by Dolphin Analyst. The turnover rate of the Northwest cuisine restaurant brand of 9.9 Group dropped to 1.8, and the turnover rate of Songhuo Hotpot dropped to 2.4.

-

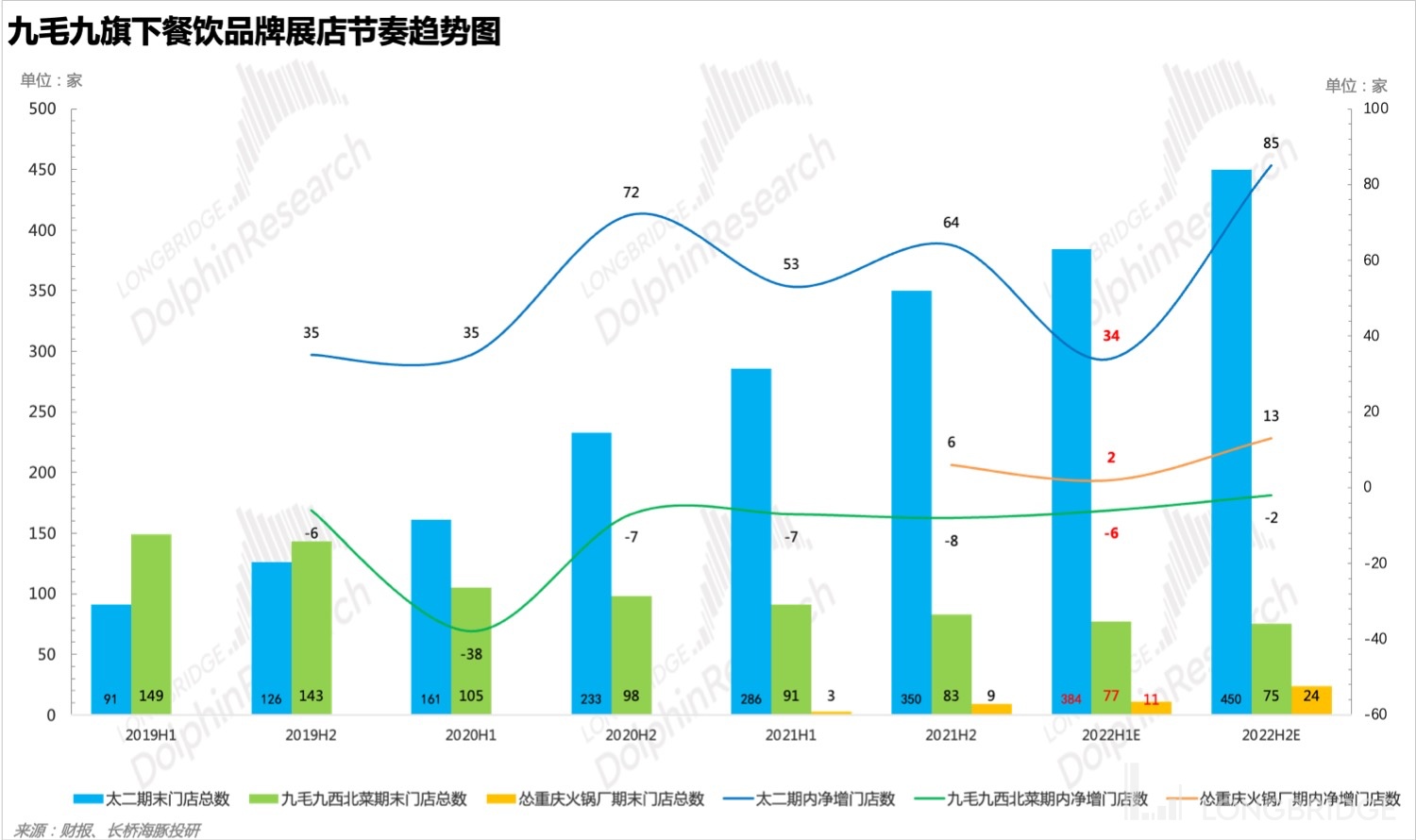

The expansion pace slowed down significantly in the first half of the year. In the second half of the year, Tai'er will increase its proportion of opening stores in sinking markets, and Songhuo Hotpot will accelerate its incubation speed. Generally, 9.9 Group tends to expand its stores firstly in first-tier cities to accumulate brand momentum and polish the single-store model, and then gradually expand and sink into lower-tier markets. However, in the first half of 2022, first-tier cities were hit hardest by the epidemic. As a result, Tai'er's store expansion pace was severely affected, and considering the impact of the epidemic on dine-in business, 9.9 Group also proactively slowed down the pace of store expansion and started to emphasize prudent operation. Therefore, in the first half of the year, the net increase of Tai'er stores was 34, and it is expected that the opening of stores in lower-tier markets with less impact from the epidemic will be strengthened in the second half of the year. Songhuo Hotpot still maintains the strategy of accumulating brand momentum first in high-tier cities. However, considering the good performance of the existing stores and the high cost-effectiveness of rent under the epidemic situation, Songhuo Hotpot will accelerate its incubation pace in the second half of the year. It is expected that the number of stores in 2022 can reach about 24.

Dolphin Analyst's overall view:

In the first half of the year, the high proportion of 9.9 Group's stores in first- and second-tier cities was severely affected by the epidemic, with a lack of consumer scenarios. Although the revenue performance is not so pessimistic, it is only slightly worse than Dolphin Analyst's expectations. However, the profit is indeed worse. The positive signal is that since June, with the easing of the epidemic situation and the relaxation of epidemic prevention policies, the operating data of 9.9 Group's restaurants have recovered relatively well on a month-on-month basis. It is expected that the overall performance will be better in the second half of the year.

From the current recovery situation, the recovery situation since June is actually quite good. Most stores have already recovered to more than 80% of the normal situation in the past. The scene of queuing for some stores has reappeared, and the turnover rate is also recovering. By observing third-party data, it is found that the customer unit price has not decreased, and the expansion pace has obviously improved in the second half of the year. Overall, the improvement in the first and second half of the year is a high probability event.

