Asset Carnival! Will 2026 Really Enter the "Nixon Era"?

大家好,我是海豚君!

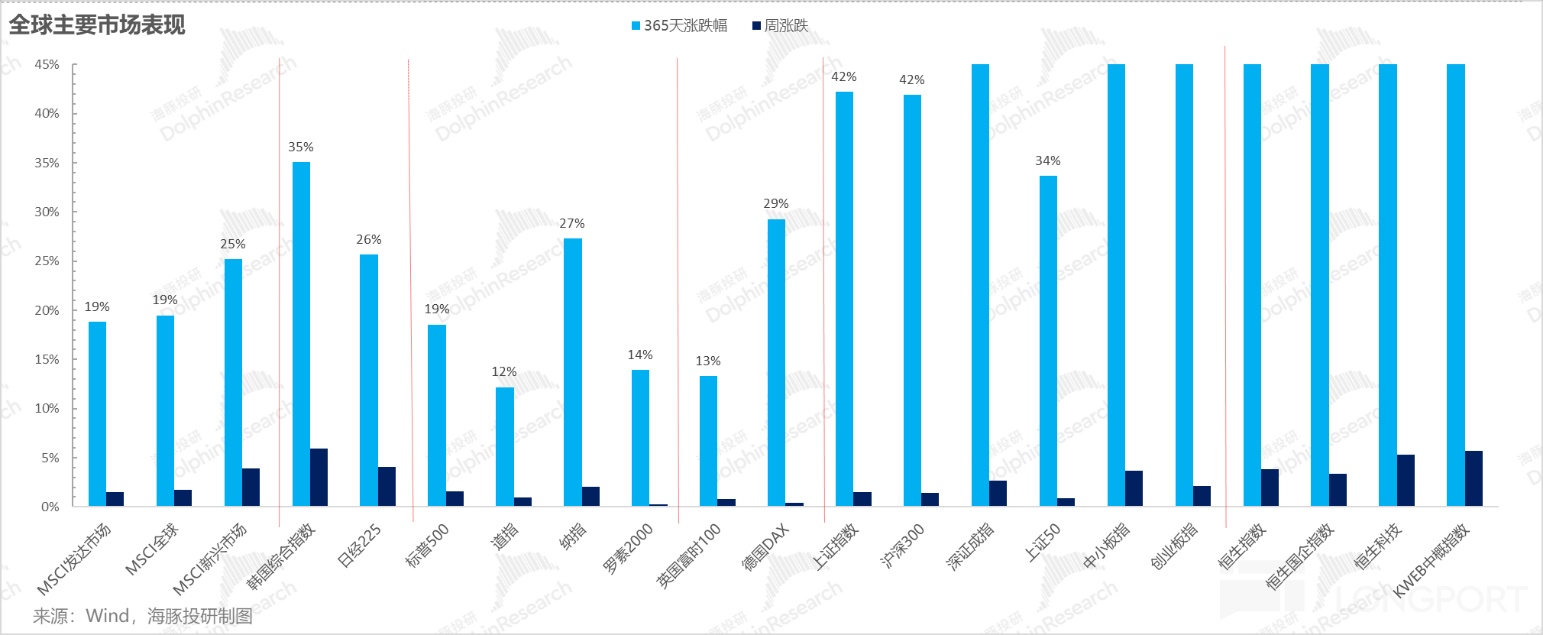

降息在即,全球资产已然大狂欢了。本周的策略周报我们来详细来连接一下这一轮特朗普 “混乱” 出拳背后的清晰 “暗线”:

一、美债涨、美股涨?软着陆预期的精准演绎

面对近期美国经济体现的通胀上行 vs 就业下行,似乎美债开始交易就业走弱,要降息了,而美股大涨,反而是在定价降息之后经济加速回升。

这二者看似交易的是完全不同的经济基本面,但本质上其实都是在定价经济不衰退、未来会更好的情况。

而且,上周已发布的数据,似乎确实是这个交易组合的确认:

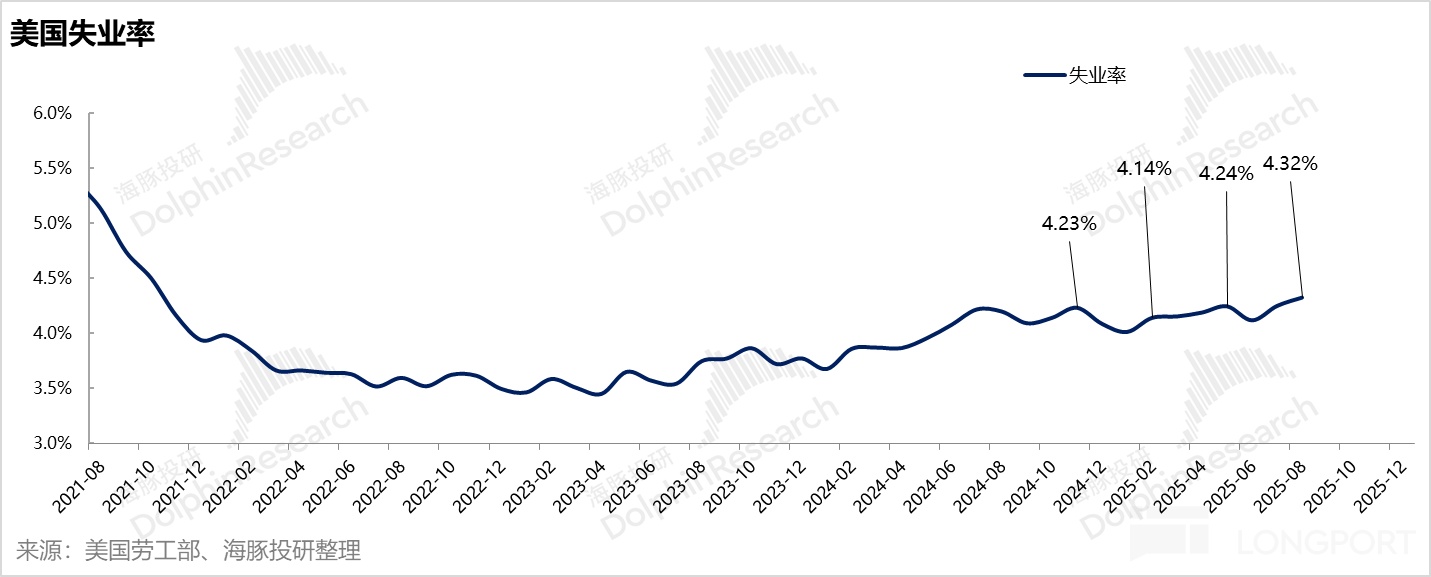

首先去年新增就业最终下调了超 91 万,比之前贝森特预告的 80 万还要更多,下调幅度超出市场预期。但其实这个下调,在失业率仍在 4.3% 上下的情况下,只是说明了就业没原本想象的那么好,但绝对也不是无序失业,降息还是 “预防式降息”。

对应到马上要开的美联储议息会议,这样的修正很难让美联储从原本计划降息 25 个基点的决策改为降息 50 个基点,但可能的效果是为美联储进一步软化口径,或者说进一步在策略的天平中向就业这端考量提供了 “有效的数据支撑”,还是之前海豚君说精准投喂美联储的决策体系,方便美联储向 “鸽派” 方向顺利演进。

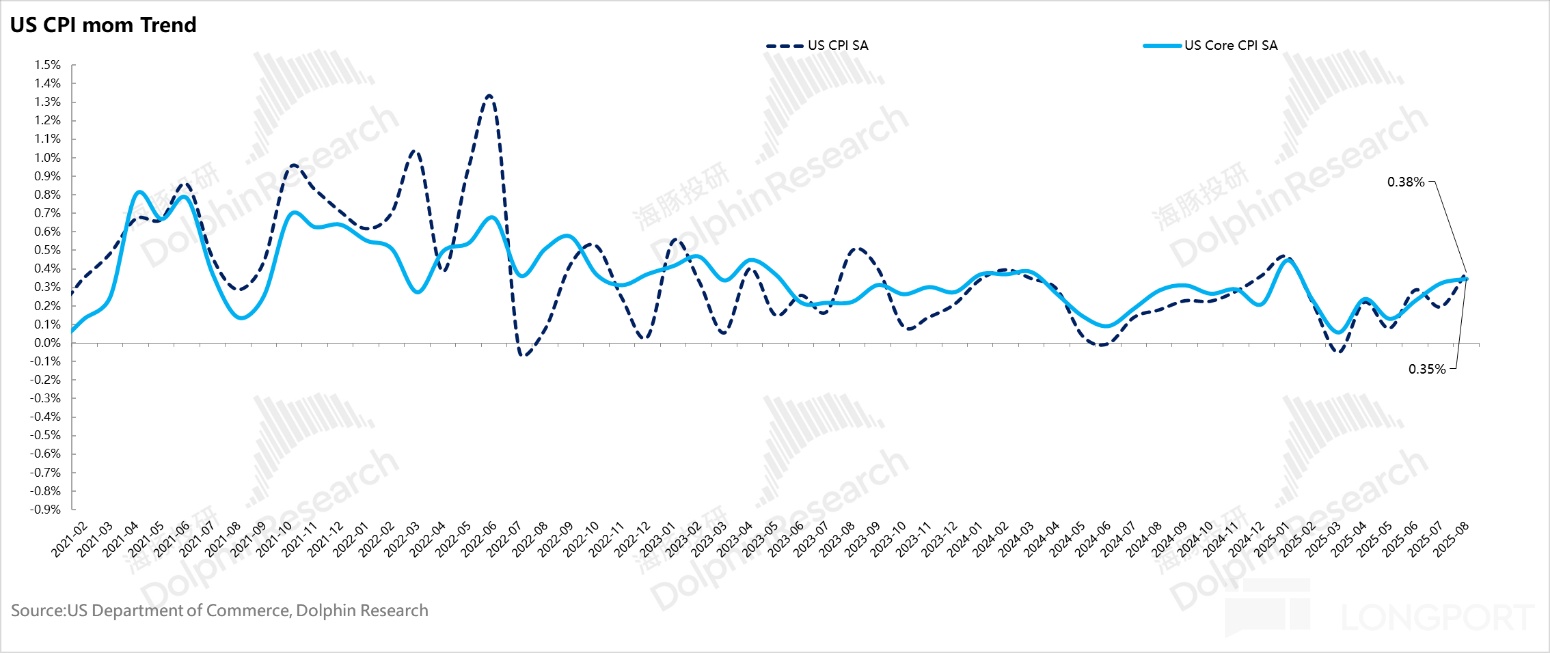

而除了就业,上周公布的 8 月核心 CPI,是观察关税有没有向实体经济渗透的一个关键指标,结果是环比增长了 0.35%(如果接下来每个月都是这个增长,那么一年后的 CPI 同比就会是 4.3%),确实还是在比较高的状态。

但细分看这个数据,核心商品从之前月份的 0.2% 环比增长了 0.3%,关税最容易直接渗透的类目里总体物价扩张不算夸张,反而是和关税关联较小的核心服务商环比从 0.2% 到 0.4%,而主要也是因为居住成本中的业主等效租金环比增加。

