Horizon Robotics: Can China’s AD substitute chips unseat NVDA?

By 2025, EVs have become a sector under scrutiny for overcapacity. Electrification innovation is nearing its endgame, leaving OEMs stuck in me-too competition and sustained NPM pressure.

The auto industry is entering the second half of the transition from EVs to smart cars. Users now prioritize better experience, making intelligence the new moat. In autonomous driving, chip vendors are the key 'picks-and-shovels' suppliers.

$HORIZONROBOT-W(09660.HK) is a core domestic ADAS/AD chip player, with an estimated 30-40% share of China shipments in 2024. In 2025 it is rolling out the high-end J6P, paired with its city NOA stack HSD, aiming to challenge NVIDIA.

At the same time, Nio, XPeng, Li Auto, BYD and others are moving to in-house chips. This raises concerns over how much value remains for Horizon if OEM self-design scales up.

Dolphin Research’s deep-dive on Horizon will address the following:

1) What is the market size for autonomous driving chips?

2) How is competition shaping up across the stack?

3) How to assess OEM in-house chip efforts?

4) What kind of company is Horizon, and what is its core edge?

5) How to think about Horizon’s valuation and investment case?

I. What is the market size for autonomous driving chips?

a. Downstream demand: penetration accelerating, with faster mix shift to higher tiers

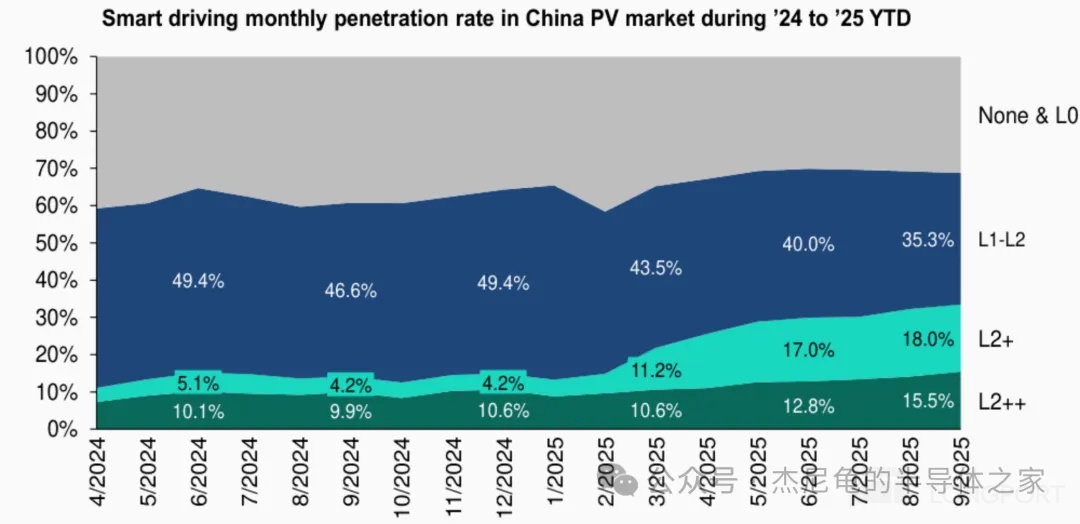

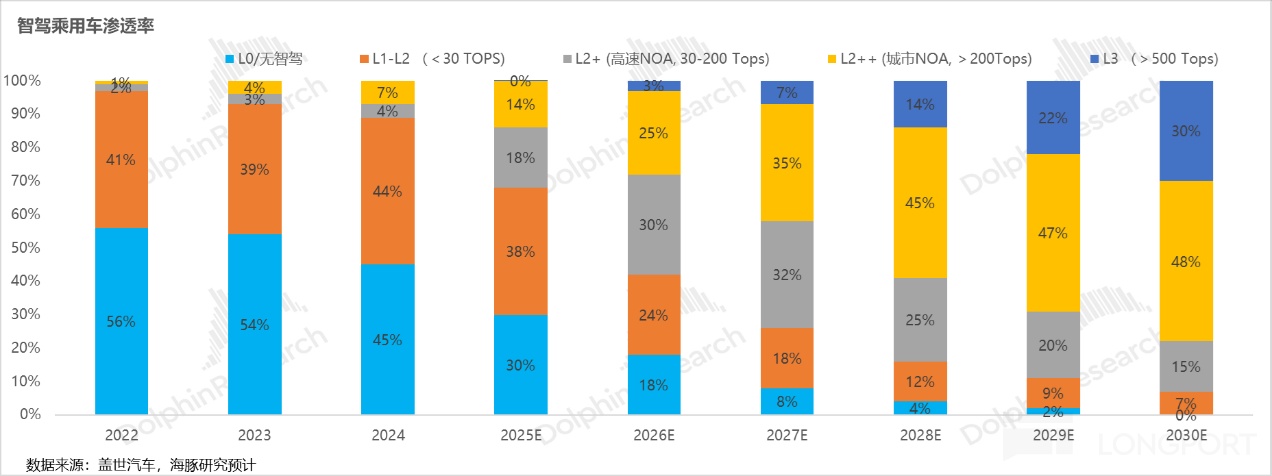

In 2024, only 11% of new cars in China were equipped with L2+ ADAS (4% highway NOA, 7% city NOA). In 2025, BYD is driving 'intelligence for all' by pushing highway NOA into RMB 100k–200k mass models, while Huawei and the NEV insurgents are accelerating adoption of city NOA. L2+ and above reached 33.5% in Sep, and penetration is rising fast.

Source: Berstein. Note: L1–L2 = basic ADAS, L2+ = highway NOA, L2++ = city NOA

Dolphin Research expects competition to move up the curve, with mid/high-tier AD (especially city NOA and above) penetrating faster:

① BYD’s 2025 attempt to democratize highway NOA (into RMB 100k–200k) underperformed, showing that the real pain point is city NOA (L2++), which is what users are willing to pay for. ② From OEM plans in the RMB 100k–200k core price band: Leapmotor targets city NOA by YE, and XPeng is rolling city NOA into the RMB 100k–150k Mona M03. We expect BYD/Geely and other mass OEMs to push city NOA further down-market in 2026.

b. Higher tiers require much more compute

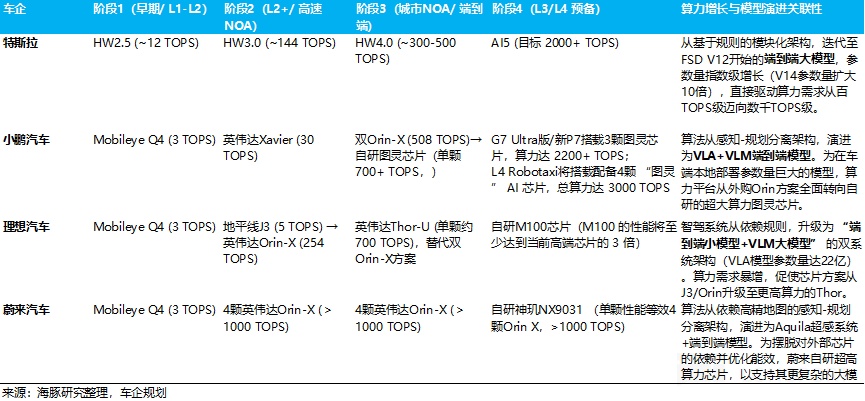

As AD advances and E2E foundation models go on-car, model parameters are rising exponentially. Today’s mainstream city NOA needs nearly 500 TOPS, about 4–5x highway NOA. L3–L4 requires a step-change in compute.

