LULU (Trans): New styles to account for 35% of the Spring 2026 lineup

Below is Dolphin Research's Trans of Lululemon FY25 Q3 earnings call. For our First Take, see: Lululemon: Real Turnaround or Flash in the Pan?$Lululemon(LULU.US)

- Key Takeaways

1) Full-year guide update:

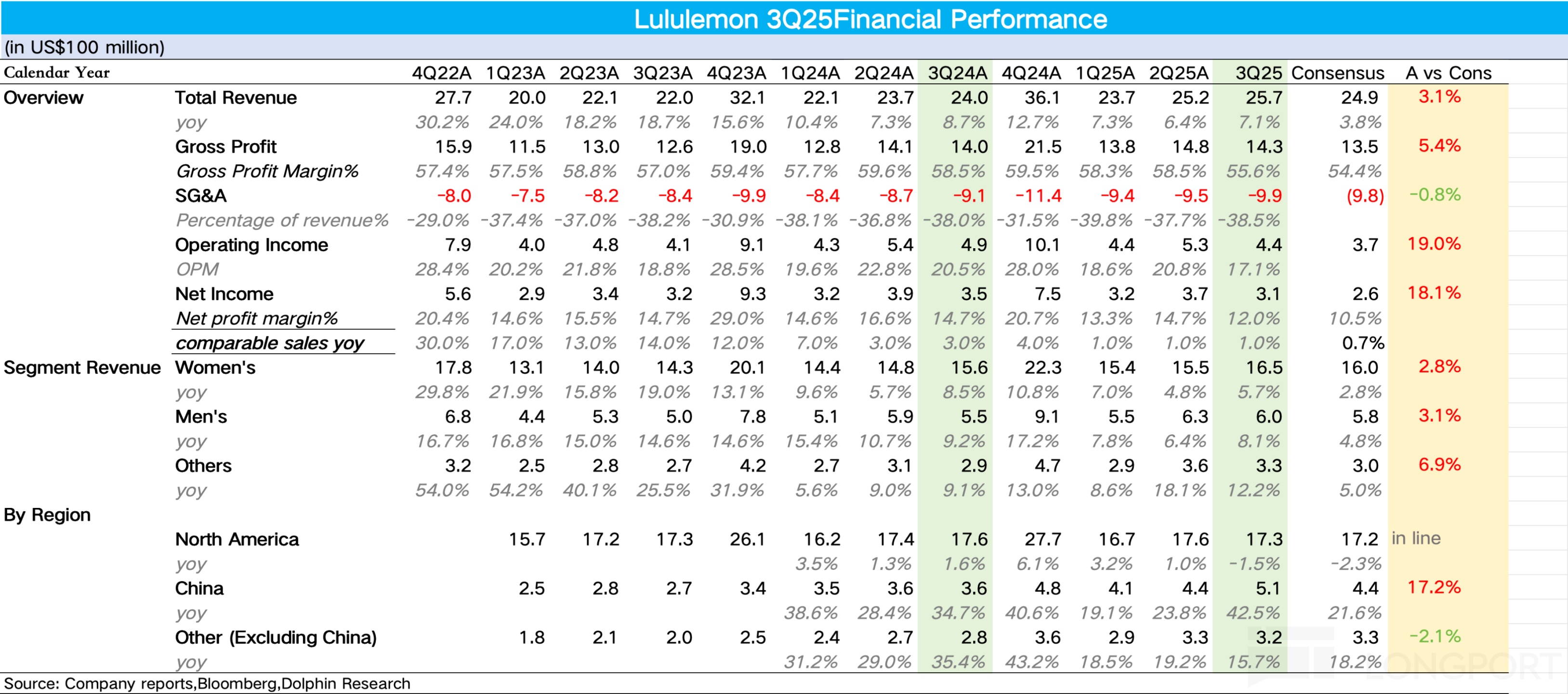

a) Revenue: FY guide raised to $10.96bn–$11.05bn. Ex-53rd week, this implies +5% to +6% YoY.

- U.S.: expected at -1% to +2% YoY, unchanged vs. prior.- Mainland China: raised, now expected to exceed the high end of +20% to +25%.

b) GPM: full-year down ~270bps, better than the prior ~300bps down, driven by lower estimated customs/tariff impact.

c) SG&A: expected down ~120bps, vs. prior 80–90bps, as the company plans to further invest in Q4 marketing to drive traffic and brand. d) OPM: expected down ~390bps, in line with prior guide.

e) Diluted EPS: raised to $12.92–$13.02. f) New stores: plan for net 46 openings, incl. 15 in the Americas (9 in Mexico), with most of the rest in China. The team is closely monitoring potential 2026 openings and will stay cautious given weaker U.S. trends.