Dolphin Analyst will share the summary of the phone meeting with Longbridge users through the Longbridge App, and interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and get the summary of the phone meeting for the first time.

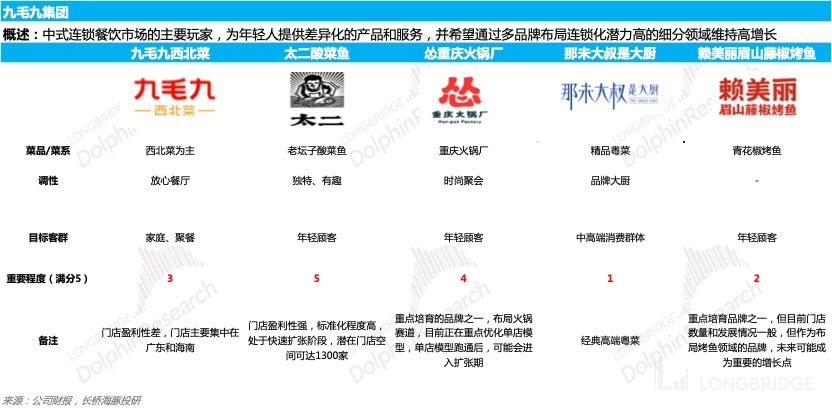

Before the start of the text, let's quickly review the catering brands under the Jiukoukou Group:

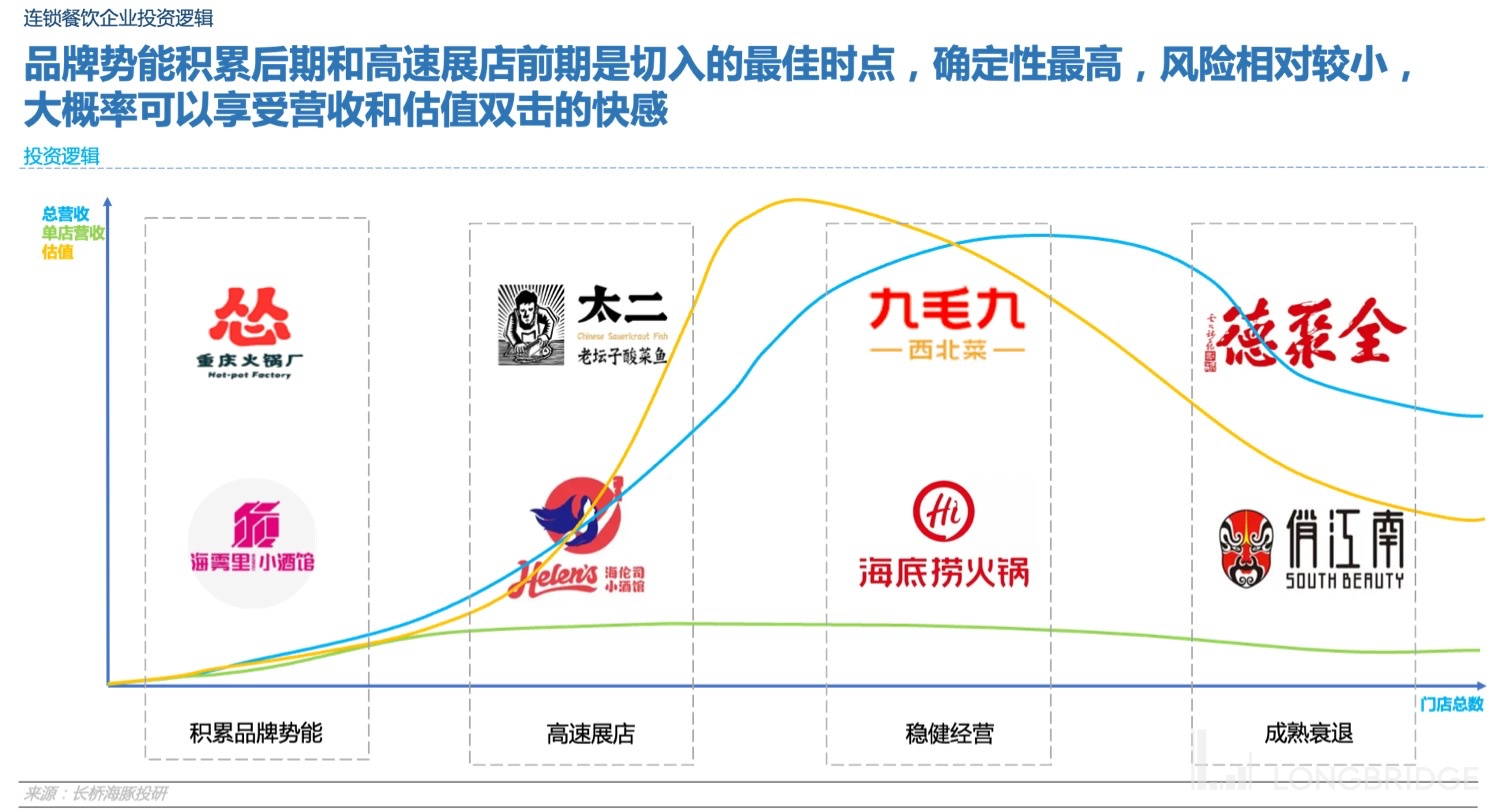

The best investment entry point for a chain catering company is the brand momentum accumulation period in the later stage and the high-speed store expansion period in the early stage. These two stages have high certainty, and the valuation will rise rapidly with the increase of store number and total revenue. Focusing on the Jiukoukou Group, Tai'er, the core brand, is in the mid-stage of rapid store expansion, which is the main support point of the valuation and revenue of the listed company. Song is in the incubation stage and accumulates brand momentum in the later stage. It is expected to take over Tai'er to support the growth of the listed company. Jiukoukou Northwestern cuisine has completed store contraction and entered a steady operation stage.

