Rate Of Return

Rate Of ReturnFinally got the lottery, bros

The best news today is that the lottery insulator, which is me, finally won the lottery for $BAO PHARMA-B(02659.HK). Tomorrow afternoon's grey market, I'll take a bite and then run:

JD Industrial has set the issue price at 14.1, originally the price range was 12.7 to 15.5, right in the middle of the range. Now, those who applied and those who didn't are both nervous; those who applied fear getting too many, and those who didn't fear it rising too much.

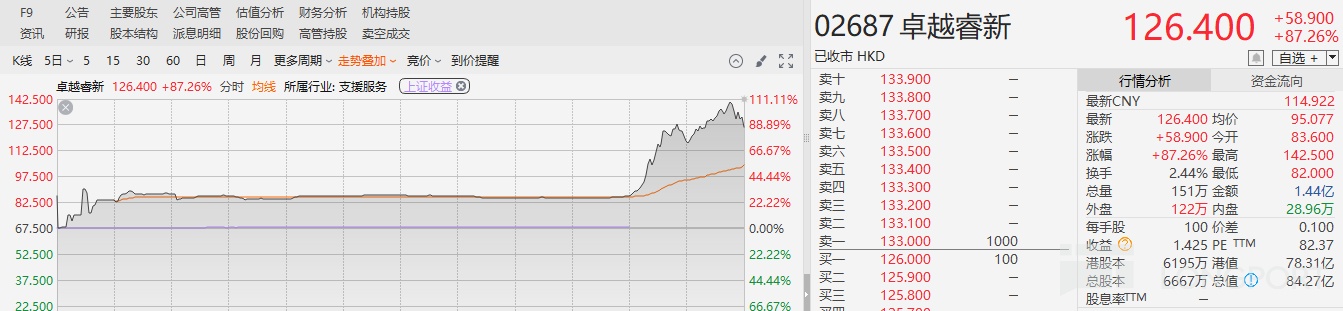

I didn't apply, just watching the show. But today's listing of Zhuoyue Ruixin$ABLE DIGITAL(02687.HK) had a big pull at the close, hovering around a 25% gain all day, and closing with an 80%+ gain:

Zhuoyue's pull is naturally positive for the sentiment of Hong Kong IPO subscriptions. Everyone is now worried that the sentiment might reverse, but I think the market will continue to fluctuate.

I'll keep an eye on the upcoming IPOs. A moderate cooling of sentiment will increase our subscription success rate, though we'll also need to bear some risk of breaking the issue price.