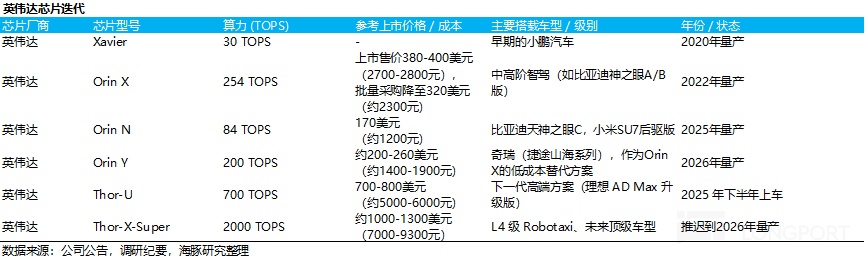

Among leaders, Tesla’s FSD V14 (rolled out this year) has ~10x the parameters of V13, and its planned AI5 targets 2,000–2,500 TOPS, 5x HW4.0 (mass production planned for end-2026). In China, NVIDIA’s dual Orin‑X (508 TOPS) is increasingly tight for E2E + VLA deployment. XPeng equips >2,200 TOPS (3 self-designed Turing chips) for L3 passenger cars, and ~3,000 TOPS (4 Turing chips) for L4 Robotaxi, or 4–6x vs. prior gen.

c. Higher-compute chips command higher ASPs, making chips the only hardware with a sustainable volume + price uptrend

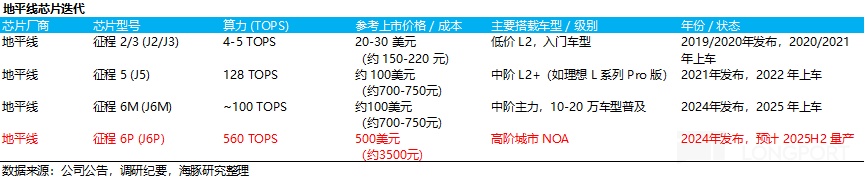

With each upgrade cycle, higher-compute chips are priced multiples above lower tiers, driving a structural volume-plus-ASP story. Horizon’s J6P for city NOA is ~$500, about 5x the J5/J6M for highway NOA, and far above its first-gen J2/J3 for L1–L2.

NVIDIA’s Drive AGX Thor for next-gen L3–L4 (2,000 TOPS) is priced at ~$1,000–1,200, or ~1.5–2x Thor‑U. This illustrates the same ASP ladder.

Therefore, unlike lidars that follow 'more units, lower price', we see AD chips as the only hardware in AD with durable volume + ASP tailwinds, for three reasons:

① AD chips are the backbone of performance

As the 'brain' of the AD system, every step-change in experience (e.g., rules-based to E2E) directly depends on exponential compute gains. With batteries/motors increasingly commoditized, the AD experience differentiates. Chips set the ceiling for features and user experience, so OEMs pay up for higher compute (e.g., NVIDIA Thor), pushing ASPs higher.

② The biz. model is shifting from hardware to services

Monetization is moving from silicon-only to bundled soft + hard. Horizon HSD and Huawei ADS are tightly coupling chips with the algorithm stack, selling a turnkey solution, which prices above bare die. Pricing is also front-loaded: to enable future software subscriptions (e.g., Tesla FSD), OEMs must pre‑install higher-compute chips at SOP. Consumers pay for 'future optionality', lifting chip ASPs.

③ Higher-tier chips have higher barriers

Chip R&D is R&D‑intensive and long-cycle. High-compute AD chips amplify these traits, creating barriers that can lead to oligopoly.

d. TAM: high-compute chips are the core driver

While 3P vendors are shifting from hardware pricing to bundled soft + hard (chip + model), and Horizon even offers a more open ARM‑like model (BPU IP, white‑box algorithms, OS licensing), shipments of silicon remain the base. Thus, we size the market primarily on chip value.