In addition, from the revenue model of chain restaurants, it is basically calculated by multiplying the store revenue by the number of stores using the traffic flow (corresponding to turnover rate), customer per capita consumption, and single store operating days. Therefore, Dolphin Analyst will focus on the 2022 mid-year financial report from two aspects: single store revenue and store expansion pace. As for the operating days, everyone can make a judgment based on the situation of the epidemic, so I will not repeat it here.

The following is a detailed interpretation of the financial report:

I. Single store revenue: Turnover rate declined, and single store revenue performance was poor

In the first half of 2022, Jiukoukou's catering brands were severely affected by the epidemic, with the loss of the consumption scenario of dining in, and the severe decline in customer traffic. Therefore, the significant decline of the turnover rate indicator became the culprit for the decline of single store revenue. Then, under the situation where the store expansion speed slowed down significantly, the revenue of each brand declined (Song Hot Pot was opened newly in the same period last year and the number of stores was very small, and this period's revenue mainly came from the new stores, which cannot effectively reflect the impact of the epidemic).

1. Turnover rate

The turnover rate of Jiukoukou Group's core brand has all declined, and the reasons are basically similar to those in the first half of 2020, mainly due to the impact of the epidemic. However, since June, with the relief of the epidemic, the relaxation of control policies, the recovery of people flow, most of Tai'er's stores have resumed to more than 80% of the normal situation in the past. Benefiting from store adjustments, 9.9 has exceeded its past operating data, and overall, its brands are expected to improve. In addition, Dolphin Analyst has observed that third-party data shows that the reputation scores of Tai'er pickled fish, coward Chongqing hot pot, and 9.9 Northwest cuisine have basically remained stable, with no obvious changes. This also reflects that these restaurants are still maintaining their attraction to customers. With the restoration of the epidemic, customer flow will gradually recover, boosting table turnover and improvements.

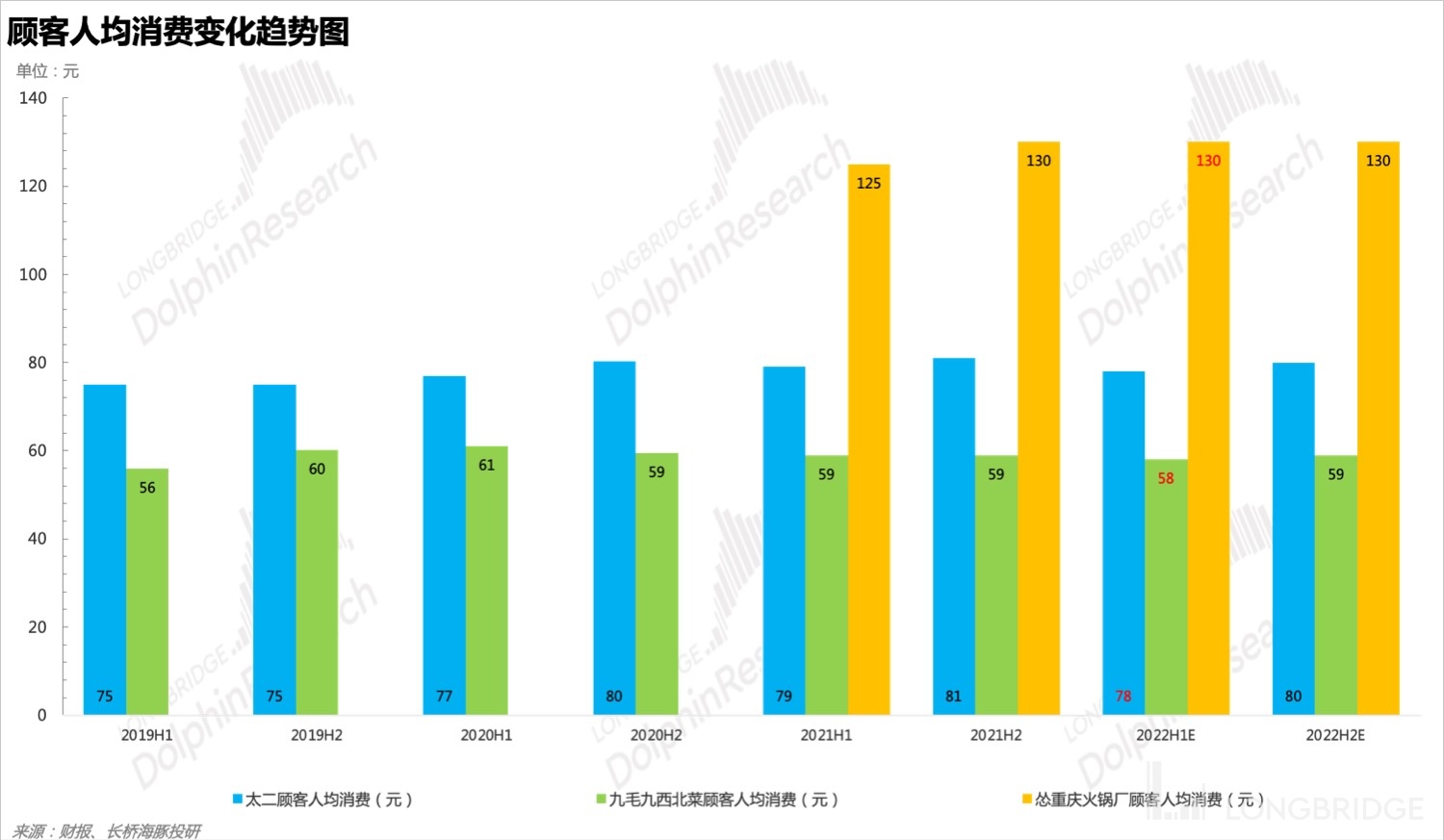

2. Customer Average Spending

During the epidemic in the first half of the year, there was no significant change in customer average spending, which has also remained stable as of June. Dolphin Analyst has discovered through third-party tracking data that in June, Tai'er's customer spending averaged around 91 yuan, 9.9 Northwest cuisine averaged around 64 yuan, and coward Chongqing hot pot averaged around 150 yuan. Compared with the past data, there were no significant changes, and the financial report also showed no significant changes.

