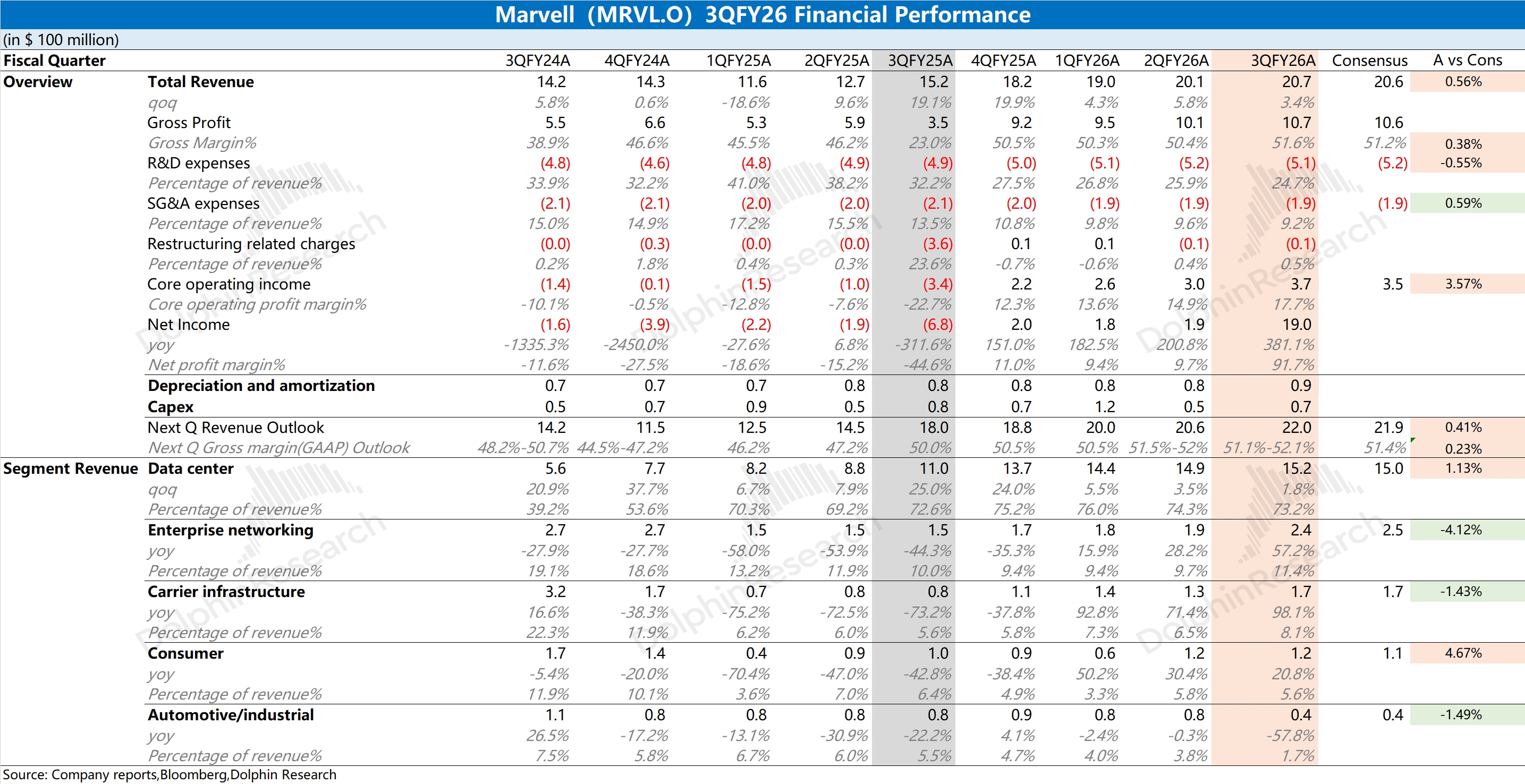

Marvell Technology Quick Interpretation: The company's performance this quarter and guidance for the next quarter basically met expectations. The quarter-on-quarter performance this quarter was not mainly driven by data centers, but rather by the recovery of enterprise networks and carrier businesses.

In the data center business, the company's optical interconnect products achieved double-digit growth quarter-on-quarter, but the custom ASIC business was affected by demand fluctuations (Amazon's product cycle), resulting in a quarter-on-quarter decline, ultimately leading to the company's data center business not showing significant quarter-on-quarter growth this quarter.

Compared to this earnings report, the two core "highlights" provided by the company after the meeting are more important:

1) Raising guidance for the next fiscal year: The company's management had previously provided guidance for an 18% growth rate in the data center for the next fiscal year during a small meeting in September, and this time raised the guidance to 25%. With major manufacturers increasing capital expenditures, the company has also raised its expectations for next year;

2) Announcing the strategic acquisition of Celestial AI: This can fill the company's technological gaps and enrich its data center product matrix. Celestial AI's photonic fabric platform provides high bandwidth, low latency, and low power solutions for multi-rack XPU clusters (hundreds of XPUs).

Previously, Marvell Technology's stock price was deeply mired in concerns about "Alchip competition." The definitive guidance provided by the company's management can somewhat alleviate market concerns. Compared to companies like NVIDIA and Broadcom, Marvell is still on the periphery of the AI chip market.

The announcement of the strategic acquisition of Celestial AI fills the company's shortcomings in the scale-up interconnect field and conveys the company's determination to continue competing in the data center and AI markets. For more information, please follow Dolphin Research's subsequent commentary and management minutes. $Marvell Tech(MRVL.US) $GraniteShares 2x Long MRVL Daily ETF(MVLL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.