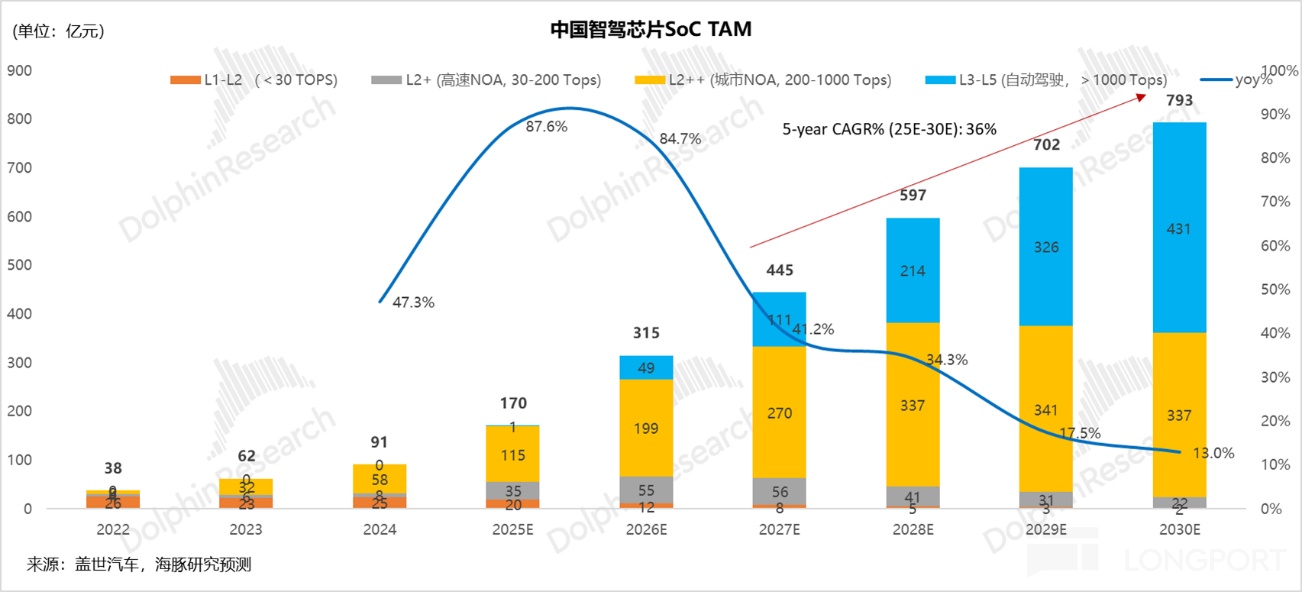

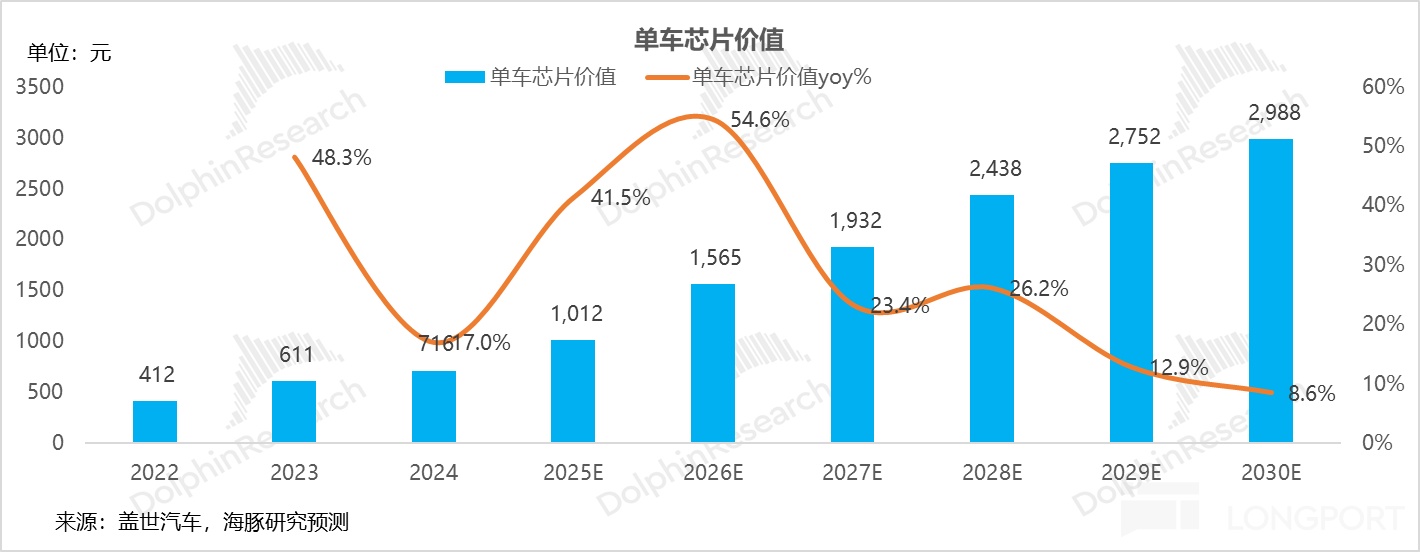

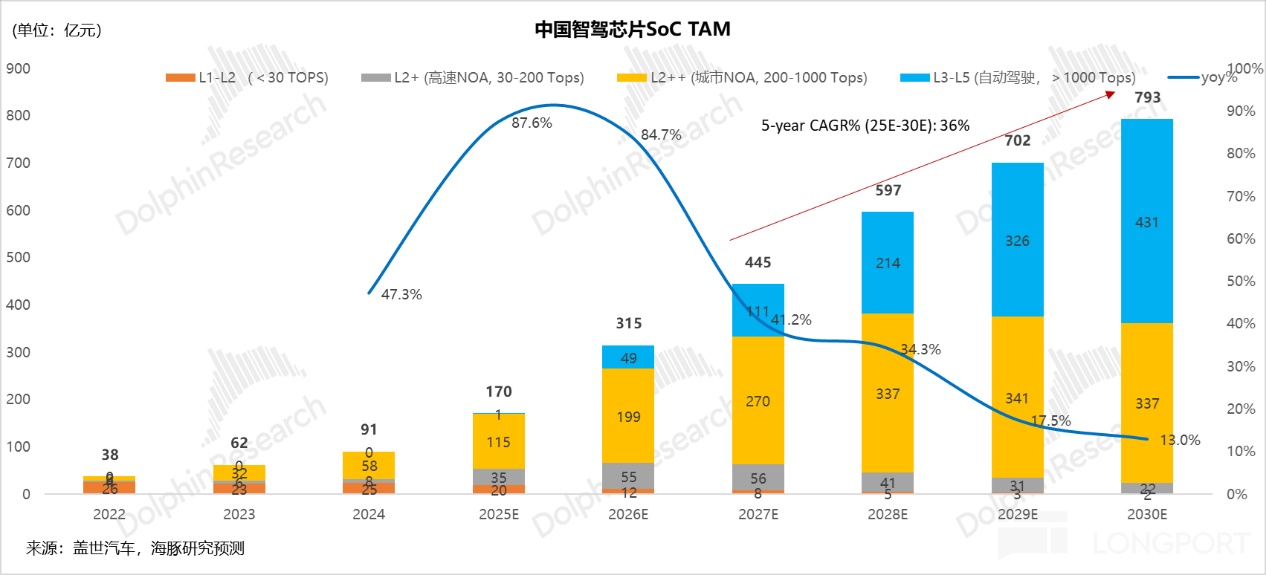

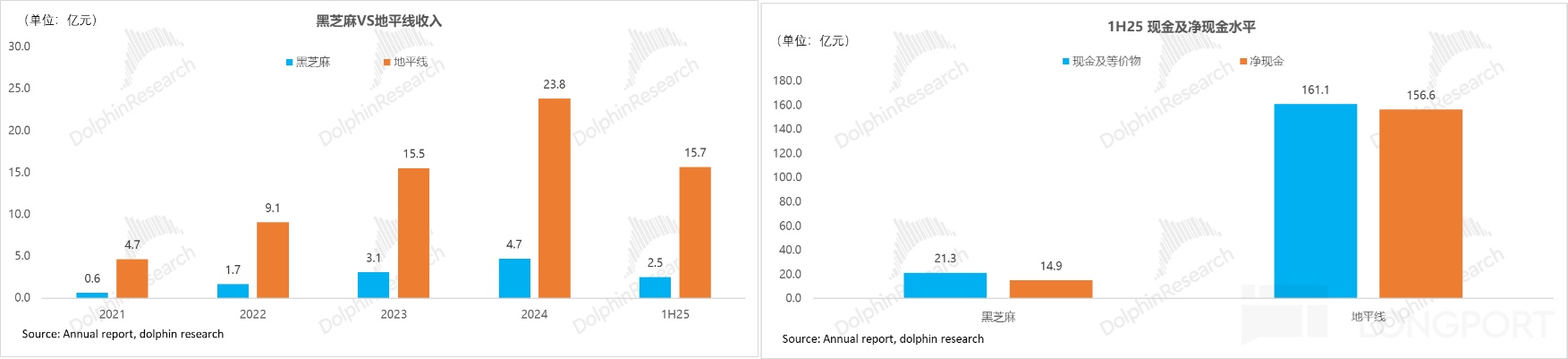

Given the volume + ASP thesis, Dolphin Research estimates 2025–2030 market CAGR at 36% to RMB 79.3bn. Per‑vehicle chip value CAGR is ~24% over five years, with AD vehicle volume CAGR ~10%.

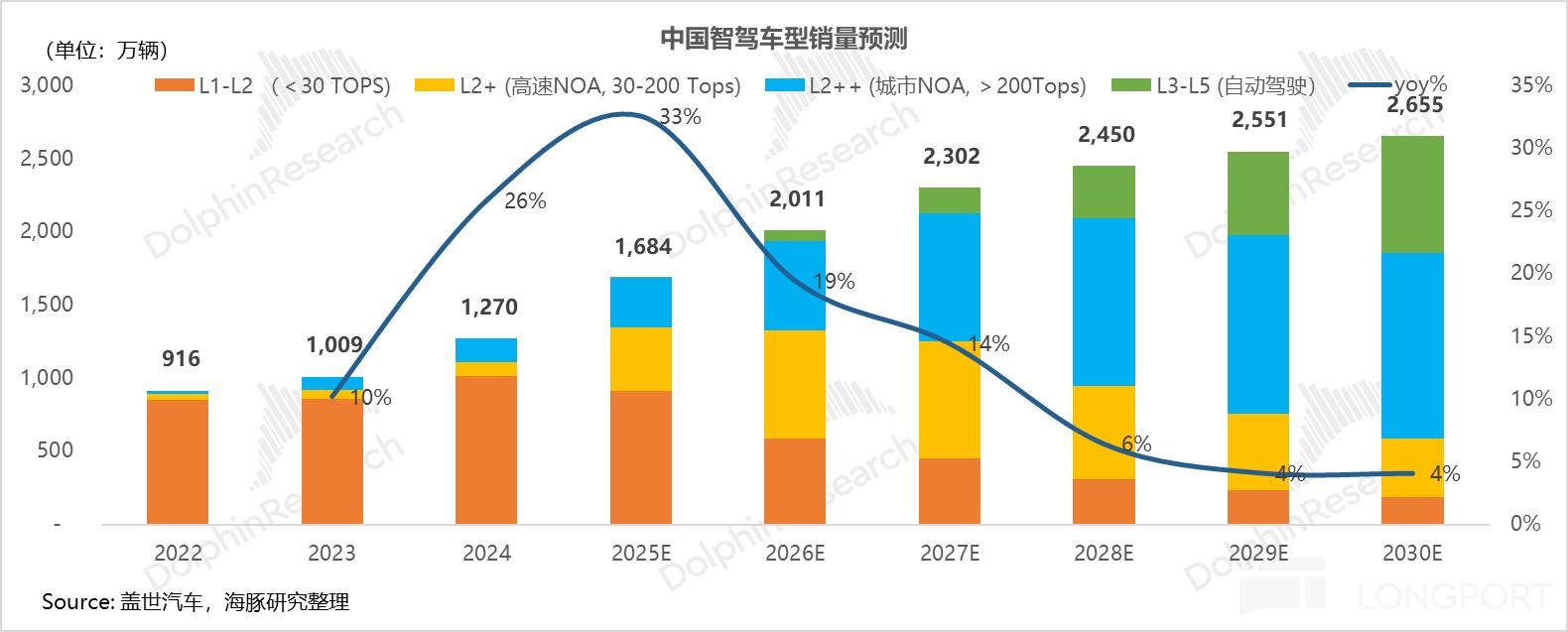

On volume: China PV sales were 23.1mn in 2024, with AD penetration at 55%. By 2030, we expect AD to reach 100% penetration, with L2+ and above at 93% (≈26.55mn AD vehicles).