2) Q4 guide:

a) Revenue: $3.50bn–$3.59bn. Ex-53rd week, +2% to +4% YoY, below Q3 trend.

b) GPM: down ~580bps, driven mainly by higher tariffs and removal of de minimis (~410bps combined). Also impacted by fixed-cost deleverage, investments, and higher markdowns (by ~100bps).

c) OPM: down ~680bps, with ~410bps tied to tariffs and de minimis. d) Diluted EPS: $4.66–$4.76 vs. $6.14 a year ago.

e) Inventory units: expected to remain elevated in unit growth. The company plans to grow units below sales next year to lift full-price sell-through and leverage chase capabilities.

II. Earnings Call Details

2.1 Management Highlights

1) Holiday performance: During Thanksgiving, results were solid. The team cleared seasonal and end-of-life product on higher traffic to optimize inventory, while launching well-received full-price drops, especially limited-edition Train.Early access Black Friday for members, launched a week ahead, significantly boosted e-comm traffic and sign-ups, setting a new single-day online transactions record. Management noted sales decelerated post-Thanksgiving and reflected this in Q4 guidance.

2) Three pillars to re-accelerate the U.S. biz.:

a) Product creation: increase newness frequency and breadth, targeting 35% newness mix by next spring. Shorten core dev. cycles from 18–24 months to 12–14 months, and use chase to replenish bestsellers within 6–8 weeks.Focus on updates and innovation, especially in Train, and rationalize legacy styles misaligned with the future brand vision to reset product lifecycles.

b) Product activation: elevate in-store experience via curated assortments by store/market and lower local inventory density, and upgrade digital through a redesigned site to improve visual merchandising and conversion. Launching an Amex Platinum partnership to attract high-value customers.Continue to invest in integrated marketing around newness and innovation, leveraging creators on social to drive traffic.

c) Enterprise efficiency: to offset higher tariffs and de minimis removal, actions include strategic pricing, supply chain initiatives (vendor negotiations, DC network efficiency), and enterprise-wide savings. The aim is to protect the P&L and absorb tariff costs, leveraging ~$1bn cash and zero debt to underpin long-term TSR growth.

3) Guidance:

a) Mainland China: now expects full-year revenue growth at or above the high end of +20% to +25% ex-53rd week. b) Q4 revenue trend: below Q3, largely due to calendar shifts (Q3 helped, Q4 hurt).

c) U.S. Q4: despite post-Thanksgiving softness, expected to be slightly better than Q3.

2.2 Q&A

Q: How was demand cadence in Q3 and QTD trends? Any color on the post-Black Friday slowdown? Looking to next year, how long to fully optimize the assortment?

A: In the U.S., Q3 tracked broadly as expected, with Aug. strongest and Oct. softer as planned. For QTD, Thanksgiving was strong, but traffic did ease post-holiday, and we baked this into the latest guide.On timing, we will anchor on Q1 to activate newness across the assortment and drive benefits from higher newness penetration. We will intensify product activation to maximize exposure and awareness via omnichannel marketing.

Q: With assortment changes, what tailwinds and headwinds frame next year's OPM? Will reinvestment tied to experience and newness activation be needed?

A: Looking to 2026, OPM will face puts and takes, and we will provide more detail after we see initial results from the assortment reset in Mar. next year. Headwinds include higher full-year tariff costs and de minimis removal, plus certain expenses like incentive comp coming back from 2025 levels.We are actively mitigating tariffs and costs while pursuing ongoing savings and efficiency. Despite pressures, we will stay focused on productivity and update in Mar.

Q: How did lululemon track vs. the category/market this quarter? Which lines will see the earliest newness inflows?

A: The broader apparel space remains under pressure. We held share in premium active, but saw slight share loss in high-performance as consumers traded down.On newness, the pipeline is healthy. We refreshed lifestyle styles such as SBA and launched high-performance lines like Mile Maker and Shake It Out with good results. Into spring, we target 35% newness, balancing innovation in performance activities that grew in Q3 and lifestyle newness, starting the year with Train and then new drops across Scuba, Swiftly, and ABC.

Q: In the CEO search, what attributes are the BOD prioritizing?

A: Experience in growth and transformation.

Q: How much of the new line and future strategy comes directly from primary research and customer feedback?

A: We will keep prioritizing innovation across five activities: Run, Train, Yoga, Golf, and Tennis. For example, Train will debut a new high-performance fabric built for weight training.We will also refresh core franchises using high-value guest data, iterating Swiftly, updating men's ABC, and seeking innovation within winners like Waffle and Scuba. We combine our own guest behavior data with ambassador and community insights to pinpoint opportunities.

Q: What price actions have you taken QTD, and are more planned for spring? What underpins holding or supporting OPM next year?