II. Store Expansion Pace: Hindered in the First Half but Recovered in the Second

In the first half of 2022, Tai'er pickled fish opened 34 net new stores, coward Chongqing hot pot only opened 2, and 9.9 Northwest cuisine closed 7 stores. In the second half of the year, the overall expansion speed accelerated, and as of August 1, Tai'er had added about 15 new stores, and coward Chongqing hot pot added 1.

1. Tai'er Pickled Fish

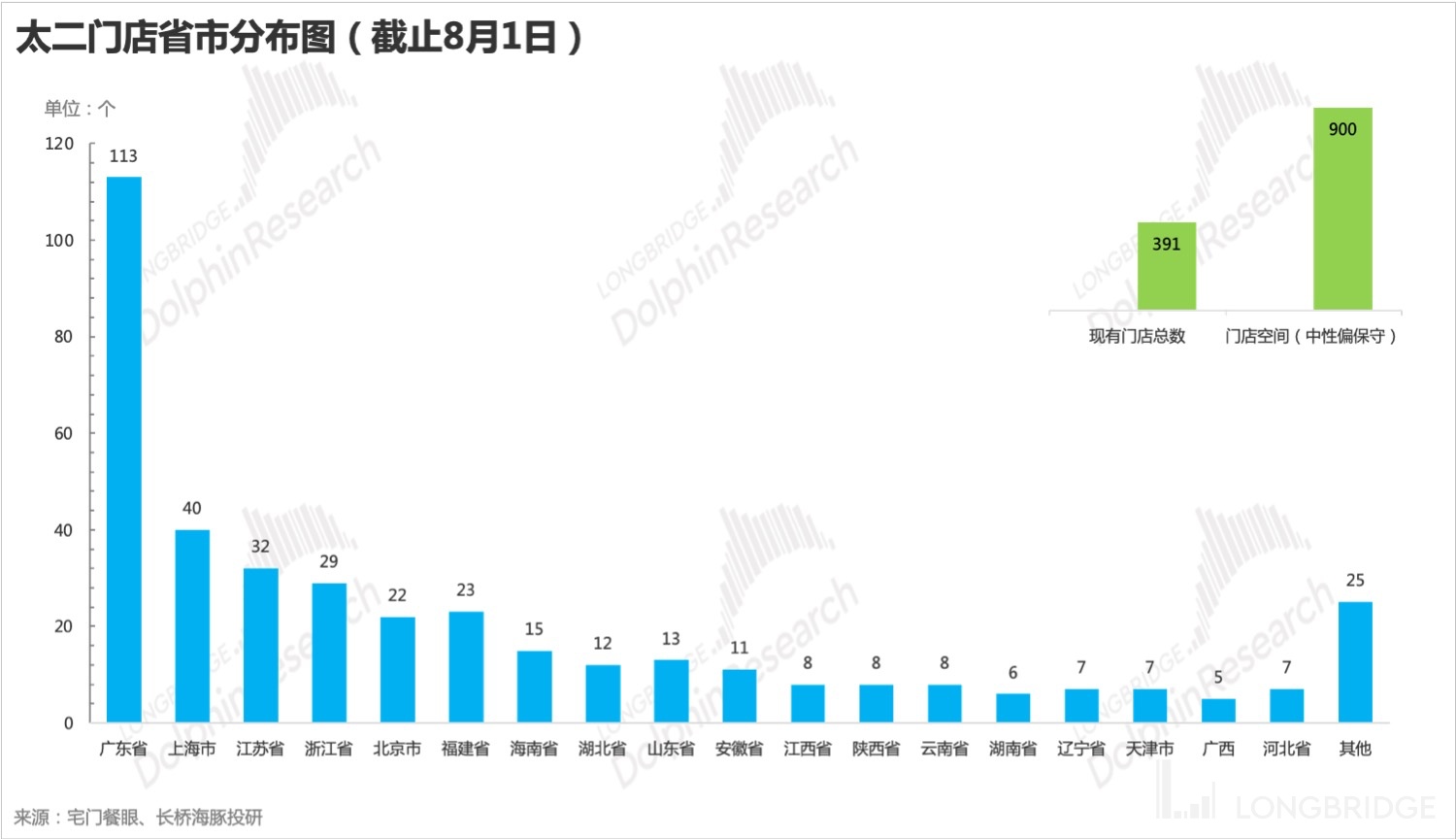

As of August 1, Tai'er has a total of 291 stores and has added about 15 new stores since June. Compared with the first half of the year, their store expansion pace has significantly accelerated, and it is expected to achieve the goal of adding 120 new stores throughout the year.