On ASP: the Avg. chip value per PV was ~RMB 716 in 2024, as ~80% of AD cars were L1–L2. As mix shifts up, compute 'inflates' structurally and per‑car chip value rises. We expect per‑car chip value to approach ~RMB 3,000 by 2030, driven by high‑compute share gains (200+ TOPS reaching 78%).

Market value decomposition makes the trend clear:

In 2024, L2++ penetration was only 7% but captured 64% of chip market value, because high‑compute chips carry far higher value.

Dolphin Research expects this to persist: AD SoC market CAGR at 38% in 2025–2030, with 200+ TOPS growing the fastest (five‑year ~46% CAGR, reaching 78% of total). This will crowd out L1–L2 small‑compute (five‑year CAGR −35%) and L2+ mid‑compute (−9%).

Conclusion: high‑compute chips are the core engine of market growth. For vendors, they are the key ticket to stay at the table.

II. What does competition look like?

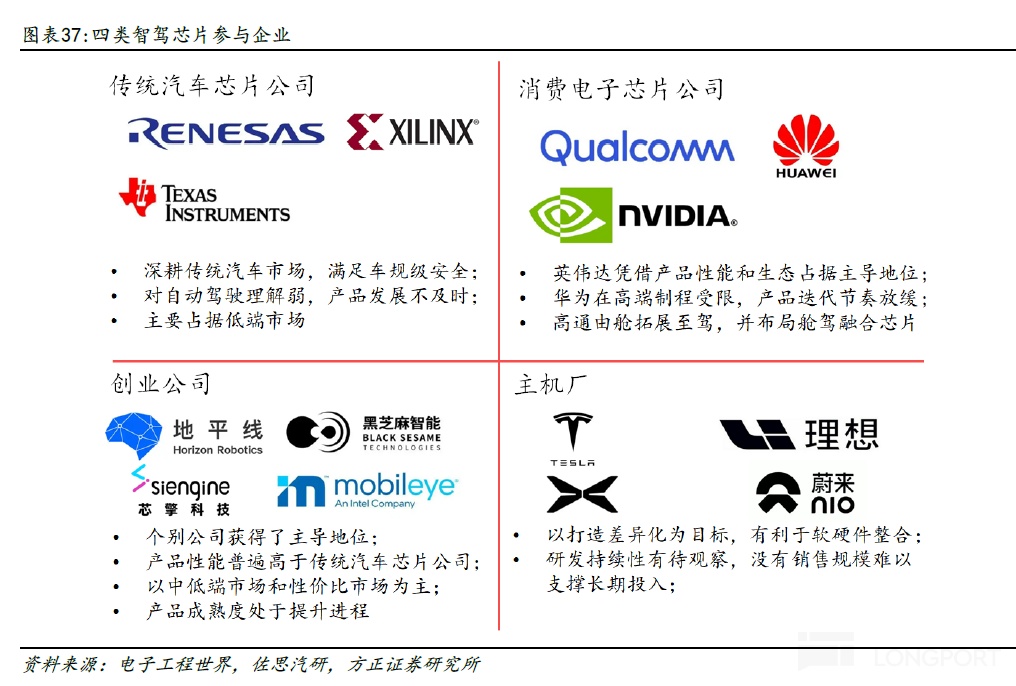

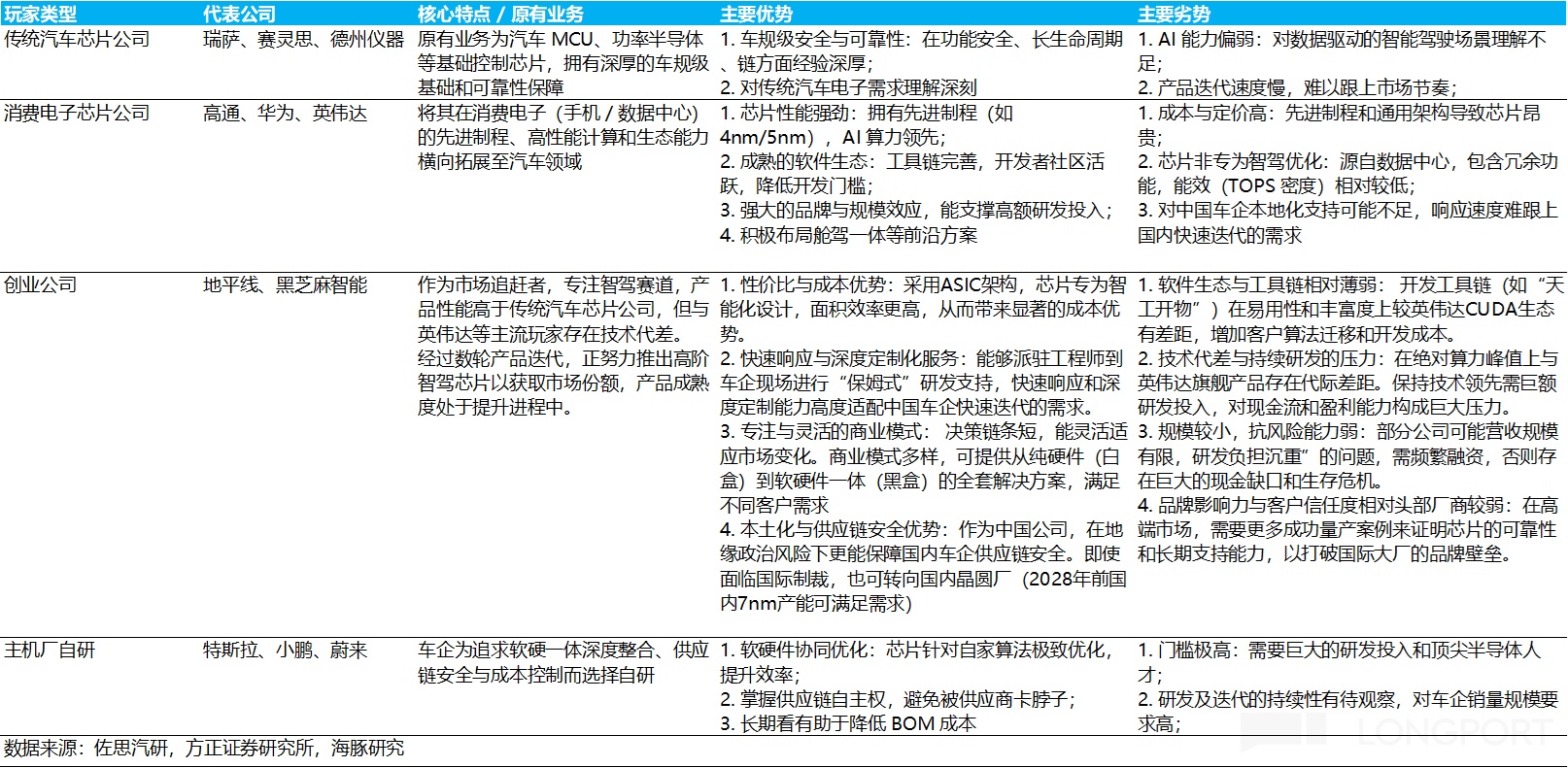

Localization in high‑tier AD chips remains low, leaving ample room for import substitution. Competitors fall into four groups:

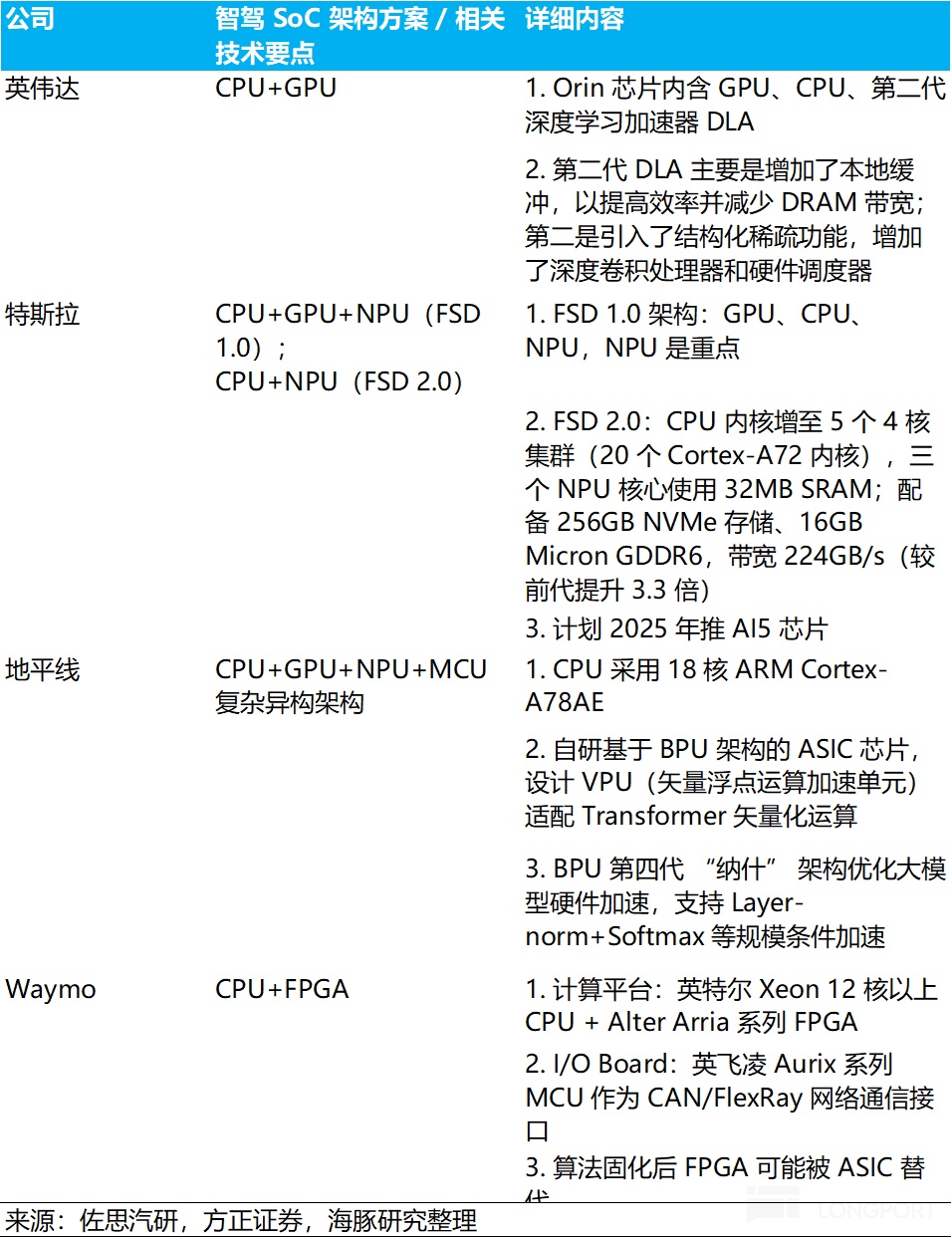

① Traditional auto chip firms: Renesas, Xilinx, Texas Instruments, etc., historically in MCUs, power, sensors, PMICs. Strengths: auto‑grade safety and electronics. Weaknesses: weaker AI and slower iteration, with limited data‑driven AD understanding; they focus on L2 and below.

② Consumer/compute chip firms: Qualcomm, Huawei, NVIDIA, etc., expanding from consumer and cloud into auto, leading L2+ and above. Weaknesses: general‑purpose architectures not optimized for AD, higher cost/price, and limited localized support for China OEMs.

③ AD startups: Horizon, Black Sesame, etc. Focused challengers pushing from mid to high compute to challenge NVIDIA, though current shipments still skew mid/low.

④ OEM in‑house: Tesla, XPeng, Nio, etc. Vertical integration for control and BOM savings, and potential to extend to embodied AI. But chip self‑design has very high bars in scale, talent, and capex, so not everyone can execute.

By compute tier, market performance breaks down as follows:

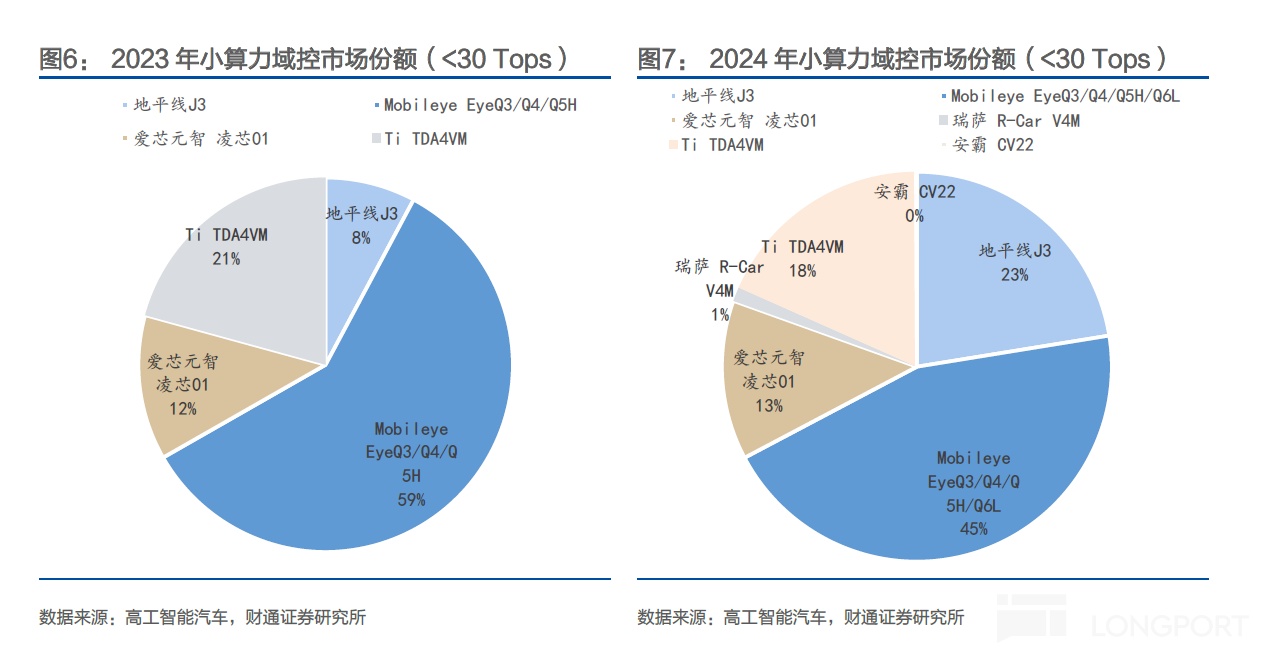

① Small compute (<30 TOPS): Mobileye leads

Used for L1–L2 ADAS, with lower tech barriers and emphasis on cost, reliability, and scale. Structure is relatively stable. Mobileye dominates with its mature front‑view integrated black‑box solution, while Renesas, TI and other traditional suppliers hold smaller shares.

