美联储宣布降息 25 个基点,将利率目标区间下调至 3.50%-3.75%,连续第 3 次降息。此次决议以 9-3 的投票比例通过,其中 2 人支持维持利率不变,1 人支持降息 50 个基点(近 6 年最大分歧)。美联储还决定从 12 月 12 日起的 30 天内购买 400 亿美元国库券,以维持充足的准备金供应。

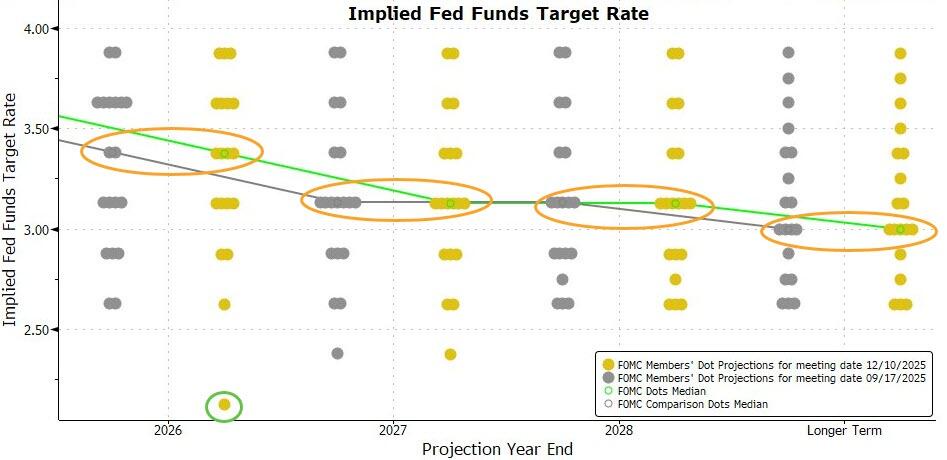

本次政策声明删除了对失业率 “较低” 的描述,改为 “失业率截至 9 月略为攀升。经济展望上调今年及此后三年 GDP 增长预期,小幅下调今明年通胀和后年失业率预期。与上次一样,美联储官员目前也预计,在今年降息三次后,明年和后年大概各会有一次 25 个基点的降息。本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。