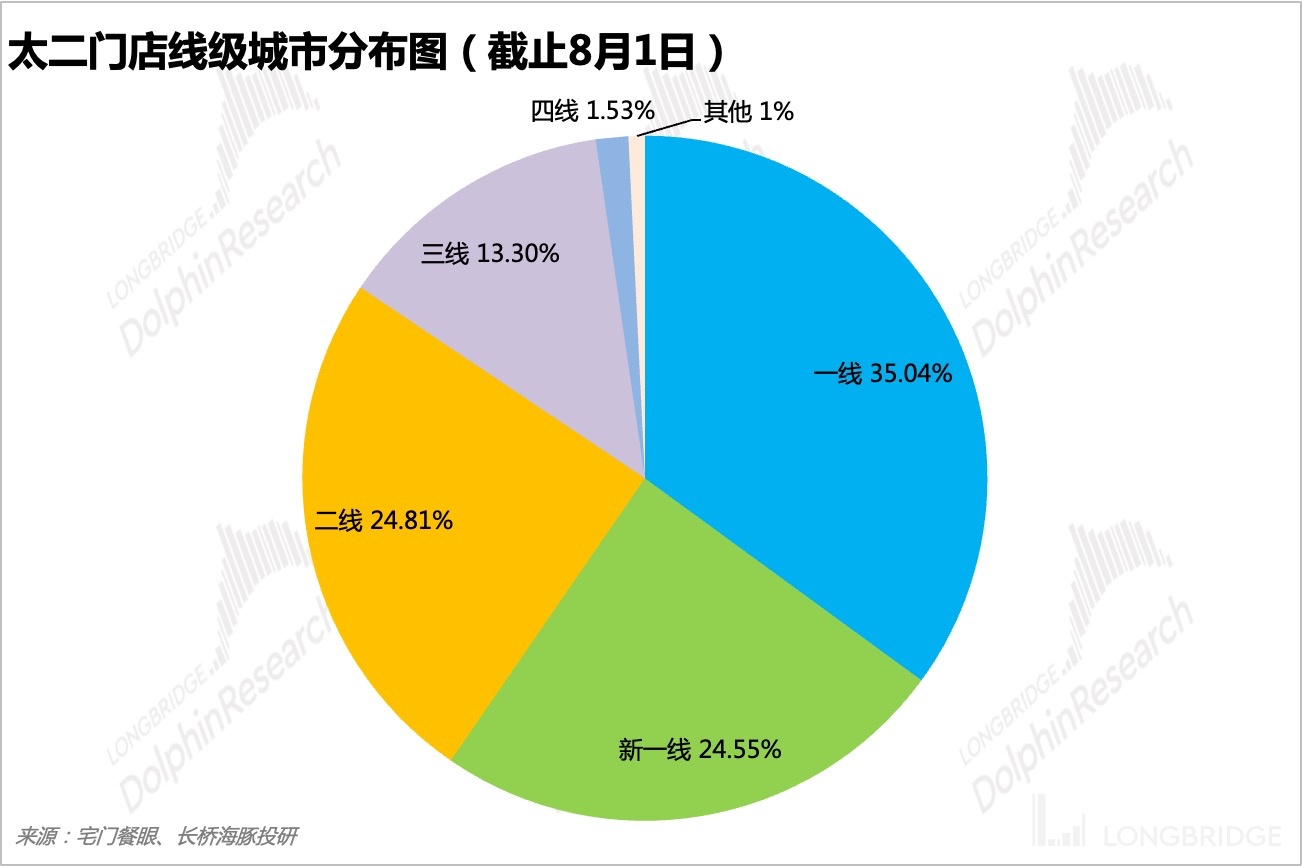

In addition, Dolphin Analyst has noticed that by comparing the line-level cities of Tai'er stores in June, July, and August, the proportion of first-tier cities is slowly decreasing, while the proportion of third and fourth-tier cities is on the rise. Dolphin Analyst believes that in the case of a larger impact in high-tier cities due to the epidemic, 9.9's decision to slow down on the expansion of high-tier cities and start strengthening the expansion of low-tier cities can improve overall risk resistance. Even in the event of an epidemic in low-tier cities, the number of stores affected at one time is relatively small.