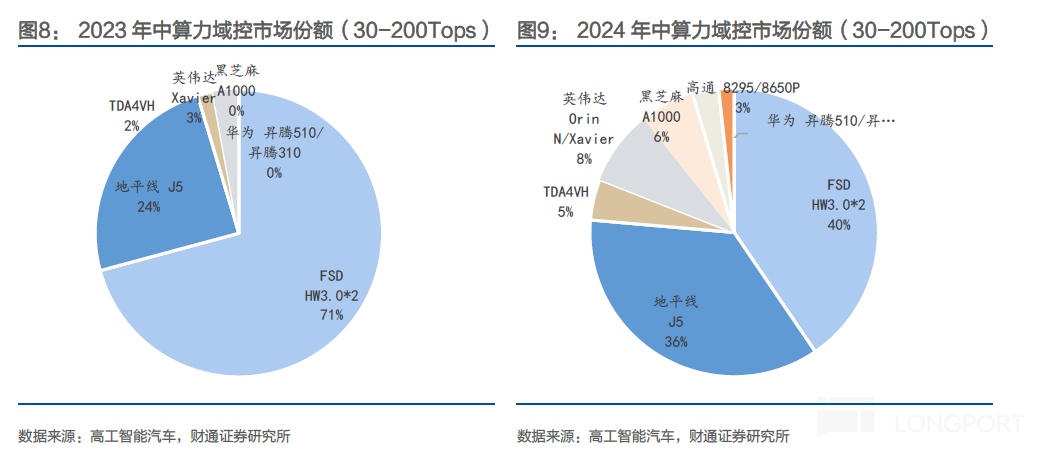

② Mid compute (30–200 TOPS): Horizon leads among 3P

This is the main battlefield for 'intelligence for all', focused on L2+ highway NOA and the most crowded competitively. Tesla’s in‑house FSD (HW3.0) led early on, but Tesla has since moved to HW4.0 (into high compute).

Horizon’s J5, with tight soft‑hard integration and strong value‑for‑money, lifted share to 36% in 2024, second only to Tesla’s in‑house platform. It is the largest 3P supplier in this tier.

③ High compute (>200 TOPS): NVIDIA dominates 3P

This is the core future battleground and the key ticket to stay in the game. Traditional auto chipmakers and Mobileye lack high‑compute products and advanced AD software, and have largely fallen behind.

Beyond Tesla and Huawei’s in‑house stacks, no 3P has truly displaced NVIDIA Orin so far:

① Vertically integrated players: Tesla and Huawei. Tesla has long pursued in‑house chips, while Huawei delivers integrated soft + hard for its 'Smart Selection' and 'HI' modes. ② 3P leader: NVIDIA, with Orin‑X and Thor and the mature DRIVE platform, maintains dominance.

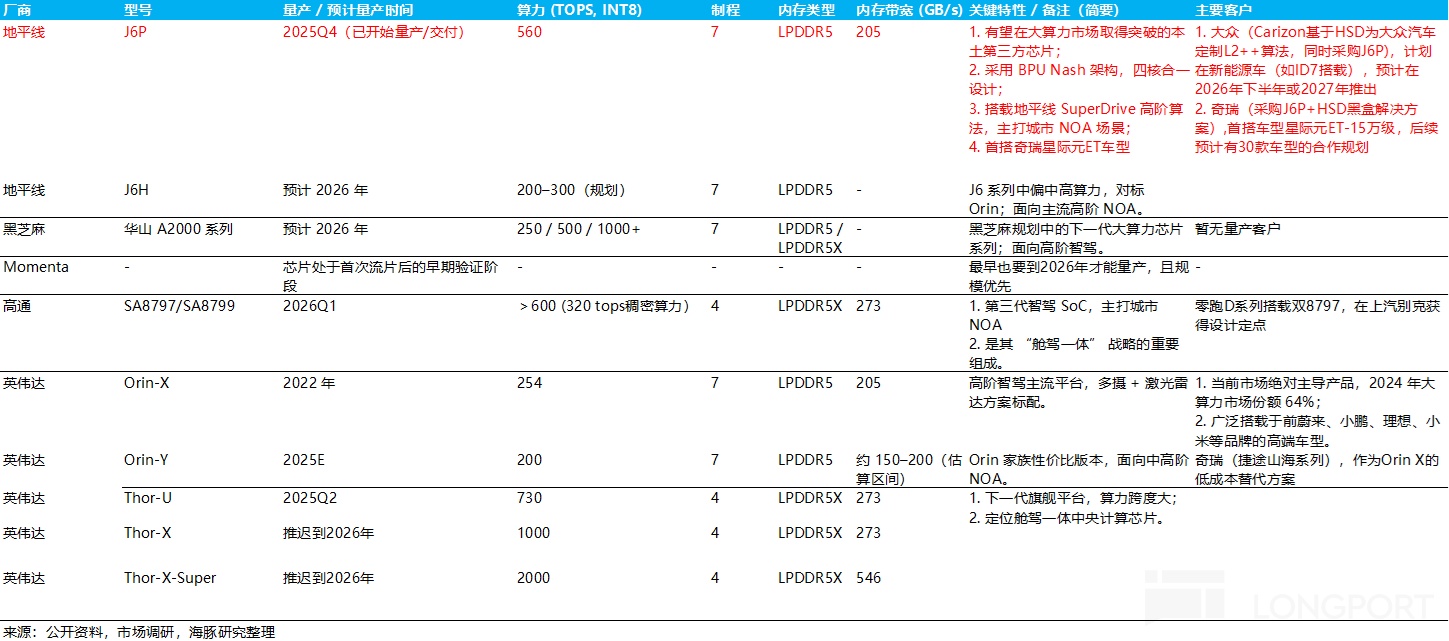

③ Challengers: Horizon, Black Sesame, Qualcomm, Momenta. Horizon’s flagship J6P (560 TOPS) reaches high‑end compute levels, making challengers the biggest swing factor ahead.

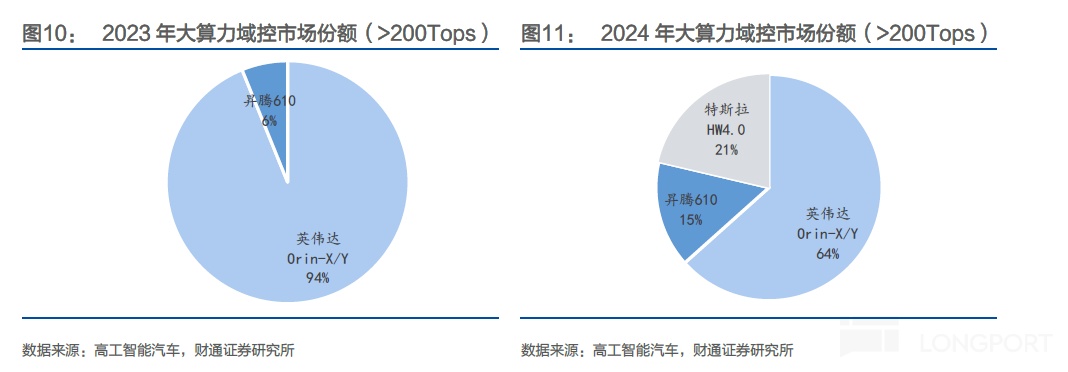

In the core high‑compute lane, local penetration is still very low:

In 2024, China suppliers captured only 13% of OEM AD/ADAS SoC value in China, with just 3% in mid/high compute (100+ TOPS) where NVIDIA dominates. Winning high compute is thus the key path for import substitution and growth.

Downstream, domestic players offer stronger value‑for‑money, tighter soft‑hard collaboration and faster support. Supply chain security is also a core consideration for China OEMs.