也就是说 8 月虽然核心 CPI 还赞 0.35% 的高位运行,但看起来更像是内生性通胀,而非是关税直接导致的外生性通胀。这种情况下的逻辑链条(决策者的自我说服)非常完美:

a. 关税导致的外生性通胀风险不大,定性上是更偏一次性的外力因素;

b. 而内生性通胀,在就业放缓的情况下,薪资和通胀互相投喂的螺旋风险小。

因此,这种情况下,美联储把决策天平转向就业,前瞻式降息,是完全合情合理的决策,可以保证经济的完美着陆。

二、当前美国经济真走弱了吗?其实并不差

同时,考虑到就业数据已经订正得 “惨不忍睹”,我们在看一下另外两个数据:

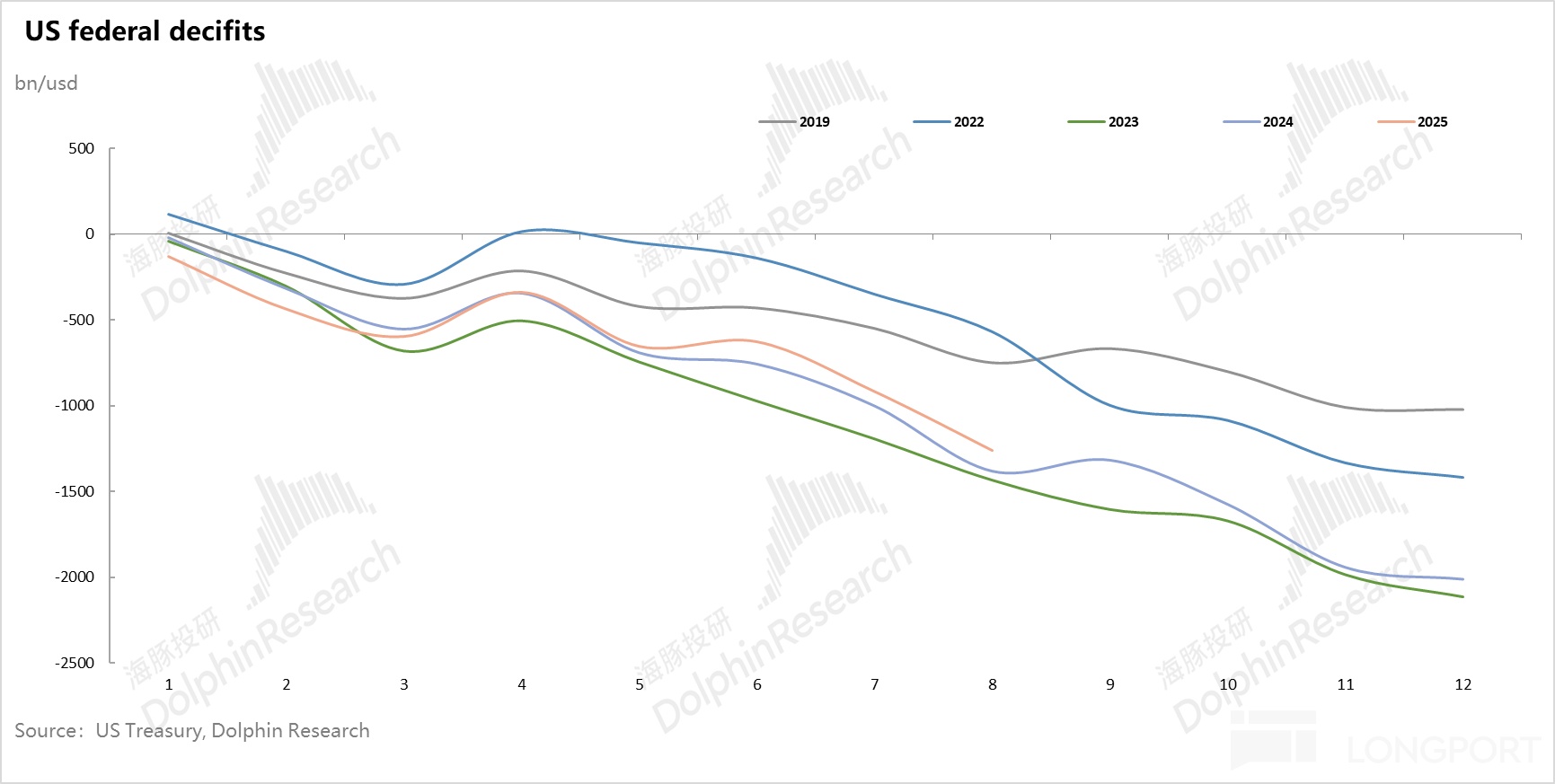

1)2025 年美国财政的刺激规模:截止到今年 8 月,美国联邦财政赤字相比 2024 年确实低了一些,二季度剔付息支出的赤字率 3.1%,也比去年同期的 3.6% 有所下降。但本身这个赤字水平相比疫情前的正常经济时期,还是在较高的水平上,财政对经济的扶持力度并没有明显减少。