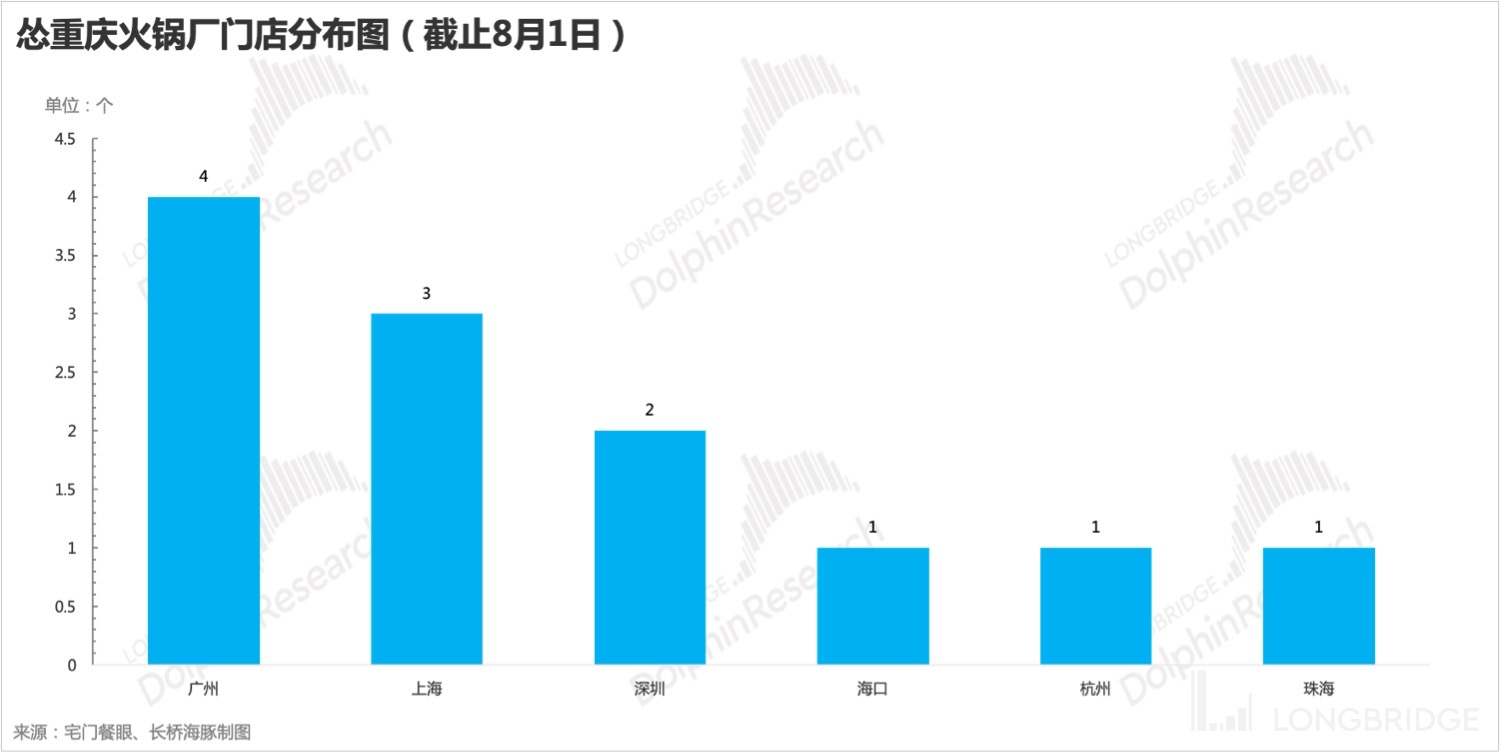

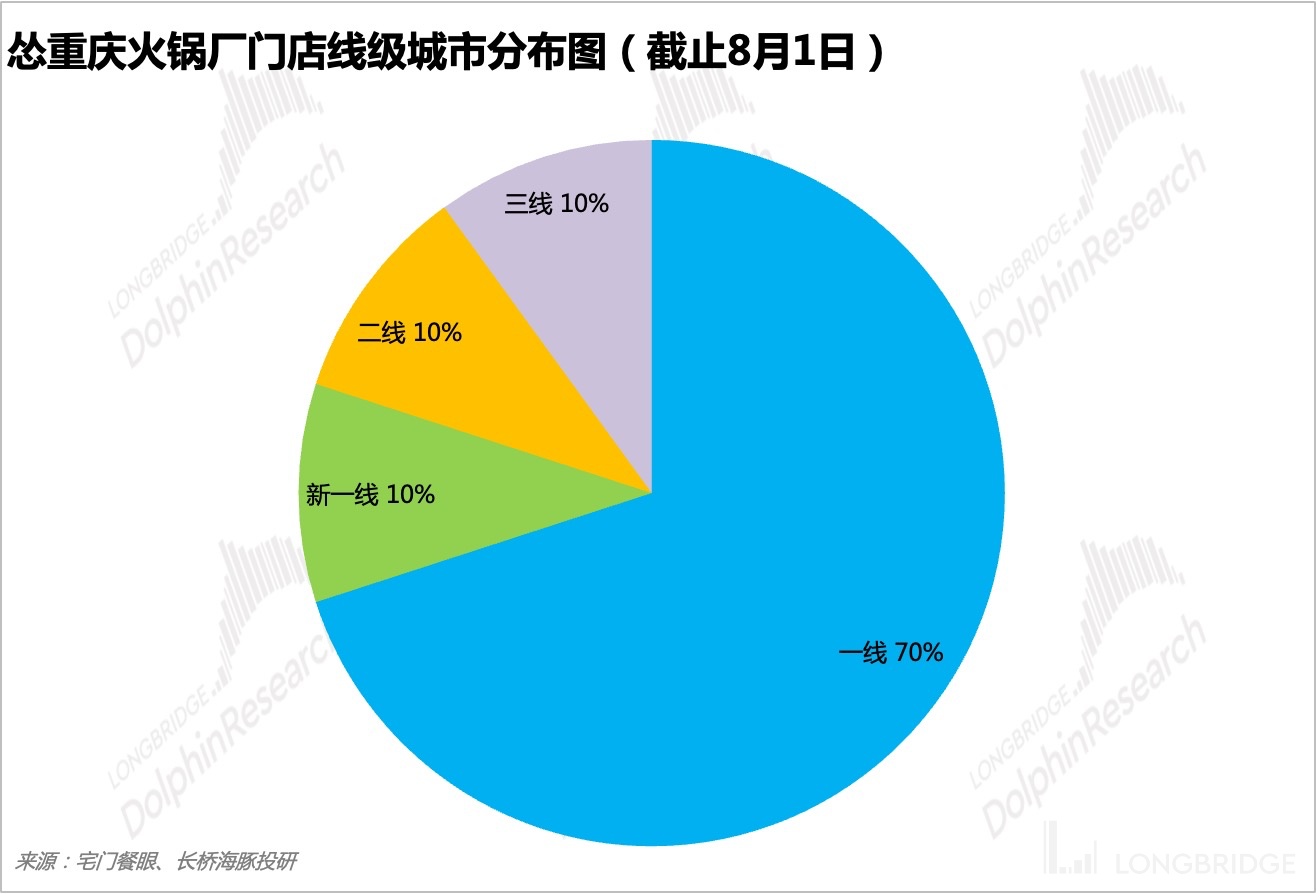

2. Sōng Chóngqìng Hotpot

Sōng Chóngqìng Hotpot has opened 2 stores in the first half of the year, and plans to accelerate store expansion in the second half of the year. Currently, it has reached 12 stores, with a year-end goal of around 24 stores. The Dolphin Analyst believes that Sōng Chóngqìng Hotpot is still in the stage of accumulating brand momentum in high-line cities and optimizing single-store models, and has not yet entered the period of rapid store expansion. It is necessary to wait for specific data after the operation of more than 20 stores to make judgments. It is suggested that everyone remain calm and look at Sōng Chóngqìng Hotpot's incubation without getting too excited.