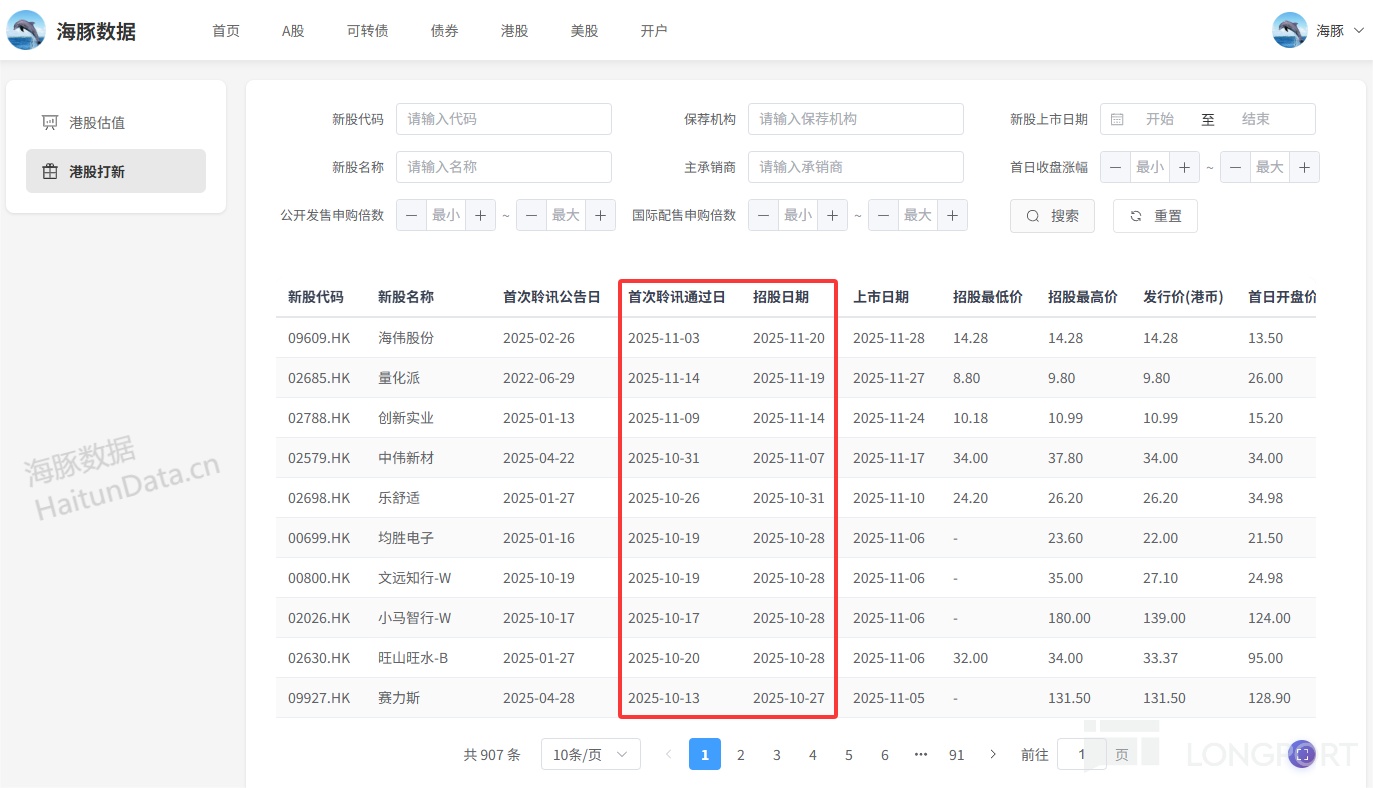

Another new stock listed today, Guoxia Technology$GUOXIA TECH(02655.HK), seems worth participating in at first glance. Many new stocks have passed hearings recently, with 7 in the last 10 days. Usually, after passing the hearing, the subscription will start within half a month:

Now that it's December, if they don't list this year, they'll need to update annual report data after the new year. It's expected that many new stocks will start subscriptions in the next week or two.

Guoxia Technology's subscription closes this Thursday morning, and I'll decide how much to subscribe based on conflicts on Wednesday night.

Today, A-shares performed well, with a median gain of 0.45%, 3,409 up and 1,865 down. Trading volume surged by 300 billion yuan, breaking through 2 trillion again.

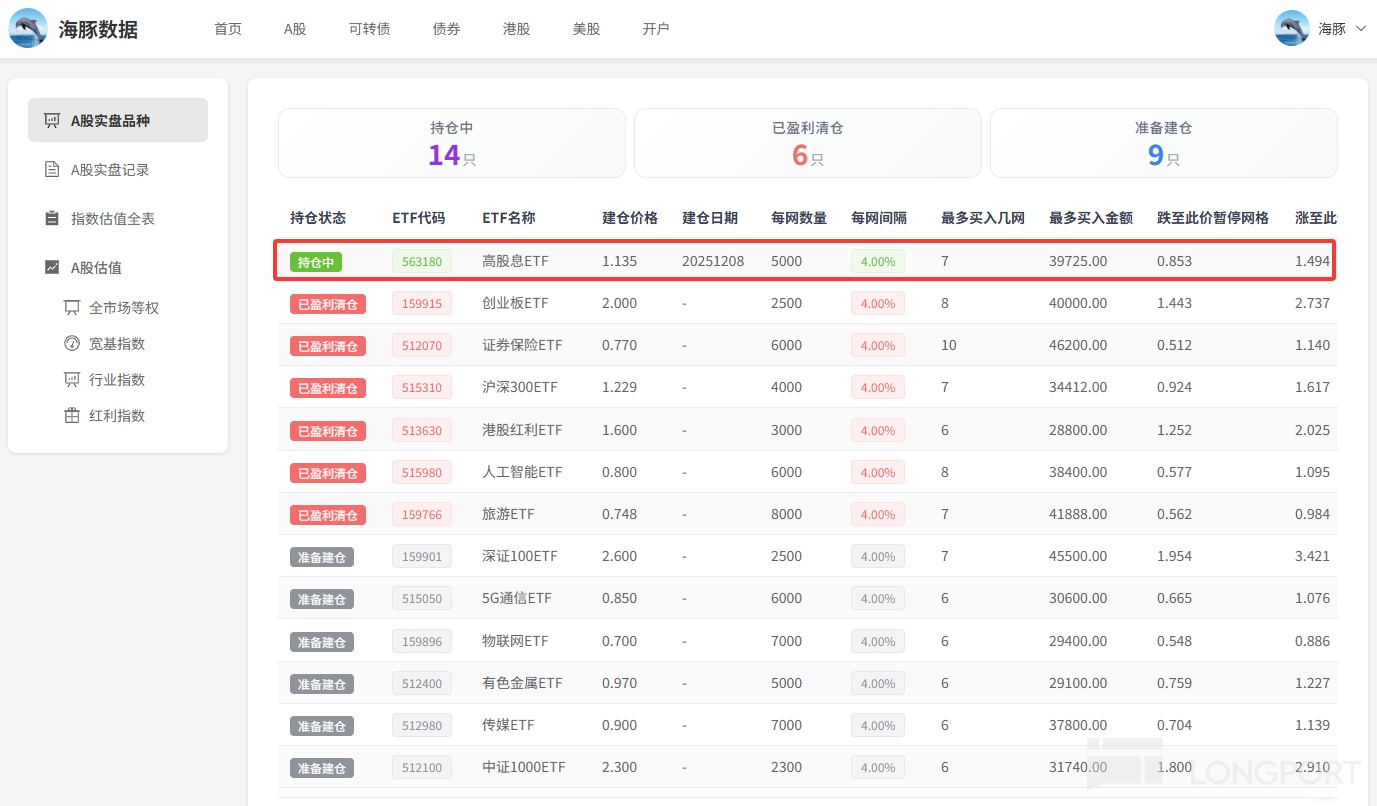

Today, I added an ETF for grid trading and expect to add more this week:

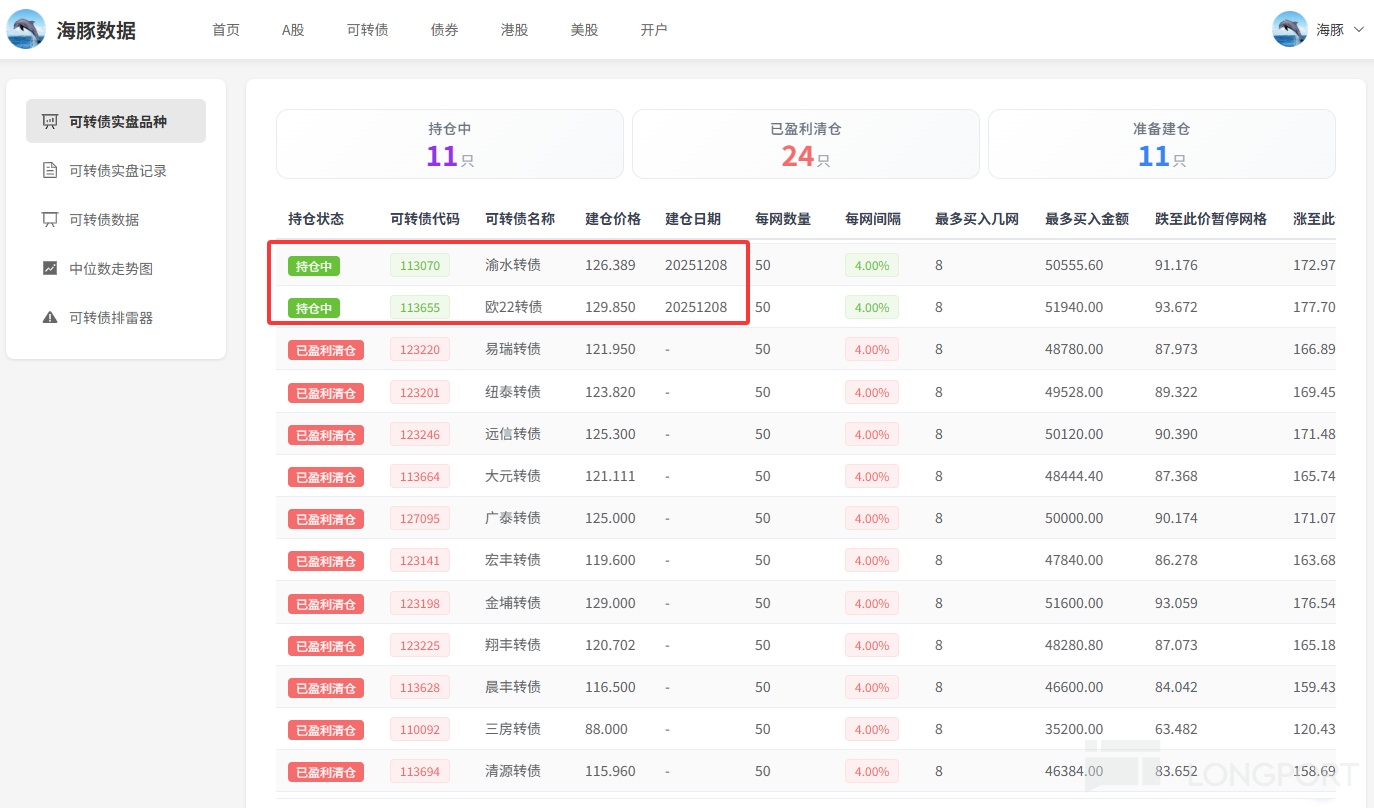

For convertible bond grids, I added 2 today, both with 4% grids:

In contrast to A-shares, Hong Kong stocks performed poorly today, with the Hang Seng Index down 1.23%, 760 up and 1,134 down.

US stocks are about to recover their losses again, showing strong resilience. The Nasdaq is just 1.91% away from another all-time high.

My US stock holdings are relatively stable, mainly in two parts: one is off-exchange regular investments, left untouched; the other is on-exchange grid trading, selecting large-cap stocks with a market cap above 20 billion, good institutional ratings, and reasonable valuations, trading in waves with the market.

Self-media: Dolphin Index Valuation

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.