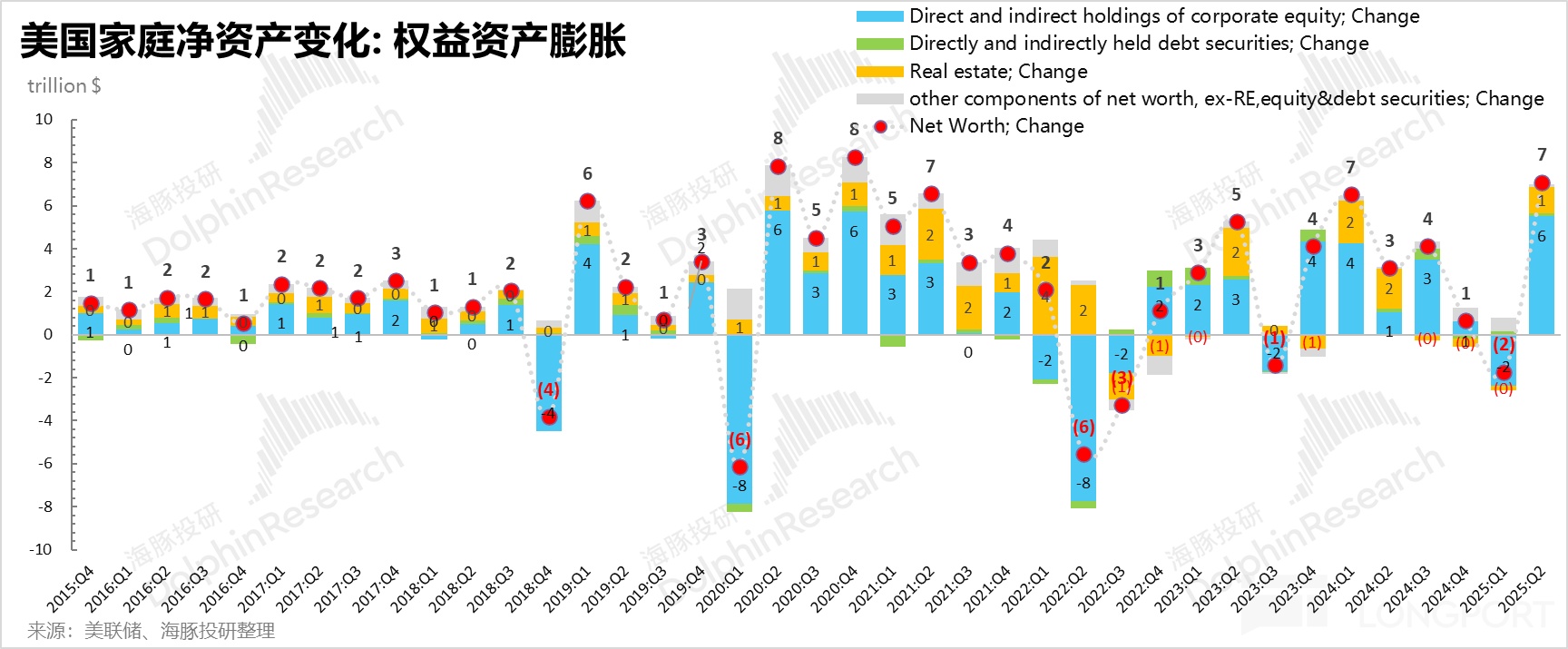

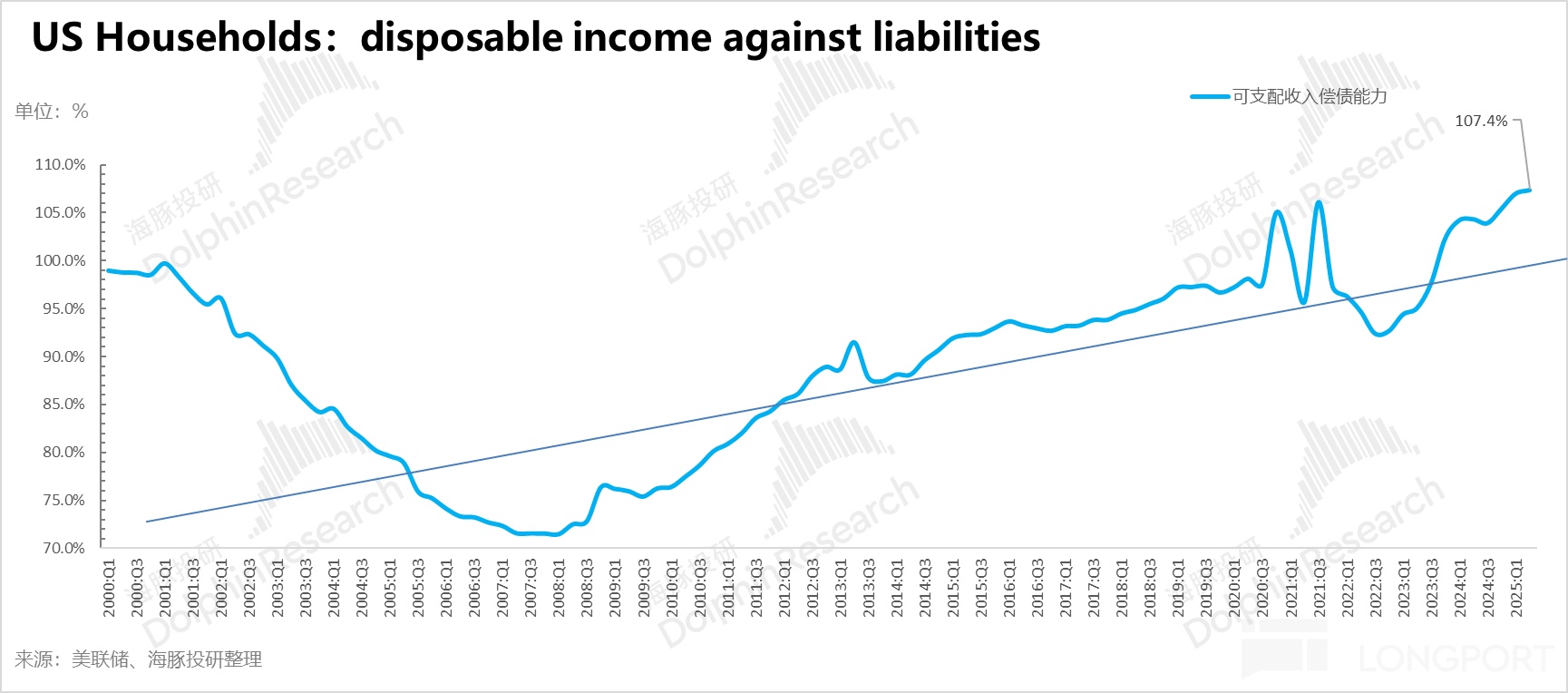

2)居民的财富效应仍在:二季度居民因为美股调整后进一步勇攀高峰,股权投资再次显著升值,家庭净资产快速回升,并创下新高;居民的可支配收入相对家庭负债的偿付能力创新高,居民杠杆率进一步下降,财富效应拉满,居民安全感进一步巩固。