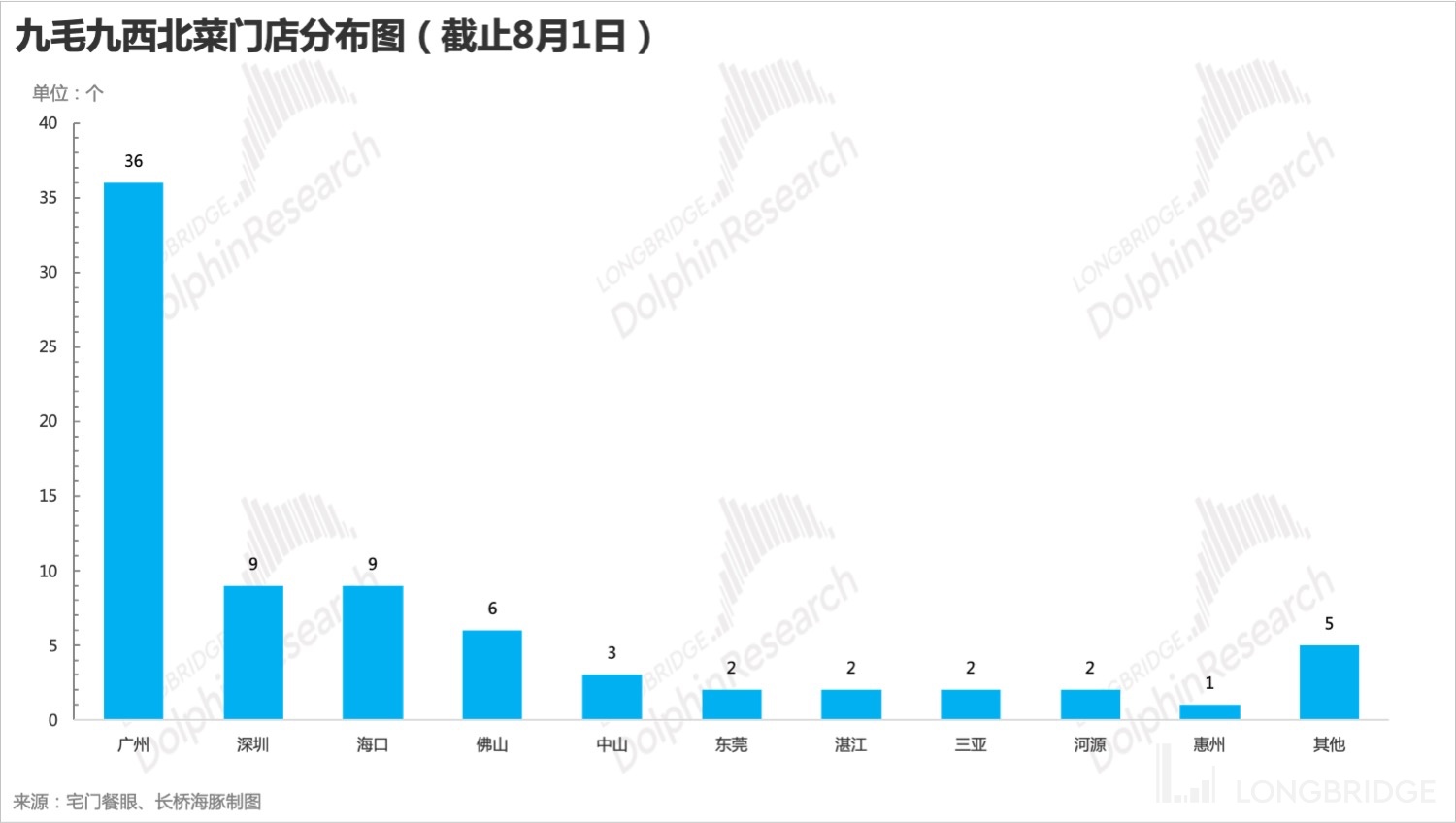

3. 9-9 North-west Cuisine

The number of 9-9 North-west Cuisine stores has decreased from 83 at the beginning of the year to 77 currently. The store optimization has been basically completed, and there are few follow-up work. In the future, it will probably maintain around 75 stores and strive for steady operation. The Dolphin Analyst believes that 9-9 North-west Cuisine has entered a phase of stable operation, and in the short term, it will basically maintain a stable situation, whether it is the number of stores or store operating data, such as turn-over rate and per capita customer consumption.

