Microsoft 1QF26 Quick Interpretation: Overall, Microsoft's performance this quarter can still be described as impeccable, with various indicators generally positive and better than Bloomberg's consensus expectations. The guidance for the next quarter also remains stable.

However, the market reaction after the earnings was a slight decline. Dolphin Research believes the main reason is that Microsoft is the most consistently bullish target in the market, with expectations set very high. For example, the core Azure growth rate this quarter actually met or was slightly below optimistic buy-side expectations. Given the expectation of a perfect score, even a 90 can seem unsatisfactory.

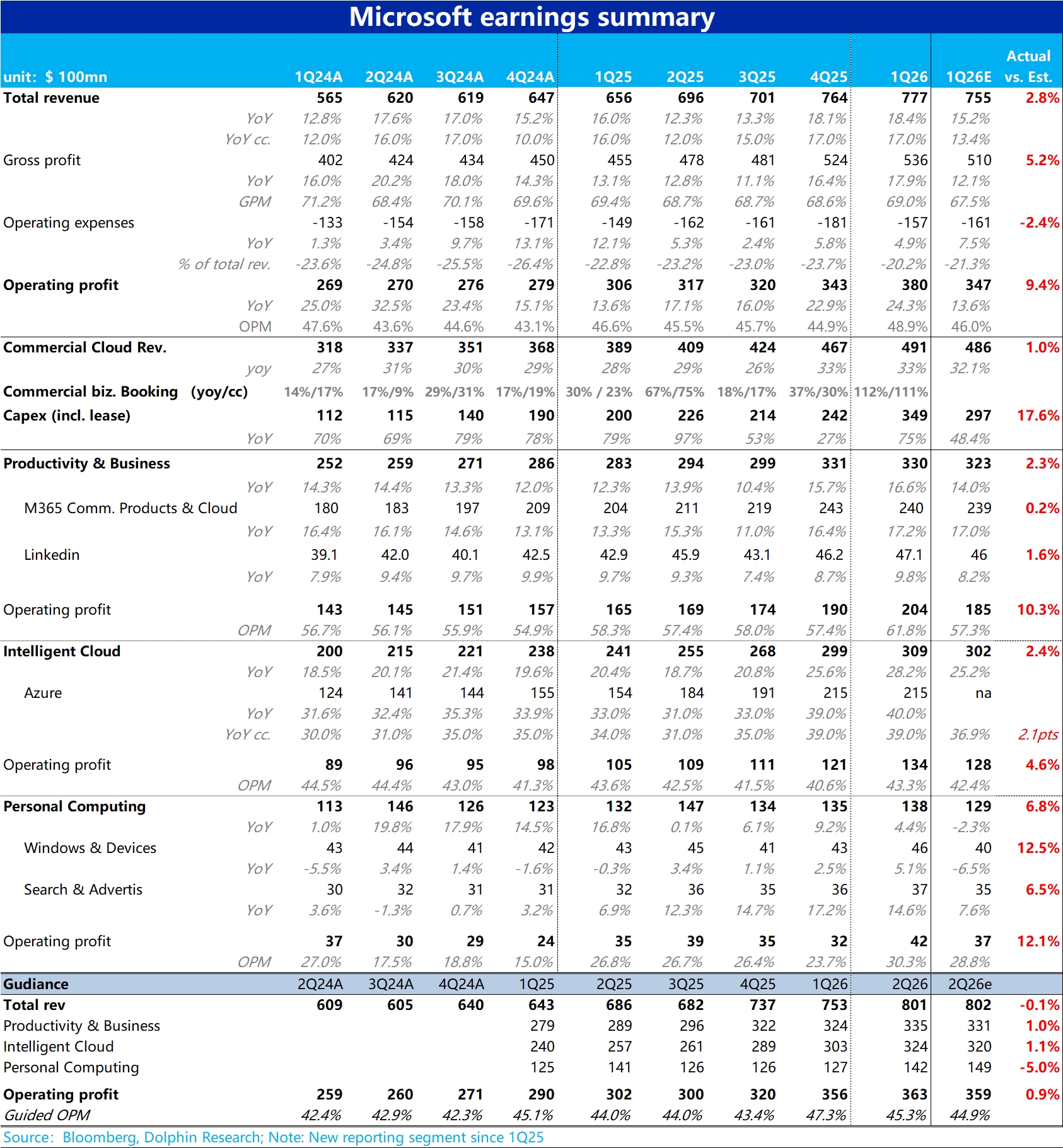

1. In terms of overall performance, this quarter's revenue increased by 18% year-on-year, and operating profit grew by 24%. While revenue growth was roughly flat with a slight increase compared to the previous quarter, operating profit showed a significantly accelerated growth beyond expectations. Contrary to the company's guidance of a year-on-year decline in operating profit margin, the actual margin improved by more than 2 percentage points year-on-year.

2. Behind the counter-trend improvement in operating profit margin, on one hand, the company offset the negative impact of high Capex and depreciation better than expected through price increases and operational efficiency improvements. The actual gross margin only contracted by 0.4 percentage points year-on-year, far less than the market's expected contraction of nearly 2 percentage points.

Meanwhile, this quarter's operating expenses only grew by less than 5% year-on-year. With the assistance of AI, Microsoft continues to excel in cost reduction, efficiency improvement, and expense control.

3. In terms of segments, the market's most focused Azure business grew by 40% and 39% year-on-year under variable and constant currency rates, respectively, consistent with the previous quarter when viewed under the latter metric.

Although higher than the company's guidance of 37% growth under constant currency rates, considering the significantly exceeded expectations in the previous two quarters, the leading sell-side expectations and actual performance are basically consistent, while buy-side expectations for growth could reach 41% or higher. Compared to the previous two quarters, this time there are not many surprises.

4. In terms of capital expenditure, including lease expenses, this quarter reached a record 34.9 billion, a sequential increase of over 10 billion, significantly exceeding the sell-side's general expectation of about 30 billion.

This reflects the CSP and the entire industry chain's increasing investment in computing power. On one hand, it shows Microsoft's optimistic view of AI prospects, and on the other hand, it also means greater pressure on depreciation and gross margin in the future.

5. In terms of forward-looking indicators, the balance of unfulfilled enterprise contracts this quarter increased by 51% year-on-year, and the company disclosed that the amount of new contracts signed in a single quarter surged by over 110%. It is evident that the demand for AI and other enterprise services remains quite strong. The medium-term performance trend remains optimistic.

6. Finally, it is worth noting that this quarter mainly reflects Microsoft's other losses (excluding interest/investment parts) related to OpenAI, reaching 4.9 billion, a sequential increase of 1.6 times from the previous quarter. It can be deduced that OpenAI's single-quarter loss is nearly 15 billion. Although Microsoft confirms that OpenAI's losses have a cap, the net profit in the short to medium term is still under considerable pressure. $Microsoft(MSFT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.