Among 3P vendors positioned to break through in high compute, the key names are Horizon, Black Sesame, Qualcomm, Momenta, and NVIDIA:

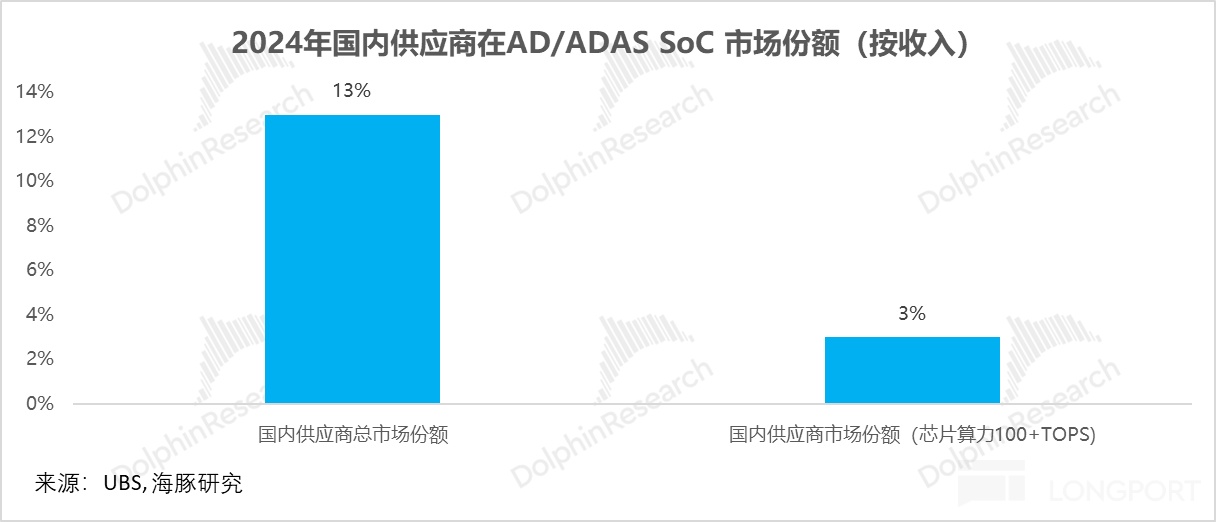

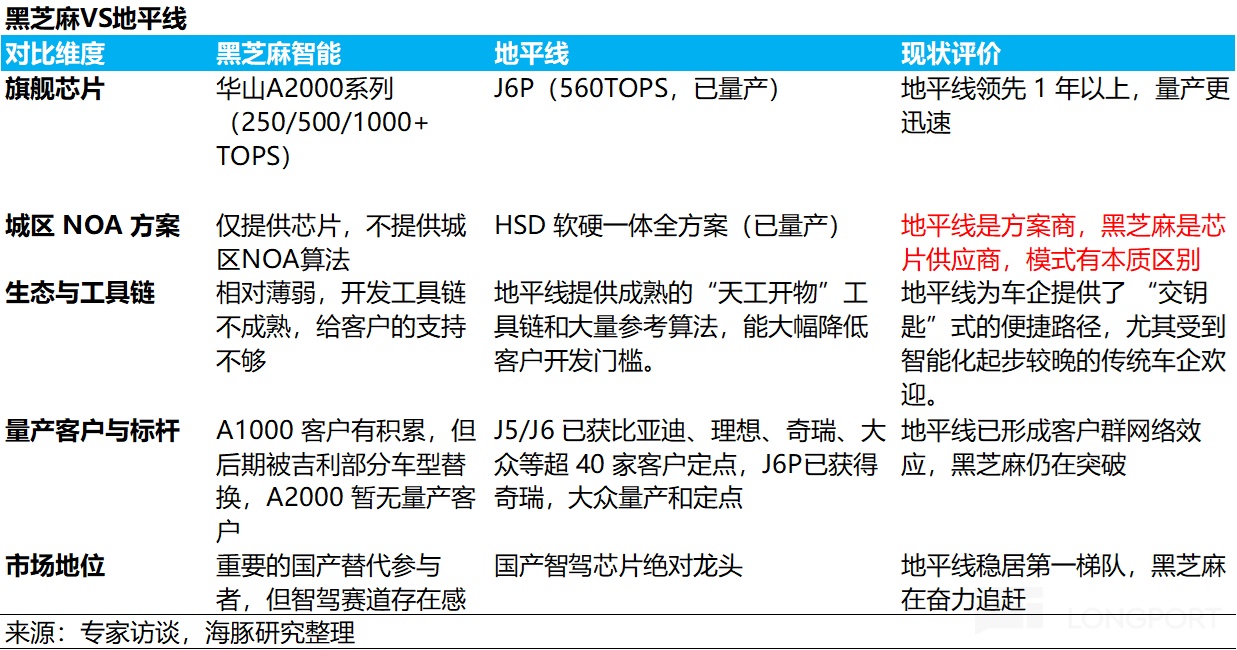

① Black Sesame vs. Horizon: gap between a chaser and the domestic leader

Black Sesame targets 2026 mass production for Huashan A2000 (250/500/1000+ TOPS) to compete in high compute. But on critical vectors it still lags clearly. a. Mass production timing: A2000 trails Horizon J6P by ~1 year, risking the city NOA ramp window; switching costs are high. A2000 has not announced SOP wins, while Horizon’s J6P + HSD has fixed‑point awards and SOP at Chery and Volkswagen.

b. Ecosystem: Black Sesame is primarily a chip vendor (basic perception), without a turnkey city NOA stack. OEMs must either self‑develop or co‑develop with third‑party algorithm firms (e.g., Momenta). Horizon offers a bundled 'J6P (560 TOPS) + HSD (city NOA)' solution, sharply lowering dev. threshold and time for non‑full‑stack OEMs.

c. Toolchain: Versus Horizon’s mature 'Tiangong Kaiwu' platform and model library, Black Sesame’s tools are thinner, increasing dev. cycles and costs, which raises OEM adoption hurdles (also one reason some A1000 programs were later replaced).

d. Cash generation: Black Sesame’s revenue scale is small and cash reserves limited, yet R&D is heavy. Without new financing, its net cash of ~RMB 1.49bn funds a little over a year of operations, implying elevated risk. Horizon’s scaled shipments and higher value‑add model provide stronger self‑funding and a safety buffer.

② Momenta: strong algorithms, weaker hardware

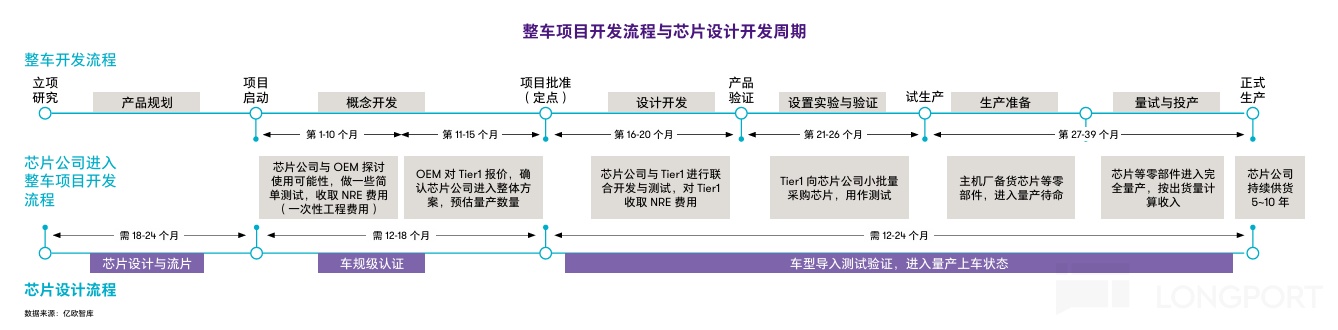

Momenta leads in AD algorithms and plans to self‑design chips, but near‑term it poses limited threat versus Horizon’s full‑stack delivery model. a. Chip schedule lags Horizon: Momenta is in early post‑tape‑out testing. From 'tape‑out success' to 'mass‑market SOP' it must clear engineering, supply chain and OEM award hurdles (12–18 months for AEC‑Q plus validation), likely missing the current city NOA window and trailing Horizon by ~2–3 years.

As a latecomer, it must prove not only performance parity but also superior TCO, dev. convenience and ecosystem maturity, which is difficult. b. Horizon is better positioned near term: Horizon already delivers integrated hardware‑to‑software solutions plus toolchains and base software. Momenta, historically software‑first and partnered with Qualcomm/NVIDIA on hardware, shifted to in‑house due to high partner costs, creating a second, capital‑intensive business to build from scratch. This raises financial pressure and extends the time to close hardware gaps.