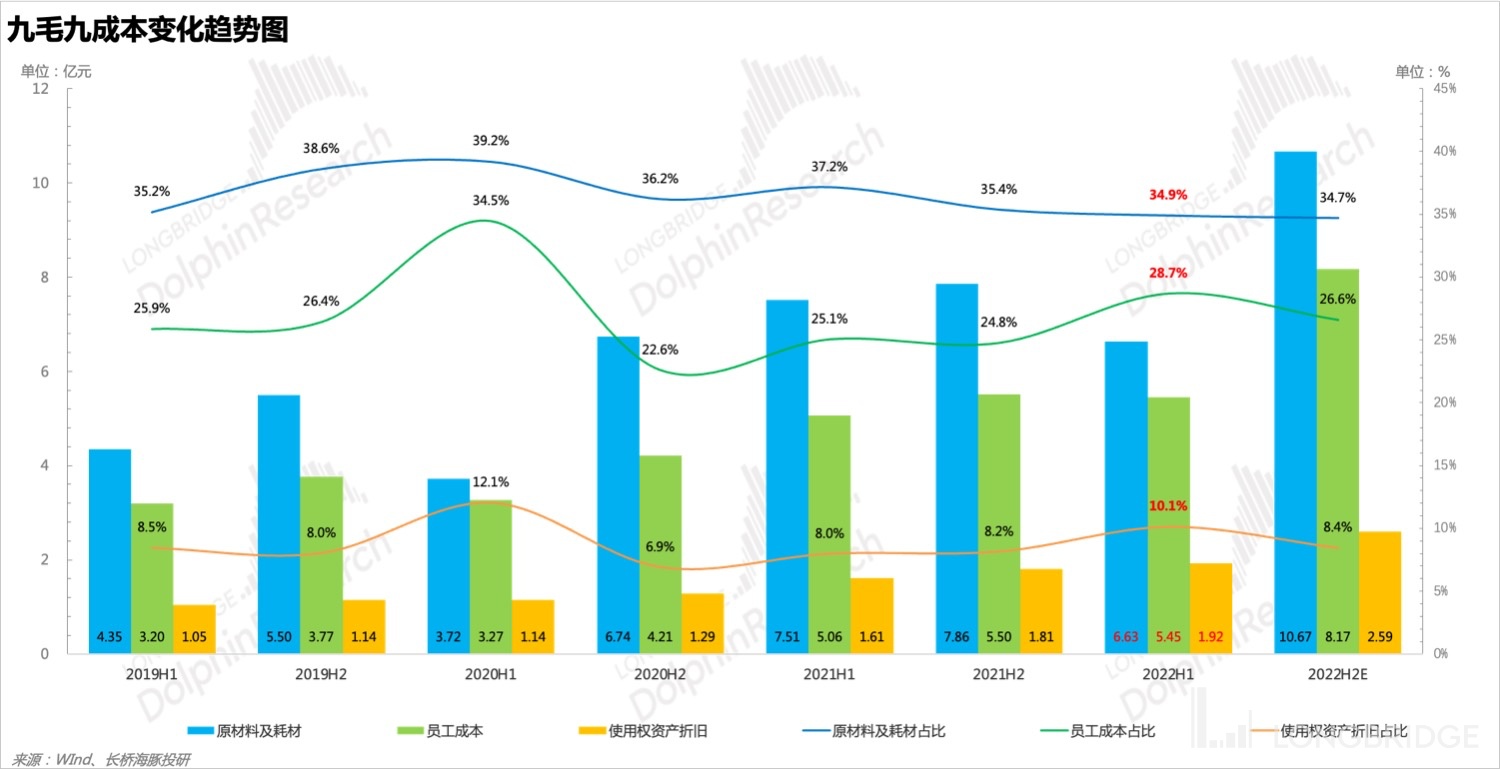

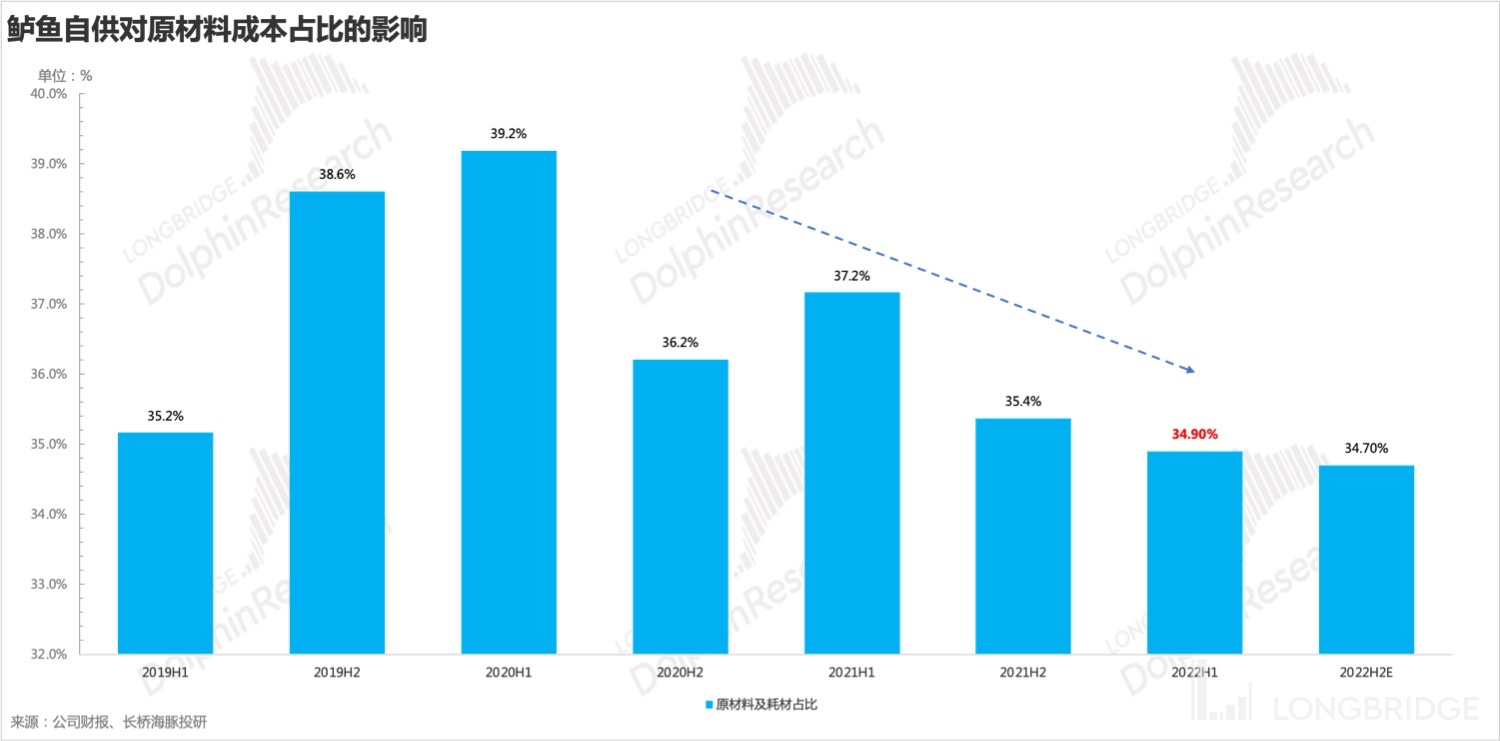

3. Cost: the pressure on costs is easing, and the profit situation will recover

It is expected that the ratio of fish supply in the second joint venture of 2022 will gradually increase. In addition, with the easing of the epidemic and the recovery of people flow, the promotion of "buy one and get one free" will gradually weaken or even be cancelled in store, and in the second half of the year, the fixed expenses of rent and labor will not erode profits. Therefore, the overall profit situation will improve in the second half of the year.

<此处结束>

<此处结束>

Dolphin Analyst "Nine-nine" Historical Articles:

Depth

June 23, 2022, "The Breeding Method of 'Fatty Fish' Taier"

June 28, 2022, "Can Taier support the soaring stock price of Nine-nine?"

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.