理想 3Q25 火线速读:海豚君第一眼看到理想的财报,只能用 “惨不忍睹” 来形容,毛利率大幅下跌,以及净利润反而从盈利转为亏损。

但仔细审查之后,发现导致理想这季度财报 “惨不忍睹” 的罪魁祸首是 Mega 召回事件带来的对成本端计提了接近 11.1 亿元的负面影响。

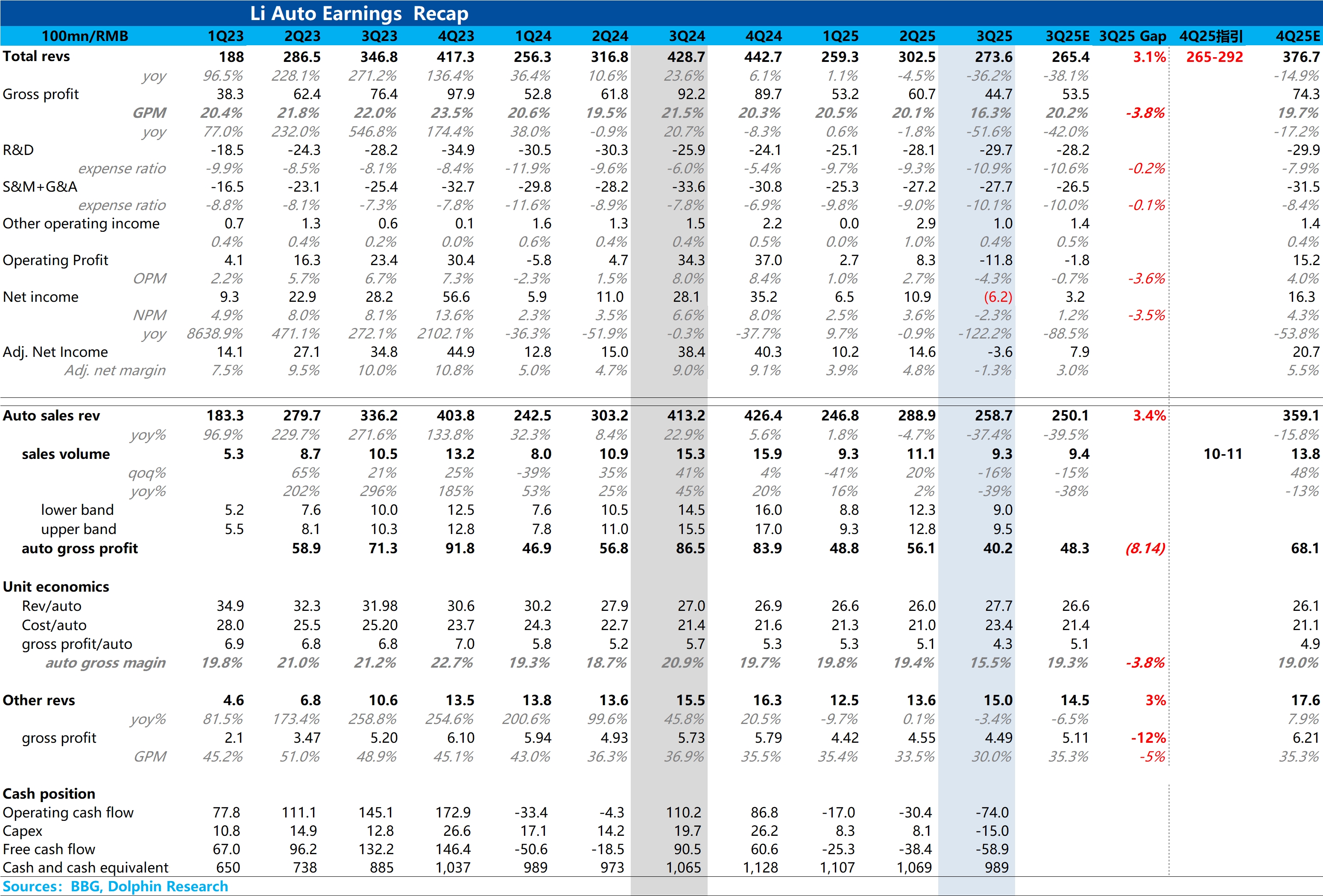

而加上这个一次性事件带来的影响后,理想三季度的 “真实” 毛利为 55.8 亿元,整体毛利率则为 20.4%,整体收入和毛利率端都是略超市场预期的状态,所以三季度财报如果去除 Mega 影响后,整体业绩表现还算小超市场预期的状态。

具体来看:

三季度卖车收入 258.7 亿元,超出预期的 250 亿元,主要由于三季度从高价的 i8+Mega 两款纯电车型把单价拉到了 27.7 万元,超出市场预期的 26.6 万元。

去除 Mega 召回对成本端的负面影响后,本季度卖车毛利率 19.8%,环比上季度 19.4% 上升了约 0.4 个百分点,表现也还可以,主要仍然是卖车单价上行所带来的,对冲销量环比下滑的单车摊折成本上行的负面影响。

最后在 “真实” 毛利率环比上行的带动下,虽然研发费用的投入仍然在加大,但去除 Mega 召回影响后的 “真实” 净利润为 4.9 亿元,略超市场预期的 3.2 亿元。

但海豚君需要提醒的是,相比三季度业绩本身,市场会更关心的是四季度的指引,而四季度指引方面理想并不及预期。

而从指引来看,四季度的销量指引仅 10 万-11 万辆,由于 10 月 3.2 万辆销量已知,隐含的 11 月/12 月平均月销仅 3.4-3.9 万辆,大幅低于市场预期的 13.8 万辆,而这一方面说明 i6 这款爆款车型的爬坡速度不及预期,但更重要隐含的是 L 系列增程车型的销量相比三季度还要再大幅环比下滑,尤其在理想还在对 L 系列加大折扣力度的情况下,L 系列 “内忧外患” 比想象中的更为严重。

在 i6 低价上市,L 系列加大折扣但仍然销量还在环比大幅下滑,理想四季度的卖车毛利率预计仍然要承受很大的压力,具体需要看管理层如何指引。$理想汽车(LI.US) $理想汽车-W(02015.HK)

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。