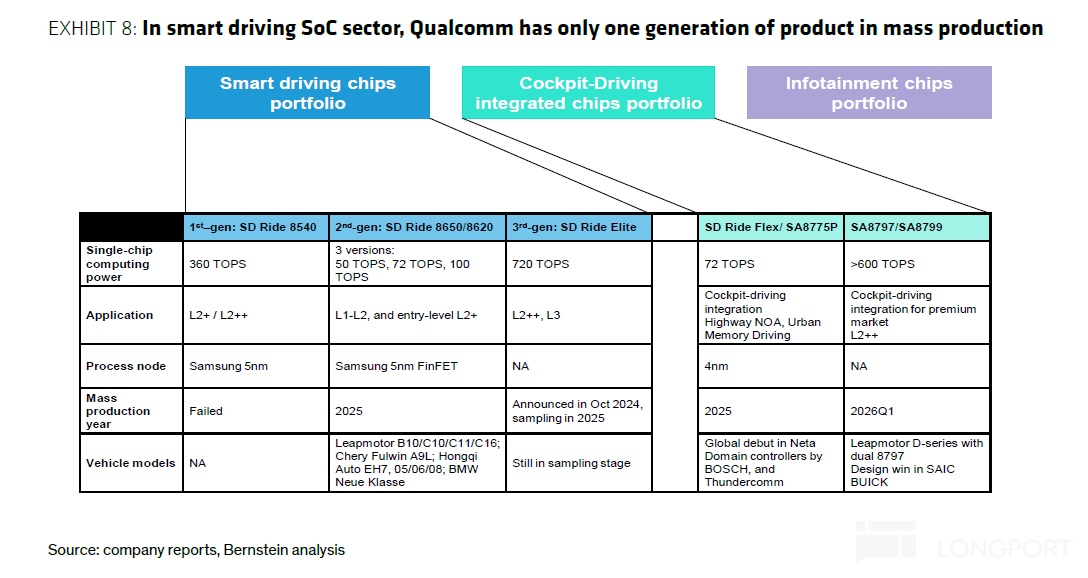

③ Qualcomm: a cross‑over

Qualcomm is strong in cockpit, catching up in AD. Auto is ~9% of revenue, largely cockpit SoCs. In AD, it started later, with only one gen (SA8650P) in mass production so far. Next‑gen focuses on 'cockpit + driving' integration (e.g., SA8797/SA8799) with SOP in Q1 2026. Leapmotor’s D series (dual 8797) is awarded, implying potential in high compute ahead.

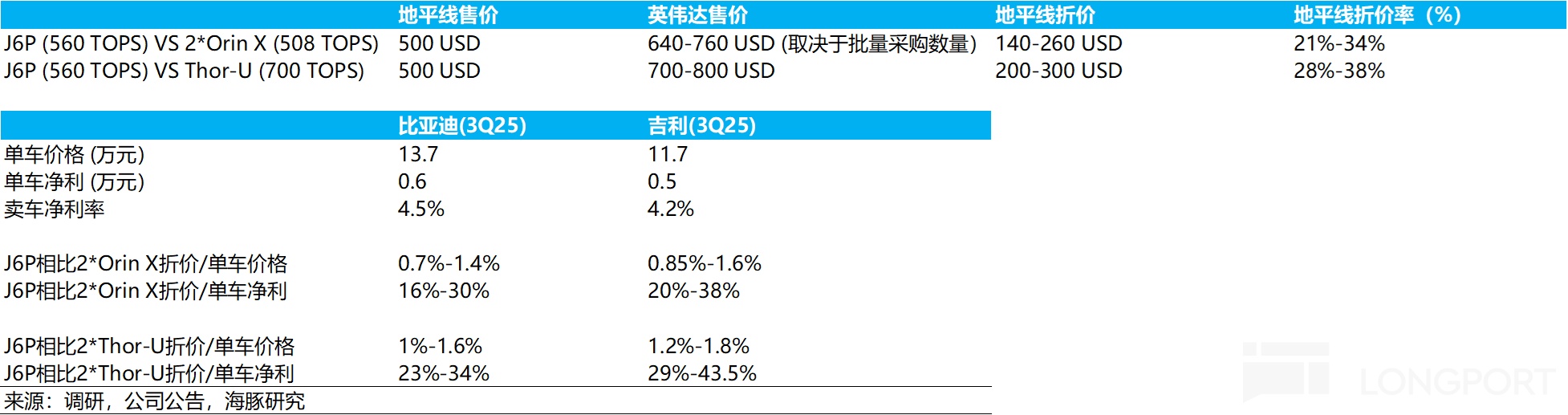

④ NVIDIA vs. Horizon: Horizon pursues value leadership

NVIDIA leads high compute via a) advanced process and high‑performance GPU architecture with very high peak TOPS; b) the mature CUDA ecosystem. Orin X/Y held ~64% share in 2024, and the next‑gen Thor family is at least one year ahead of domestic peers in R&D and SOP timing.

But general‑purpose GPU platforms face structural disadvantages in AD inference:

a. Architectural redundancy raises cost: GPU architectures (e.g., Ampere) include many units and caches not needed for AD inference, leaving performance headroom under‑utilized and wasting die area. b. Pricing too high for mass AD: Priced by general compute peaks, GPUs are too expensive for China’s low‑single‑digit margin PV market, limiting city NOA penetration in mid/low-end models.

Horizon’s relative advantages:

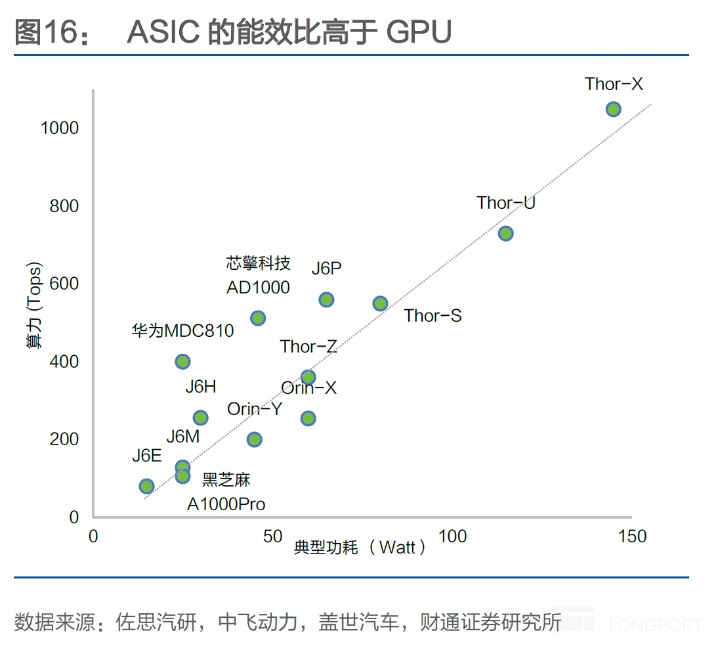

a. Software‑first co‑design: Horizon designs hardware backward from software needs, deeply optimizing for the latest Transformer, BEV and other mainstream AD models, reducing redundancy and maximizing algorithm throughput. b. ASIC‑centric heterogenous architecture with better perf./mm² and efficiency

Horizon uses a CPU + GPU + NPU (ASIC) mix, with a self‑developed BPU as a domain‑specific ASIC to differentiate vs. NVIDIA GPUs. With specialization, it achieves higher perf./area and clear cost benefits: delivering equal performance on smaller die and ~20–40% cost advantage vs. comparable NVIDIA solutions. J6P’s energy efficiency is ~1.2–1.4x Thor, with clear power advantages.

This helps large, low‑margin OEMs like BYD and Geely bring city NOA to mass models using Horizon J6P, accelerating down‑market adoption.

Takeaway: Horizon, the high‑compute 'NVIDIA‑alternative' for China?

Despite many rivals, Horizon has pursued a software + hardware + tools 'turnkey' model from day one, investing early and consistently. Among domestic peers it built first‑mover and differentiated advantages, with a 1–2 year SOP lead and stronger, more stable cash generation.

In high compute vs. overseas peers, Horizon’s ASIC approach offers better cost and power than GPUs, aligning with the push to bring city NOA to RMB 100k–200k mass models. As such, Horizon is best placed to capture the import‑substitution window in high compute, challenge NVIDIA’s leadership, and take 3P share.

This piece covered competitive dynamics in AD chips. Next, we will focus on Horizon’s valuation and investment value—stay tuned.

<End>

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.