而居民部门作为美国内需增长的主动力,资产的财富效应这样持续,自然也不会吝啬花钱,帮助有效提振美国国内内需。

这样宏观组合结合在一起,就成了当下有稳健的居民内需 +AI 带来的企业投资内需;且当下经济不差的情况下,往前展望开来,2026 年还是宽松货币政策 + 积极财政政策的组合。

这样的组合,尤其是这一轮在通胀没有有效扑灭的情况下开始降息,美元走弱持续的背景下,对全球资产都会沟通利好。

三. 2026:重回尼克松时代?

显然,2026 年的经济前景,只剩下一个核心问题,经济增长很好,但通胀在没有控制好的情况下就开始降息,真的不会反噬吗?

海豚君对这个问题提供的观察是:反噬或许会来,但是 2026 年共和党面临中期选举的节点上,这个风险其实不会很大,尤其是现在的美国白宫能够施压美联储调整政策的情况下,很难排除白宫会有实际上的价格控制政策,从而让 2026 年看起来是一个“最好的年份”。

而这种价格控制,其实现在已有苗头:

a. 能源:努力快速结束乌克兰战争、提高美国国内传统能源勘探开发;

b. 医疗:把美国药品价格降到 “最惠国” 水平;

c. 住房:目前美国政府官员还在评估是否要颁布 “国家住房紧急状态”,以应对住房负担能力下降;

d.水电煤:特朗普竞选时曾誓言,要在上任后的 12 个月内把美国国内的电价砍半,尤其是当下政府鼓励的 AI 产业对电力需求旺盛的背景下。

强控美联储 + 变相控物价,这样的组合放在一起,看起来像什么?在海豚君看来,似乎很像闪回到尼克松时代。大家知道尼克松时代的失控的通胀,但是这是下半段的故事,这个故事的上半段是尼克森通过控制美联储 + 控制价格,在 70 年头两年,通过 “看得见的组合铁拳”,实现了物价的控制和经济的繁荣。

而当下,“尼克森下半段” 未到,市场当然重点关注故事上半段 “盛世经济” 带来的交易机会,整个交易机会都会偏向于特朗普政策主导下的 “政策市”——白宫政策鼓励哪些行业,哪些行业就有超额的投资机会;而他要限制哪些行业的物价,这个行业就很难跑赢市场。

