Top 10 Influencers in 2025

Top 10 Influencers in 2025ARCT

Personally bought a little at 9.8, because after a quick review, I believe ARCT is a typical misjudgment🤔, not a value reassessment.

First, safety clearance is the minimum threshold.

After review by the Data Monitoring Committee, the trial was approved to continue. The DMC consists of independent experts whose primary task is patient safety. If they saw unacceptable risks, they would directly recommend suspending the trial. Since the trial continues, the worst safety issues may have been ruled out.

Second, there is potential value in early signals.

AI imaging showing reduced mucus plugging is a real and meaningful biological activity signal. This indicates the drug is producing pharmacological effects at its intended site of action (the lungs). For new modalities like mRNA therapy, early biomarker improvements sometimes precede clinical function, such as FEV1 improvement.

Previously, market expectations were too high, betting on seeing dramatic FEV1 improvement with a single dose, but such expectations are unrealistic for early-stage, complex diseases and entirely new technology platforms. The stock price plunge is somewhat a reset of expectations, not a zeroing of value.

Because the long-term story remains, the company's technology platform, LNP delivery, and self-amplifying mRNA potential are not limited to this one drug or this one disease. If you believe in the platform's value, this setback in CF is a discount opportunity for the platform's worth.

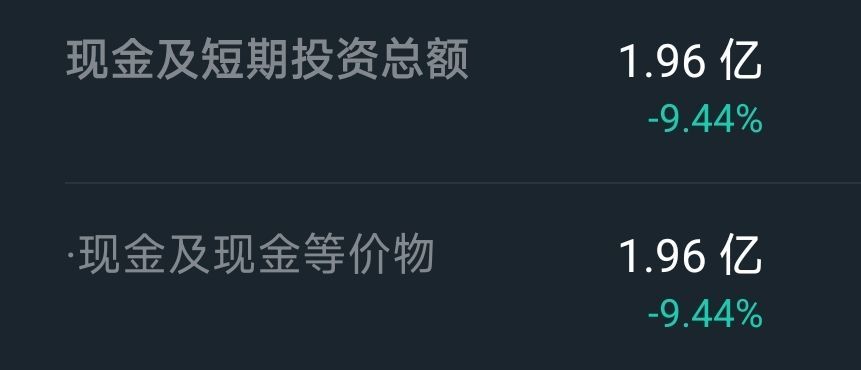

Moreover, from a cash flow perspective, this is not a company that needs a short-term capital raise or faces immediate funding shortages.

Based on their historical R&D expenses, $120 million in net cash is enough to sustain them until the end of 2026, meaning as long as there is progress with at least one drug by the end of next year, there is basically no structural risk. This is without even counting debt—their debt ratio is extremely low, which indirectly means their debt issuance liquidity is very high.

Of course, efficacy shortcomings are the core issue.

In clinical development, when there is clear and strong efficacy data, it is clearly announced. Arcturus' press release did not do this. The absence of FEV1 data can also be a red flag. The market can reasonably infer: if there were even a slight positive trend in FEV1, the company would have released it to stabilize the stock price. Since it wasn’t mentioned, the data is likely unfavorable or even negative. In clinical data interpretation, 'trend' is almost synonymous with statistically insignificant or weak effects. It fails to convince scientists, the FDA, and investors.

Moreover, while Type I CF patients have high unmet needs, they are also a harder group to show efficacy in. If the effect is not obvious in this group, the results for other mutation types, such as F508del patients, are even more concerning. Delaying the development process to 2026 means huge time costs and capital consumption. During this period, competitors' therapies, such as Vertex's next-generation CFTR correctors, gene therapies, etc., may further consolidate their market position, leaving less and less room for ARCT-032.

The biggest paradox emerges: is capital betting on these drugs themselves? The company's greatest value is actually the platform as a whole. As long as the platform's evolutionary capability remains unchanged, drugs will continue to be produced.

Think carefully about what you're doing before placing your bet.

Personally, I'm betting that the value of the therapy and platform evolution remains unchanged; when liquidity is released again, it will rebound to around 20, and the platform's value won’t let the company go bankrupt to zero. If you haven’t thought through the logic, the advice is to stay away.

$Arcturus Therapeutics(ARCT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.