A: No new price increases since last quarter. Earlier, we took modest increases on a small set, with elasticity in line with revenue and margin expectations, and we will stay mindful of competition with no additional increases planned now.For 2026 OPM, negatives outweigh positives. Next year will be the first full year absorbing higher tariffs, so margin pressure is likely, and while cost offsets are progressing, margin improvement will be a multi-year effort.

Q: How are your largest franchises performing, and is a 2026 'reset' warranted to showcase new innovation and design language? What early proof points give confidence the 2026 line can change U.S. trends?

A: Strategy is to balance growth and innovation across the five performance activity categories, serving athletes through tights, tops, and more. Social lifestyle is healthy, but Lounge is the most challenged core area, which we are addressing by updating Scuba materials and silhouettes, with positive Intl feedback.Given saturation in many North American cores and runway Intl, we will drive growth outside NA while reshaping and innovating within NA. To ensure visibility, we are lowering in-store density and curating in pilots in LA and Miami with strong results, and online the new site design gives better tools to put newness front and center via storytelling and navigation.

Q: Can you quantify the NFL collaboration's impact on sales and margins, and is it attracting new guests as planned?

A: We are pleased with NFL performance, with a strategy similar to other key partnerships focused on guest acquisition across both men and women. It is early, but we are encouraged by new guest adds.Financially, the contribution is small today but profitable overall. Given revenue sharing, we are not breaking out specific figures.

Q: Any incremental thoughts on the Q3 'trade down' behavior and its implications for pricing as a lever against tariffs?

A: This behavior has been visible all year and reflects consumer uncertainty. Shoppers are highly responsive to promotions and are seeking value, which continued through Q3.Pricing remains very strategic. We are satisfied with elasticity on actions already taken, which aligned with sales and margin plans, and will continue a measured, SKU-by-SKU approach.

Q: Regarding the Canada DC slated for next year, does de minimis removal change its role, and how are you thinking about it?

A: We are deeply evaluating the DC network. This does not mean pulling back from Canada, but it does imply network adjustments to maximize efficiency, and we will share more as we progress into 2026.

Q: How did e-comm vs. stores perform this quarter? How would you characterize the China athleisure market, and are there notable tier-city differences?

A: Mainland China sustained very strong growth, and overall results were solid. Some outperformance was timing-related due to earlier platform events, yet we remained among the least promotional brands, using events to activate products like Scuba.Outlet penetration is low, which helps efficiently clear markdown product. Outerwear is a standout with Wonder Puff and new silhouettes like Feather Weight resonating, and we are gaining share with strong execution across all city tiers.

Q: Will leadership changes affect the timing or scope of the significant 2026 product updates? How are guests responding to new products vs. legacy lines?

A: We are confident in the innovation work and do not expect leadership changes to alter the 2026 rollout or timing. We are energized by the 35% newness goal.Early reads on new products, viewed as future cores, show outperformance in the U.S. with very strong responses across both high-value and broader guests. We are encouraged by the hit rate and will keep increasing newness mix to offset elongated lifecycles in some cores.

Q: Under the interim co-CEO structure, who do design and merchandising report to, and who makes final product decisions?

A: Andre Maestrini will continue as Chief Commercial Officer, leading global markets and GMs, and bringing Intl perspectives to North America. During the CEO search, design, merchandising, and brand report directly to Meghan (CFO).We operate as a peer-led team and that will continue. Many key design, product, and merchandising decisions for 1H next year, including buys for Winter 2026, were made before the search began, so the focus now is executing the plan Meghan outlined and driving the inflection.

Q: How are you thinking about markdowns? Why were Q3 markdowns higher than expected, and why step up further in Q4? How confident are you in lifting full-price mix next year, and when might it show?

A: Sales underperformed plan this year, creating more seasonal inventory and driving higher-than-expected Q3 markdowns, with a further step-up in Q4 as reflected in guidance. Next year we will run a more conservative inventory posture, planning unit growth below sales to reduce markdown risk and using chase to capture upside. This new inventory dynamic starts in Q1, with a more prudent approach to support higher full-price sell-through.

Q: What progress have you made mitigating tariffs, and any updated quantification for the gross and net impact this year and next for tariffs/de minimis?

A: Our FY tariff outlook improved, with the yearly pressure updated from ~220bps to ~190bps, a net impact of Approx. $210mn. For next year, prior impact was estimated at ~320bps, and while we are not updating the figure today, progress is coming from vendor negotiations, DC network and inventory placement, and enterprise efficiency.OPM next year will have puts and takes, but driving an inflection remains the priority, and we will provide a fuller update in Mar.

<End>

Risk Disclosures and Statements:Dolphin Research Disclaimer and General Disclosures