而且在 2026 年在力保守住中期选举的大逻辑下,博弈特朗普政策上出大的利空、捡到类似今年上半年关税打出来的那种大坑的机会,其实并不大。

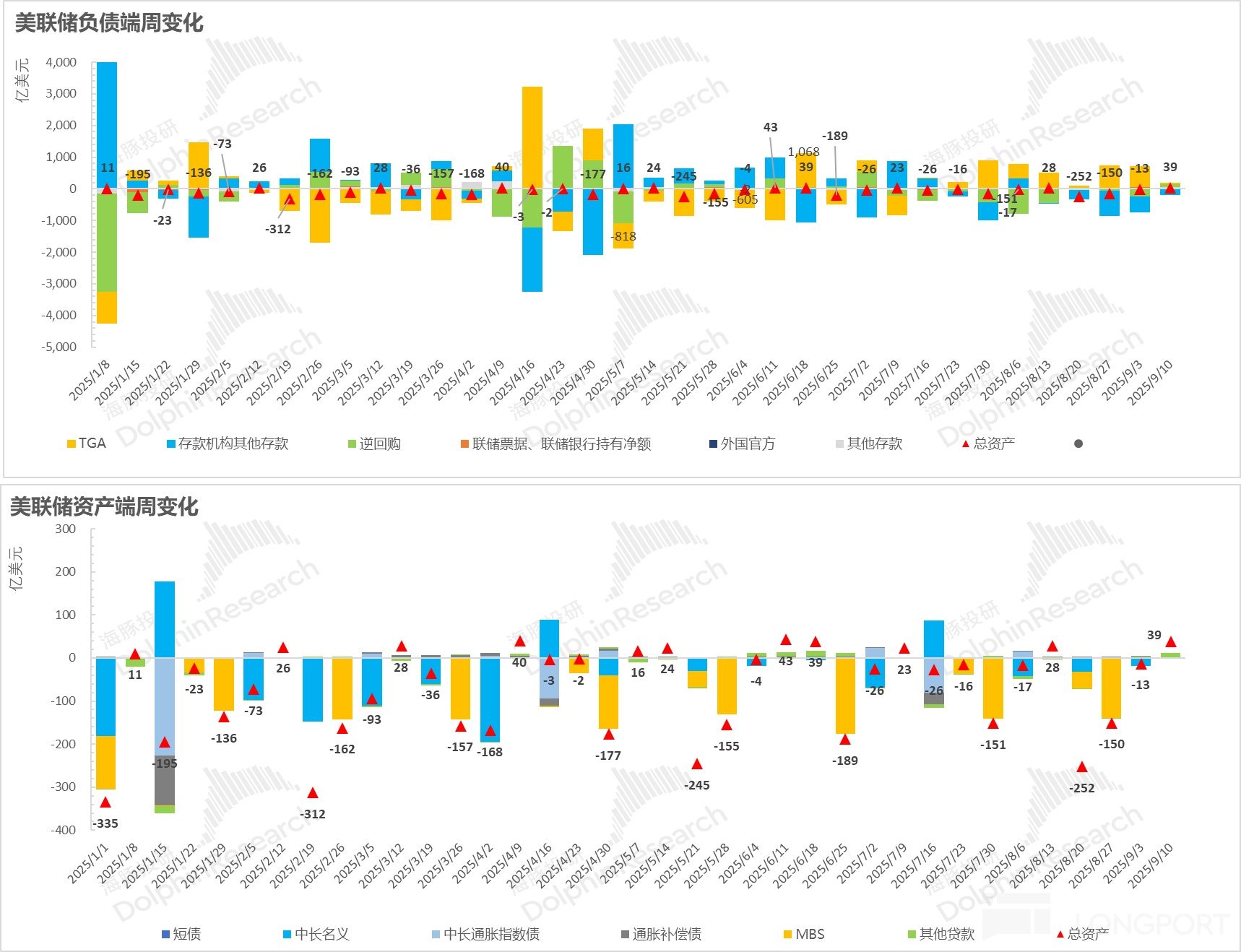

短期而言(9 月份而言),只是发债带来的小的流动性冲击,且这个冲击在上周表现并不明显:财政部在最近的一周放缓了发债重建 TGA 账户的进度,截止 9 月 10 日周,TGA 余额重建到 6675 亿美金。

由于 9 月底要达到了 8500 亿,9 月份剩下时间,还是要继续吸食市场流动性,反而给市场创了一定的寻找优质且价格不是贵得离谱的公司的机会。

而整体寻找的方向上,海豚君认为,可以围绕:a. 特朗普政策鼓励;b.降息拉高小盘股弹性;c. 降息美元走弱,带动非美股的新兴资产机会,当然,这个过程中港股也会受益。

四、组合收益

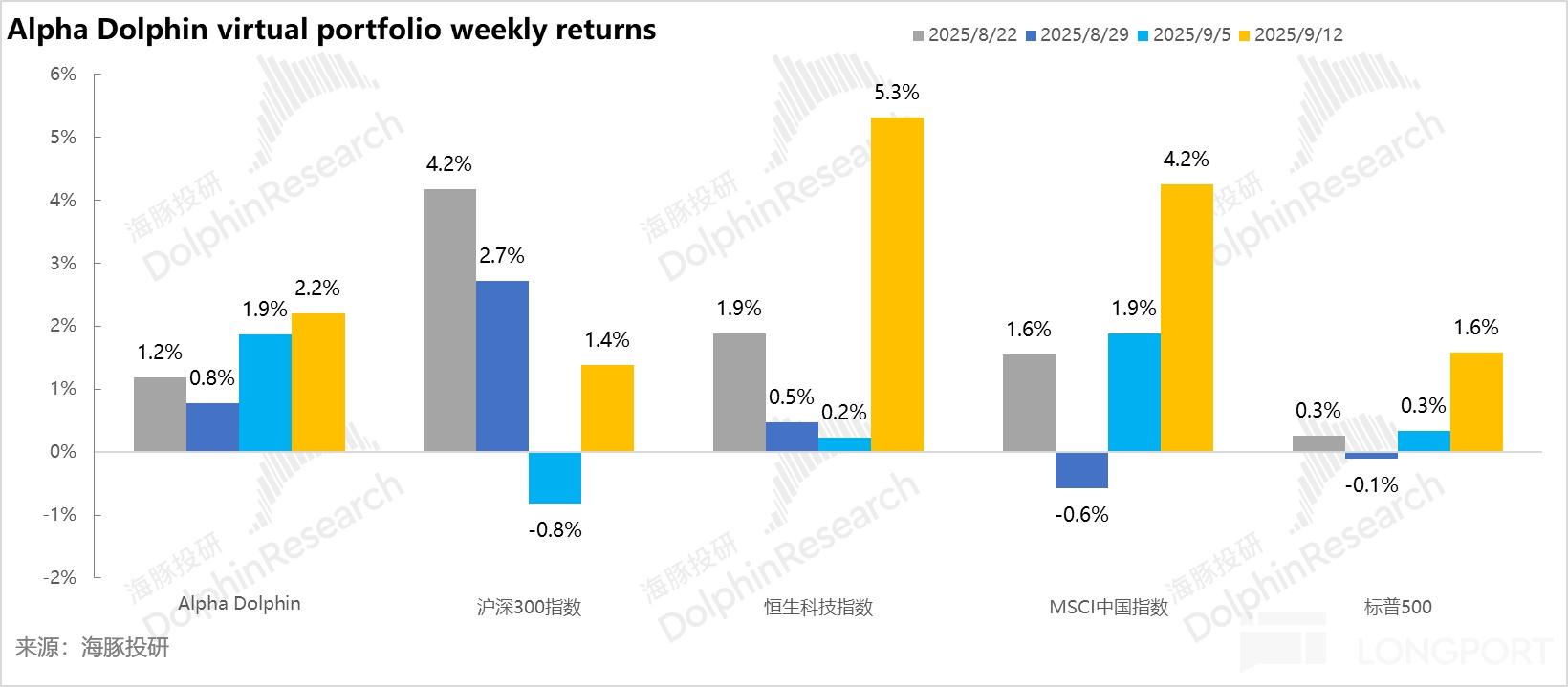

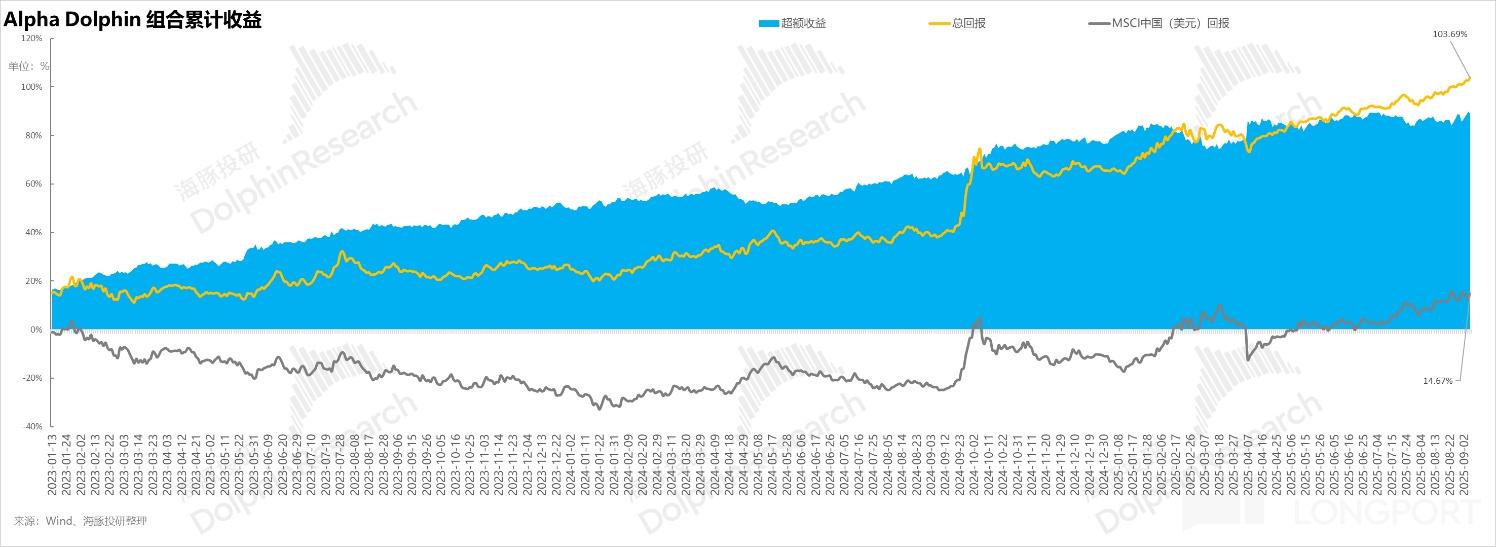

上周,海豚投研的虚拟组合 Alpha Dolphin 未调仓。当周上行 2.2%,跑超标普 500(+1.6%)、沪深 300(+1.4%),但跑输 MSCI 中国指数(+4.2%)、恒生科技(+5.3%)。

自组合开始测试(2022 年 3 月 25 日)到上周末,组合绝对收益是 109%,与 MSCI 中国相比的超额收益是 89%。从资产净值角度来看,海豚君初始虚拟资产 1 亿美金,截至上周末超过了 2.11 亿美金。

五、个股盈亏贡献

上周海豚君的虚拟组合 Alpha Dolphin 的收益主要来源于网易、阿里巴巴、B 站等中概资产在美联储降息的大背景下跑出超额收益,但由于配置中有较高的黄金和债券等,导致收益相比高弹性指数如恒生科技等稍低。

具体个股主要涨跌幅解释如下:

六、资产组合分布

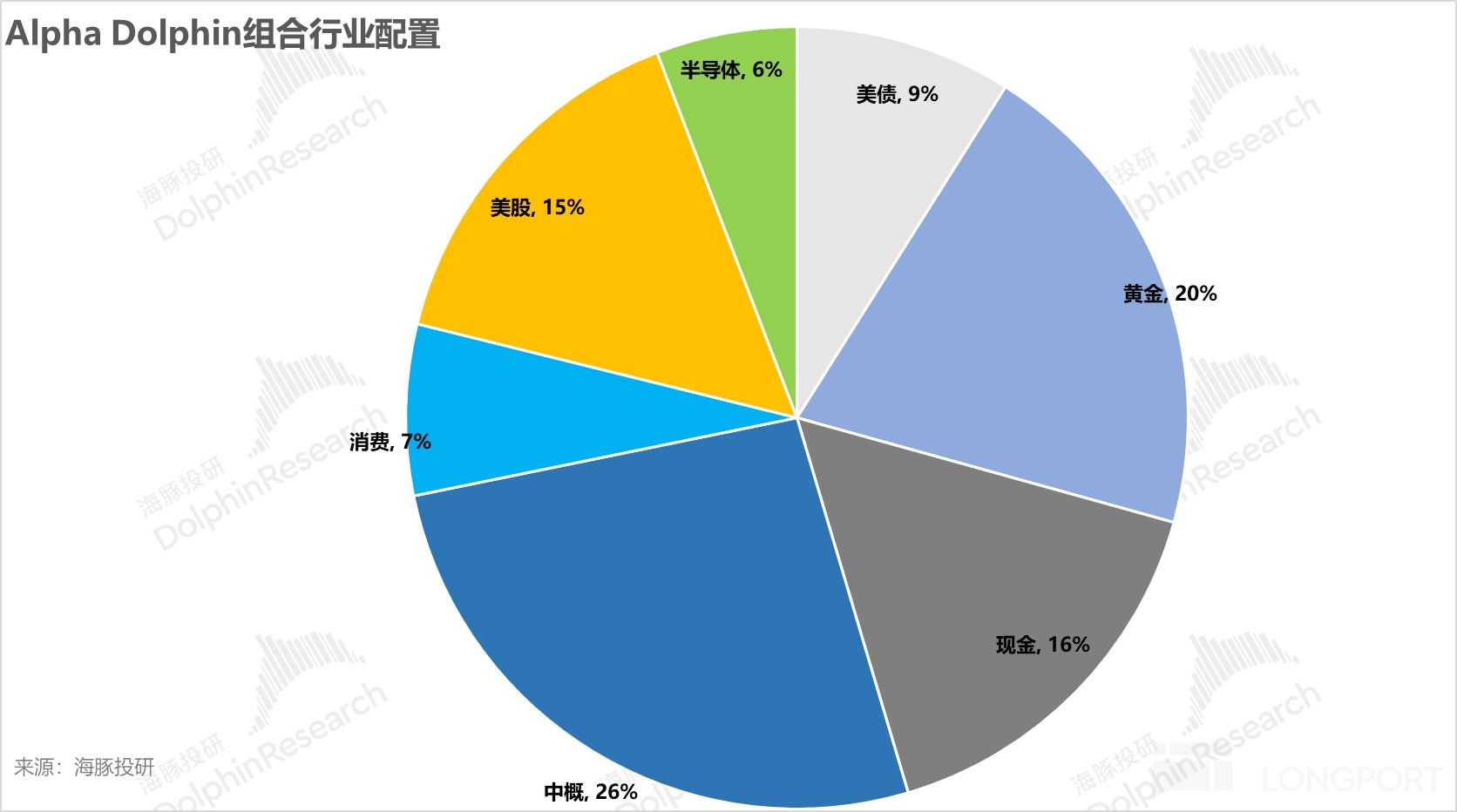

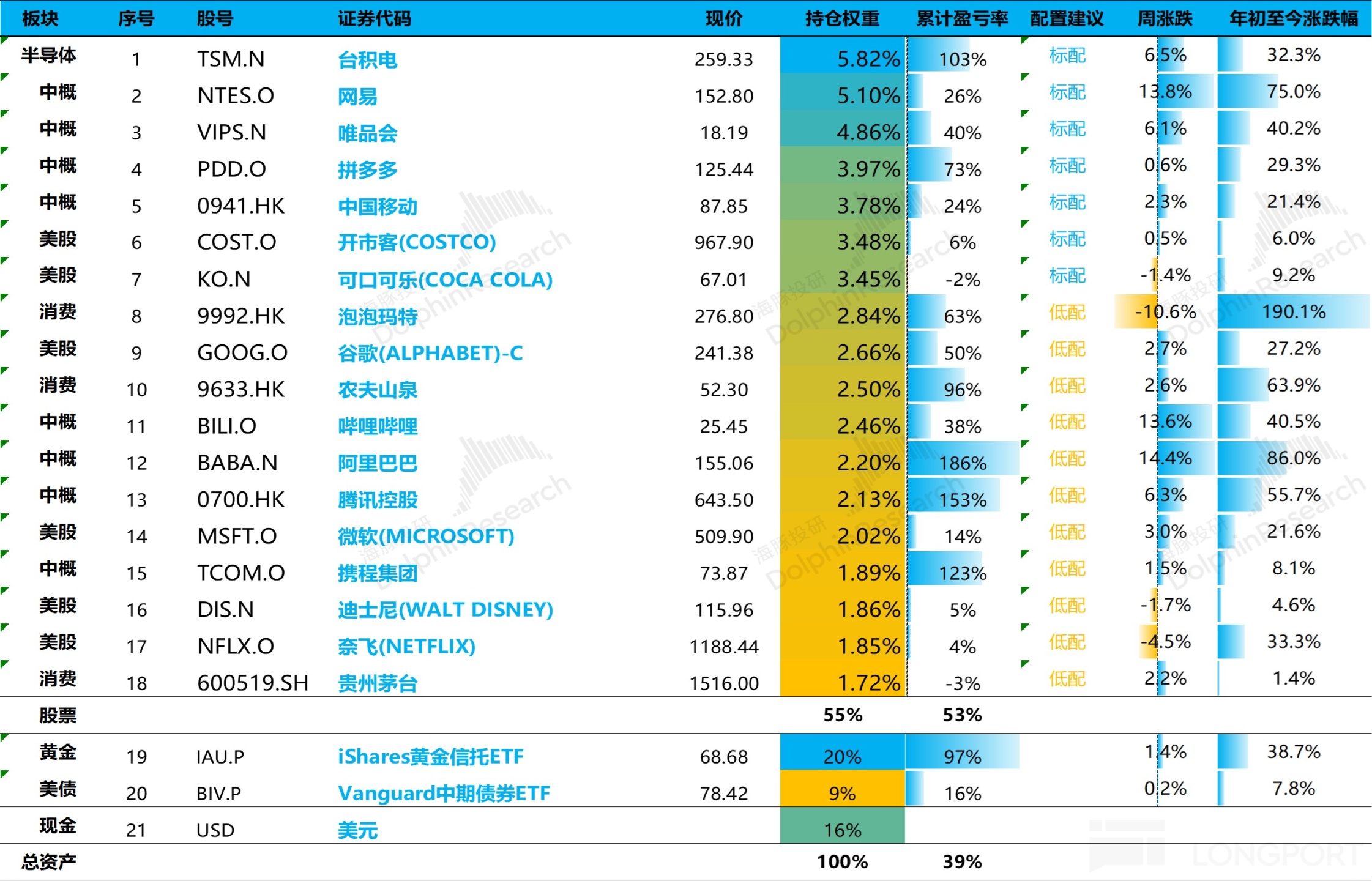

Alpha Dolphin 虚拟组合共计持仓 18 只个股与权益型 ETF,其中标配 7 只,其余低配。股权之外资产主要分布在了黄金、美债和美元现金上,目前权益资产与黄金/美债/现金等防守资产之间大约 55:45。

截至上周末,Alpha Dolphin 资产配置分配和权益资产持仓权重如下:

<正文完>

本文的风险披露与声明:海豚投研免责声明及一般披露

近期海豚投研组合周报的文章,请参考:

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。